Sharps Technology acquires over 2M SOL worth $400M

Nasdaq-listed Sharps Technology made its first big crypto move, buying 2M SOL under a new digital treasury plan.

The company acquired more than 2 million Solana (SOL) tokens valued at over $400 million. The deal was funded via a recent PIPE stock placement. SOL will now serve as a core asset in Sharps Technology’s digital treasury.

The company said it will provide regular updates on its crypto holdings and performance to maintain investor transparency.

Until now, Sharps focused on medical devices and pharma packaging, particularly syringes and healthcare solutions.

The Solana investment marks a pivot toward Web3, with the company describing the network as “the fastest and most in-demand public blockchain” and positioning its capital to generate yield within it.

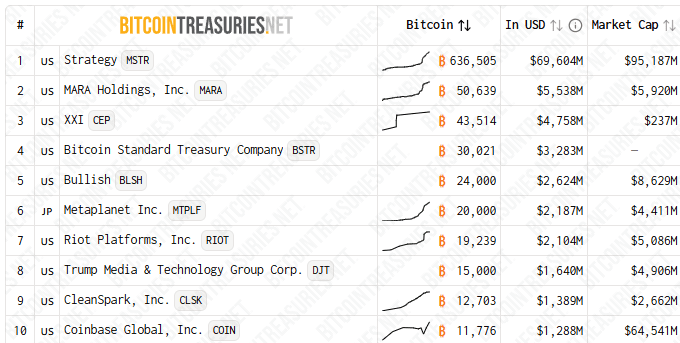

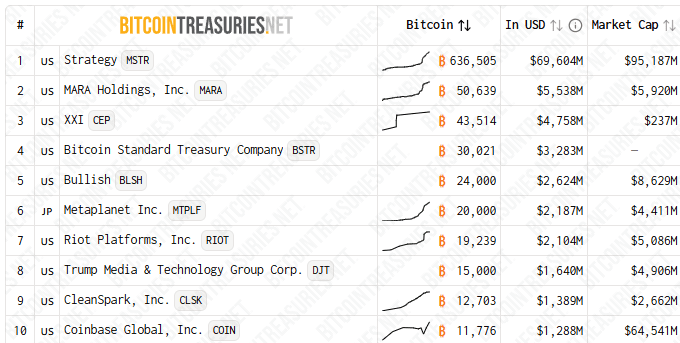

Sharps is not the only public company adopting a digital asset treasury strategy. Since 2020, Strategy has been steadily accumulating Bitcoin, now holding more than 250,000 BTC, making it the largest corporate holder. Tokyo-based Metaplanet has acquired 20,000 BTC over the past year, branding itself the “Japanese Strategy.”

Top 10 corporate projects accumulating Bitcoin. Source: bitcointreasuries.net

Data from HC Capital shows that Sharps Technology immediately took the top spot among public companies by Solana holdings. Upexi Inc. ranks second with 2 million SOL, followed by DeFi Development Corp (1.42 million SOL), Mercurity Fintech (1.08 million SOL), and iSpecimen Inc. (1 million SOL).

Recommended