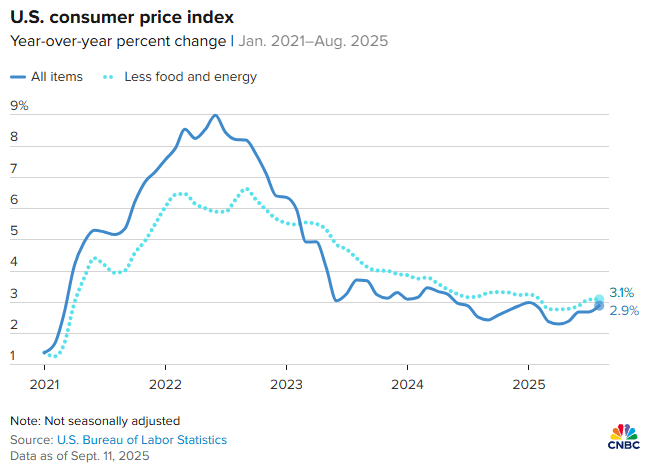

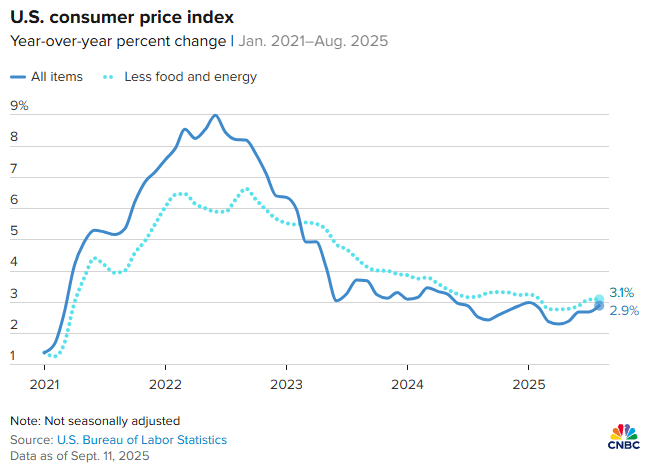

US inflation hits 2.9% in August

In August, the US consumer price index (CPI) rose 0.4%, the biggest monthly jump since January. Annual inflation reached 2.9%, the highest since early 2025, the Labor Department reported.

The main drivers were housing costs (+0.4%), food (+0.5%) and energy (+0.7%). Gasoline rose 1.9%, which experts linked to tariffs. Core inflation, which excludes food and energy, rose 0.3% on the month and 3.1% year-over-year, in line with forecasts.

CPI change chart. Source: cnbc.com

At the same time, jobless claims spiked. For the week ending Sept. 6, filings reached 263,000 – the highest since October 2021 and above the forecast of 235,000. That’s an increase of 27,000 from the prior week.

The surge points to a weakening labor market, which until recently had been considered relatively resilient. Continuing claims held at 1.94M, near a four-year high.

For the Federal Reserve, these figures will be key in deciding interest rates at the Sept. 17 meeting. Analysts note that the combination of moderate inflation and a sharp rise in unemployment strengthens the case for easing policy.

Principal Asset Management estimates the Fed will almost certainly cut rates next week. Markets also see a high likelihood of further cuts in October and December.

The mix of accelerating inflation and rising claims presents a “complex puzzle” for the Fed, but investors interpret this as a clear signal: monetary policy is turning looser, and borrowing costs are heading lower.

Recommended