New Nasdaq rules spark crypto stock selloff

Nasdaq tightened rules for public companies buying crypto assets for treasury reserves. Shares of leading crypto treasuries and nine major miners declined following the announcement.

Nasdaq has announced new rules for companies building up cryptocurrency reserves through stock issuance. Such issuers must now obtain shareholder approval before issuing new shares. If they fail to comply, the exchange may suspend trading or delist them.

The measure targets the practice of companies boosting their market value by rebranding as “crypto treasuries.” According to Bloomberg, since January approximately 184 public firms have disclosed plans to raise more than $132B for crypto purchases, with most trading on Nasdaq.

Following the news, shares of crypto treasuries and mining companies came under pressure. Affected stocks included Strategy (MSTR), BitMine and SharpLink Gaming, as well as nine leading miners, including Iris Energy (−7.39%), Cipher Mining (−7.46%), Hut 8 (−5.57%), Bitdeer (−4.9%), Marathon Digital (−4.41%) and Riot Blockchain (−1.33%).

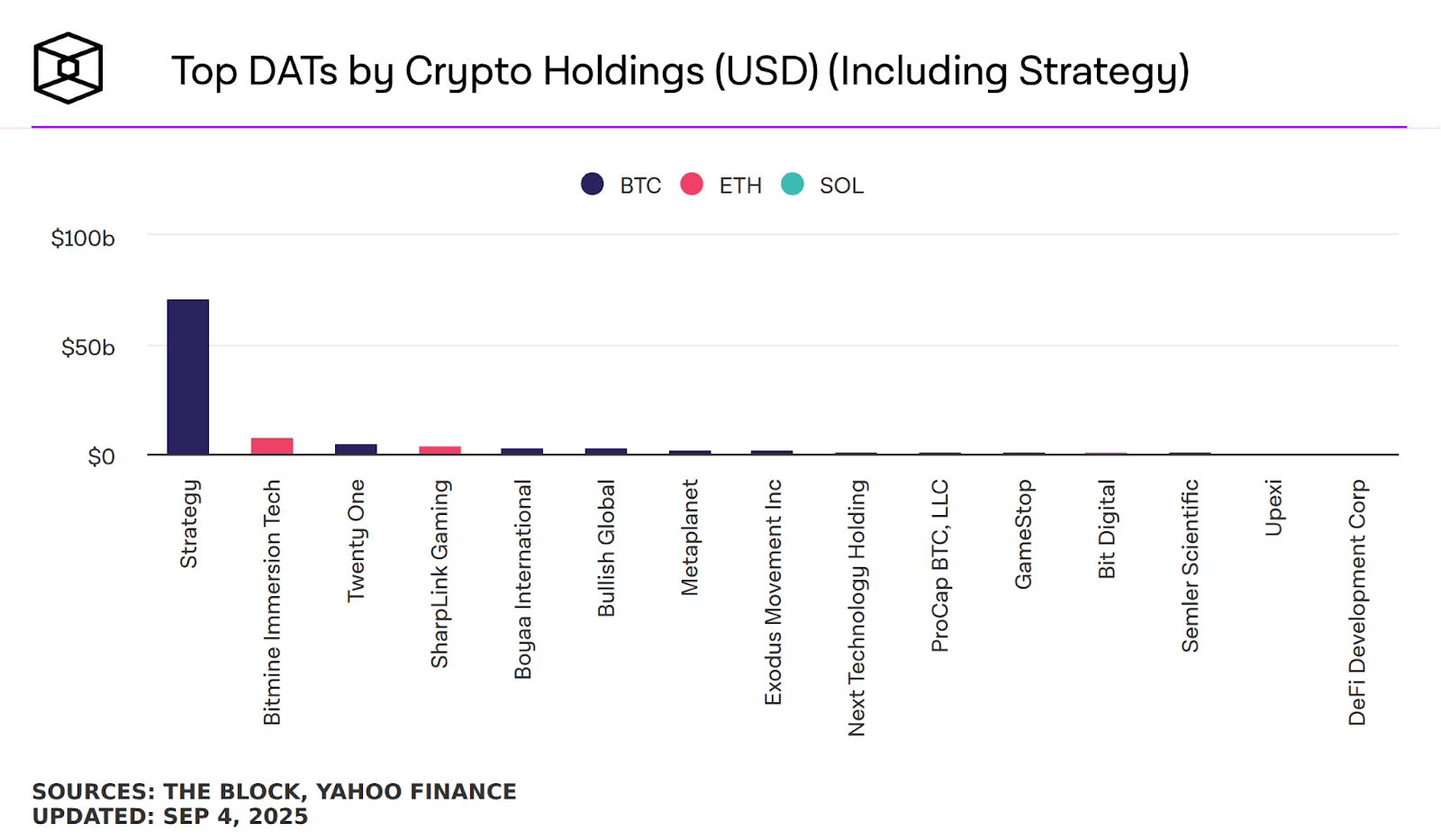

Strategy remains the largest public holder of cryptocurrency, with a Bitcoin portfolio far ahead of its competitors. Other notable players in the segment include Bitmine Immersion Tech, SharpLink Gaming, Metaplanet and others, though their holdings are much smaller compared to the leader.

DAT (Digital Asset Treasuries) ranking by Bitcoin holdings. Source: theblock.co

The regulatory move coincides with growing interest in corporate crypto reserves amid Donald Trump’s second-term policies. However, the stricter rules create uncertainty for companies that sought to quickly convert capital into digital assets.

BTC briefly declined 2% on the news but held above $110,000. Meanwhile, investors turned cautious toward stocks with crypto exposure, fanticipating potential further regulatory pressure from Nasdaq.

Recommended