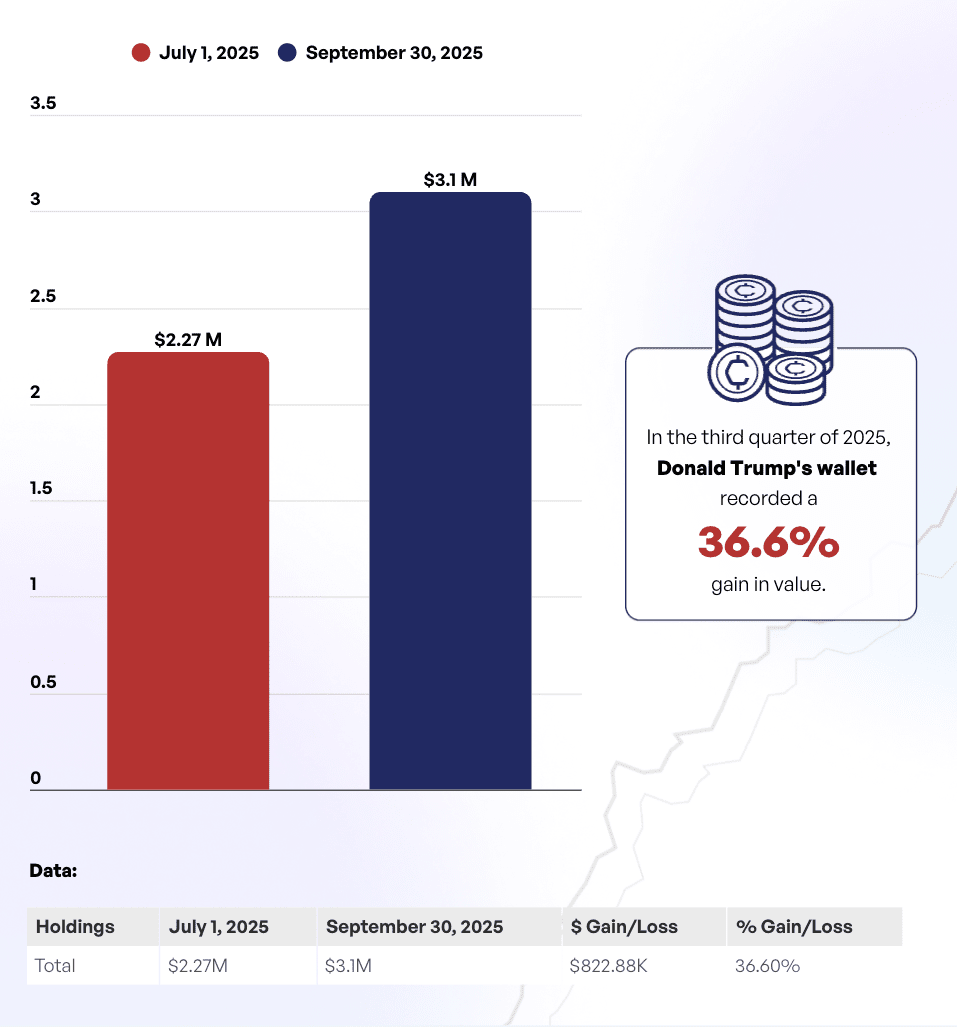

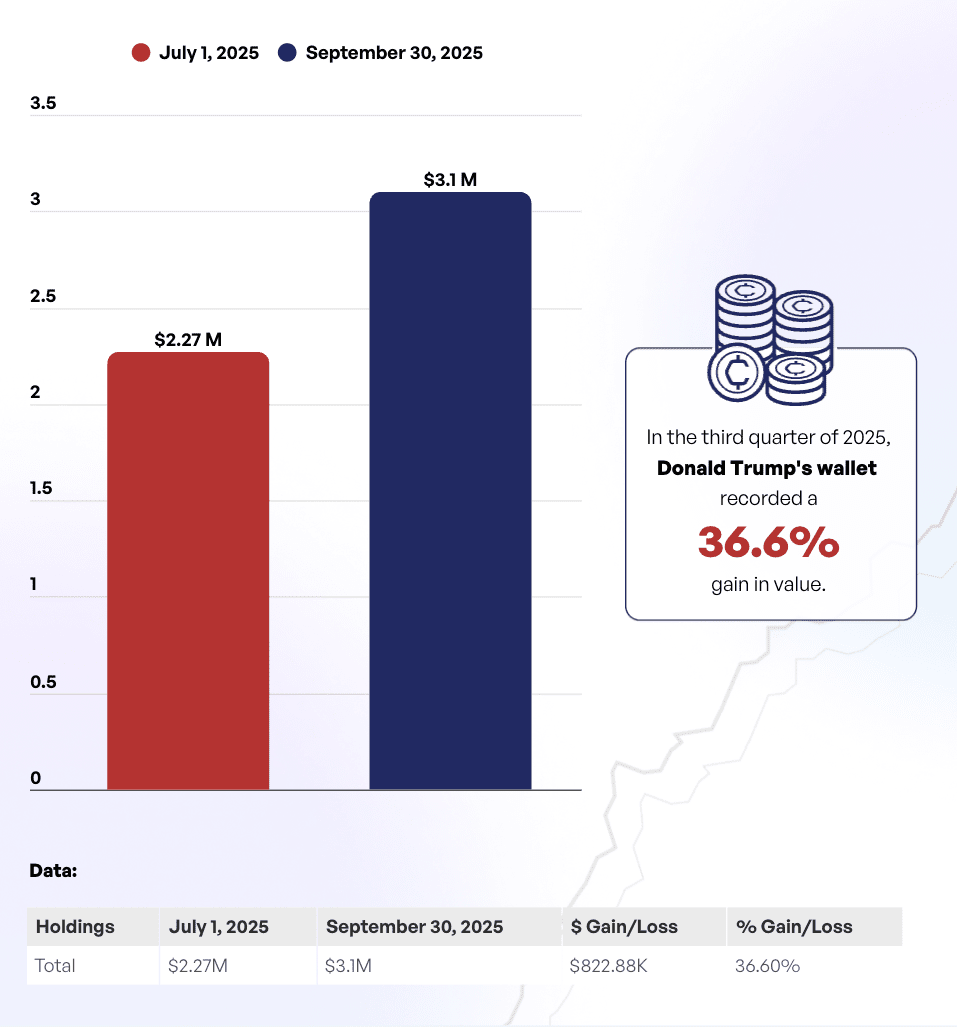

Trump’s on-chain crypto rebounds 36.6% in Q3: Finbold report

US President Donald Trump’s crypto portfolio rebounded 36% in Q3 2025, according to Finbold’s Crypto Market Report.

Between July 1 and September 30, Trump’s on-chain portfolio climbed from $2.27 million to $3.10 million, reversing part of early-2025 losses. A review of the wallet, which blockchain analytics firm Arkham Intelligence has linked to Trump, found the third-quarter increase followed a sharp drawdown earlier in the year. Even after the rebound, the wallet remained 69.5% lower year-to-date compared with January 1, when it stood near $10.16 million before tumbling in Q1 to $1.96 million.

Finbold mentioned two main factors behind the Q3 increase: incoming transfers and unexpected airdrops to the wallet, along with occasional price spikes in Trump-themed tokens. These rallies boosted the market-to-market value of assets in the wallet. Arkham Intelligence previously reported cases where meme-token creators sent coins directly to the public wallet, such as Trump Frog (TROG), increasing its valuation without active trading.

Donald Trump’s crypto wallet rose 36.6% in Q3 2025, reaching $3.1 million. Source: Finbold

The report also highlights the World Liberty Financial (WLFI) ecosystem linked to the Trump family, which saw its market value surge in Q3. WLFI’s holdings rose from $179.3 million on July 1 to $10.81 billion by September 30 - a 5,931% increase in just three months.

Its governance token, which allows holders to vote on the protocol’s future, began trading publicly on major crypto exchanges on September 1, 2025. The Trump family and its affiliates reportedly control 22.5 billion WLFI tokens. High-profile crypto investors, including TRON founder Justin Sun, have backed WLFI, publicly supporting the project and making a significant investment.

BlackRock’s crypto portfolio analysis by Finbold, meanwhile, shows growth of $22.46 billion (from $79.63 billion to $102.09 billion), led by Bitcoin (+$10.99 billion) and Ethereum (+$11.46 billion). During the profitable quarter, Bitcoin millionaire addresses climbed by 7,872, bringing the total to 190,199, with over 22,000 holding $10 million or more.

Recommended