Trump effect: Bitcoin Asia boycott Hong Kong’s fragile neutrality

A diplomatic dispute erupted ahead of Bitcoin Asia 2025 as government and regulatory representatives withdrew from panels, unwilling to share the stage with Eric Trump. The episode highlighted how political risks limit Hong Kong’s crypto ambitions and its efforts to remain neutral between Washington and Beijing.

A diplomatic dispute has erupted ahead of the upcoming Bitcoin Asia 2025 conference in Hong Kong. Several senior officials, including government and financial regulators, have withdrawn from the event. The unofficial reason: Eric Trump, son of former U.S. President Donald Trump, was added to the speaker list.

What began as a scheduling issue quickly became more than that. The episode exposed Hong Kong’s vulnerability as it seeks to establish itself as a neutral crypto hub in Asia while avoiding Beijing’s red lines. The “Trump Effect” is a warning that Hong Kong’s path to global hub status will be shaped not only by markets and technology, but by politics.

What began as a scheduling issue quickly became more than that. The episode exposed Hong Kong’s vulnerability as it seeks to establish itself as a neutral crypto hub in Asia while avoiding Beijing’s red lines. The “Trump Effect” is a warning that Hong Kong’s path to global hub status will be shaped not only by markets and technology, but by politics.

Eric Trump's participation led to a boycott of Bitcoin Asia 2025 by government officials.

Two prominent names vanished from the Bitcoin Asia 2025 lineup – Eric Yip, executive director of Hong Kong’s Securities and Futures Commission, and legislator Johnny Ng. Both had been billed as key speakers but withdrew in the final days leading up to the event.

The official versions sound neutral: business trip, family circumstances. But sources in the Hong Kong media claim that the decision is directly related to the appearance on the agenda of Eric Trump, the son of the US president and co-founder of the American Bitcoin cryptocurrency project.

For Beijing, the Trump name is associated not only with cryptocurrencies but also with trade tariffs and growing confrontation with Washington. Therefore, for officials, participating in the same panel with him proved to be too risky a signal. In fact, this is a cautious attempt by Hong Kong to keep its distance and prevent interpretations that the city is moving closer to the US administration.

For Beijing, the Trump name is associated not only with cryptocurrencies but also with trade tariffs and growing confrontation with Washington. Therefore, for officials, participating in the same panel with him proved to be too risky a signal. In fact, this is a cautious attempt by Hong Kong to keep its distance and prevent interpretations that the city is moving closer to the US administration.

World Liberty Financial: Why Eric Trump was invited to speak

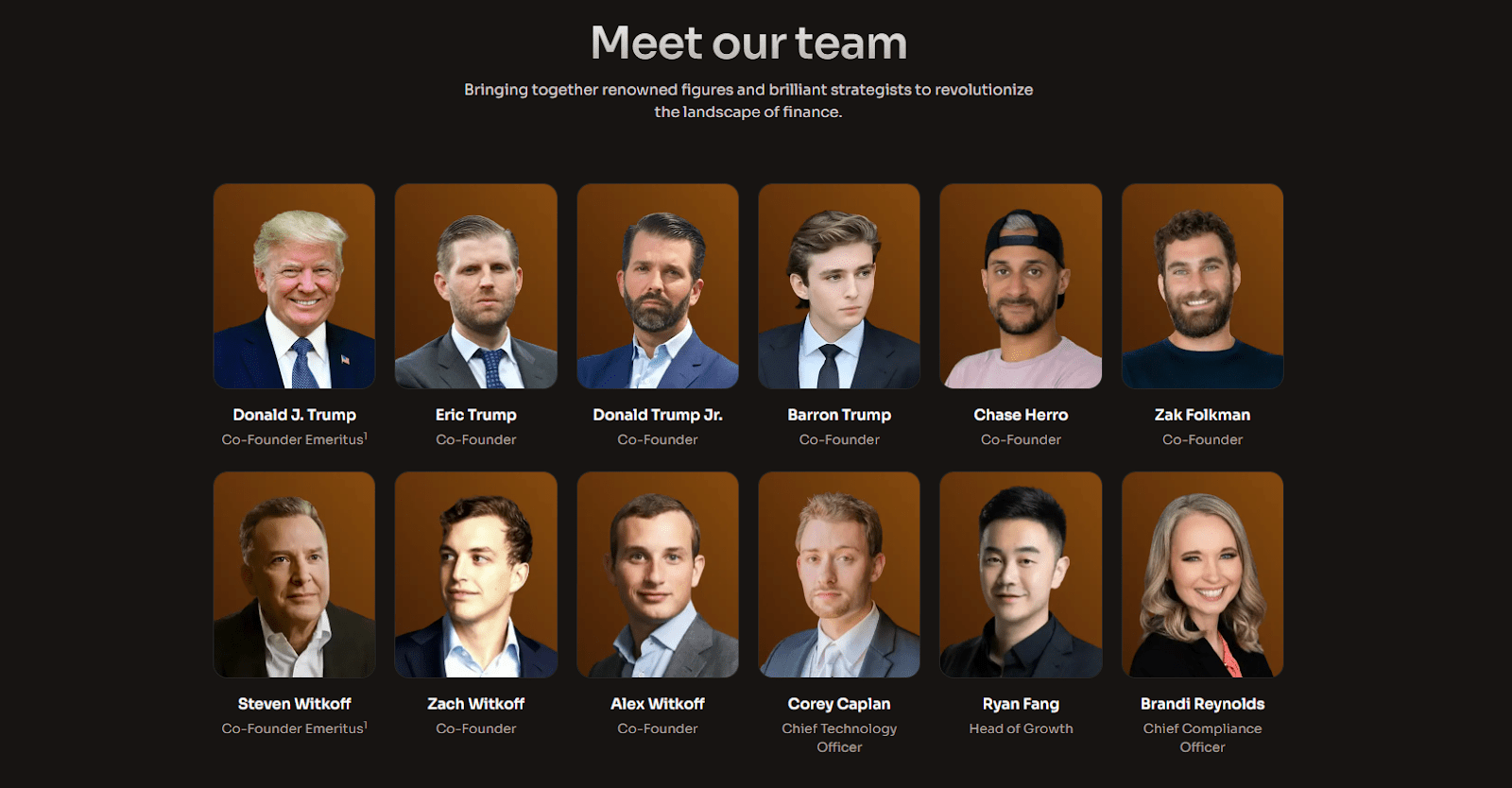

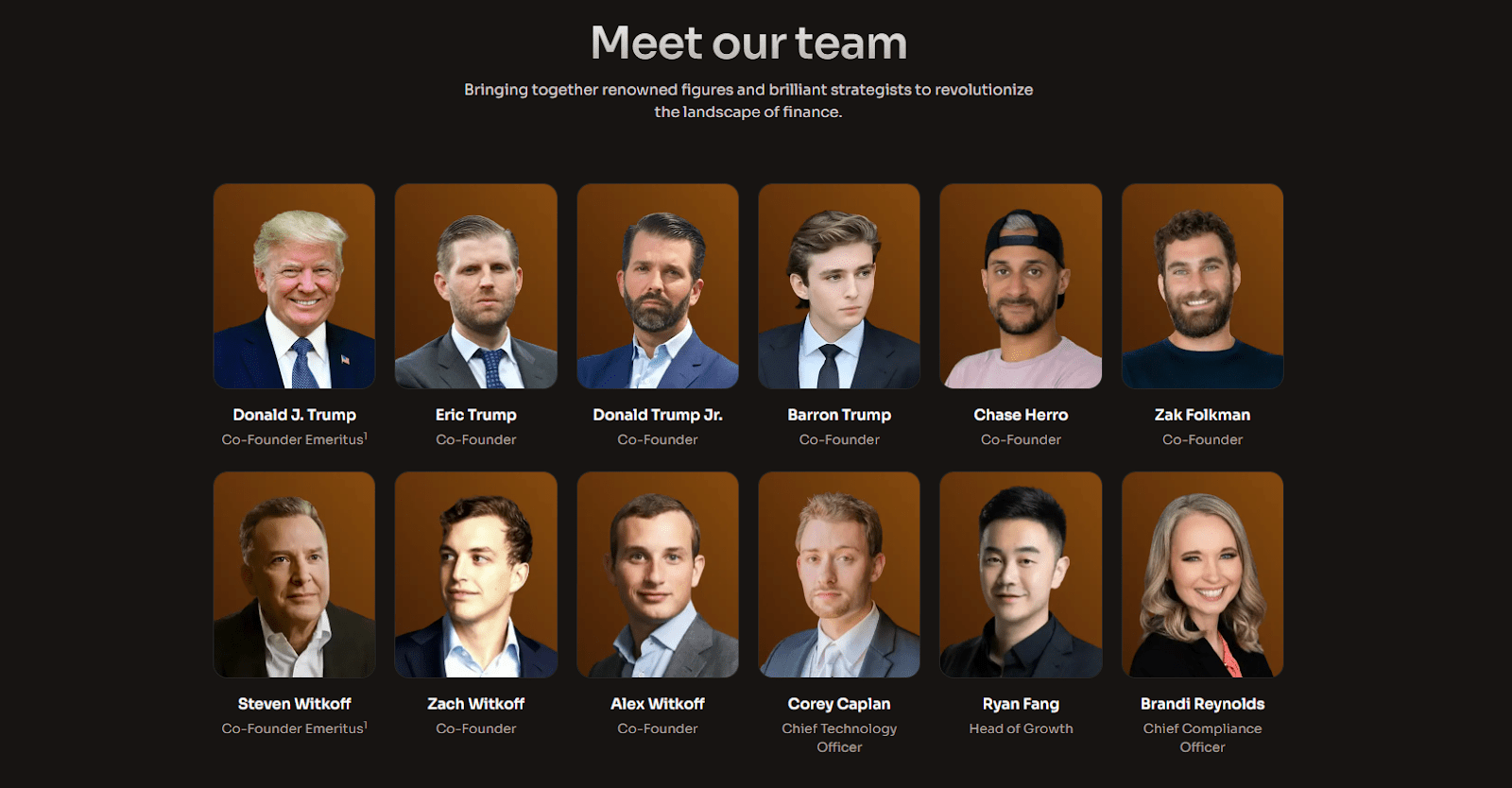

It is no coincidence that the organizers of Bitcoin Asia 2025 chose Eric Trump. He has become one of the faces of the new family venture World Liberty Financial (WLF) – an ecosystem that includes the USD1 stablecoin and the WLFI government token. The project was launched with the direct involvement of the Trump family: Donald Trump is listed as co-founder Emeritus, while Eric, Donald Jr., and Barron are official co-founders.

Regulators simultaneously launched sandboxes for stablecoins and digital funds, and approved Asia's first spot ETFs on Bitcoin and Ether. The Hong Kong Monetary Authority supported test projects on tokenization and the issuance of digital bonds, while the largest digital bank, ZA Bank, began offering retail trading of crypto assets to its customers.

World Liberty Financial team members. Source: worldlibertyfinancial.com

WLF is cultivating the image of a "political stablecoin experiment": its model is tied to actual revenue from U.S. Treasury bonds and uses these proceeds to burn WLFI tokens, creating an artificial scarcity effect. To supporters, this represents innovation and a "trump card" in the crypto economy. To critics, it's an elaborate scheme with Ponzi-nomics elements, legitimized by White House branding.

For the conference, inviting Eric was an obvious strategic move: to attract attention through a keynote speaker who bridges the worlds of politics, cryptocurrency, and institutional capital. But this very choice backfired, triggering a diplomatic scandal.

Hong Kong's crypto strategy: Building a global digital asset hub

Over the past two years, Hong Kong has been actively rewriting the rules of the cryptocurrency market. In June, a new exchange licensing system came into force: now retail investors can only trade Bitcoin and Ether on platforms approved by the Securities and Futures Commission. Participants are required to comply with strict regulations, from verifying the identity of clients to a limited list of tokens included in authoritative indices.

Regulators simultaneously launched sandboxes for stablecoins and digital funds, and approved Asia's first spot ETFs on Bitcoin and Ether. The Hong Kong Monetary Authority supported test projects on tokenization and the issuance of digital bonds, while the largest digital bank, ZA Bank, began offering retail trading of crypto assets to its customers.

For the authorities, this is not just support for the industry, but part of a strategic plan to restore the city's global financial status. After the pandemic and capital outflow, the government is betting on cryptocurrencies and Web3 as a new driver of trust and investment. Financial Secretary Paul Chan directly referred to crypto assets as "an inevitable element of future finance."

The incident demonstrates that Hong Kong's model of openness is limited by the boundaries of political acceptability. The city strives to prove its role as a global hub, but every move must consider both business interests and political context. That is why the Trump story has become an indicator of how fragile the balance between global ambitions and local constraints remains.

For investors, this is a lesson: Hong Kong is indeed ready to take the crypto offensive, but success will depend not only on regulation and infrastructure, but also on the city's ability to strike a balance between Beijing's demands and the expectations of the international market. It is this balance that will determine whether Hong Kong becomes a leader in Asia or remains a cautious mediator.

Navigating between Beijing and Washington: Hong Kong's delicate balance

Hong Kong's course toward crypto openness is a delicate one. The "one country, two systems" formula gives the city room to maneuver, but any move requires looking back to Beijing. Cryptocurrencies remain strictly prohibited in mainland China, and Hong Kong's overly close ties with American projects risk being interpreted as a political challenge.

In addition to political restrictions, there are also practical ones. Banks are still reluctant to work with cryptocurrency companies, as access to accounts and credit remains a challenge. The sector suffers from a shortage of qualified specialists and high requirements for "responsible officers" who must bear legal responsibility for compliance with the rules. Added to this is regulatory uncertainty in segments such as DeFi, staking, or gaming tokens, where there are no clear rules.

As a result, Hong Kong appears to be a liberal hub for digital assets on paper, but in practice, entrepreneurs must consider ongoing risks, ranging from political signals to infrastructure challenges.

In addition to political restrictions, there are also practical ones. Banks are still reluctant to work with cryptocurrency companies, as access to accounts and credit remains a challenge. The sector suffers from a shortage of qualified specialists and high requirements for "responsible officers" who must bear legal responsibility for compliance with the rules. Added to this is regulatory uncertainty in segments such as DeFi, staking, or gaming tokens, where there are no clear rules.

As a result, Hong Kong appears to be a liberal hub for digital assets on paper, but in practice, entrepreneurs must consider ongoing risks, ranging from political signals to infrastructure challenges.

The Eric Trump story as an indicator of Hong Kong's dependence on China

The situation surrounding Bitcoin Asia has demonstrated that the primary risk to the crypto industry in Hong Kong is not technological, but rather political. The very fact that Eric Trump was invited turned an industry event into a diplomatic issue. This is an alarming signal for international investors: any association with "uncomfortable figures" can instantly alter the authorities' attitude and call into question the platform's neutrality.

The incident demonstrates that Hong Kong's model of openness is limited by the boundaries of political acceptability. The city strives to prove its role as a global hub, but every move must consider both business interests and political context. That is why the Trump story has become an indicator of how fragile the balance between global ambitions and local constraints remains.

The price of neutrality: Hong Kong's crypto ambitions meet political reality

The Bitcoin Asia boycott story tested the maturity of Hong Kong's strategy. The authorities wanted to present the city as a platform open to global leaders and ideas. Still, they found that political associations can instantly undermine efforts to create an image of a neutral hub.

For investors, this is a lesson: Hong Kong is indeed ready to take the crypto offensive, but success will depend not only on regulation and infrastructure, but also on the city's ability to strike a balance between Beijing's demands and the expectations of the international market. It is this balance that will determine whether Hong Kong becomes a leader in Asia or remains a cautious mediator.

Recommended