OpenSea relaunches as multichain platform for token trading

Former NFT market leader OpenSea has officially completed its transformation into a crypto aggregator, combining trading for all types of tokens - from traditional digital assets to memecoins.

Following years of declining interest in NFTs and large-scale layoffs, the company has successfully rebooted its business, pivoting toward tokenization and multichain trading.

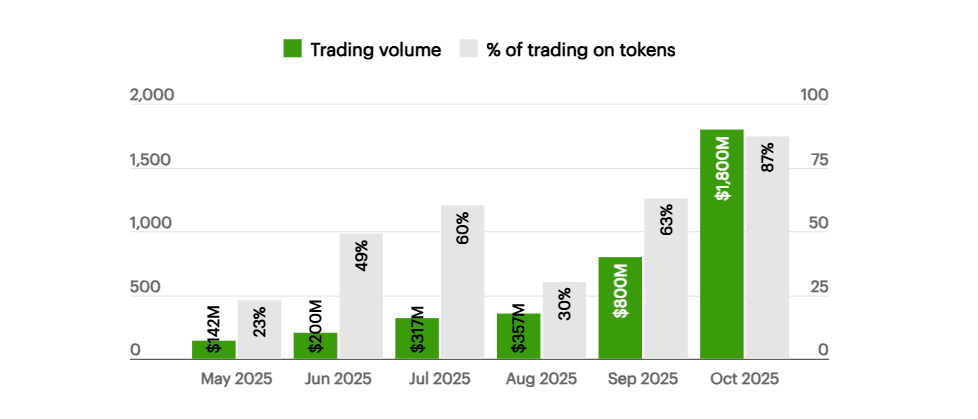

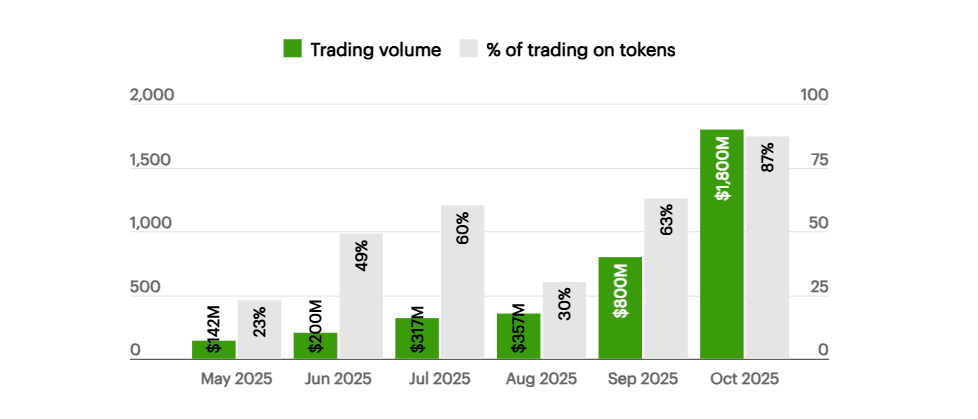

Since early October, OpenSea’s trading volume has reached $1.6 billion, its highest level since 2022. However, NFT-related transactions now account for just $230 million, while the majority of trades involve cryptocurrency tokens.

Token trading share on OpenSea reached 87% in October. Source: forbes.com

Another example of the broader NFT market downturn is Christie’s, one of the world’s oldest auction houses, which has shut down its dedicated NFT division. The company - once a driving force behind the NFT boom after the record-breaking sale of Beeple’s Everydays: The First 5000 Days for $69.3 million in 2021 - is now folding its digital art operations into its traditional auctions under the broader “20th–21st Century Art” category.

OpenSea now supports 22 blockchains, including Ethereum, Solana, and Base, aggregating liquidity from DEXs such as Uniswap and Meteora. The platform charges a 0.9% transaction fee, generating over $16 million in revenue in just two weeks.

Project founder and CEO Devin Finzer explained the strategic shift as a necessary adaptation to the new phase of crypto adoption - one dominated by speculative tokens and active trading. OpenSea aims to become a one-stop platform for all digital asset operations, making crypto trading as intuitive as Robinhood or Coinbase.

By pivoting toward memecoin and DeFi token markets, OpenSea is regaining momentum amid a sharp decline in trading volume at its main rival Blur, whose activity has plunged from $1 billion to under $100 million.