September turns green for Bitcoin ETFs, but narrows to IBIT

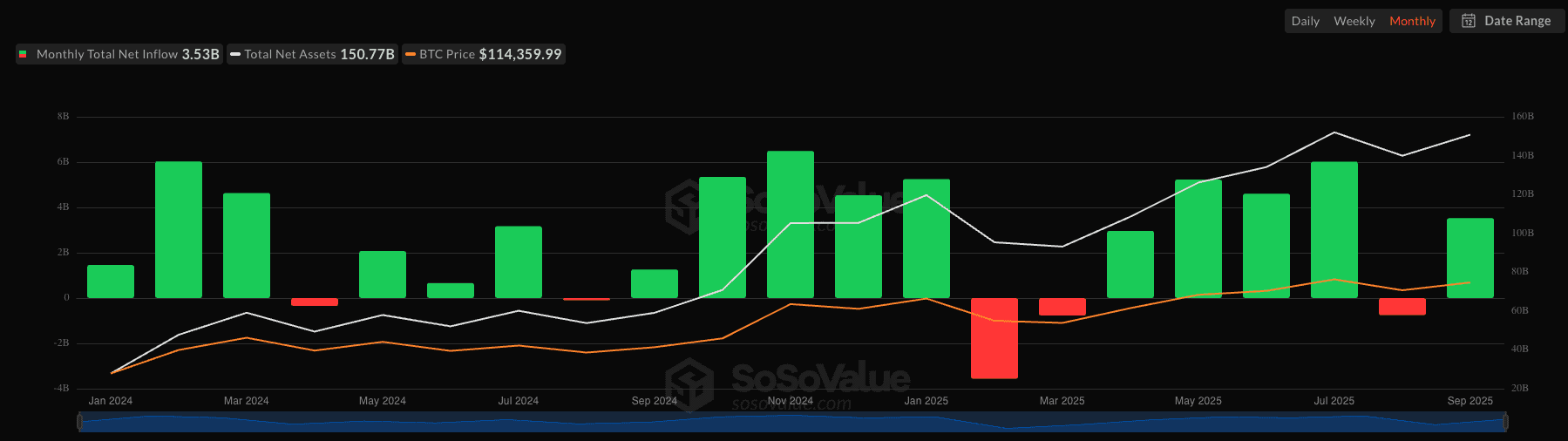

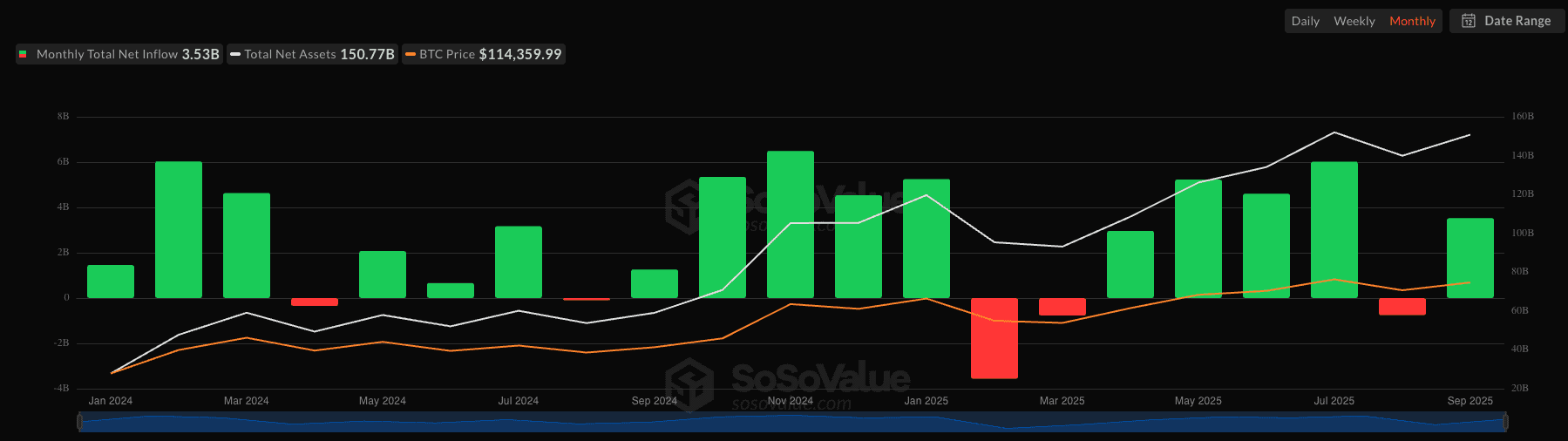

September closed green for U.S. spot Bitcoin ETFs, with roughly $3.53B of net inflows after a red August (−$0.75B).

Participation eased month over month, with ~$73B traded versus $78B in August. Total AUM finished near $150.8B as BTC’s mid-month strength offset weakness in the final week.

September turned green for Bitcoin ETFs (~$3.53B) even as breadth narrowed; AUM closed near $150.8B with BTC around $114K. Source: SoSoValue

Inside the month, inflows were front‑loaded. The first three weeks were positive and together added around $3.5B; the last week flipped to −$0.9B on the heaviest turnover of the month. Volumes climbed as the month progressed, and mid-month (~$153B) before sliding alongside BTC’s price. That mix points to rotation and de‑risking rather than an exit.

Leadership stayed narrow. IBIT (iShares Bitcoin Trust, BlackRock) did almost all the lifting – about $2.66B in September inflows, roughly 75% of the month’s total. Liquidity was similarly concentrated: ~$55.5B traded (~76% of the segment), with month-end AUM around $87.8B (~58% share). FBTC (Fidelity Wise Origin Bitcoin Fund) contributed a modest ~$524M and about $7.14B in turnover, while peers were mixed to negative. When one fund dominates inflows, rallies can be fragile and reversals faster.

The broader frame is constructive but selective. Month‑on‑month flows returned positive without a surge in activity. The quarter (Jul–Sep) ended net positive even as volumes stepped down. Over the past six months, steady inflows and price combined to lift AUM materially; over 12 months, the segment remains a net gatherer with strength concentrated in late ’24 and the first half of ’25.

Bottom line: September was green but narrow – nearly all net inflows went to IBIT while trading volumes eased.

Heading into October, key watch points include whether leadership broadens beyond IBIT and if BTC stabilizes to prevent AUM declines.

Recommended