Wall Street shrugs off U.S. government shutdown as stocks rise

U.S. markets are opening the week with measured optimism: futures on the Dow, S&P 500 and Nasdaq are higher, setting the tone after several days when politics overshadowed macroeconomics.

The start of a heavy reporting week, when most major names publish their quarterly results, brings investors back to familiar anchors: revenue, margins, and guidance. That is where the market is trying to pin risk assessment, even as the ongoing shutdown keeps nerves on edge. Closed regulators are a major source of uncertainty, but for now this impact is more technical than fundamental. Releases of some economic data have been delayed, calendars adjusted, and market noise has increased.

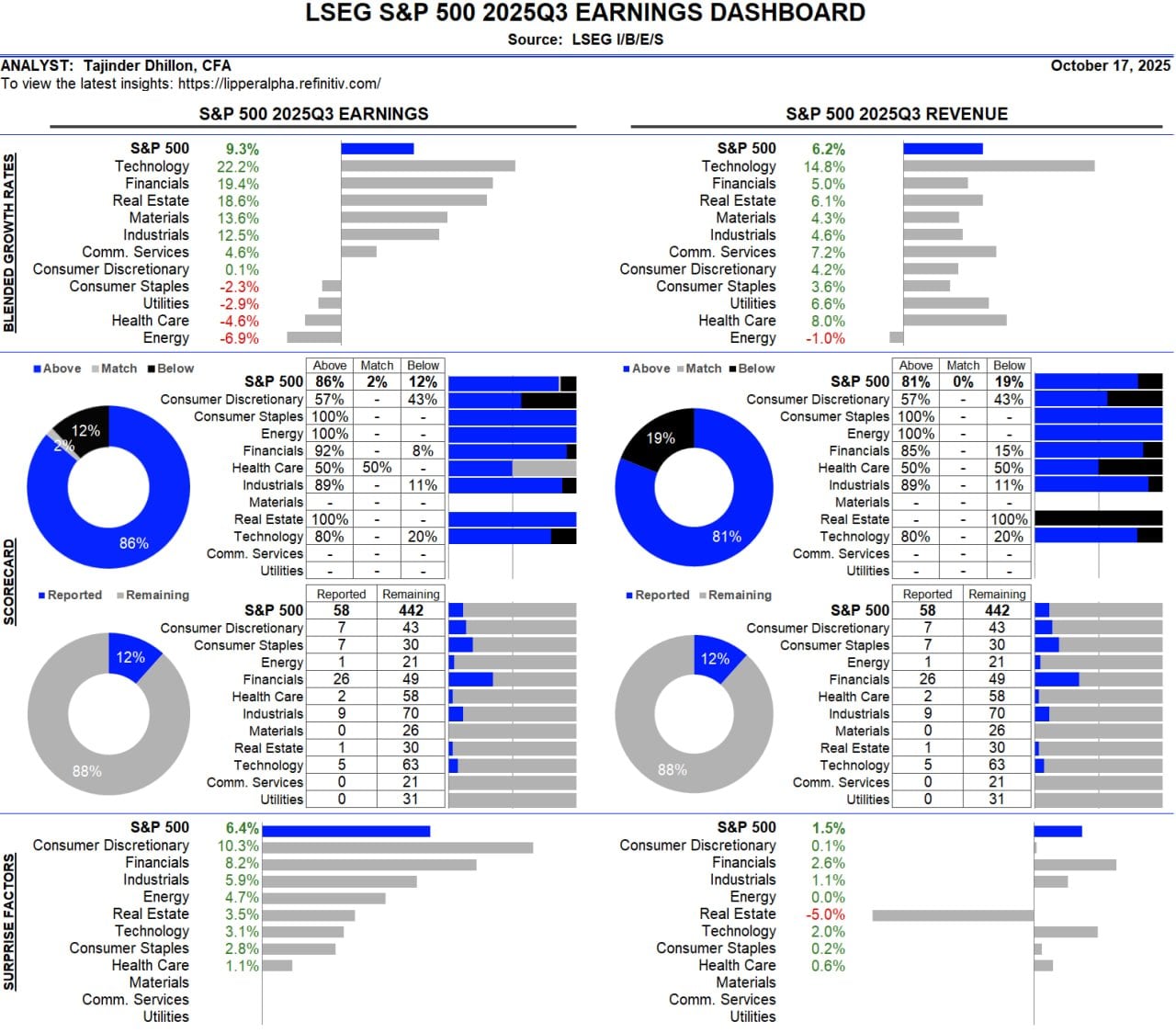

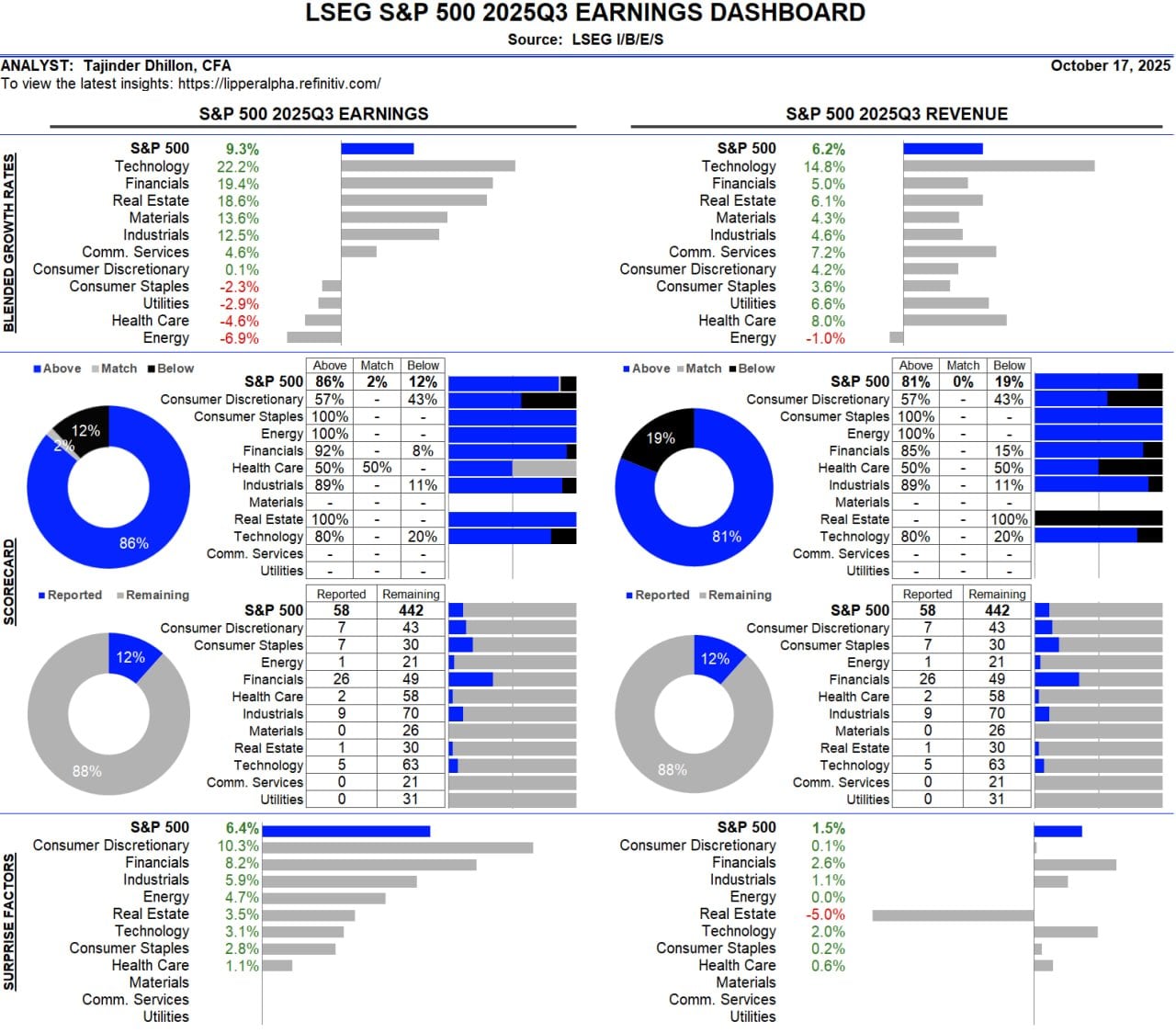

Markets appear to be betting that company fundamentals outweigh politics for now. Investors are focusing on private‑sector results rather than waiting for a political resolution in Washington. According to LSEG, analysts expect a notable year‑on‑year rebound in S&P 500 earnings, and that optimism is already reflected in equity prices.

The S&P 500 index continues to recover. Source: lipperalpha.refinitiv

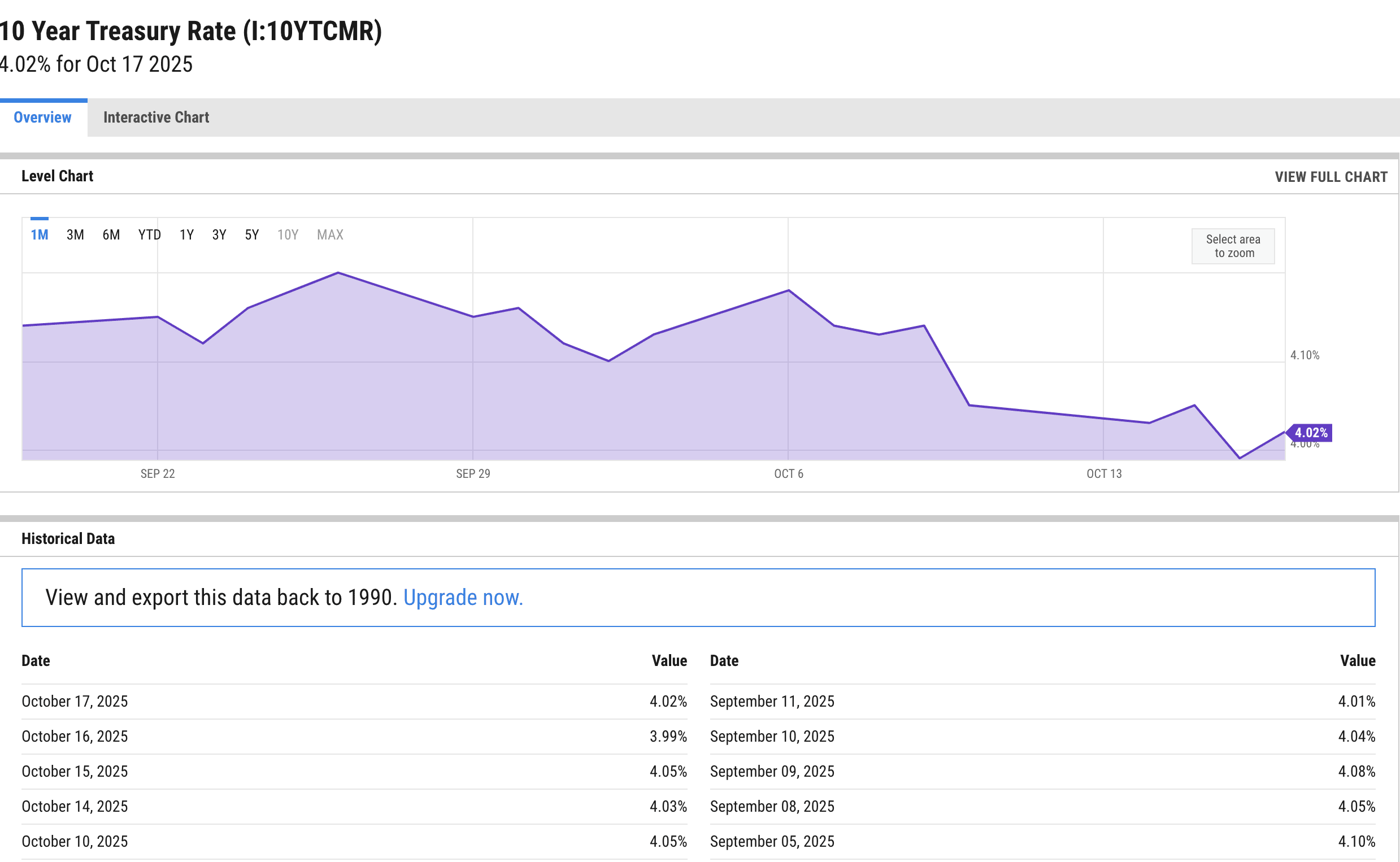

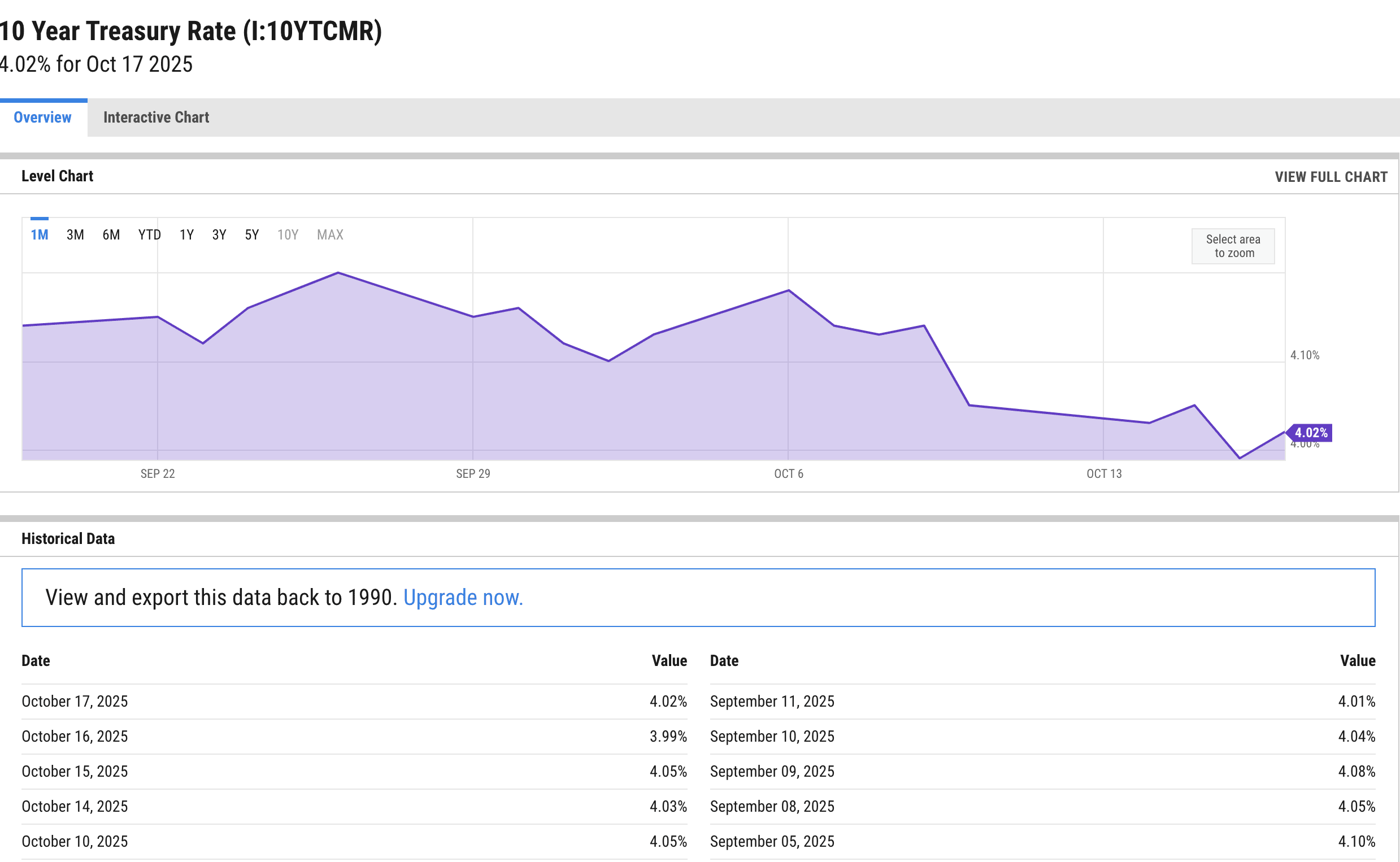

The key variable keeping enthusiasm within “measured positive” territory is the yield on U.S. Treasuries. The 10‑year Treasury note hovers around 4.0%–4.1% after last week’s pullback, and every shift in the yield curve quickly feeds through to growth multiples.

In practical terms, if the 10‑year yield moves toward 4.2%, institutional investors typically take profits. If it stays closer to 4.0%, the market tends to rise on company results as investors build strategies around those numbers.

U.S. 10‑year Treasury yield as of 20 October. Source: ycharts

Technically, S&P 500 stocks are holding recent gains and testing prior highs, which amplifies the FOMO effect in higher‑beta segments. The upshot is that, despite the shutdown, the market is moving higher on the back of recovering corporate earnings and hopes for a gentle rate path from the Fed.

In the days ahead, politics will likely remain a source of volatility, but near-term trading should hinge on corporate earnings and movements in U.S. Treasury yields. Together, these two indicators will help determine the market’s direction.

Recommended