Pimco sees UK inflation easing, paving way for deeper BoE cuts

Pimco expects UK inflation to fall toward 2% by end-2026, allowing deeper BoE rate cuts than market price. The $2tn manager has positioned for this via overweight five-year gilts.

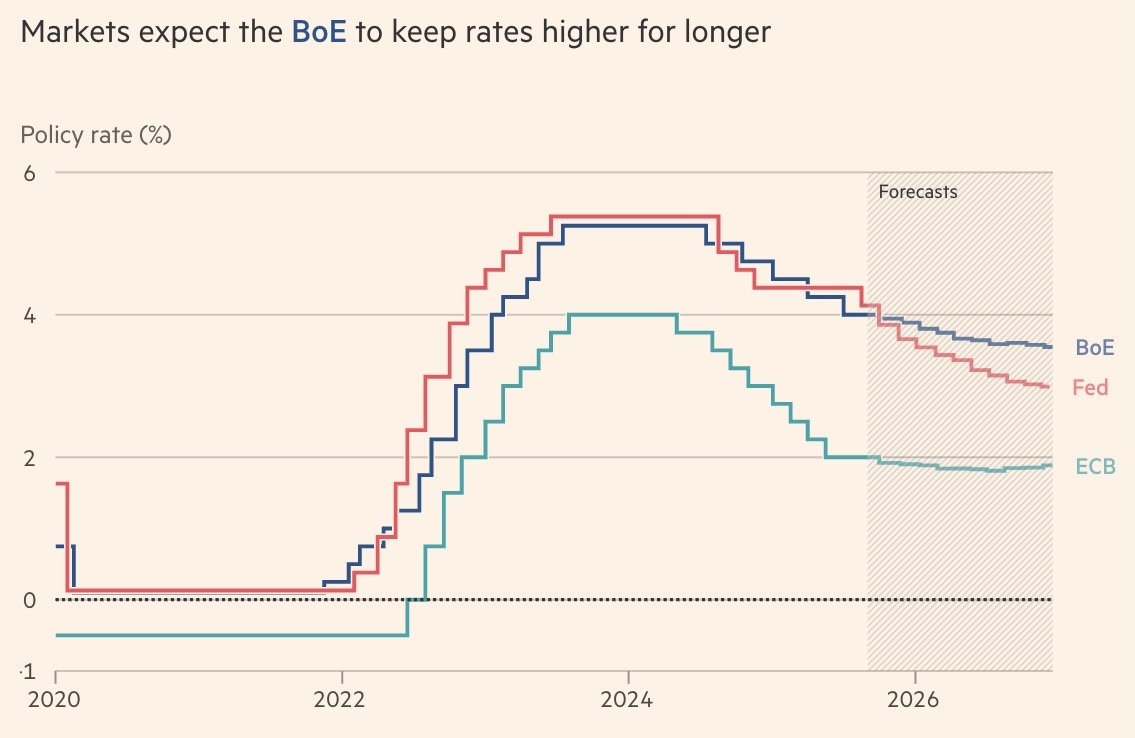

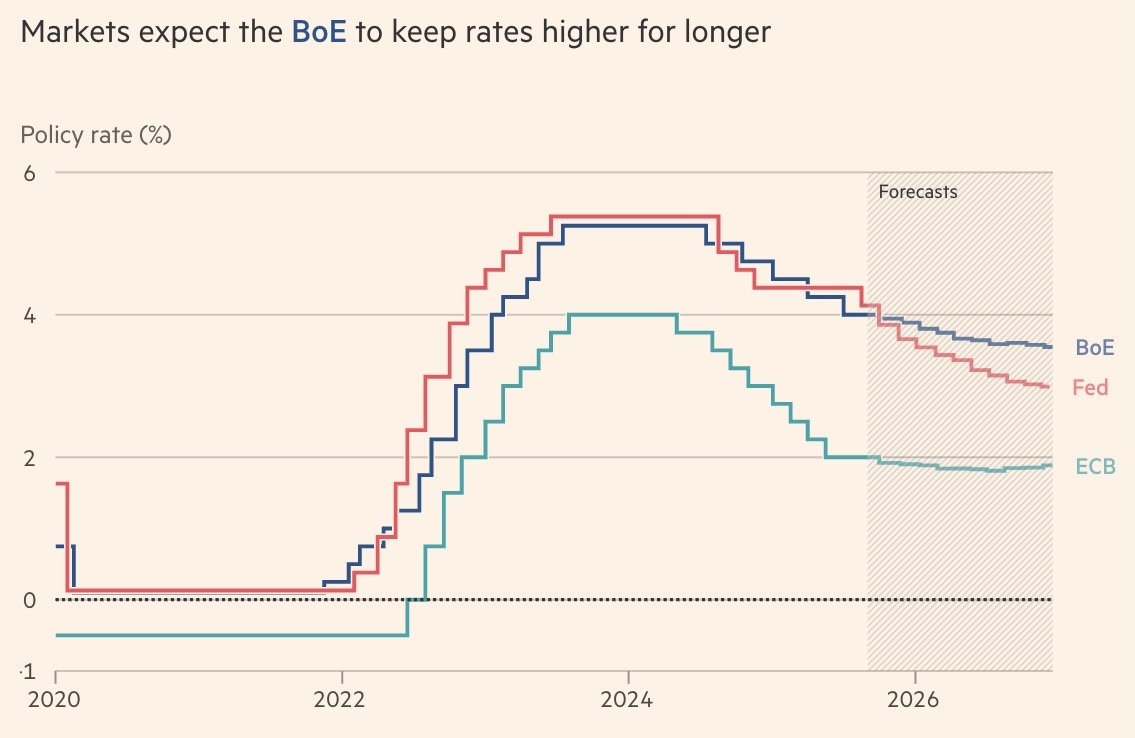

Pimco – which manages about $2 trillion – has an overweight position versus its benchmark in five‑year gilts, positioning for a path where the BoE lowers borrowing costs beyond current market pricing. In swaps, traders anticipate just one or two 25 bp cuts by the end of 2026, from today’s 4.0% policy rate. By contrast, Pimco expects progress on disinflation that would let Bank Rate move closer to its estimate of the UK’s neutral rate around 2.75%.

We don’t think the UK economy will prove to be a massive outlier,said Andrew Balls, Pimco’s chief investment officer for global fixed income, in an interview with the Financial Times.

Balls points to slowing wage growth helping to cool headline inflation and to one‑off factors – such as retailers passing through higher staff costs after increased employer national‑insurance contributions – that should fade. The firm projects inflation easing toward 2% by late 2026, bringing the UK more in line with peers after a stretch of stickier prices tied partly to food.

Markets have treated the UK as an outlier this year. The OECD sees Britain recording the highest G7 inflation rate in 2025. The ECB has already reduced its deposit rate to 2%, from 4% at mid‑2024, and Fed‑funds futures point to four quarter‑point cuts over the next 12 months from the 4-4.25% range. LSEG forecasts referenced by the FT still show the BoE keeping rates higher for longer than the Fed or ECB into 2026.

The BoE itself struck a cautious note last week, holding at 4.0% and warning that medium‑term upside risks to inflation remain prominent in the Monetary Policy Committee’s outlook. UK CPI is running at 3.8%, and the government has stressed the need to keep pressure on inflation. Chancellor Rachel Reeves recently told ministers to join the fight against rising prices amid persistent cost‑of‑living strains.

Fiscal policy is another swing factor. The November Budget could include new revenue measures to plug an estimated £20bn fiscal hole. Balls said investors will watch any duties or VAT changes closely for their potential impact on the inflation path.

Pimco’s positioning reflects a view that the UK will ultimately rejoin the pack as disinflation gathers pace, rather than remain a “massive outlier” on prices and rates. For bond investors, that scenario would favour intermediate maturities like five‑year gilts, which tend to be more sensitive to shifts in the policy path than very short‑dated bills.

The debt market will now weigh incoming data on wages, services inflation and retail margins against the BoE’s steady‑hand stance. If inflation cools toward the 2% target on Pimco’s timetable, room for deeper cuts than currently priced could open in 2026, narrowing the gap with the Fed and ECB and easing a key brake on the UK economy.

Recommended