🌋 Jerome Powell: Crypto Market Braces for Fed Chair’s Speech

posted 30 Sept 2024

Powell’s Speech - Today, on September 30, Federal Reserve Chair Jerome Powell will be delivering his latest briefing.

Powell’s Speech

Today, on September 30, Federal Reserve Chair Jerome Powell will be delivering his latest briefing.

Jerome H. Powell. Source: US Federal Reserve

Bitcoin, which has already slipped below $64,000 on Monday, may continue to struggle as investors anxiously await any hawkish* remarks from Powell, seeking to secure profits before any downturn.

However, optimism remains among some investors. On September 18, the Federal Reserve cut interest rates by 50 basis points, a decision that was certainly calculated. This has led to cautious speculation that the Fed may maintain its easing stance for the time being.

That being said, Bitcoin appears overbought in the short term, with over 90% of coins currently in profit, mostly held by non-professional investors.

*Hawkish refers to regulators or policymakers favoring tighter economic controls. You can find more market slang in our glossary.

Non-Farm Payrolls: A Potential Market Shakeup on Friday

While the first half of the week may play out calmly, things could shift dramatically on Friday. That’s when the U.S. releases the Non-Farm Payroll (NFP) data, one of the most critical economic reports, traditionally published on the first Friday of each new month.

Mention “Non-Farms” to a seasoned trader, and you’ll often see a spark of excitement in their eyes. Why? The volatility that follows this report is immense.

The U.S. dollar’s strength is closely tied to investor sentiment, and investor sentiment is directly linked to economic activity. Job growth in non-agricultural sectors provides a reliable indicator of economic health. If investors get spooked, there’s usually a sell-off, and when they feel confident, buying intensifies. This results in sharp short-term price swings, often driven by broader market positioning.

Naturally, Bitcoin and other cryptos follow the same pattern as the USD. Since Bitcoin is primarily priced in dollars, a stronger USD typically pushes Bitcoin lower, and a weaker dollar helps Bitcoin rise.

Uptober: The Best Month for BTC

October is just around the corner, bringing with it Uptober – historically one of the best months for Bitcoin.

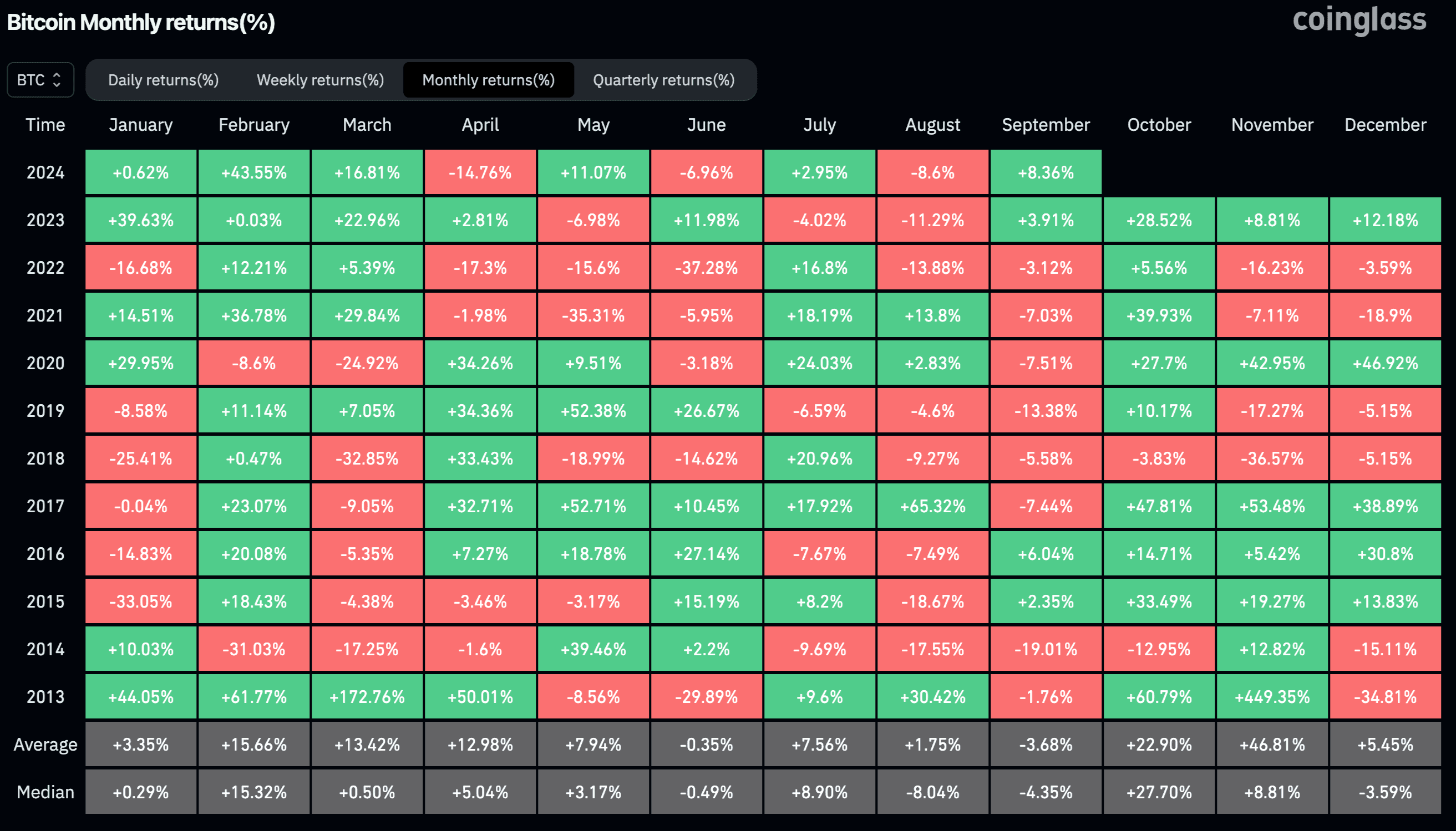

Looking at Bitcoin’s annual, quarterly, and monthly performance since 2010, October has an impressive average return of +22.9%, second only to November’s +46.8%. Over the years, Bitcoin has seen just two negative Octobers. The rest have been dominated by a bull run trend.

Bitcoin Monthly Returns History. Source: CoinGlass

With a packed week ahead, the stage is set for a potential bull run.

But remember, past trends don’t guarantee future outcomes.