Stablecoin inflows hit $45.6B in Q3 – strongest growth in a year

According to RWA.xyz, in the third quarter of 2025, stablecoin net inflows reached $45.6B, a fourfold increase compared to Q2, when the figure stood at $10.8B.

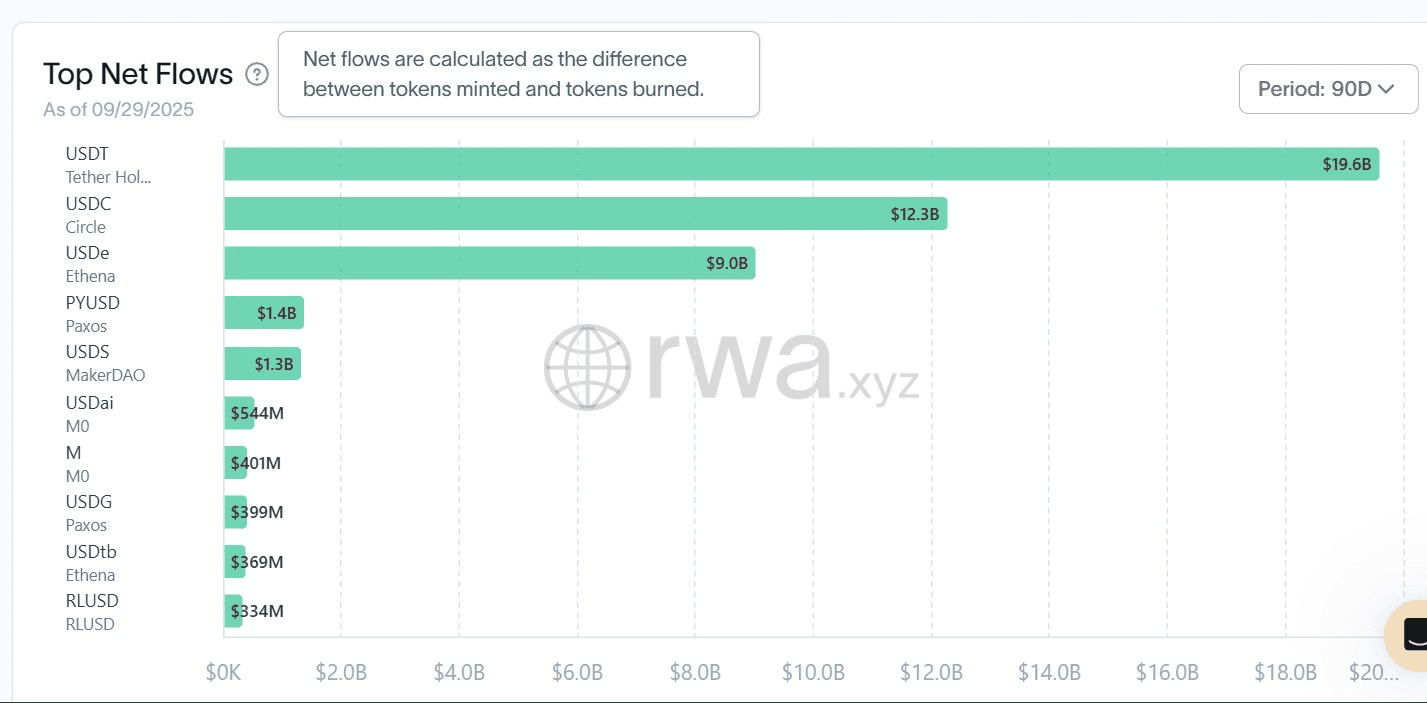

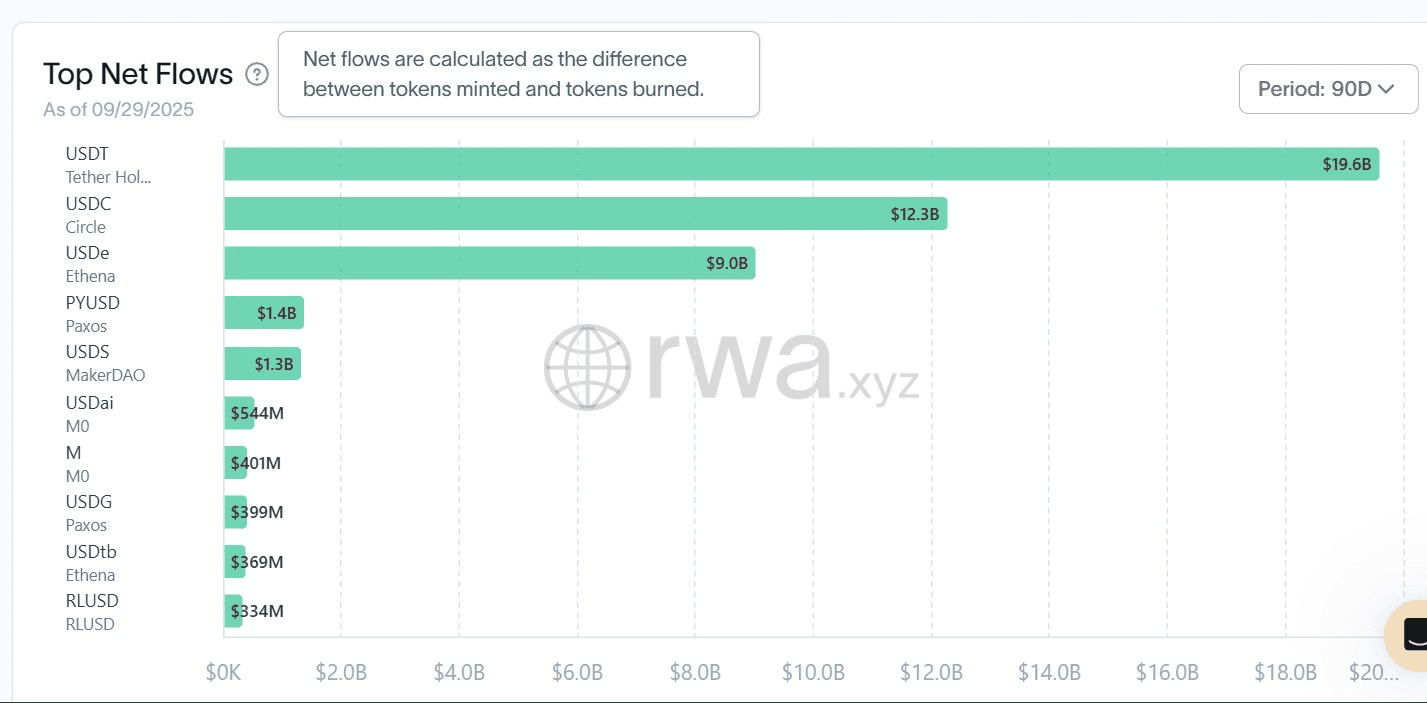

The main driver was Tether (USDT), which accounted for $19.6B in net inflows. In second place was Circle’s USDC with $12.3B. The third-largest contributor was Ethena’s synthetic stablecoin USDe, which added $9B compared to just $200M the previous quarter.

Additional contributions came from PayPal USD (PYUSD) with $1.4B and Sky Protocol’s new stablecoin USDS with $1.3B. Ripple USD (RLUSD) and Ethena’s experimental USDtb also showed modest but notable growth.

Ethereum continues to be the key network for stablecoins, hosting more than $171B of total supply. Tron ranks second with $76B, while Solana, Arbitrum, and BNB Chain collectively hold around $30B.

Despite record inflows, other metrics declined: the number of active addresses dropped by 22.6% to 26M, while monthly transfer volume fell 11% to $3.17T. This suggests that the inflows are primarily driven by institutional demand and hedging, rather than retail user activity.

Thus, Q3 became the most successful quarter for the stablecoin market in 2025, solidifying their role as a core liquidity instrument in the crypto industry.

Additional contributions came from PayPal USD (PYUSD) with $1.4B and Sky Protocol’s new stablecoin USDS with $1.3B. Ripple USD (RLUSD) and Ethena’s experimental USDtb also showed modest but notable growth.

Ranking of stablecoins by capital inflows. Source: rwa.xyz

The surge in demand for stablecoins reflects a broader strengthening of interest in dollar-backed digital assets. According to DefiLlama, total market capitalization rose to $290B over the past 30 days. USDT remains dominant with around 59% market share, USDC holds about 25%, while USDe is quickly gaining traction, now controlling around 5% of the market.

Ethereum continues to be the key network for stablecoins, hosting more than $171B of total supply. Tron ranks second with $76B, while Solana, Arbitrum, and BNB Chain collectively hold around $30B.

Despite record inflows, other metrics declined: the number of active addresses dropped by 22.6% to 26M, while monthly transfer volume fell 11% to $3.17T. This suggests that the inflows are primarily driven by institutional demand and hedging, rather than retail user activity.

Thus, Q3 became the most successful quarter for the stablecoin market in 2025, solidifying their role as a core liquidity instrument in the crypto industry.

Recommended