Investment trends in Ukraine 2025

Ukrainians are rethinking how they save and grow their money. With war, inflation, currency swings, and uncertainty, traditional options no longer seem like the only reliable option. Instead, people are focusing on diversification.

To see how investment strategies are changing, Ipsos and WhiteBIT conducted a survey in April–May 2025. It included 650 financially active Ukrainians aged 18–65, living in cities of over 100,000 people, excluding temporarily occupied and active combat areas.

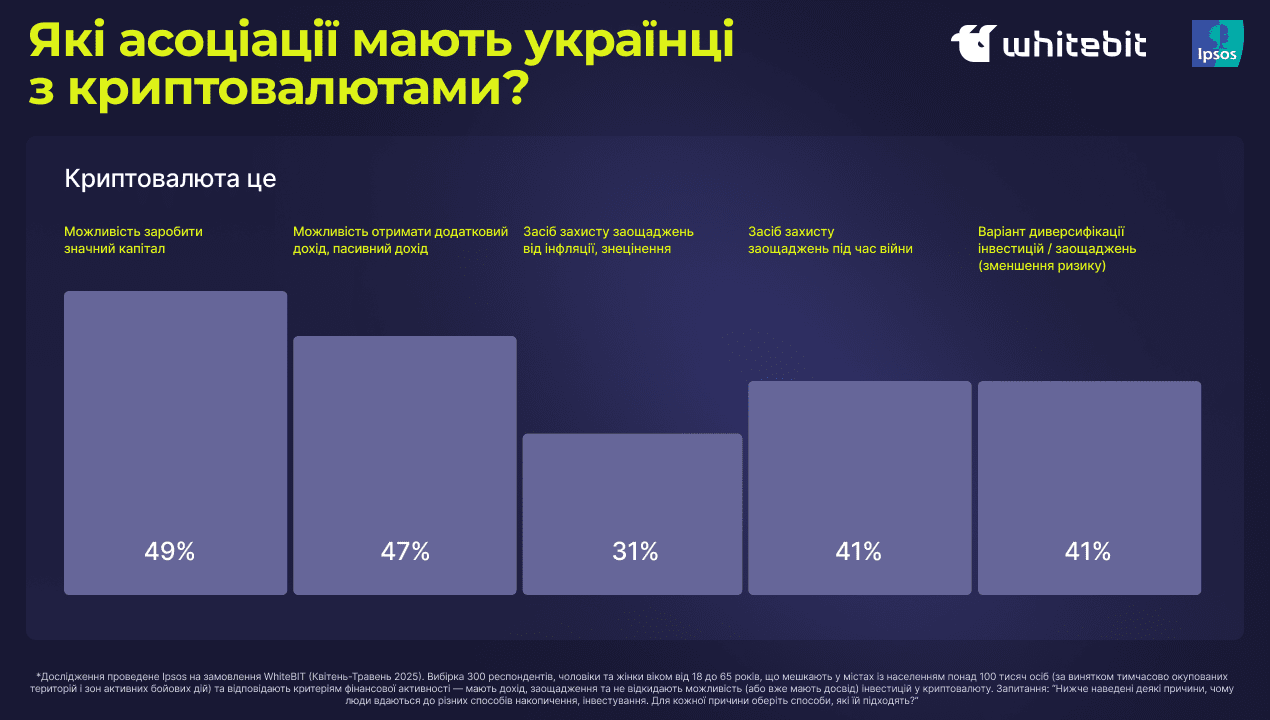

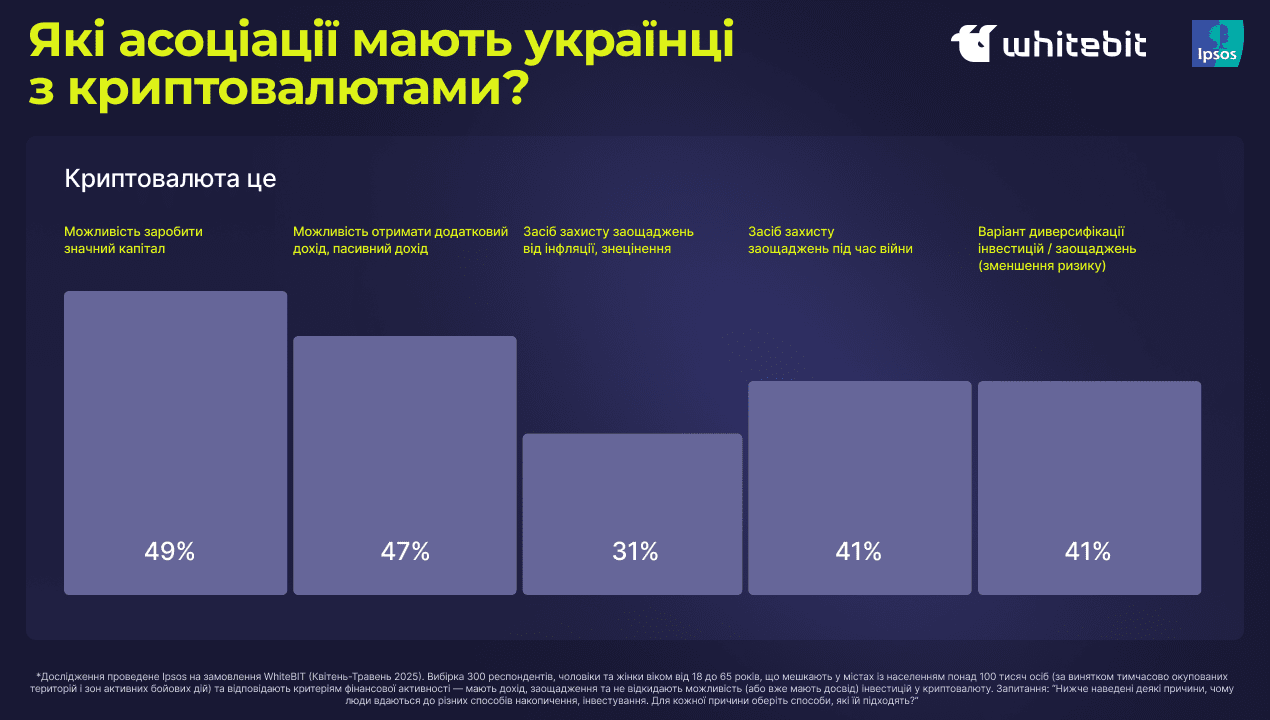

Most often, cryptocurrency is seen as a way to build significant capital, generate additional passive income, protect savings from inflation, and diversify investments.

Goal: grow and protect wealth

Investing is becoming the new financial norm for Ukrainians. An increasing number of people are moving beyond traditional savings. The survey found that more than half of respondents already consider or use alternative tools outside of cash and bank deposits. This indicates Ukrainians are looking not just to protect their money, but to grow it.

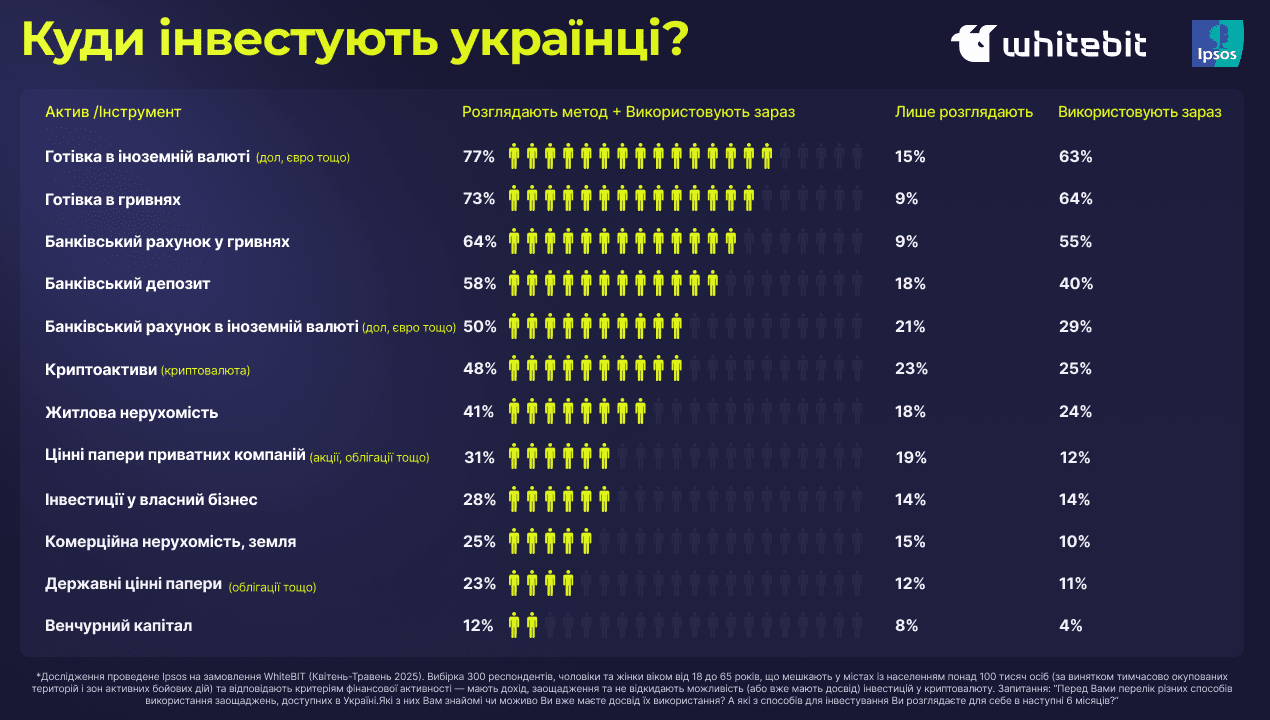

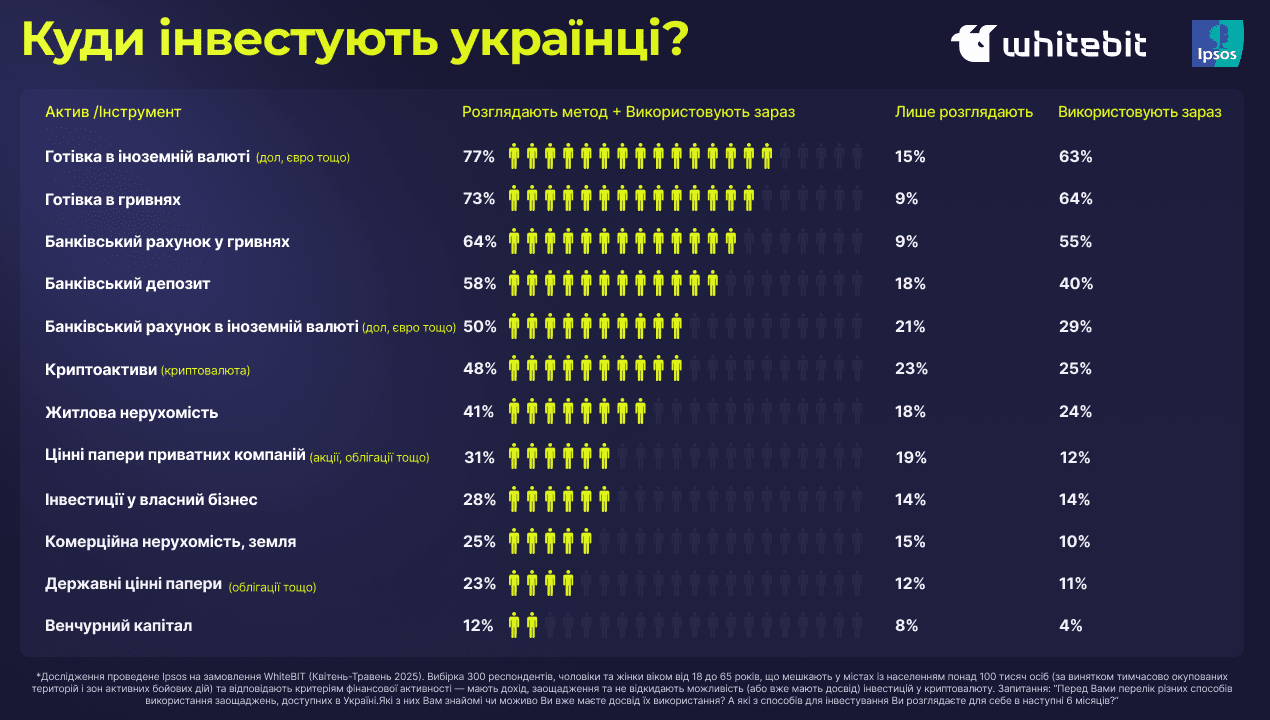

Investment trends among Ukrainians. Source: Ipsos and WhiteBIT survey

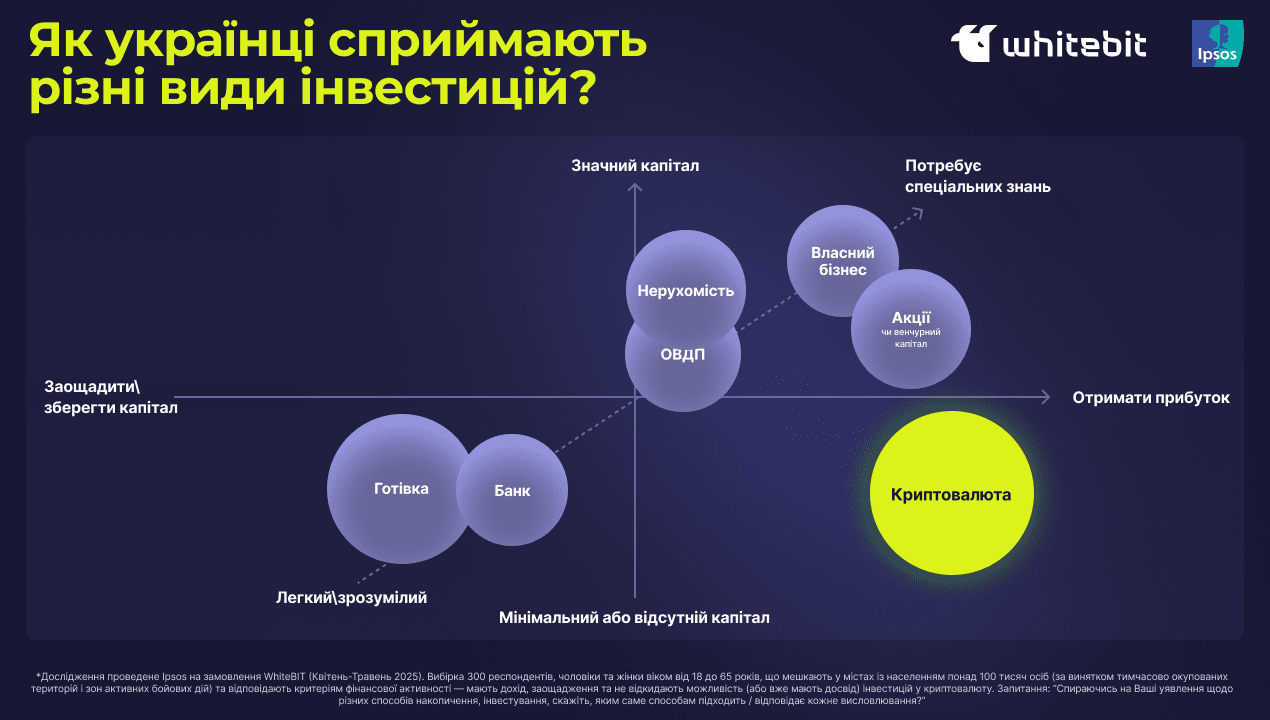

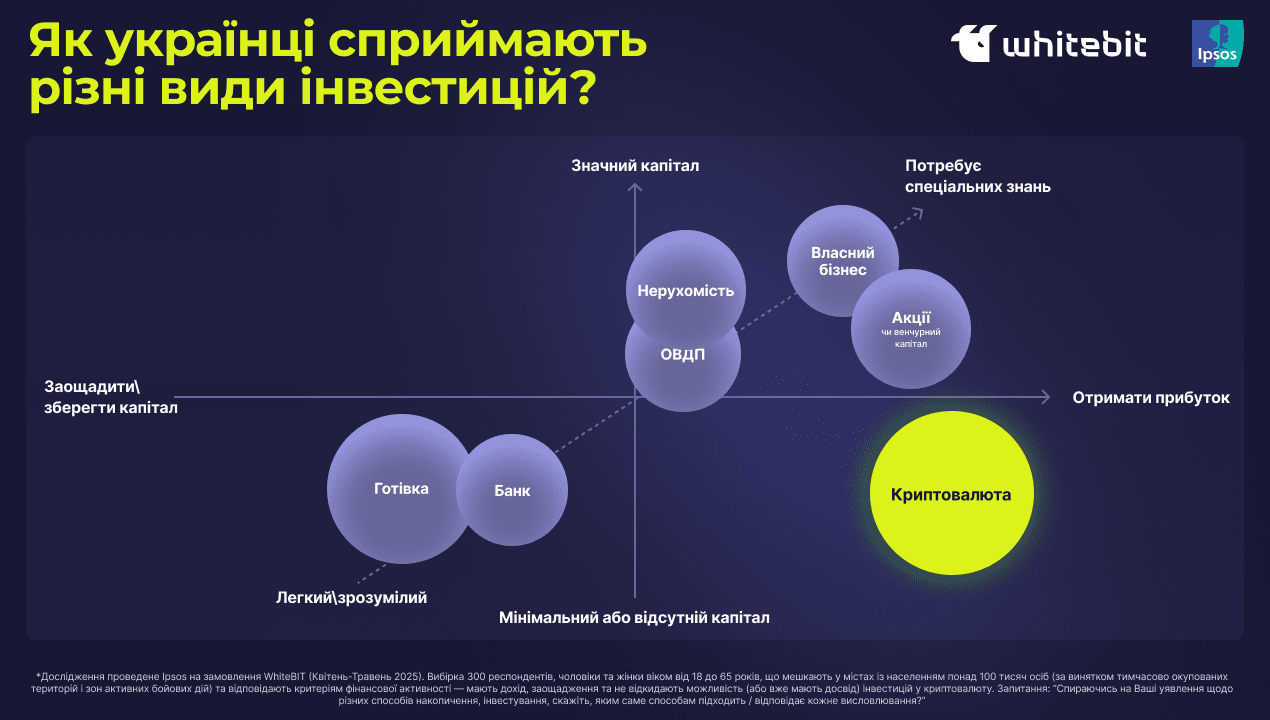

The survey shows that Ukrainians choose investment tools based on their goals. If the priority is protecting savings from inflation and devaluation, respondents lean toward cash or foreign-currency bank deposits. For passive income, government bonds and residential real estate are the preferred options.

To protect their savings from inflation, Ukrainians see foreign currency and real estate as the most reliable tools. For potential capital growth, respondents are more likely to consider cryptocurrency, private company shares, starting a business, or commercial real estate.

How Ukrainians choose investment tools. Source: Ipsos and WhiteBIT survey

Crypto is no longer exotic – it’s part of the strategy

The Ipsos survey shows that digital assets are already among the five most popular investment and savings tools for financially active Ukrainians, alongside bank accounts, deposits, and real estate.

- 25% of investors have already invested in cryptocurrency.

- Another 23% say they plan to start soon.

Most often, cryptocurrency is seen as a way to build significant capital, generate additional passive income, protect savings from inflation, and diversify investments.

How Ukrainians use cryptocurrency. Source: Ipsos and WhiteBIT survey

Interest in cryptocurrency as an effective investment tool is growing worldwide. People choose digital assets for their strong profit potential, portfolio diversification, and immunity to inflation. Thanks to technological innovation and regulatory initiatives, trust in this asset class is also steadily increasing,” said Volodymyr Nosov, founder and president of WhiteBIT. “It’s no surprise that crypto deposits are among the most popular products - they allow users not only to safeguard their funds but also to grow them, offering attractive returns.

New financial habits: digital assets

For Ukrainians who already have experience with digital assets, cryptocurrency is no longer just a trading tool. It is increasingly used in a broader financial context as a flexible instrument that combines investing, saving, and everyday transactions.

Common use cases include trading (57%), long-term holding (52%), protecting savings from inflation (51%), as well as daily financial operations and money transfers.

This versatility helps explain the growing interest in crypto tools amid an unstable economy, limited access to traditional financial services, and Ukrainians’ broader drive for greater financial autonomy.

Despite the rising popularity of digital assets, some Ukrainians still approach them with caution. This hesitation mainly stems from the technology’s novelty and the perceived need for deeper understanding. 60% of financially active respondents believe that using cryptocurrency requires special expertise. In practice, information is widely accessible - most platforms, including WhiteBIT, provide high-quality educational videos.

Key investment trends

Based on WhiteBIT’s research, several trends are shaping the future of investing in Ukraine:

- Diversification over conservatism. Cash and banks remain the most popular choices, but interest in alternative tools is rising quickly.

- A drive for independence. Experts note that during wartime instability, people increasingly look for tools that let them manage their finances outside of state or banking systems.

- Educational potential. The desire to learn more about blockchain and the digital economy is a key trigger opening new doors to the world of investing.

Final words

Ukrainians are ready to take responsibility for their financial future. Traditional savings tools are now complemented with new options - from commercial real estate to digital assets. At the same time, cryptocurrency is gradually losing its image as something “exotic” and becoming just another instrument in the modern investor’s portfolio.

While mass adoption is still underway, there is already a clear shift from saving to investing, from caution to active financial engagement. This reflects not just a response to war, but the maturity of a new economic culture.

The survey was conducted by Ipsos for WhiteBIT in April–May 2025. It covered 650 respondents aged 18–65 living in cities with over 100,000 residents (excluding temporarily occupied and active combat zones). The sample included 300 financially active participants with income, savings, and openness to crypto investment (or prior experience), and 350 respondents who already hold part of their savings in cryptocurrency.

Recommended