Oil drops over 2% as China–U.S. tensions and supply fears collide

Oil prices extended their slide as trade tensions intensified between the United States and China and a pessimistic forecast from the International Energy Agency (IEA).

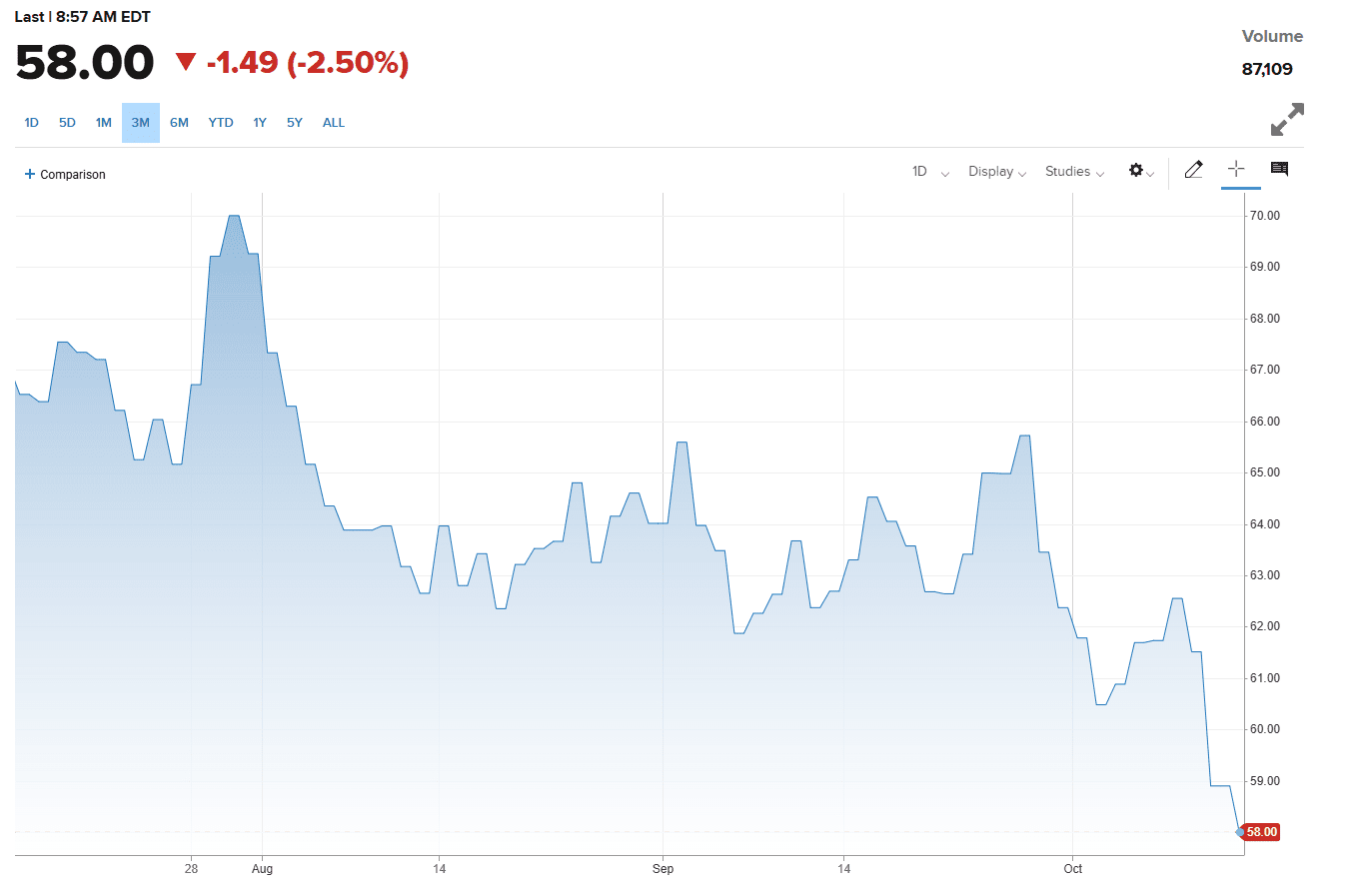

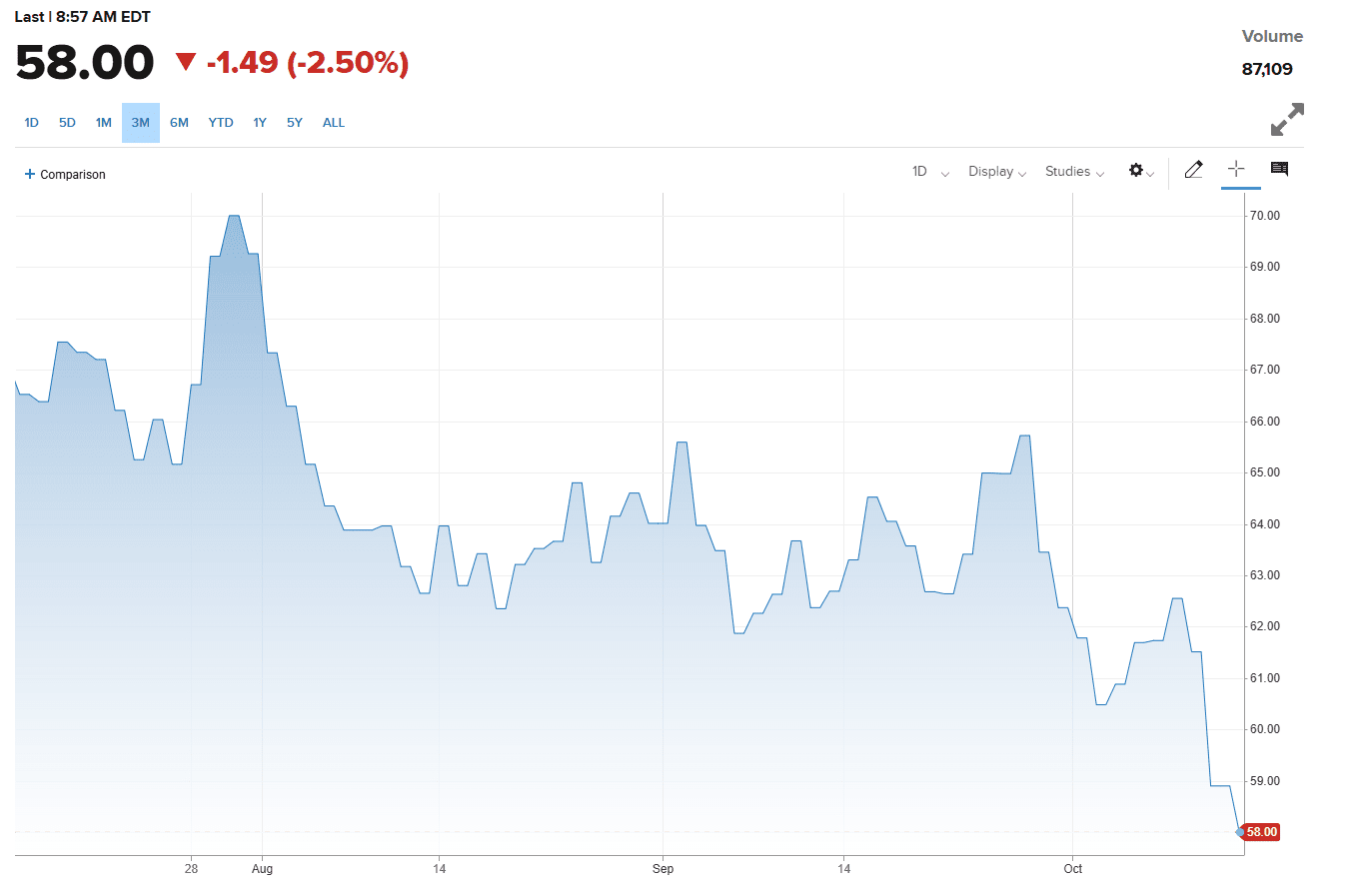

On Tuesday, Brent fell 2.3% to $61.8 per barrel, while WTI declined 2.4% to $58.1, their lowest points in five months.

WTI price. Source: cnbc.com

The selloff stems from geopolitical uncertainty and shifting supply-demand expectations. The IEA raised its global oil supply growth forecast, warning that 2026 could see a surplus could reach nearly 4 million barrels per day, the highest level on record. At the same time, the agency lowered its demand growth outlook, putting further downward pressure on prices.

Tensions escalated when the Trump administration hinted at potential 100% tariffs on Chinese goods, while Beijing responded with sanctions against five U.S. companies and threats of further retaliatory measures. UBS analysts pointed out that bearish momentum picked up as the trade standoff between the world’s two largest economies cast a shadow over global demand prospects.

For the first time this year, the oil market slipped into contango – a sign of oversupply, where short-term futures trade below long-term ones. Goldman Sachs and JPMorgan expect Brent to test $55-$58 range.

OPEC+ hasn't lost hope entirely, projecting oil demand to rise by 1.4 million barrels per day in 2026, though acknowledging that the market remains fragile and vulnerable to political shocks.