Gold tops $4,000: what’s driving the historic rally

On October 8, spot gold set an all‑time high, clearing $4,000 per troy ounce. Market quotes turned into a larger story about fear, hope and global uncertainty.

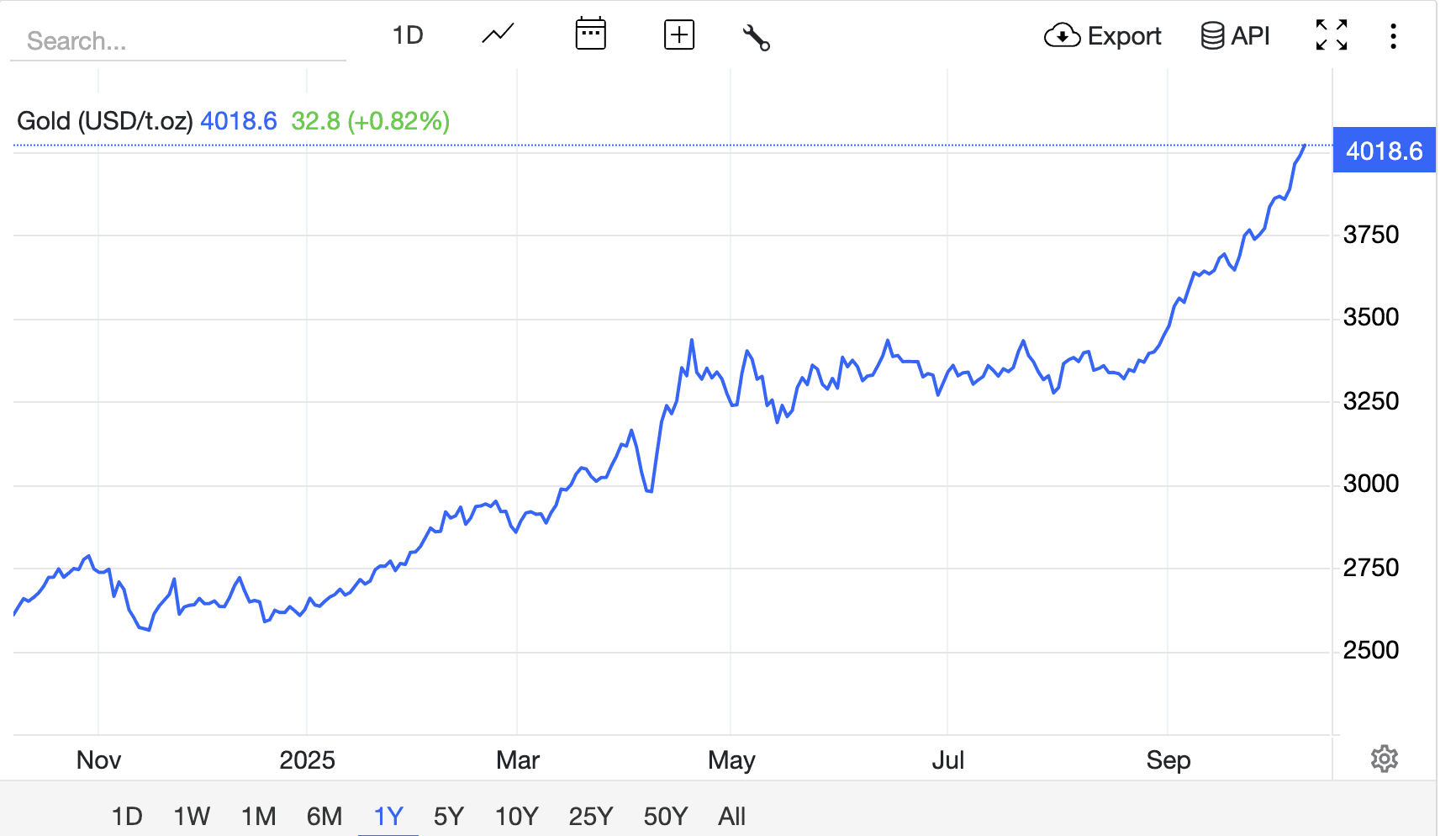

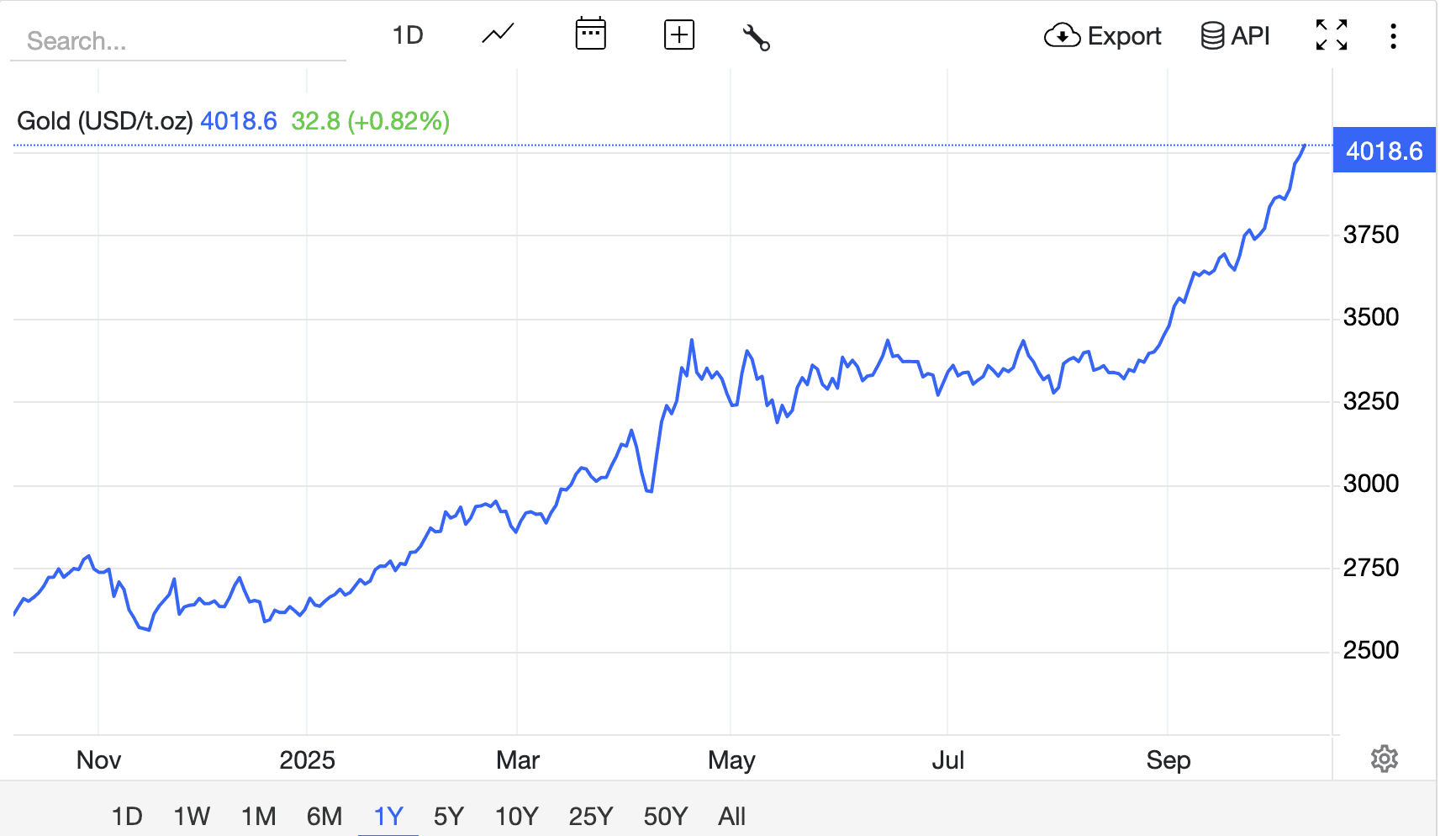

The 2025 rally has been months in the making. In March, the bullion market broke above $3,000; by late September it was trading near $3,800 and in early October the psychological barrier was finally shattered.

On trading screens, that rise looks steep, but behind it lie investor anxieties and urgent attempts to diversify financial risk.

Gold price shows exponential growth. Source: TradingEconomics

The forces are familiar, but their sequence matters. Political turbulence in Washington and renewed debates over fiscal discipline turned gold into a hedge against uncertainty. In that setting, precious metals, long viewed as a store of value, also attracted momentum-driven inflows as prices accelerated.

A weaker dollar lowered the entry bar for global buyers, while central banks added to reserves, creating a rare “anchored” demand that does not vanish with every price pullback.

Notably, adjacent segments rallied in step: silver became the relative outperformer, up nearly 60% year to date and topping $48 per ounce, revisiting 14‑year highs. Platinum hovers around $1,660 and palladium near $1,330.

Against this backdrop, gold‑mining equities found a second wind as margins expanded and business strategies were repriced. Analysts describe this as a broad revaluation of the precious metals sector. That breadth also makes the move fragile: a single data printed on the macro calendar can trigger a correction.

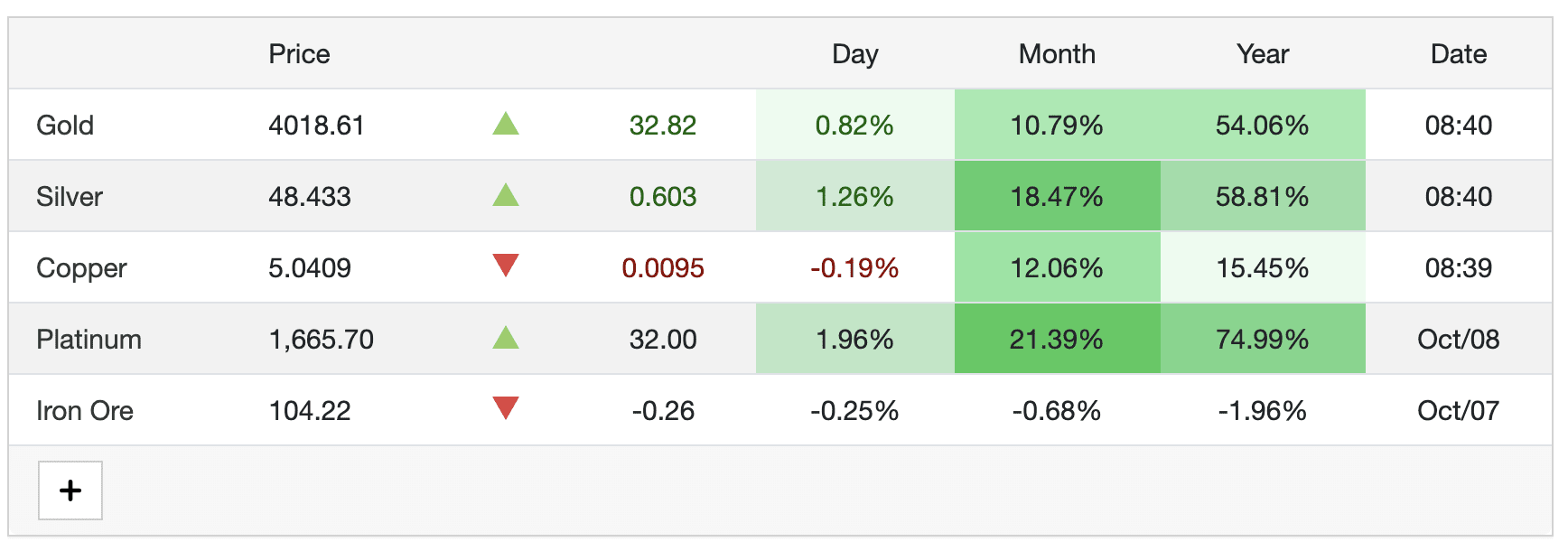

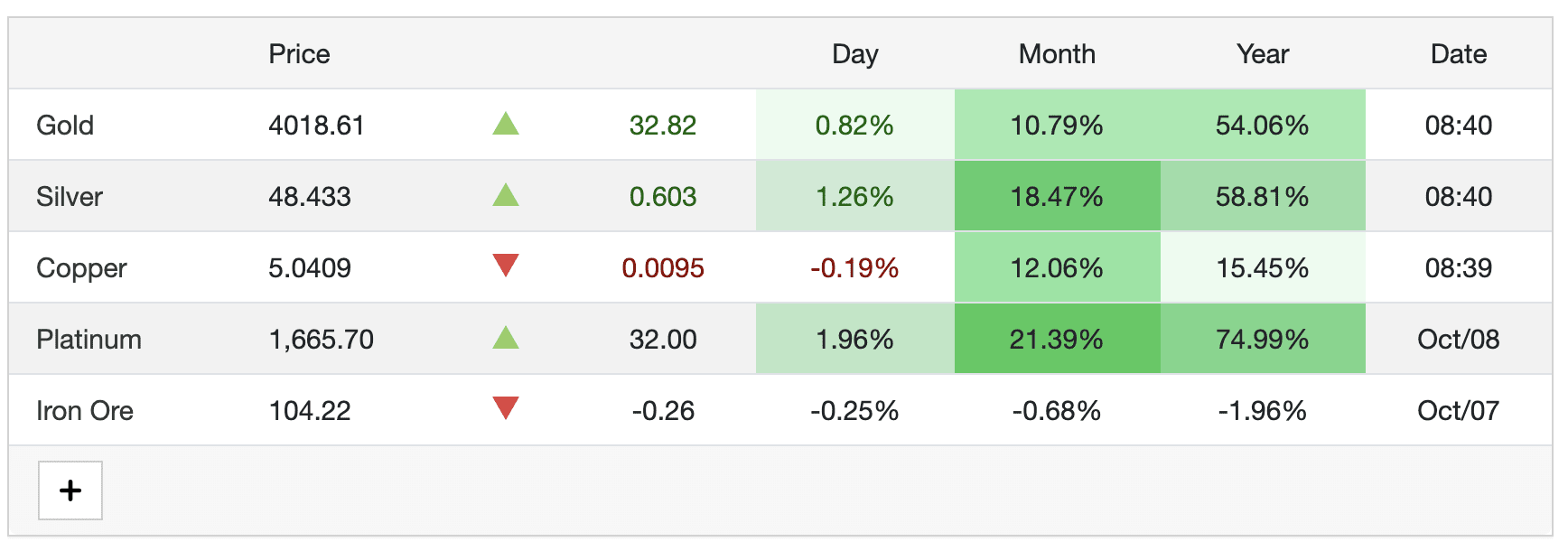

Precious‑metals segment posts price gains. Source: TradingEconomics

The next stretch will likely be shaped by three conditions: the pace of the Fed’s policy shift, the dollar’s trajectory, and the persistence of geopolitical risks. If central‑bank demand persists, the new levels can stick but volatility will remain elevated.

Investors should remember that gold is not a source of outsized returns but a seatbelt for the portfolio. Buying at market peaks carries additional risk, so maintaining disciplined sizing and long-term strategy is essential – as is the psychological readiness to withstand sharp pullbacks.

Recommended