Oil edges higher as Kurdish flows stall

Oil rose after the expected restart of exports from Iraq’s Kurdistan unexpectedly stalled. For many market participants, this signaled that extra barrels are delayed and the short‑term balance will likely remain tight.

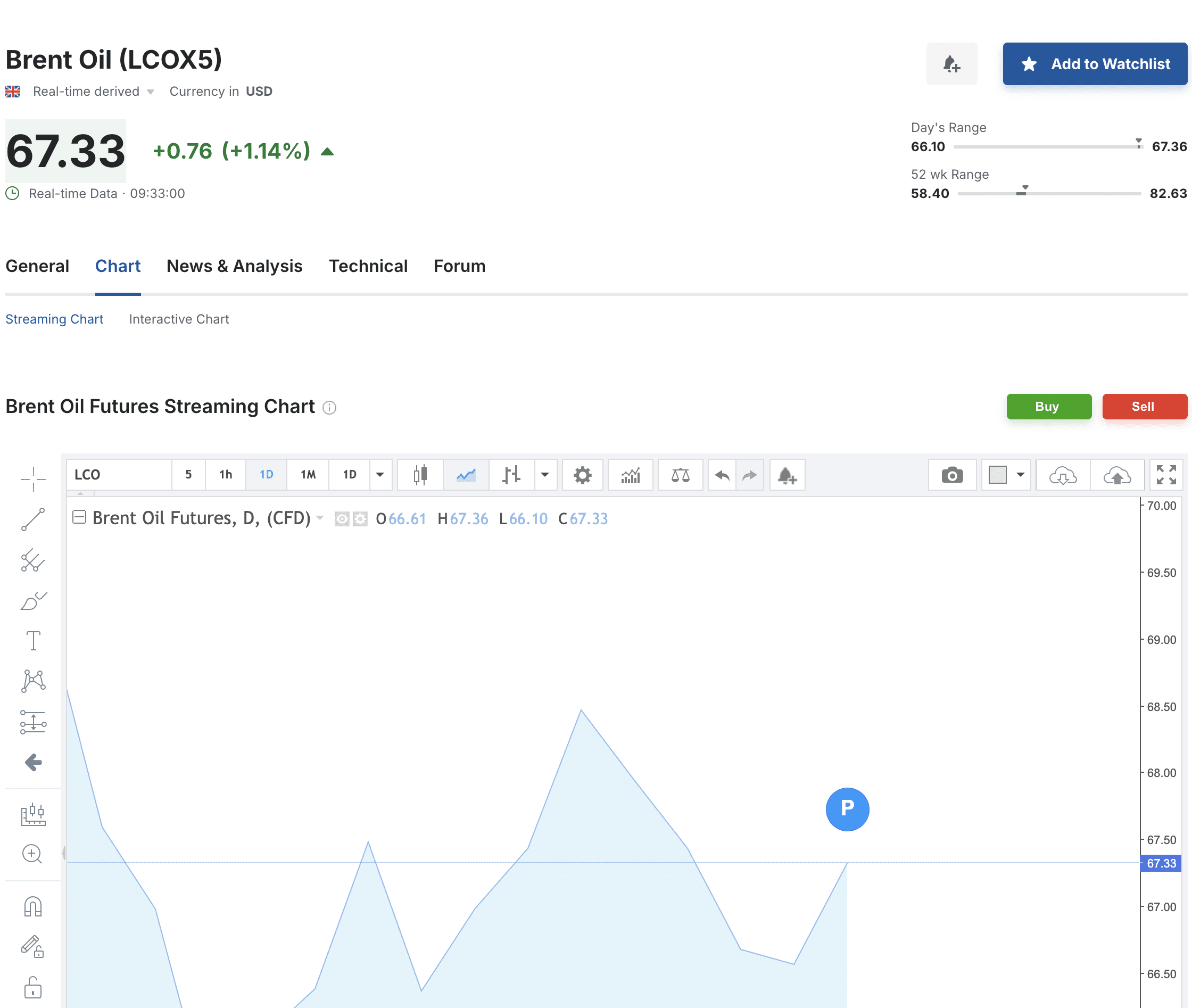

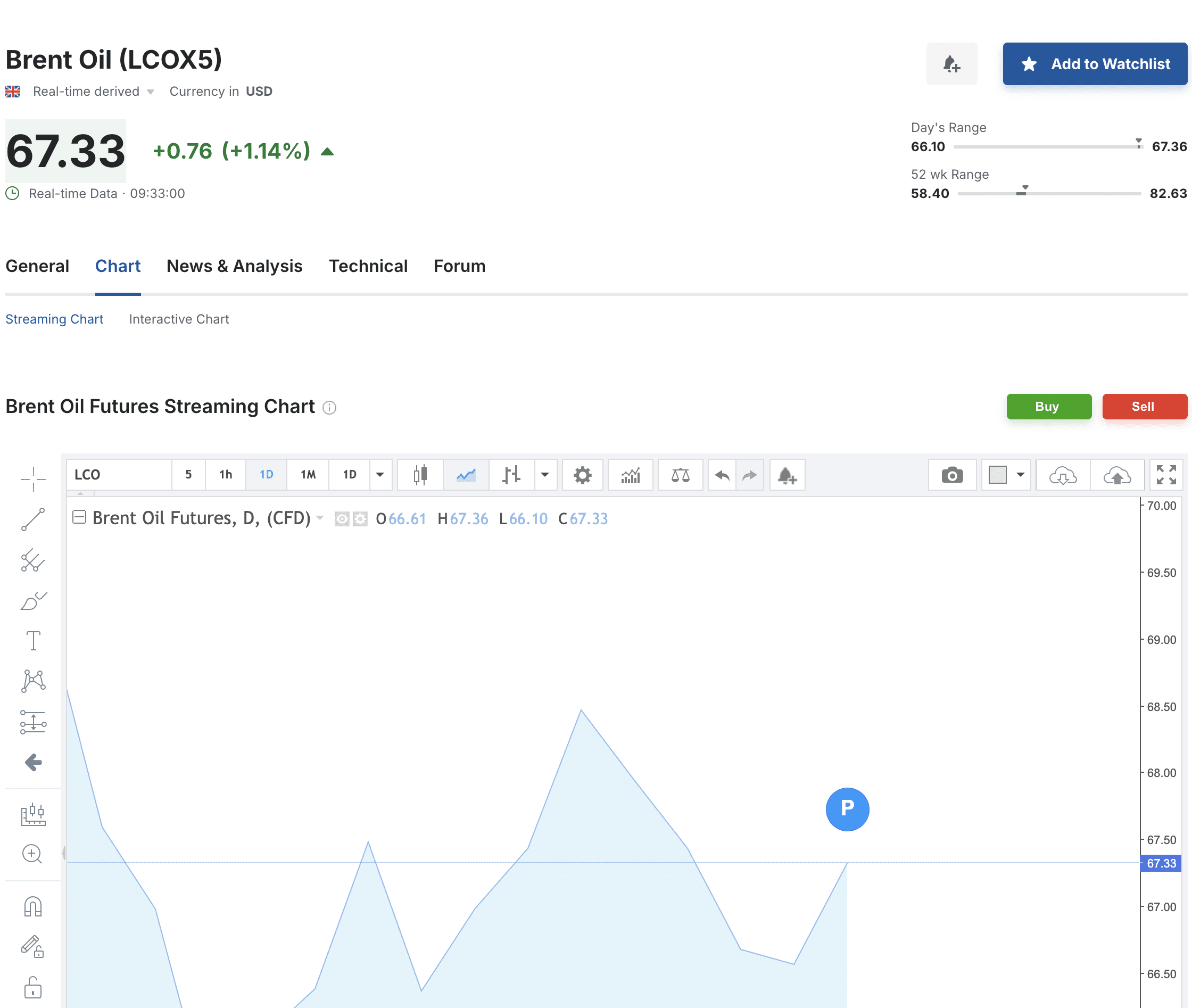

By 11:10 GMT, Brent futures were up about 0.8% to roughly $67 a barrel, while U.S. WTI gained around 1.1% to $63. The day before, both benchmarks fell for a fourth straight session, losing about 3% in total.

Today’s rebound looks largely like an attempt to claw back part of those losses as traders reassess headlines and supply risks.

Brent price chart Source: Investing.com

The key driver was a pause in talks to restart Kurdish exports through Turkey. Several producers are seeking additional guarantees on overdue payments, which is slowing the deal. The discussion concerns the potential return of several hundred thousand barrels per day to the market, volumes that have largely been outside global flows since March 2023.

Even so, the broader outlook remains mixed. The International Energy Agency notes that supply is rising faster than expected, with output increasing both inside OPEC+ and among non‑OPEC producers, and a surplus could persist into 2026. Demand, in turn, is constrained by a soft macro backdrop and the quicker adoption of electric vehicles.

Investors are also weighing the European Union’s debate over tighter restrictions on Russian oil and lingering geopolitical risks in the Middle East.

In the near term, traders are watching preliminary estimates for U.S. inventories: last week, a build in commercial crude stocks was expected alongside draws in gasoline and distillates.

Against this backdrop, analysts point to low crude inventories in OECD countries as a price‑supportive factor, while rising exports from OPEC+ weigh on prices.

Recommended