🌋 Why Bitcoin’s future depends on building circular economies

posted 28 Aug 2025

Bitcoin has proven that it can store value. But if it remains just a "safe," its potential will be limited. To become a real currency, Bitcoin needs a circular economy where it is paid, accepted, and exchanged every day.

The HODL strategy has helped millions of people protect their capital with BTC and turned the first cryptocurrency into “digital gold.” But if it stops there, Bitcoin risks becoming stuck in the role of a speculative asset.

Real money (which Bitcoin was supposed to become, as its creator Satoshi Nakamoto envisioned) only makes sense when it moves within the economy: merchants accept it as payment, it can be freely converted into other assets, and employees agree to receive their salaries in BTC.

To reach its potential, Bitcoin needs not only to be a lockbox, but also to be part of everyday economic life — in stores, services, salaries, and payments between people.

From digital gold to real money

For a long time, Bitcoin was considered “digital gold.” It allowed people to save their money, escape inflation, and avoid banking risks. But money can't just sit under the mattress. The real power of a currency lies in its actual use.

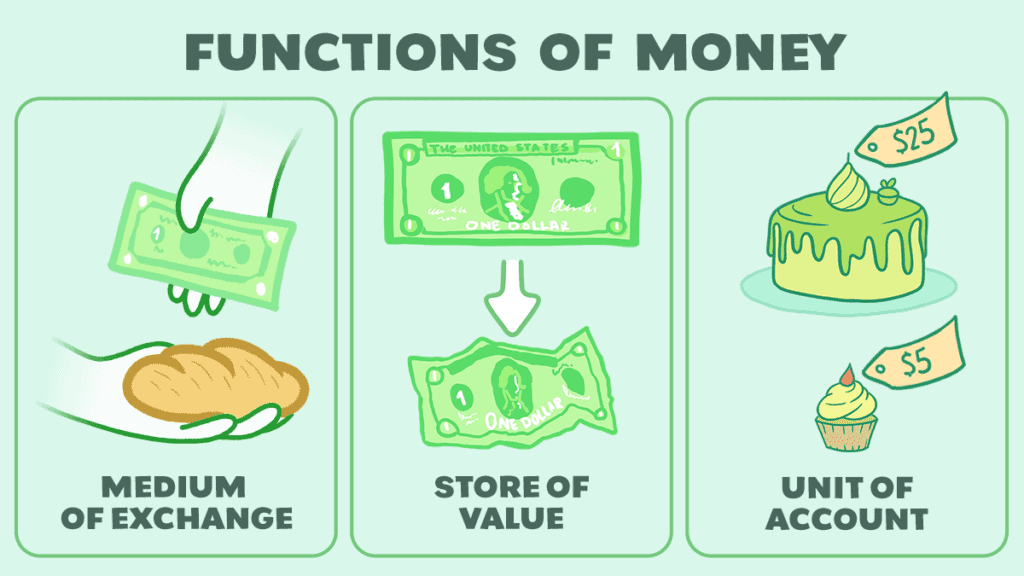

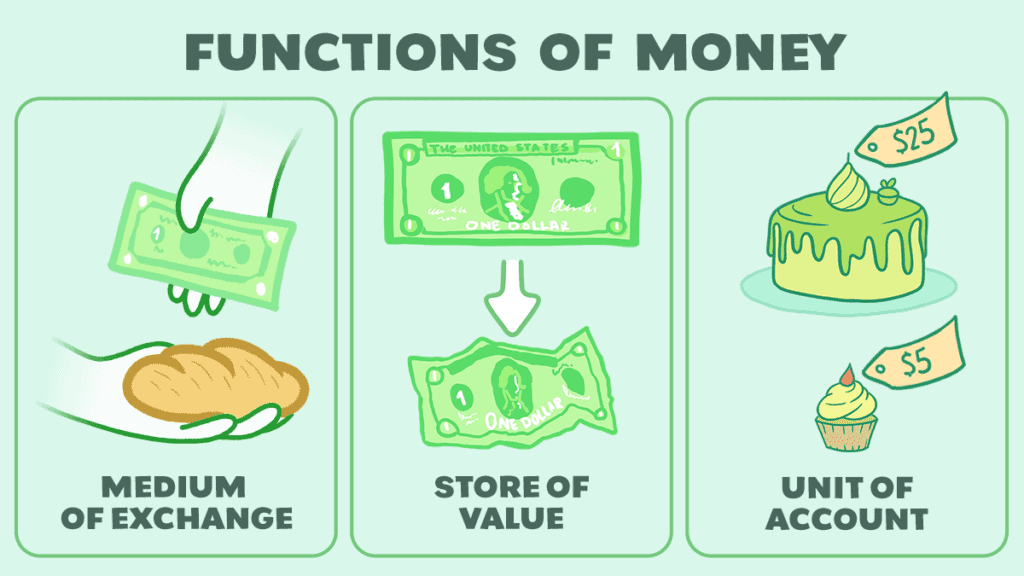

In economics, this difference is called Store of Value and Medium of Exchange. The first is about accumulation. The second is about circulation. It is useful to store bitcoins, but if they do not enter into rotation, they lose their monetary value. As one of the authors of Breez noted, “money without movement is dead.”

The three most important functions of money. Source: whiteboardcrypto.com

Today, Bitcoin is often perceived as an investment asset. This makes it similar to stocks or bonds. But it has a different nature: it was created as electronic cash. For this idea to come to life, Bitcoin needs to circulate – from one person to another, from hand to hand, like regular money. Only then will it become not just a store of value, but a fully-fledged economy.

Why long-term Bitcoin storage does not reveal the true potential of cryptocurrency

HODL has become a symbol of faith in Bitcoin. However, if the strategy relies solely on accumulation, there are risks.

First, the network effect begins to slow down. The fewer people who spend and accept Bitcoin, the weaker its real-world application becomes. It ceases to be a currency and turns into a rare digital artifact.

Secondly, Bitcoin risks becoming stuck in the status of a speculative asset. People buy it for the sake of price growth, not for use. Thus, it loses part of its mission – to be money without intermediaries.

Thirdly, savings alone make users dependent on fiat gateways: exchanges, bank accounts, and conversions. These are the very "chokepoints" through which the state or corporation can exert pressure on the system.

As Bitcoin Magazine wrote in its article "Beyond the Vault," the power of Bitcoin is revealed in motion. Money is alive as long as it circulates. If Bitcoin is locked away in safes, it will become "digital gold 2.0" rather than a new monetary system.

What is the Bitcoin circular economy?

A circular economy is one in which money does not leave circulation. In the case of Bitcoin, this means that a person receives a salary in satoshis, pays for food and transportation with them, saves the balance, and spends it again within the same network. There is no mandatory conversion to dollars or euros – everything happens within a single ecosystem.

This approach eliminates the need for dependence on banks and intermediaries. Money moves directly from person to person, without commissions or external control. And this is not just theory. In El Salvador and other countries, there are already examples of communities where Bitcoin has become not just a means of storage, but a fully-fledged form of living currency.

Lessons from El Zonte: how a fishing village became Bitcoin Beach

Until recently, El Zonte in El Salvador was a symbol of poverty and violence. Young people had only two options: emigration or street gangs. Everything changed when a group of local enthusiasts and volunteers began introducing Bitcoin into everyday life.

They launched educational programs for children, helped families receive and spend satoshis, and cafes and shops began accepting cryptocurrency payments. Tourists and surfers joined this cycle, and the village gained a new source of income. This is how the Bitcoin Beach project, as described in the book "Bitcoin Circular Economies," was born.

This example demonstrated that even in the most disadvantaged country, it is possible to create an economy where money circulates effectively within the community. Bitcoin has become not just a digital asset, but a tool for hope and development.

Lightning Network as the lifeblood of the system

The basic Bitcoin blockchain is not suitable for everyday payments: transactions take minutes and are expensive. This is fine for large transfers, but not for paying for coffee or bus fare. This is where the Lightning Network comes in.

Lightning is the second layer of Bitcoin, which allows transactions to be carried out instantly and virtually free of charge. For the user, it's simple: they open their mobile wallet, scan a QR code, and transfer several hundred satoshis in a matter of seconds.

It is Lightning that transforms Bitcoin from "digital gold" into real money. It removes speed and price restrictions, making microtransactions possible. As Breez and HackerNoon note, every purchase made through Lightning strengthens the network: the more people use it, the more stable and accessible it becomes.

If we imagine Bitcoin as an organism, then the blockchain is its skeleton, and Lightning is the blood that carries energy through its vessels. Without it, no circular economy can function.

Conclusion: What each of us can do to promote Bitcoin

You don't need to be a miner or developer for Bitcoin to become real money. Small steps that are accessible to everyone are enough.

You can accept payments in BTC — even if only partially. You can pay with Bitcoin yourself, rather than just storing it in your wallet. You can share your experience with friends and colleagues, demonstrate how Lightning works, and offer your first satoshis to newcomers. You can support companies and projects that are building infrastructure for Bitcoin payments.

Each such action strengthens the network. A passive investor becomes an active participant. And it is this involvement that triggers a circular economy, in which Bitcoin ceases to be "digital gold" and becomes real money.