Oil oversupply fears cap price growth

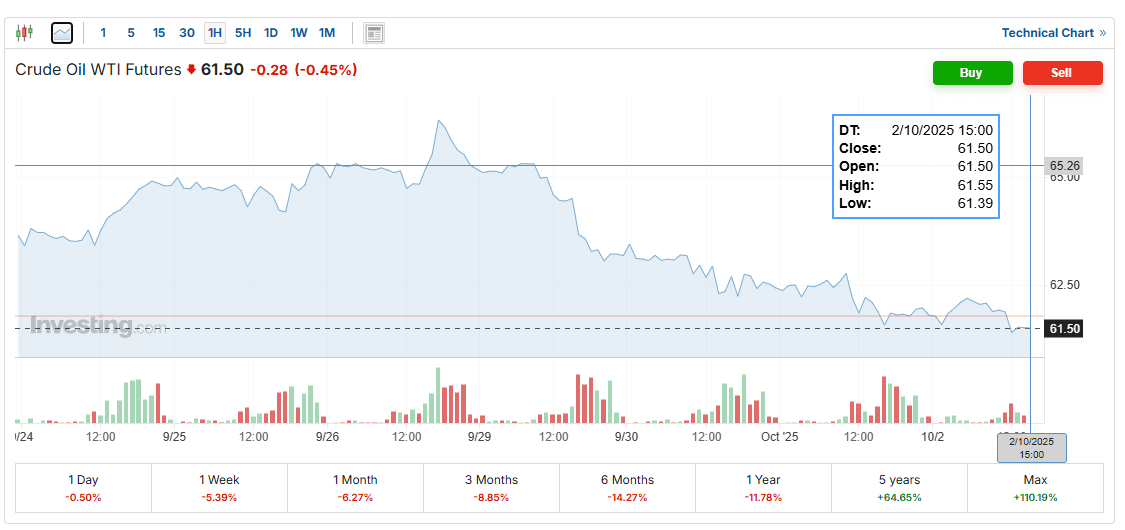

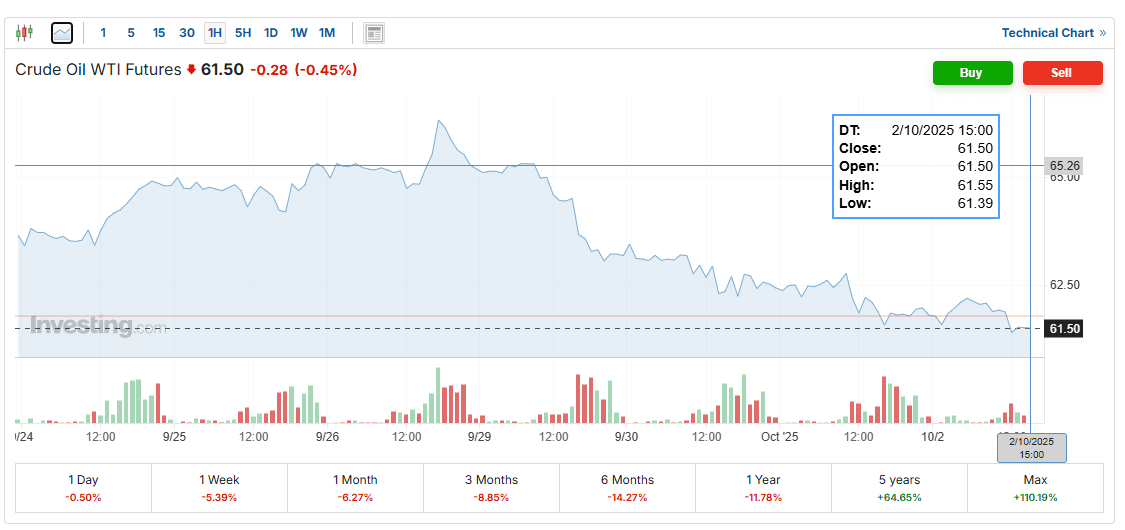

Brent and WTI hover around $65 and $62 amid talks of restricting Russian supplies and a likely OPEC+ production hike.

On Thursday, oil prices fluctuated, remaining near three-month lows. Concerns over new disruptions to Russian crude exports lent support, but gains were capped by expectations of higher OPEC+ output and data showing rising U.S. inventories.

Brent added 0.2% to $65.49 a barrel, while WTI strengthened to $61.92. Shortly afterward, however, prices reversed lower: Brent fell 0.6% to $64.98, and WTI slipped to $61.42 – the fourth consecutive day of declines.

Nevertheless, investors remain focused on supply: according to sources, OPEC+ may raise production by 500,000 barrels per day as early as November – triple the October increase. It is aimed at helping Saudi Arabia regain lost market share.

Further downward pressure came from EIA data showing a 1.8 million barrel build in U.S. crude inventories, along with weak demand from refiners.

China is softening the picture by continuing to actively replenish its strategic reserves. Traders believe Beijing’s purchases have helped limit the price drop.

Thus, the oil market is caught between opposing forces: potential tightening of sanctions against Russia and the threat of global oversupply. In the coming weeks, dynamics will hinge on OPEC+ decisions and geopolitical actions by the U.S. and its allies.

Brent added 0.2% to $65.49 a barrel, while WTI strengthened to $61.92. Shortly afterward, however, prices reversed lower: Brent fell 0.6% to $64.98, and WTI slipped to $61.42 – the fourth consecutive day of declines.

Graph of WTI oil futures prices. Source: investing.com

The primary supportive factor is discussions of new G7 sanctions against buyers of Russian oil and firms helping circumvent restrictions. At the same time, reports emerged that the U.S. will provide Ukraine with intelligence for strikes on Russian energy infrastructure, adding to geopolitical risks.

Nevertheless, investors remain focused on supply: according to sources, OPEC+ may raise production by 500,000 barrels per day as early as November – triple the October increase. It is aimed at helping Saudi Arabia regain lost market share.

Further downward pressure came from EIA data showing a 1.8 million barrel build in U.S. crude inventories, along with weak demand from refiners.

China is softening the picture by continuing to actively replenish its strategic reserves. Traders believe Beijing’s purchases have helped limit the price drop.

Thus, the oil market is caught between opposing forces: potential tightening of sanctions against Russia and the threat of global oversupply. In the coming weeks, dynamics will hinge on OPEC+ decisions and geopolitical actions by the U.S. and its allies.

Recommended