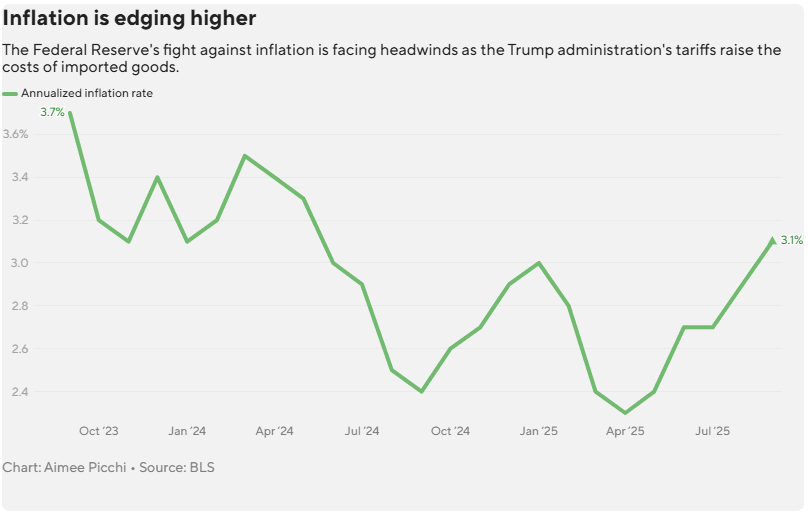

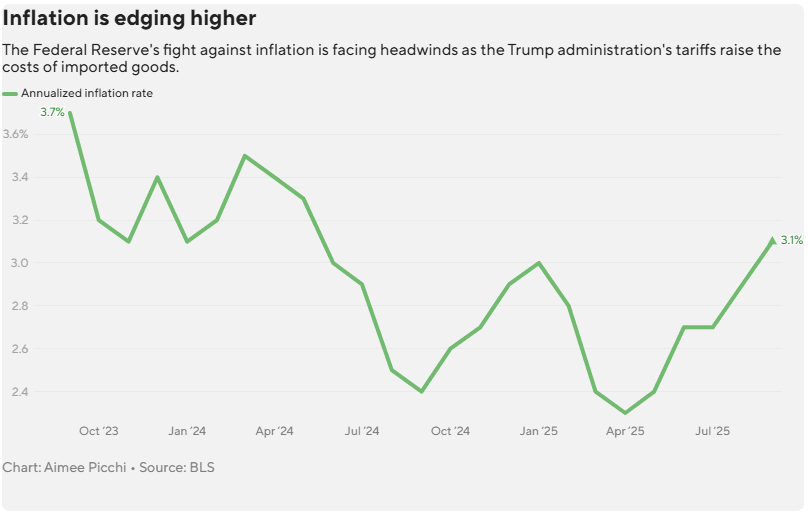

U.S. inflation for September seen at 3.1%, highest in 16 months

Friday’s Consumer Price Index (CPI) report for September has become the week’s key event for global markets.

After a nine-day delay caused by the U.S. government shutdown, the Bureau of Labor Statistics (BLS) is set to release data on Friday, October 24. Economists expect a 0.4% month-over-month rise and about a 3.1% year-over-year inflation rate, the highest in 16 months.

Annualized inflation rate. Source: cbsnews.com

The report will serve as the final major macro indicator before the Oct. 28–29 FOMC meeting. Despite the uptick, CME FedWatch data shows markets still pricing in a more than 98% chance of a rate cut.

The rise in prices has been partly fueled by the Trump administration’s new trade tariffs, which have driven up import costs. Goldman Sachs estimates that about 55% of tariff-related expenses could be passed on to consumers.

Even so, stronger inflation data is unlikely to shift the Fed’s stance. Most trackers expect a cut next week, with debate over whether another could follow in December, as policymakers balance persistent inflation against signs of labor-market cooling.

Markets are bracing for short-term volatility. A hotter-than-expected CPI reading could trigger a brief correction, but investors see any pullback as a buying opportunity, confident the Fed will proceed with its monetary easing cycle.

For crypto markets, the CPI release carries similar weight. A reading above 3.1% could pressure Bitcoin and other risk assets, while softer data often supports risk appetite, potentially improving liquidity conditions.