Kadena is dead: what should ASIC miner owners do?

On October 21, 2025, Kadena Foundation announced its closure, leaving thousands of specialized ASIC miner owners with hardware they now need to figure out what to do with. We examine what options remain for miners and whether it's worth continuing to support the network.

Kadena Foundation announced its closure, leaving thousands of miners with an uncomfortable question: what to do with hardware that's now almost worthless?

Unlike universal GPUs or Bitcoin ASIC miners that can be redirected to other coins with the same algorithm, Kadena ASICs work exclusively on the Blake2S algorithm – and there are virtually no alternatives.

Kadena ASIC: how much did profit dreams cost

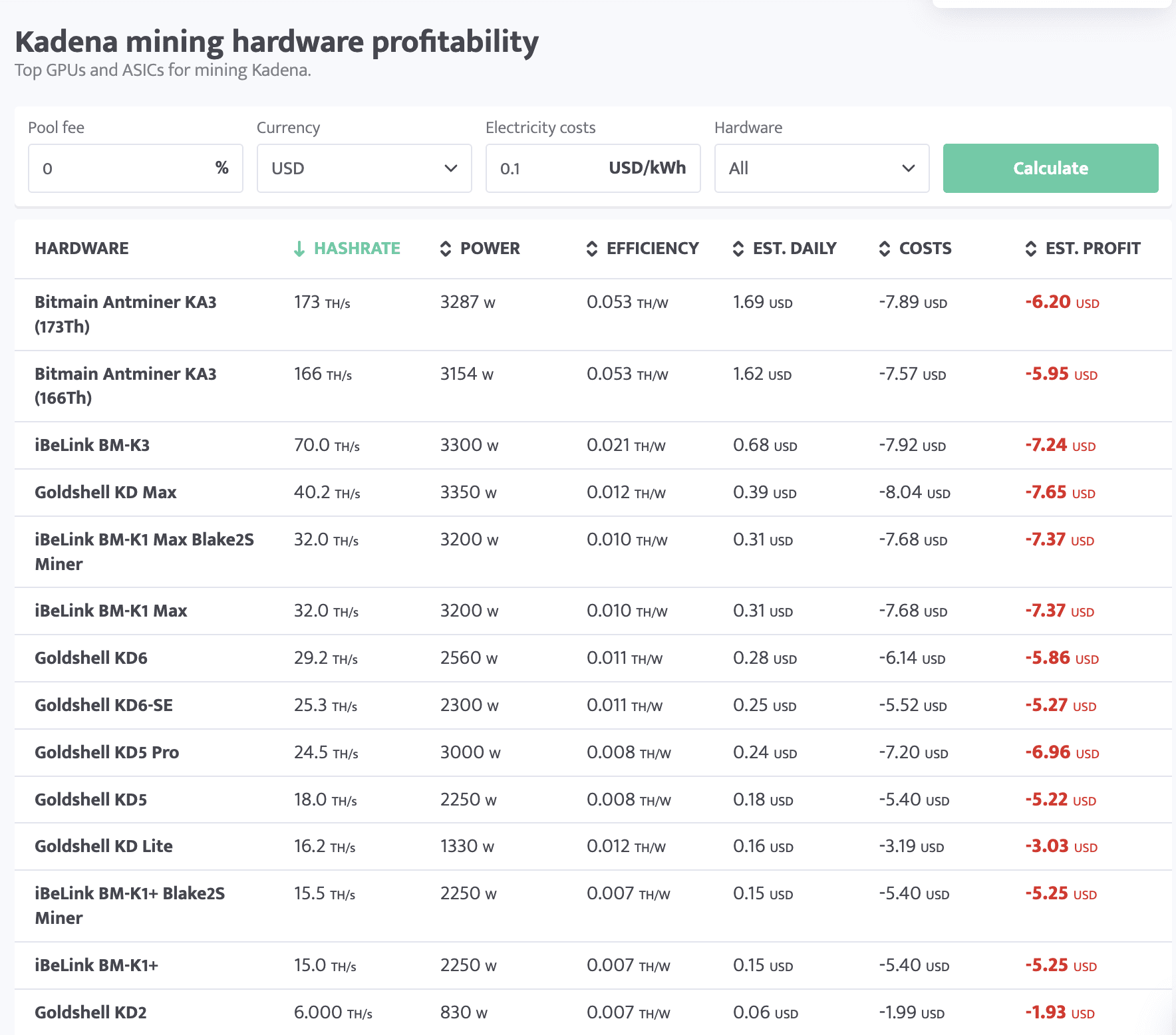

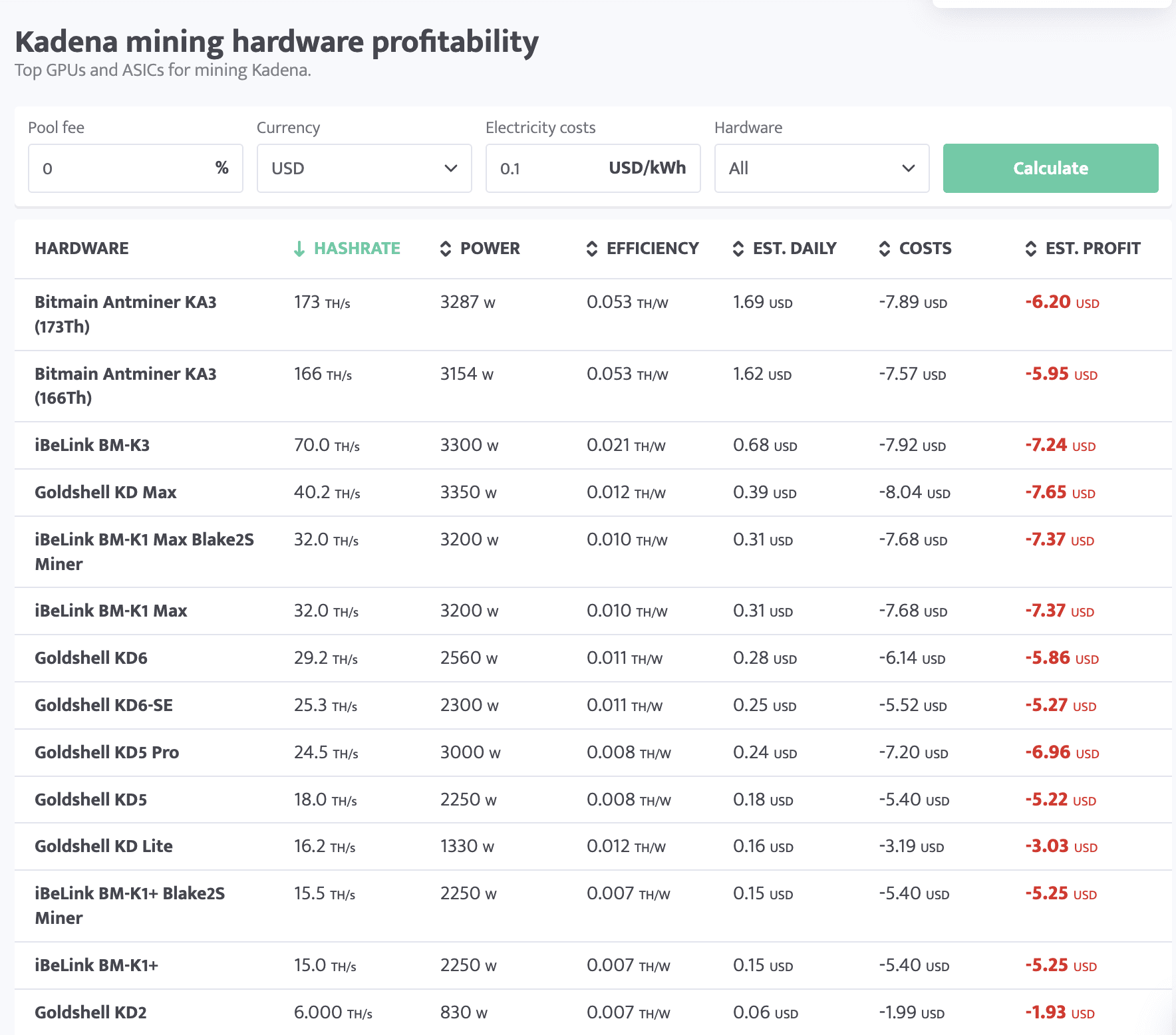

Specialized ASIC miners for Kadena were expensive investments. The top Bitmain Antminer KA3 with 166 TH/s hashrate cost $3,600–$4,000 and consumed 3,154 W of electricity. Before the project closed, it brought a meager $0.18 per day at electricity costs of $0.10/kWh. Now its daily profitability is minus $7.57.

The even more expensive iBeLink BM-K1 Max at $6,700–$7,700 consumes 3,200 W (watts) and brings minus $6.19 daily. Even the compact Goldshell KD6 at $2,000 operates at a loss of $5.08 per day.

Profitability of different Kadena mining machines. Source: minerstat.com

In other words, even before the crash, most models barely broke even. After the liquidation announcement and KDA price crash of 47%, all mining devices without exception became toxic assets for their owners, simply burning money on electricity.

Blake2S problem: technical dead end

Blake2S is a variant of the Blake2 cryptographic hash function, optimized for 32-bit platforms. Kadena was the only significant cryptocurrency using this algorithm for mining. Other Blake2S coins include Verge (XVG), where this algorithm is unprofitable, the dead Shield (XSH) project, and a bunch of premined scam tokens without liquidity.

It's critically important to understand: Blake2S ≠ Blake2B. Blake2B is optimized for 64-bit systems and was used by the Siacoin project, but it's a completely different algorithm. Blake2S ASIC miners physically cannot mine Blake2B coins – this is not a software but a hardware chip specification. Repurposing is impossible.

Is it worth continuing to mine KDA?

Technically, the Kadena blockchain continues to operate – it's a decentralized network that doesn't disappear instantly. But the economics look fatal. KDA price dropped to ~$0.18 (47% crash), network hashrate still holds at ~813 PH/s due to inertia, and difficulty remains high.

Even the most powerful Antminer KA3 burns $7.75 worth of electricity daily, mining $0.18 worth of coins. Without the Foundation, there's no protocol development, ecosystem updates, or even hope for price recovery. KDA trades with minimal volumes – selling mined coins becomes increasingly difficult.

The only reason to keep a miner running is ideological project support. But this costs $200–$230 per month in pure losses for an Antminer KA3 owner. Philanthropy gets expensive.

What to do with dead hardware

Sell before it's too late. The window of opportunity is closing fast – miners who don't yet know about the foundation closure might buy equipment at residual prices. The Antminer KA3, which cost $3,600, can realistically be sold for $500–$1,000 if you hurry. For iBeLink BM-K1 ($6,700 at purchase), the realistic price is now $800–$1,500. Losses amount to 70–90% of initial cost, but something is better than nothing.

Rent out via NiceHash. Theoretically possible, but currently demand for Blake2S hashrate is virtually zero – Kadena was its only market.

Dismantle for parts. ASICs contain fans that can be sold separately, universal power supplies, and metal casing as scrap. Realistic component value: $50–$150 per device. Better than keeping a dust collector in the garage.

Wait for a new Blake2S coin. To launch a new Blake2S project, you need to convince developers to choose a dead algorithm, compete with 813 PH/s of residual Kadena hashrate, and fight skepticism after KDA's failure. The probability of this scenario is less than 5%.

Use as a heater. This isn't a joke: consuming 3 kW, a miner produces ~3 kW of thermal energy. In cold regions, it's a working, albeit absurdly expensive electric heater. But this is a calculation for the desperate.

Real miner losses

Suppose someone bought an Antminer KA3 in September 2022 (launch year) for $3,600 and mined until the crash. Over three years of operation with variable profitability ($7–$10/day in 2022–2023, $3–$5/day in 2024, $0.18/day in 2025), total income was approximately $8,000–$10,000. Electricity costs for the same period were about $10,000 (at $0.10/kWh rate). The current residual value of the miner is $500.

Net result: from minus $1,500 to zero at best.

Worse scenario – purchase in 2024–2025. Price $3,600, mined $300–$500, residual value $500. Losses: $2,600–$2,800, or 73–78% of capital.

Conclusions: specialized hardware = specialized risks

Kadena positioned itself as a "scalable PoW blockchain" with ambitions to outpace Bitcoin in speed. Ultimately, the organization closed five years after launch, KDA crashed 47% in a day, and thousands of miners were left with expensive paper weights.

Three quick lessons for crypto miners

- Specialized ASIC means isolated high risk: if a project dies (as happened with Kadena), the hardware becomes worthless.

- Altcoin mining fundamentally differs from Bitcoin mining: BTC has an army of ASIC manufacturers and global infrastructure, while Kadena was a monoculture.

- Foundation closure is a death sentence for PoW networks, even if the blockchain technically operates.

The irony: simple Bitcoin ASICs on SHA-256 algorithm can be switched to dozens of forks (like Bitcoin Cash or Bitcoin SV). Kadena ASICs on Blake2S are $3,600 worth of electronic waste that cannot be repurposed.

What to do right now: perhaps better to shut down miners to stop losing on electricity. Try to sell before news of the closure becomes widespread. Accept losses and reorient to "blue chip" mining like Bitcoin or Ethereum with much more stable infrastructure.

Kadena is dead. Long live... well, anything else.

Recommended