Meta Q3 revenue jumps 26% as AI boosts ad growth

Meta closed the third quarter on a strong note. The platform posted solid revenue growth as its core advertising business continues to align with its artificial intelligence strategy.

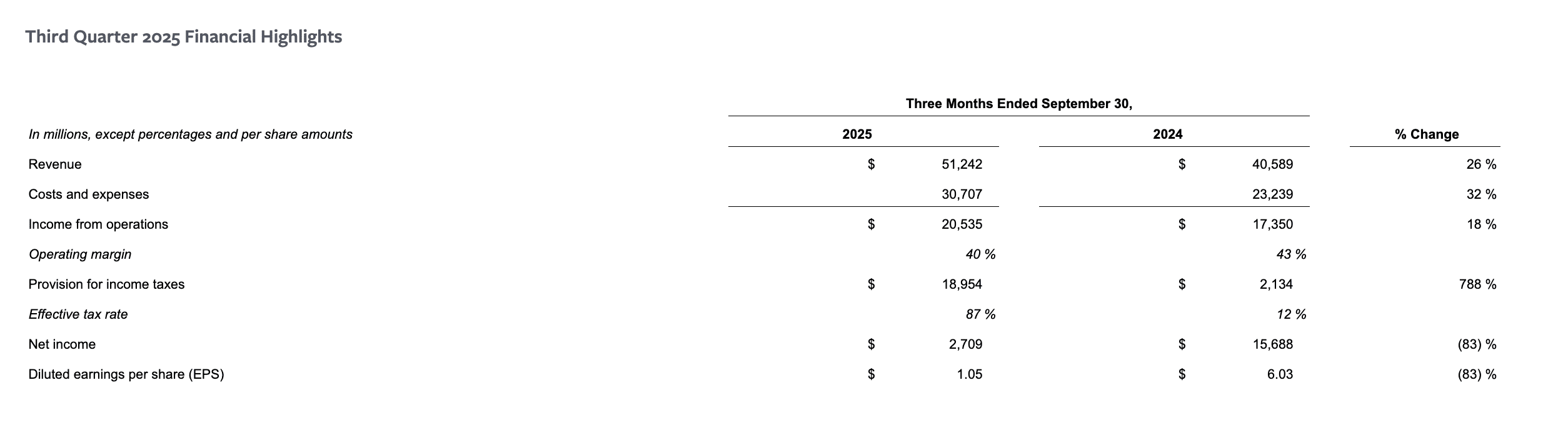

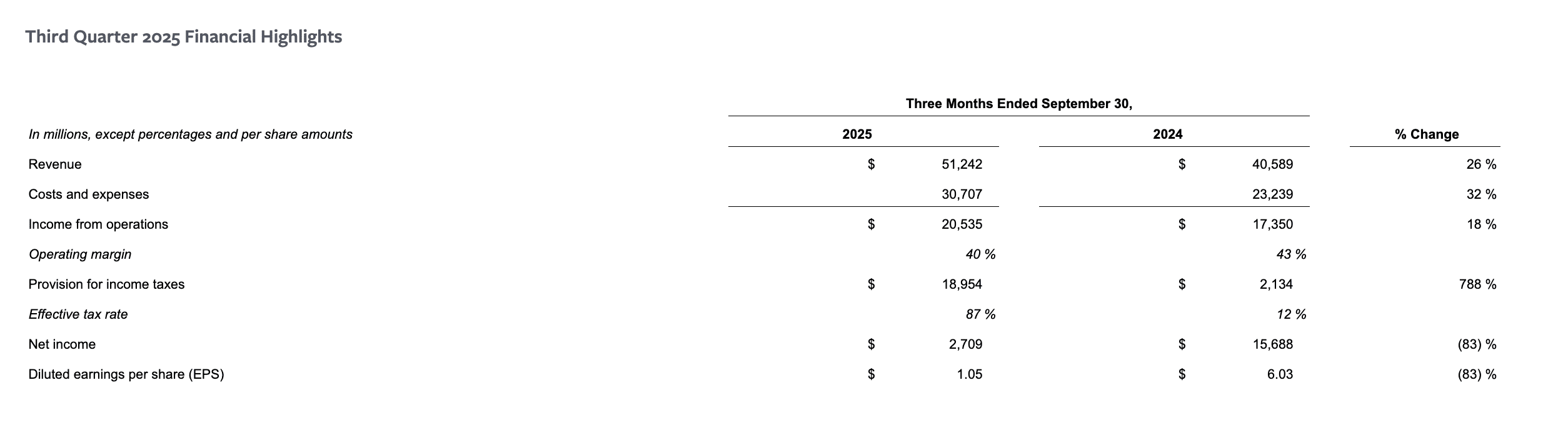

At headline levels, the numbers are straightforward: revenue rose 26% to $51.24bn, while net income declined, mainly due to a one-off tax expense that Meta described as a non-operational item in its quarterly report.

The company’s long-standing growth engine, digital advertising, is getting a second wind from AI tools and new formats. Advertising still accounts for roughly 98% of the company’s income. Ad impressions rose 14% year on year, and the average price per ad increased 10%.

Meta’s apps reach about 3.3 billion people daily, the company said. Instagram counts over 2.5 billion monthly active users, while Threads has surpassed 150 million monthly actives.

Video remains a key engagement driver: time spent watching on Instagram increased by more than one-third, and Reels revenue exceeded a $15bn annual run rate.

Data from Meta’s Q3 2025 report. Source: investor.atmeta

AI has become Meta’s production engine rather than a shop window. According to the company, more than 1bn people interact with Meta AI each month, and users have created over 20bn images since launch. To support that load, Meta is expanding its compute base: capital expenditure in Q3 reached $19.37bn; guidance for 2025 has been lifted to $70–72bn, and infrastructure spending in 2026 is expected to be “meaningfully higher”.

AI tools are already lifting engagement and ad‑targeting accuracy: this is where the advertising business feels the impact of new technology.

Looking ahead, Meta forecasts fourth-quarter revenue of $56–59 billion. Management noted ongoing risks, including seasonal volatility in Reality Labs and regulatory issues in the US and EU. These factors could moderate growth but are unlikely to change the company’s core focus on engagement-driven advertising.

Markets, however, react not to slogans but to the balance of growth and cost. Investors are closely watching how the company allocates resources between supporting the advertising engine and building out the compute base for AI. For now, that balance appears to be working in Meta’s favor.