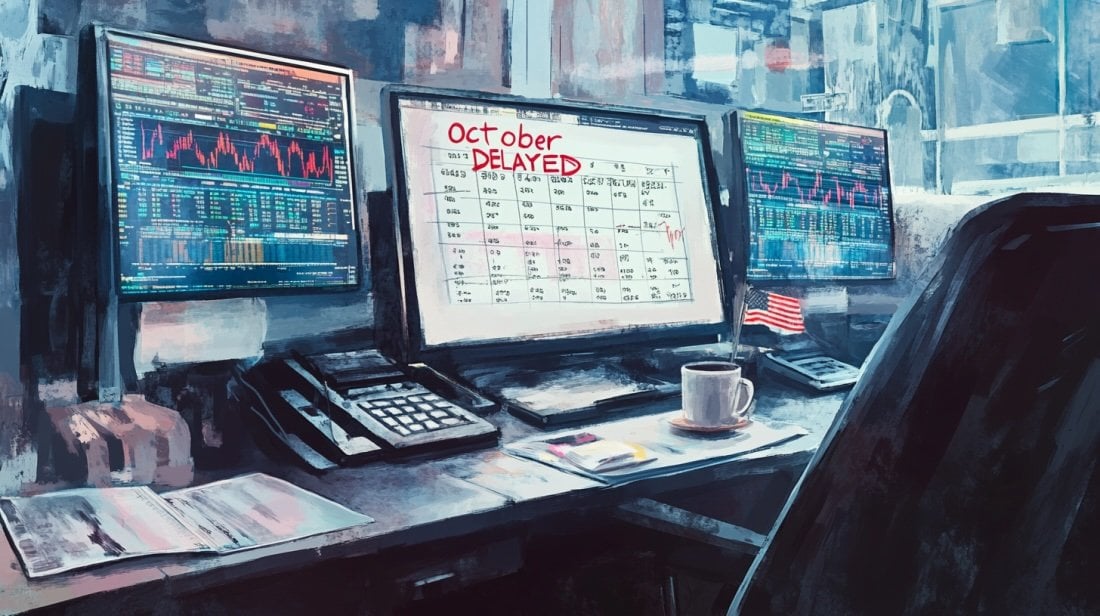

October CPI at risk amid shutdown – what it means for markets

The White House warned that October’s Consumer Price Index will probably not be released because the shutdown has paused Bureau of Labor Statistics data collection.

Press Secretary Karoline Leavitt called it an unprecedented lapse that would leave “businesses, markets, families, and the Federal Reserve in disarray,” blaming Democrats for blocking temporary funding.

BLS confirmed that most operations are suspended and said it will update the public release calendar once funding is restored; the October CPI, originally slated for Nov. 13, will be delayed.

The administration also highlighted September results as better than expected, pointing to steady headline inflation, real wage gains and softer prints in gasoline and shelter. Those talking points were posted on the White House site and X.

With core inflation slowing in September, markets were already leaning toward a rate cut at next week’s Fed meeting.

If October CPI is missing, the Fed will lean harder on PCE, labor data and high‑frequency price proxies. For crypto, the macro channel dominates: the dollar (DXY), real yields and ETF flows will steer BTC and majors; a softer dollar and stable real yields tend to support large caps, while a firmer DXY or growth scare does the opposite. Absent an official print, realized volatility can rise around Fed day as investors triangulate from imperfect signals.

Earlier we flagged consensus for September CPI at ~3.1% y/y and 0.4% m/m after a shutdown‑induced delay – the last major input before the Oct. 28–29 FOMC. We also noted NABE’s outlook: GDP near a 1.8% trend on stronger capex (computing/AI), a softer labor market, and PCE inflation around 3% into year‑end.