Global oil prices fall on supply increase expectations

Oil prices fell on September 30 on expectations of higher production from OPEC+ (Organization of the Petroleum Exporting Countries).

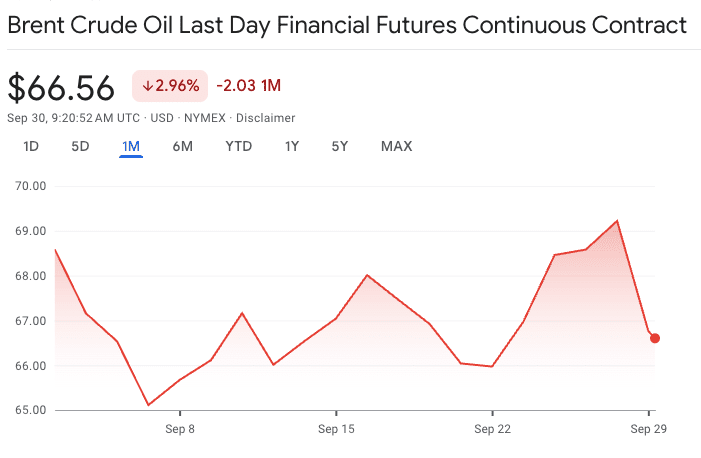

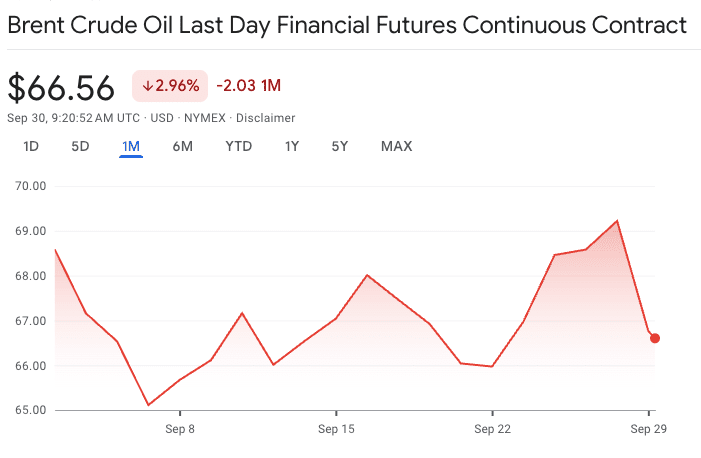

The decline is a response to the restart of crude flows from Iraq’s Kurdistan region via Turkey, developments that added to market expectations of a supply surplus. Brent crude, a major global benchmark for oil prices, dropped 1.2% to $67.13 a barrel, while U.S. West Texas Intermediate fell to $62.68, also down 1.2%. The decline follows Monday’s sharpest daily losses since early August.

In a meeting scheduled for October 5, 2025, the Organization of the Petroleum Exporting Countries and allies, including Russia, are likely to approve another production increase of at least 137,000 barrels per day, Reuters reports, citing sources familiar with the talks.

Markets reacted as crude exports from Iraq’s Kurdistan region resumed to Turkey for the first time in over two years, increasing expectations of higher oil supply. Exports were halted in March 2023 after the International Chamber of Commerce ruled that Turkey violated the Iraq-Turkey pipeline agreement.

According to the U.S. Energy Information Administration (EIA), global oil inventories could rise by more than 2 million barrels per day from Q3 2025 through Q1 2026, which is expected to push prices lower. Due to the anticipated oversupply, the EIA projects that the Brent crude price will decline to an average of around $59 per barrel in Q4 2025 and potentially fall as low as $50 per barrel in early 2026.

In a meeting scheduled for October 5, 2025, the Organization of the Petroleum Exporting Countries and allies, including Russia, are likely to approve another production increase of at least 137,000 barrels per day, Reuters reports, citing sources familiar with the talks.

Markets reacted as crude exports from Iraq’s Kurdistan region resumed to Turkey for the first time in over two years, increasing expectations of higher oil supply. Exports were halted in March 2023 after the International Chamber of Commerce ruled that Turkey violated the Iraq-Turkey pipeline agreement.

Brent crude slides nearly 3% in September amid supply concerns. Source: Google Finance

The restart on September 27, 2025, follows an interim deal between Baghdad, the Kurdistan Regional Government, and eight major oil companies. Around 230,000 barrels per day (bpd) are planned, with 180,000-190,000 bpd for export and 50,000 bpd for local use, marking a major return of Kurdish crude to the global market.

According to the U.S. Energy Information Administration (EIA), global oil inventories could rise by more than 2 million barrels per day from Q3 2025 through Q1 2026, which is expected to push prices lower. Due to the anticipated oversupply, the EIA projects that the Brent crude price will decline to an average of around $59 per barrel in Q4 2025 and potentially fall as low as $50 per barrel in early 2026.

Recommended