$1.24B from Korea flowed into US crypto and tech

South Korean retail investors spent the Chuseok holiday week (3–9 October) in clear risk‑on mode. Over this period, they invested about $1.24 bn in US tech giants and to cryptocurrencies.

According to reporters at Kedglobal, this burst of activity fits the 2025 trend in which the AI sector’s expansion and expectations of corporate‑governance reforms sustain interest in riskier assets.

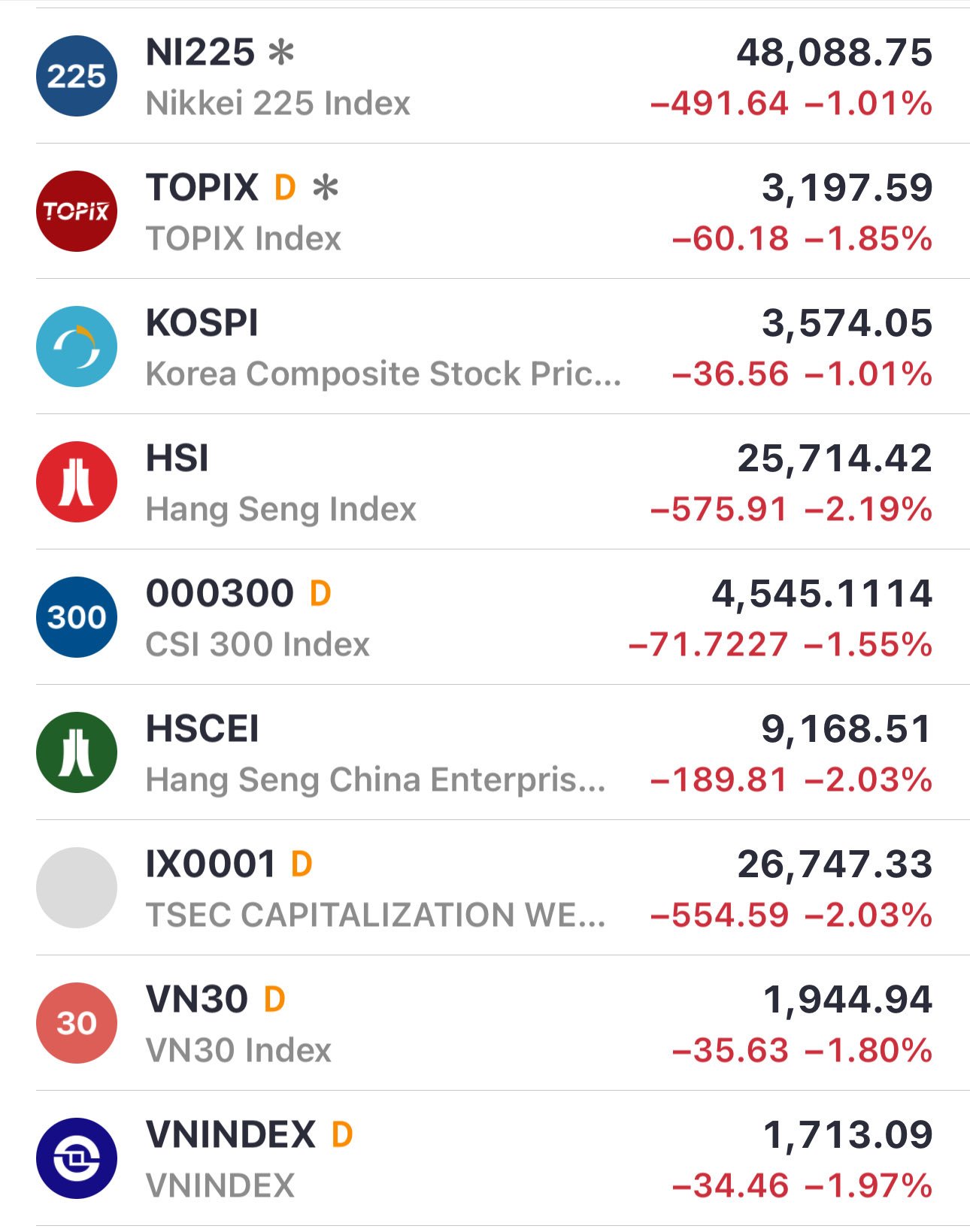

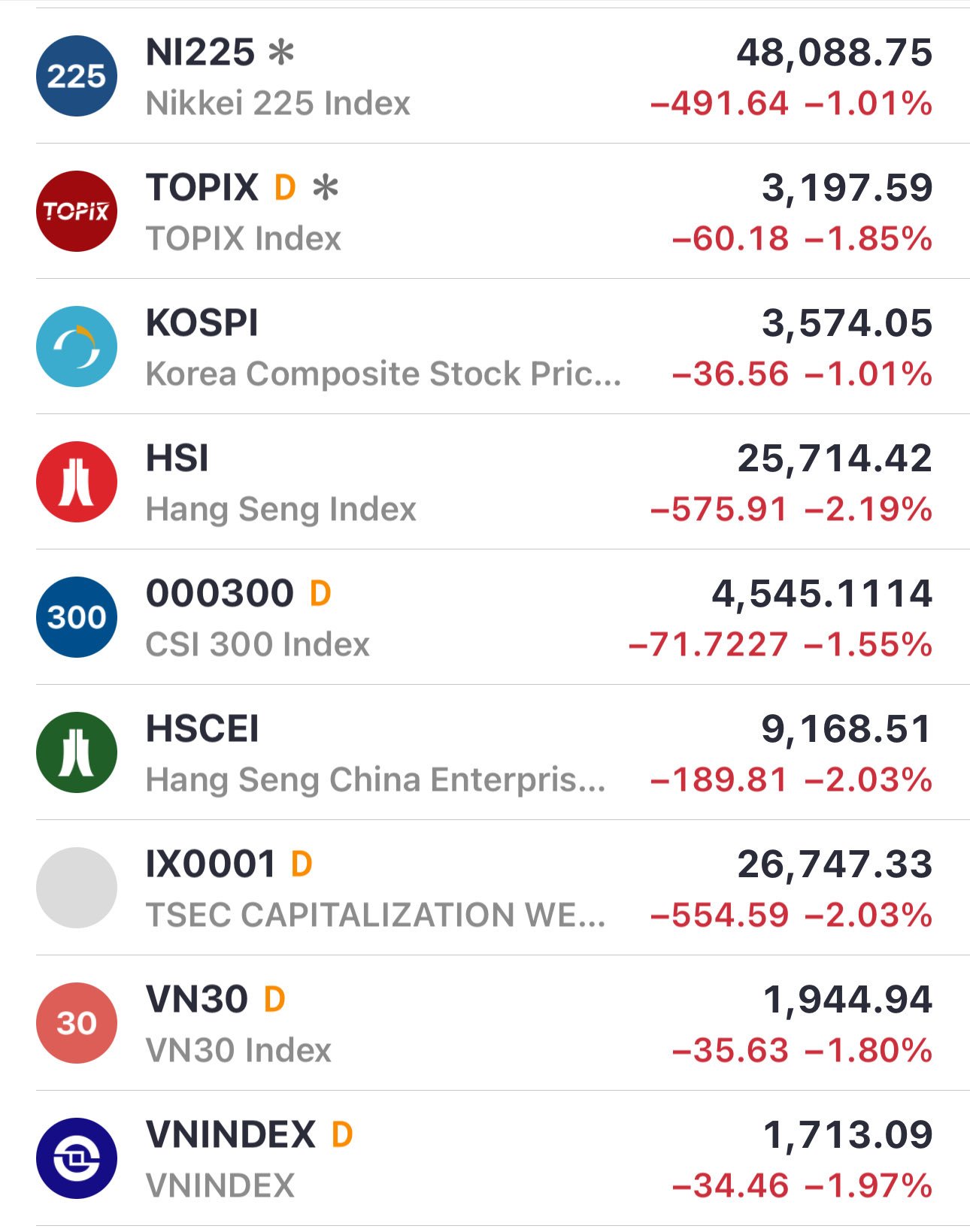

After a sharp market sell‑off on 10 October, triggered by an escalation of the US–China tariff dispute, Asian exchanges opened lower on 13 October; the KOSPI also slipped (a broad market benchmark comparable to the S&P 500 in the United States).

South Korean markets are showing a deep drawdown. Source: TradingView

Against this backdrop, yuan swings intensified and yields on Chinese issuers rose, while volatility in Hong Kong printed double‑digit moves. It’s a reminder that rallies can unravel fast when macro‑ and geopolitical risks collide with elevated tech valuations.

Why do South Korean retail investors choose the US and cryptocurrencies?

First, mega‑cap technology stocks remain a magnet for retail buyers: convenient access via popular brokerage apps combines with confidence in the long‑term cash flows of the AI economy. Second, the crypto market is again used tactically for short-term gains, particularly over holiday periods when many local instruments are unavailable. Finally, US‑dollar assets are viewed as a hedge against a weaker won.

In the short term this interest will depend on news about trade restrictions and upcoming US inflation releases. If tariff threats move from words to actions, part of the Korean retail cohort will likely take profits in big‑tech names and trim crypto exposure.

Over the longer run, AI, robotics and semiconductors remain attractive themes, but they demand strict portfolio discipline: regular rebalancing, single‑name position limits and careful management of FX risk.

Recommended