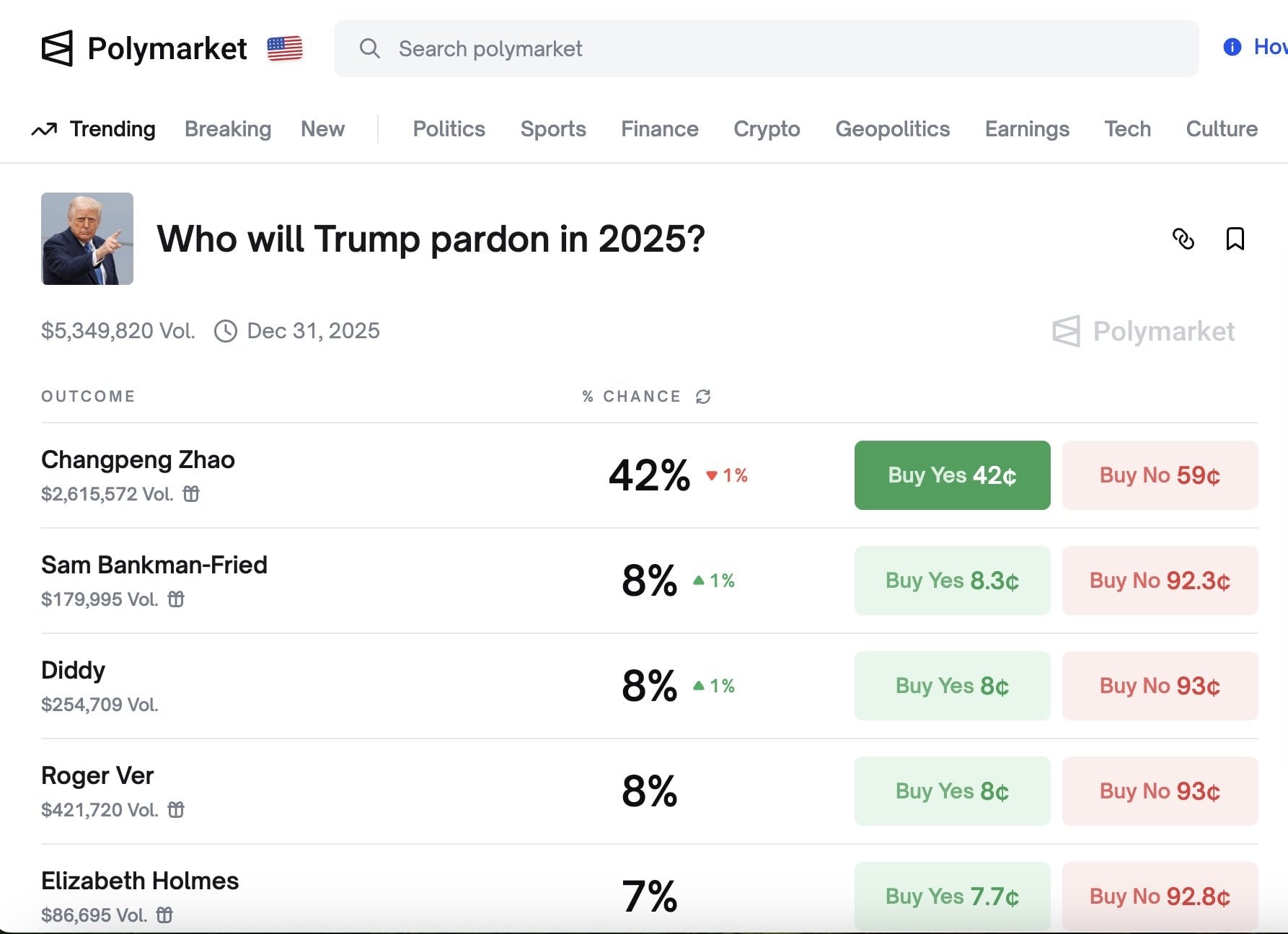

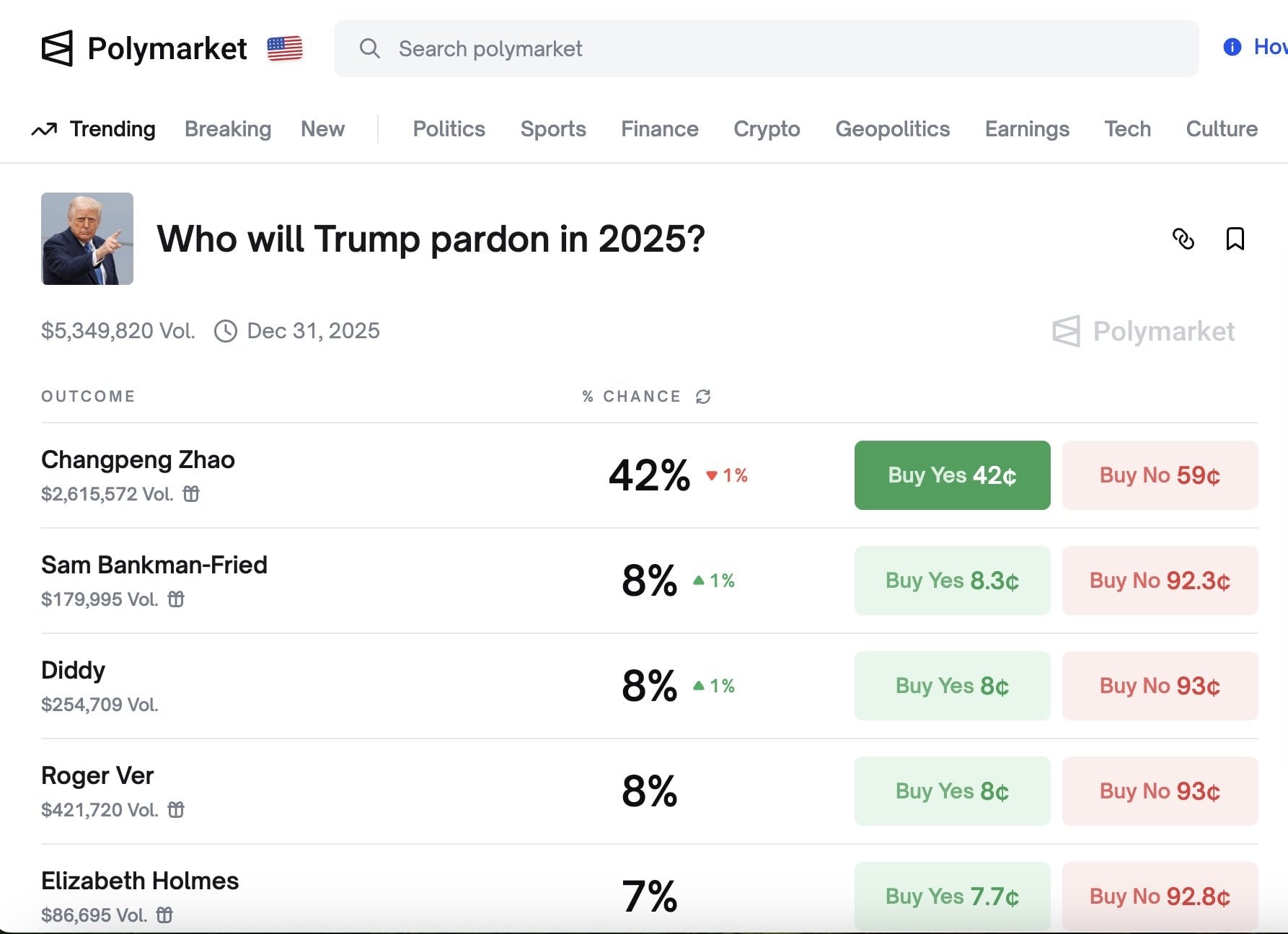

Polymarket splits on CZ pardon timing – optics vs probability

Rumors are loud, pricing is not: Polymarket has the "Pardon by Oct. 31" market near 5%, while the full‑year board shows 42% for Changpeng Zhao at the top. The split points to belief in eventual action – just not on an October clock.

The distance between the short‑dated and full‑year lines reflects mechanics more than emotion. High‑profile clemency on short notice collides with political optics and with the way the White House sequences contentious decisions, whereas a later window lets headlines cool and allows clemency to be bundled with other moves.

Two forces argue against a rush decision. First, WLFi/USD1 headline risk: World Liberty Financial’s stablecoin has been tied to high‑profile transactions, including a multi‑billion interaction involving Binance this spring; moving now would sharpen "pay‑to‑play" narratives while Senate questions and media scrutiny are active. Second, process and timing: controversial clemency is often staged alongside broader announcements or end‑of‑year releases – patterns that don’t favor a surprise October action.

In the next 2–4 weeks, the base case is no October pardon. That keeps the regulatory overhang where it is and leaves pricing mostly macro‑driven: BTC and large caps follow rates and the dollar; BNB avoids a headline spike; funding and near‑dated skew track overall volatility rather than a clemency catalyst. A true October surprise would likely jolt BNB, compress BNB/USDT basis, and lift large‑cap beta into U.S. hours – but the impulse would be brief unless policy follow‑through materializes.

Polymarket odds for a CZ pardon by Oct. 31 sit near 5%. Source: Polymarket

For the rest of 2025, Polymarket’s 42% reads as a bet on delayed action. If the news cycle cools and the White House batches contentious moves into a late‑December window, a pardon then is plausible. Should that land, expect a relief pop centered on BNB – basis tighter, funding firming, short‑dated call skew higher – with a sympathy bid in listed crypto proxies (e.g., COIN). If the calendar turns without action, markets revert to the status quo: BTC/majors remain macro‑led while BNB/Tron flows stay range‑bound, and that year‑end line should drift lower as time decays.

On the full-year market, CZ leads at ~42%, with SBF, Diddy, Roger Ver and Elizabeth Holmes around 7–8%. Source: Polymarket

GNcrypto has been tracking the politics–crypto axis all year. As GNcrypto analyzed earlier, donor cash and personnel shifts coincided with regulatory relief for major firms (Gemini, Coinbase, Crypto.com, OpenSea, Nova Labs) and the rise of politically linked stablecoin rails. That backdrop explains why traders price eventual clemency meaningfully higher than an immediate one: long‑run probabilities reflect the policy tilt; near‑term odds reflect public perception and sequencing.

Recommended