Polymarket plans new funding round at $15 billion valuation

Polymarket is preparing for a new investment round that could solidify its leadership among prediction platforms and force rivals to compete for capital.

Bloomberg reports on the new funding round, citing sources familiar with the matter. Polymarket, a platform specializing in prediction markets, could see its valuation increase to $15 billion.

The figure reflects the company’s estimated market value, not the amount being raised. Polymarket is expected to seek several hundred million dollars in new funding – but at a sharply higher valuation.

By comparison, the company was valued at around $1 billion in June. Following its deal with Intercontinental Exchange (ICE), owner of the New York Stock Exchange, that figure rose to about $9 billion. ICE invested up to $2 billion in October, becoming a key backer and effectively paving the way for this new round.

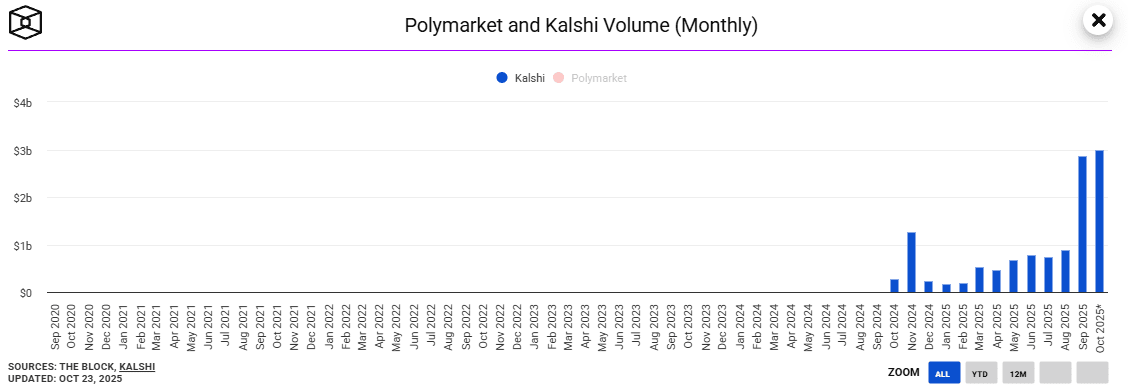

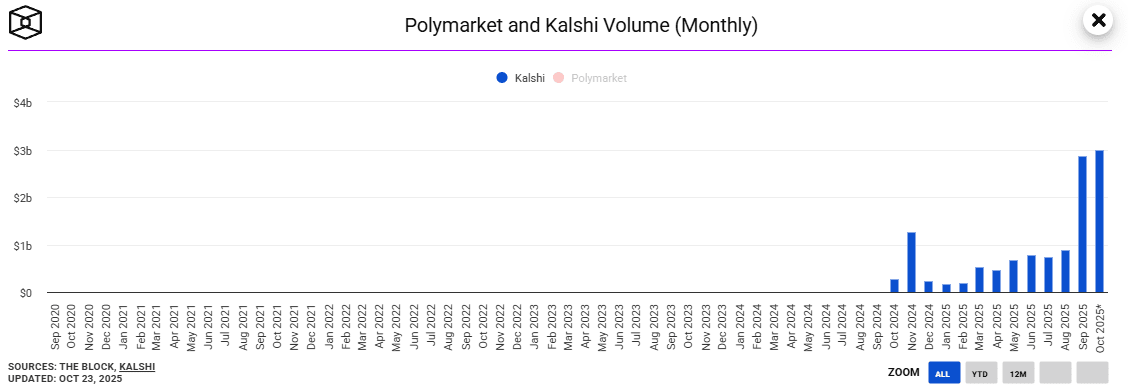

Polymarket aims to strengthen its lead as institutional investors and traditional financial firms move into the prediction market space. For the week ending October 19, trading volume on the platform hit $2 billion – a new record that surpassed activity during the 2024 U.S. presidential election.

Trading volume on Polymarket. Source: theblock.co

The surge in activity is driven not only by political markets but also by the addition of new categories, including contracts tied to corporate earnings, culture, and sports results.

Polymarket also signed its first partnership with the National Hockey League (NHL), becoming the first crypto platform authorized to use official league branding in prediction markets.

Following the ICE deal, founder and CEO Shayne Coplan has become the youngest crypto billionaire. According to sources, the company is preparing to expand operations in the U.S. under CFTC compliance and KYC verification standards – paving the way for institutional investment and faster market launches.

Polymarket’s main rival, Kalshi, is also in talks for a new funding round that could value it at over $10 billion. Analysts argue the two platforms are creating a new class of financial assets – regulated prediction contracts that merge elements of trading and real-time event analytics.

Recommended