Trump tempers rhetoric on China

On 17 October, US President Donald Trump said the “high” tariffs on Chinese goods he had threatened would not be sustainable for long.

Trump acknowledged that the high tariffs on Chinese goods are not a sustainable long-term solution. He explained that the measures were a forced response to an escalating dispute with Beijing over control of critical rare-earth metals. Trump also described Beijing as “a very strong opponent, one that only respects strength.”

He also publicly confirmed that he expects to meet China’s President Xi Jinping in the coming weeks. The statement appears aimed at easing tensions ahead of talks scheduled in two weeks in South Korea.

Against this backdrop, the White House also signaled a potential de‑escalation. Kevin Hassett, a White House economic adviser, told reporters: “We are not at war with China. I’m confident we will normalise relations.”

This tone contrasts with last week’s harsher warnings, when the administration considered 100% tariffs in response to China’s expansion of export-licensing rules for rare‑earth elements and magnetic materials.

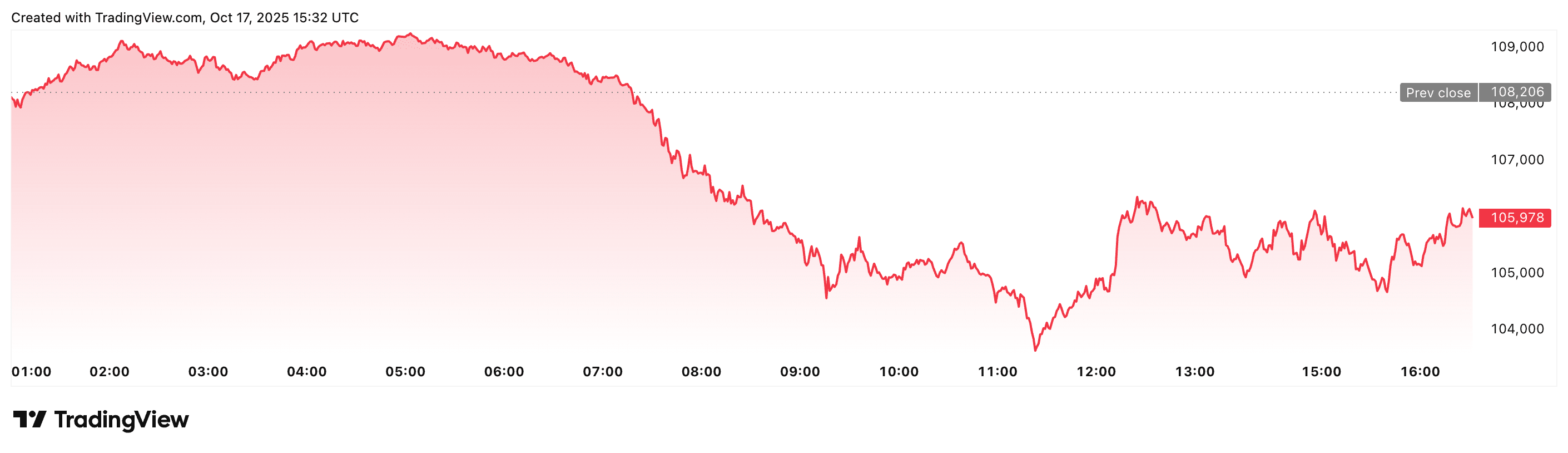

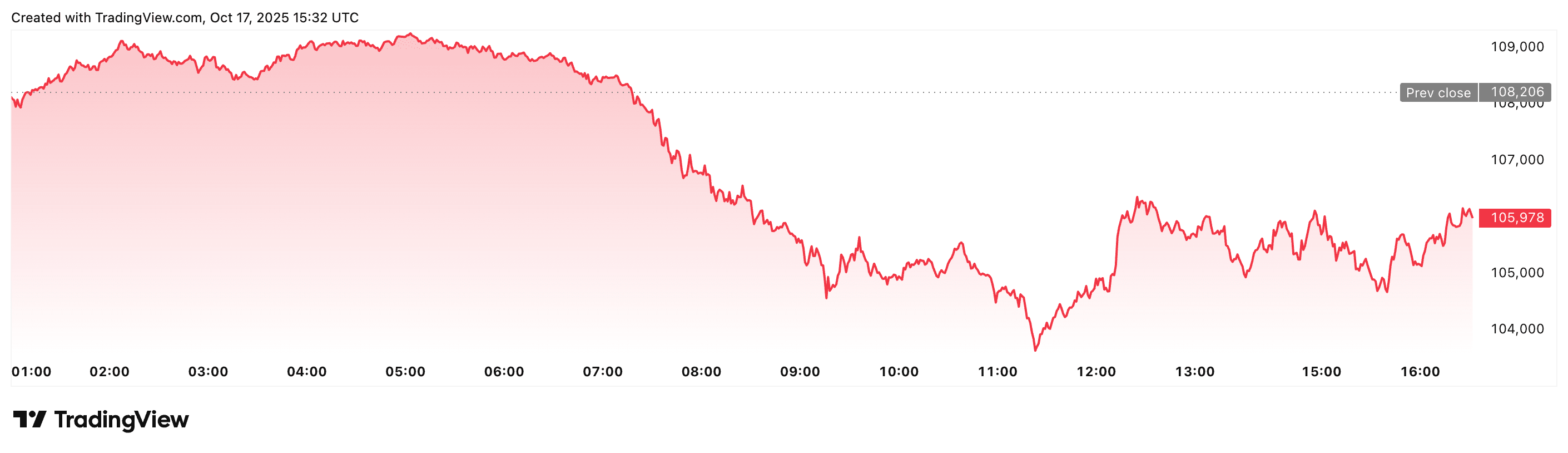

Markets remain cautious, with cryptocurrencies under pressure amid fears of a renewed trade escalation. Bitcoin briefly reached $111,000 before dropping back towards $105,500. A similar pattern was seen in Ethereum, which retreated from about $4,005 to the $3,790 area.

Bitcoin dynamics on October 17, 2025. Source: TradingView

Trump’s remarks suggest a willingness to negotiate, though a lasting resolution is not guaranteed. Still, with Beijing tightening control over rare‑earth supplies and giving no encouraging signals, investors view tensions as ongoing.

The next step is a test of practical policy. If both sides move from threats to concrete arrangements, the risk of a full‑scale tariff war should ease. For now, markets oscillate between hopes of compromise and elevated volatility – especially in digital assets, which are highly sensitive to headlines.