Crypto market flash crash: what Trump actually said

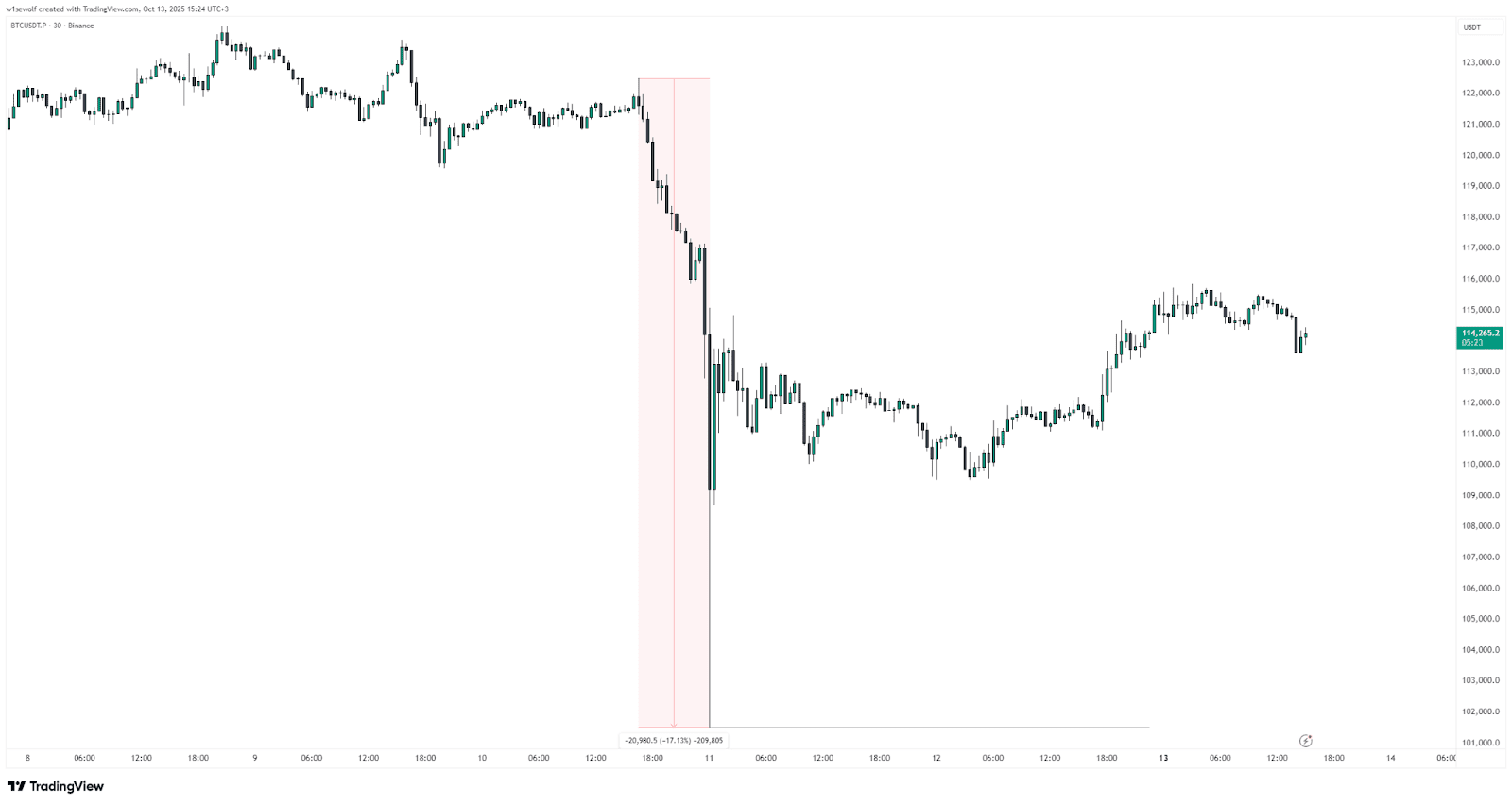

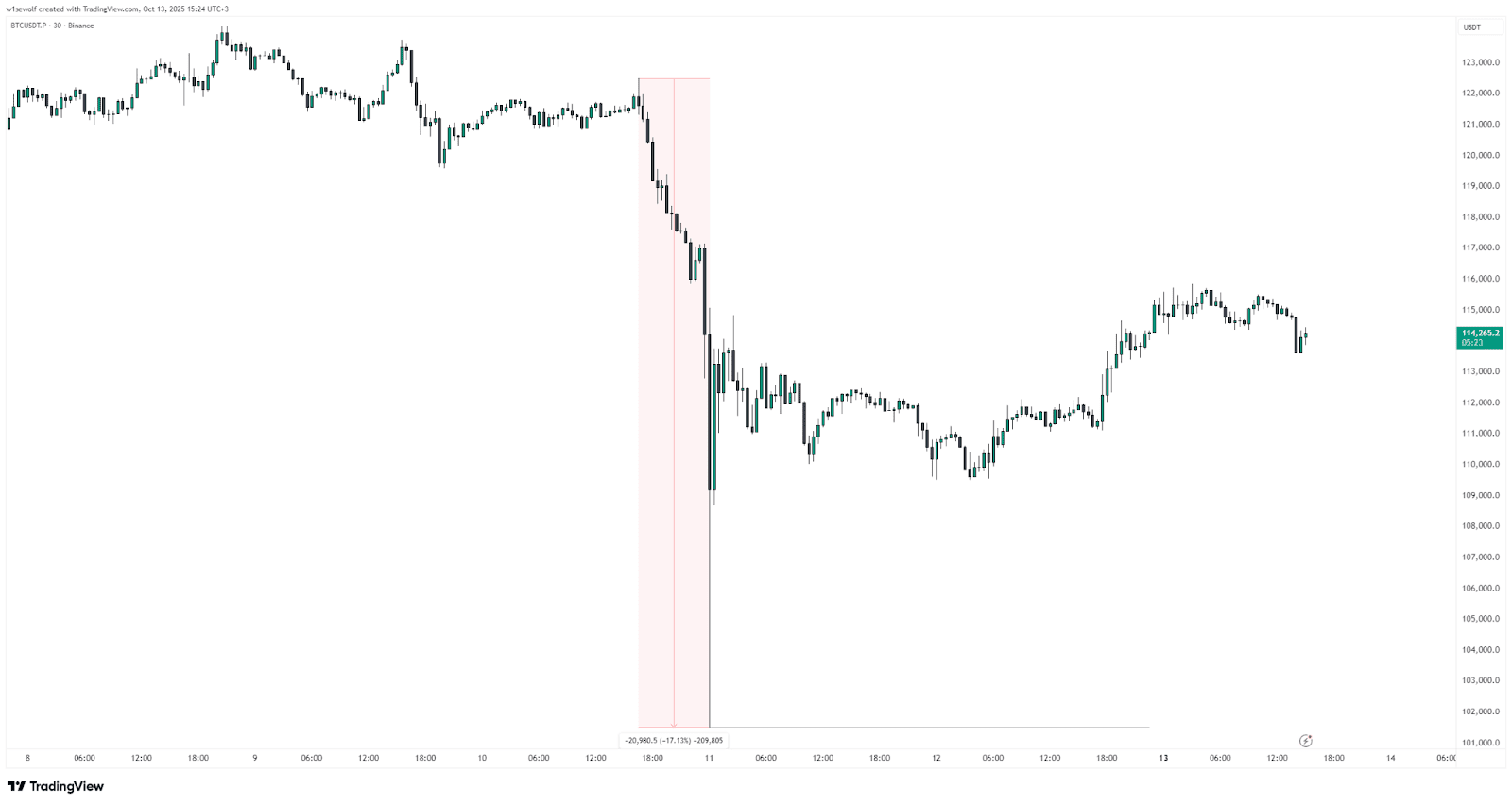

On October 10, the crypto market suffered its largest crash since 2022. In just 25 minutes, total capitalization fell by $560 billion, while futures liquidations exceeded $18.7 billion. Many are asking: why did Donald Trump's words trigger such a severe reaction?

Native cryptocurrencies on Solana, Avalanche, Near, Aptos, and Arbitrum blockchains dropped 30–50% within minutes. On some trading pairs, prices briefly fell to zero due to thin liquidity and technical issues on centralized exchanges.

Bitcoin dipped to $101,000 before rebounding above $115,000. Ethereum (ETH) lost roughly 15%. The market experienced record liquidations, with many traders losing significant positions – and in one tragic case, Ukrainian top trader Kostya Kudo reportedly died following catastrophic losses.

BTC value briefly dropped to $101,000. Source: tradingview.com

The panic selling followed massive capital outflows from Asian markets immediately after the Trump administration announced new tariffs on Chinese imports. Analysts describe the crash as a “perfect storm,” combining political risk, over-leveraged derivatives markets, and liquidity system stress.

The previous day, President Donald Trump announced an additional 100% tariff on Chinese goods (on top of existing 30% duties), effective November 1, 2025. The move marked one of the sharpest escalations in the US–China trade conflict in recent years and one of the bloodiest days for global markets.

Trump cited Beijing’s export restrictions on rare earth metals, essential for electronics manufacturing, as the reason for the tariffs. Following the announcement, the Dow Jones fell 1.9%, the S&P 500 dropped 2.7%, and the Nasdaq slid 3.5%, triggering global sell-offs and a cascade of crypto liquidations totaling $19 billion.

Washington also announced new export controls on critical software, and Trump canceled a planned meeting with Chinese President Xi Jinping at the end of October. Markets interpreted the measures as a signal for further escalation, prompting investors to exit risk assets – including cryptocurrencies.

Notably, the Trump-named crypto asset TRUMP also crashed.

Several major exchanges temporarily halted trading amid extreme volatility. Binance, OKX, and Bybit experienced brief outages, while tokens including WBETH, USDe, and BNSOL lost their peg. Traders faced massive slippage and difficulty placing orders.

Binance later confirmed $283 million in user reimbursements related to temporary token depegging. The company also announced updates to price indexes and the introduction of a “soft price floor” to mitigate future technical volatility.

After markets stabilized, Bitcoin and Ethereum recovered most losses, while altcoins continued trading 10–20% below their October 10 levels.