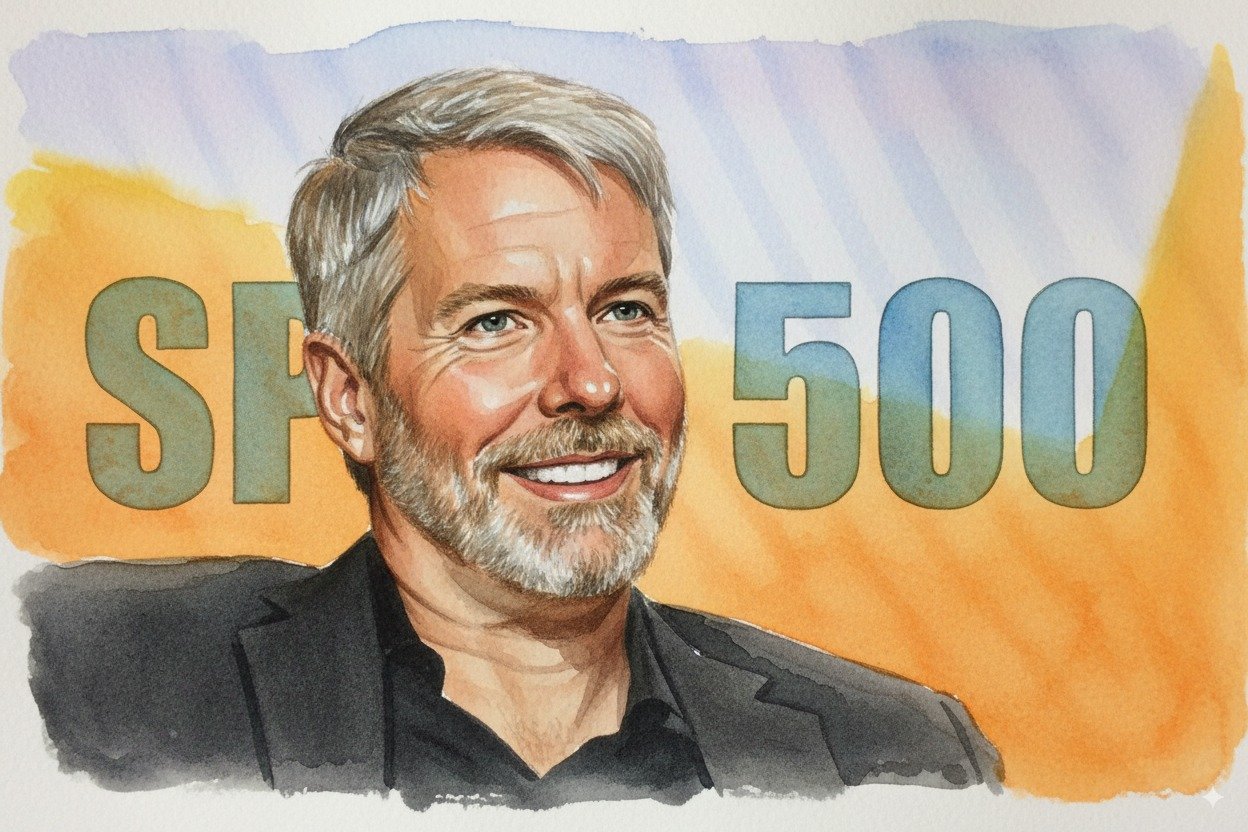

Michael Saylor reacts after Strategy misses out on S&P 500

Michael Saylor, the outspoken founder and executive chairman of Strategy (formerly MicroStrategy), responded to news that his company was not included into the S&P 500 index despite meeting the eligibility criteria.

Posting on X (formerly Twitter), Saylor wrote simply: “Thinking about the S&P right now …” - a cryptic remark that quickly drew attention from investors and crypto enthusiasts alike.

The decision by S&P Dow Jones Indices came as a surprise to many on Wall Street. Strategy, known for its aggressive Bitcoin accumulation strategy, had been widely expected to join the benchmark index this quarter. Instead, trading app Robinhood (NASDAQ: HOOD) secured the coveted slot.

While the index committee does not disclose detailed reasoning, the move raised questions about how regulators and traditional financial institutions continue to view companies with heavy exposure to digital assets.

Strategy, rebranded earlier this year from MicroStrategy, has transformed itself into a corporate proxy for Bitcoin. The firm holds more than 226,000 BTC on its balance sheet- valued at over $25 billion at current market prices - making it the largest publicly traded corporate holder of the cryptocurrency.

Its stock has soared in recent years, often moving in lockstep with Bitcoin’s price. Analysts argue this unique positioning should have strengthened its case for index inclusion. “From a fundamentals perspective, Strategy checked all the boxes,” said one equity strategist at a major U.S. bank. “The snub feels less about performance and more about optics.”

Missing out on the S&P 500 carries more than symbolic weight. Index-tracking funds and ETFs automatically allocate capital to new entrants, often driving significant inflows. Strategy’s exclusion may delay that wave of institutional buying and keep the company’s stock more volatile and closely tied to crypto cycles.

For Saylor, the outcome may serve as another rallying cry for Bitcoin adoption. The billionaire has consistently argued that Bitcoin represents a superior treasury reserve asset compared to cash or bonds, and he has shown little interest in steering the company back toward traditional software business lines.

“The market already views Strategy as a Bitcoin ETF in corporate form,” noted a portfolio manager at a digital assets fund. “S&P’s hesitation doesn’t change that reality- it just delays some inflows from passive strategies.”

While the index committee does not disclose detailed reasoning, the move raised questions about how regulators and traditional financial institutions continue to view companies with heavy exposure to digital assets.

Strategy, rebranded earlier this year from MicroStrategy, has transformed itself into a corporate proxy for Bitcoin. The firm holds more than 226,000 BTC on its balance sheet- valued at over $25 billion at current market prices - making it the largest publicly traded corporate holder of the cryptocurrency.

Its stock has soared in recent years, often moving in lockstep with Bitcoin’s price. Analysts argue this unique positioning should have strengthened its case for index inclusion. “From a fundamentals perspective, Strategy checked all the boxes,” said one equity strategist at a major U.S. bank. “The snub feels less about performance and more about optics.”

Missing out on the S&P 500 carries more than symbolic weight. Index-tracking funds and ETFs automatically allocate capital to new entrants, often driving significant inflows. Strategy’s exclusion may delay that wave of institutional buying and keep the company’s stock more volatile and closely tied to crypto cycles.

For Saylor, the outcome may serve as another rallying cry for Bitcoin adoption. The billionaire has consistently argued that Bitcoin represents a superior treasury reserve asset compared to cash or bonds, and he has shown little interest in steering the company back toward traditional software business lines.

“The market already views Strategy as a Bitcoin ETF in corporate form,” noted a portfolio manager at a digital assets fund. “S&P’s hesitation doesn’t change that reality- it just delays some inflows from passive strategies.”

Recommended