David Solomon rules out dovish Fed rate cut

Goldman Sachs CEO David Solomon doubts the U.S. Federal Reserve will cut the rate by 50 basis points in September. He considers this an unlikely scenario.

According to him, a more realistic expectation is a 25-point rate cut, and even that will depend heavily on the development of the economic situation. Solomon suggests that there could be one or two more such steps by the end of the year if economic data continues to worsen.

He noted that there are signs of "softening" in the labor market: job growth is no longer as robust as before, and the pace of hiring is slowing down. In his opinion, this could give the Fed a strong reason for a looser monetary policy.

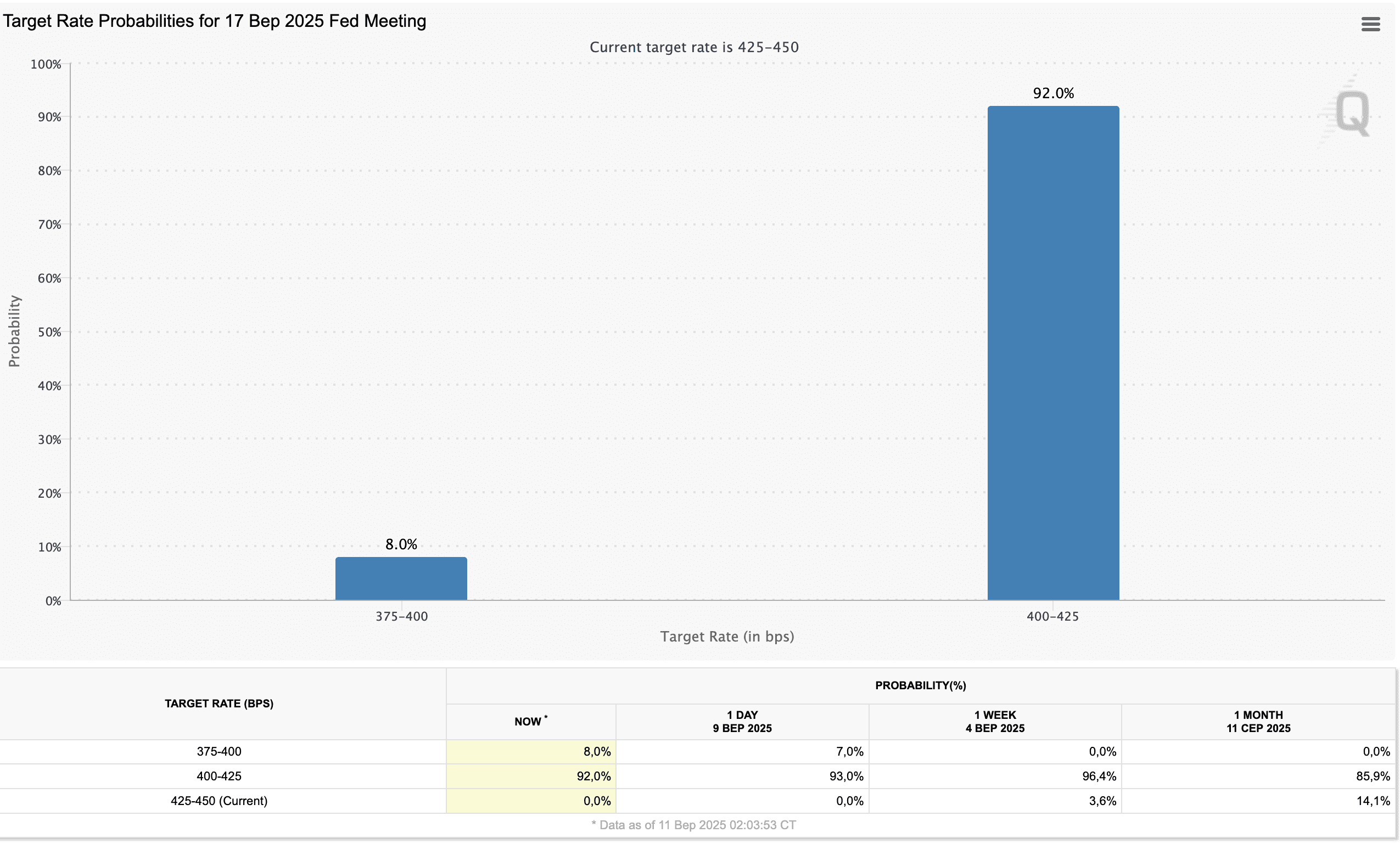

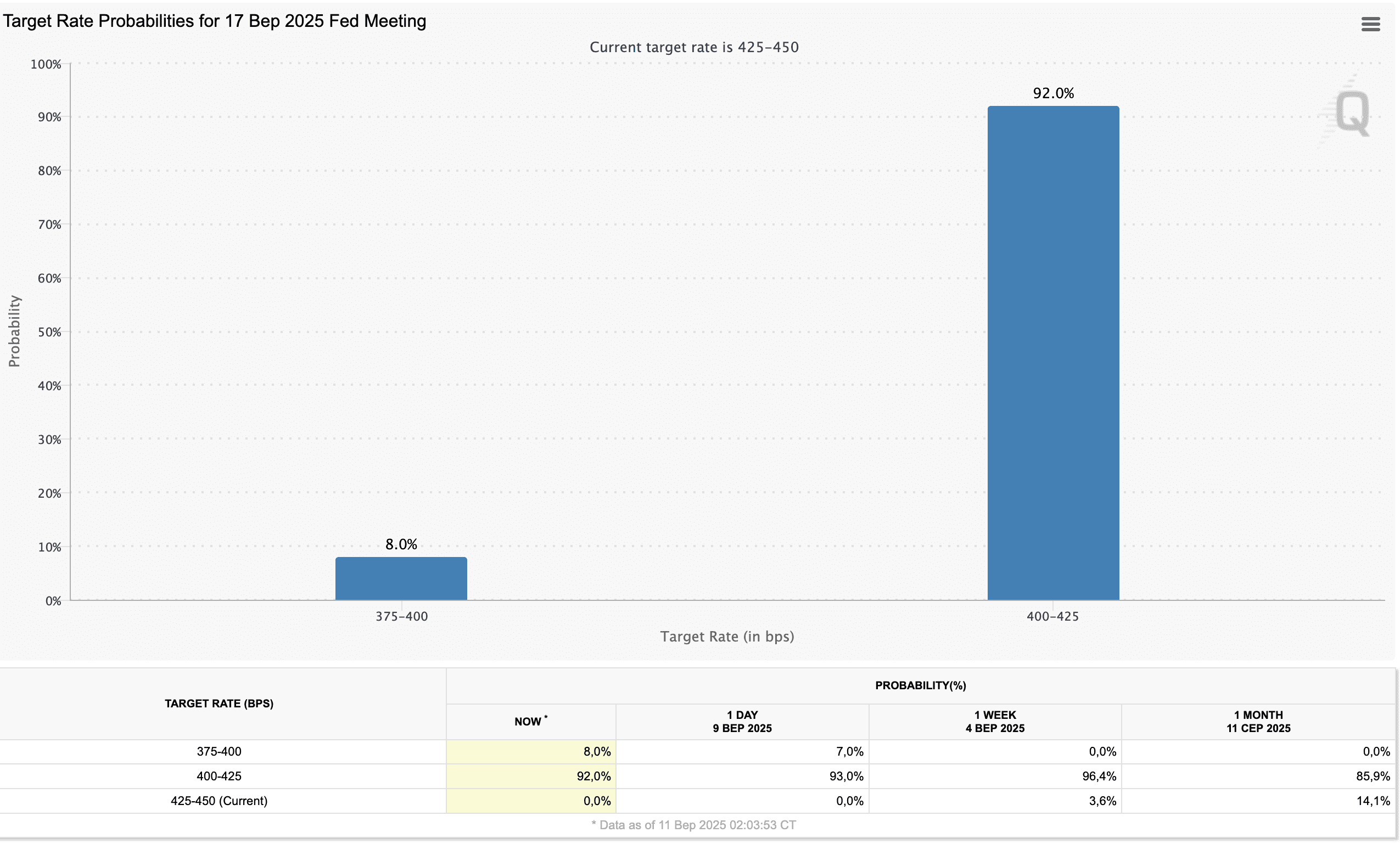

Currently, market expectations reflect this cautious outlook. The CME FedWatch tool shows that around 92.2% of market participants expect a 25-point rate cut, while only 7.8% foresee a more aggressive 50-point cut.

Market participants are almost unanimously voting for a 25-point reduction. Source: cmegroup

Solomon also noted that financial institutions like Standard Chartered recently revised their scenarios due to weak August labor market data. But overall, his expectations fit into a moderately cautious tone: a rate cut is possible, but not radical and not too fast.

Looking at the experience of past years, a Fed rate cut usually served as a signal for the crypto market. For example, in 2019, when the Federal Reserve lowered rates, Bitcoin grew by almost 20% in a couple of weeks as investors hoped that cheap money would push demand. However, each time the situation was different: sometimes crypto prices jumped, other times the impact was muted.

In such moments, the market resembles a chess match: everyone holds their breath, waiting for the regulator's next move. Cryptocurrencies can react either lightning-fast or not at all, depending on broader macroeconomic signals and institutional positioning.

Recommended