Japan’s 2-year bond auction sees weakest demand since 2009

Japan’s two-year bond sale on Sept. 30 saw the weakest demand since 2009, as investors fear the Bank of Japan may hike rates in October.

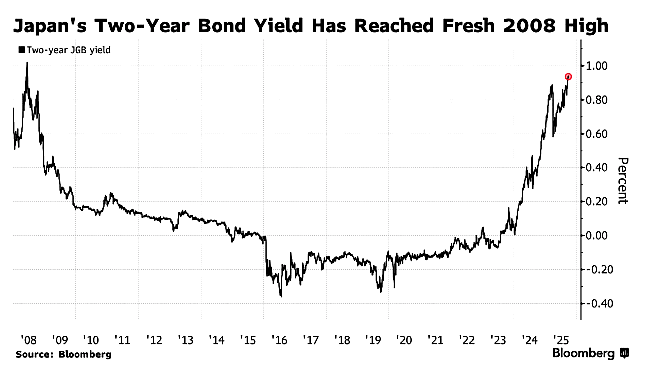

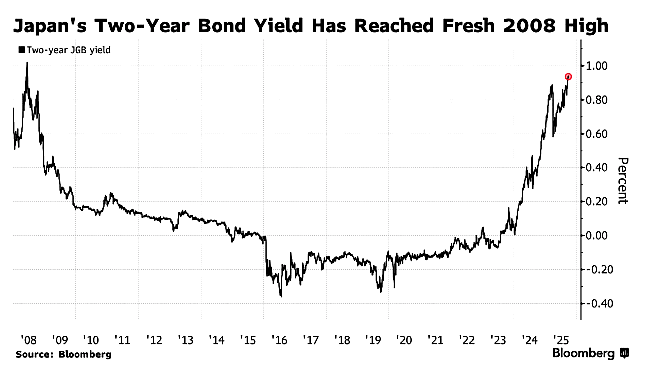

Japan's two-year bond yield reached 1% in 2025, the highest level since the 2008 financial crisis. This spike reflects the Bank of Japan’s recent move away from decades of ultra-low interest rates, a policy that had kept yields near zero to support its long-stagnant economy.

After years of low or negative inflation, prices in Japan are now rising consistently. The year-on-year core Consumer Price Index (CPI), which excludes fresh food, has stayed above the BOJ’s 2% target for around three years. In response, the BOJ has begun easing its control over the bond market, gradually reducing its purchases. With fewer bonds being bought by the central bank, demand has fallen, pushing yields higher. According to Bloomberg data, demand for Japan’s two-year government bonds dropped to a bid-to-cover ratio of 2.81, well below the 12-month average of 3.79. At the same time, 10-year bond futures dropped to 135.78.

The movement in Japan’s bond market could have global effects. Japan is the world's largest foreign holder of U.S. Treasury bonds. A rising domestic yield gives Japanese investors a greater incentive to repatriate capital, potentially creating volatility and pushing up borrowing costs in global bond markets, including the U.S. and Europe.

Related article: Bank of Japan keeps rates unchanged, announces ETF sales

After years of low or negative inflation, prices in Japan are now rising consistently. The year-on-year core Consumer Price Index (CPI), which excludes fresh food, has stayed above the BOJ’s 2% target for around three years. In response, the BOJ has begun easing its control over the bond market, gradually reducing its purchases. With fewer bonds being bought by the central bank, demand has fallen, pushing yields higher. According to Bloomberg data, demand for Japan’s two-year government bonds dropped to a bid-to-cover ratio of 2.81, well below the 12-month average of 3.79. At the same time, 10-year bond futures dropped to 135.78.

Japan’s two-year bond yield climbs to its highest level since 2008. Source: Bloomberg

Politics in Japan is adding to market uncertainty. Since Prime Minister Shigeru Ishiba said he would step down, the two-year bond yield has risen about 10 basis points. Traders are watching the ruling party’s leadership vote on October 4 for hints about how quickly the Bank of Japan might raise interest rates, with analysts expecting a possible increase from the current 0.5% to 0.75% at the October meeting.

The movement in Japan’s bond market could have global effects. Japan is the world's largest foreign holder of U.S. Treasury bonds. A rising domestic yield gives Japanese investors a greater incentive to repatriate capital, potentially creating volatility and pushing up borrowing costs in global bond markets, including the U.S. and Europe.

Related article: Bank of Japan keeps rates unchanged, announces ETF sales