Gold as a quasi‑reserve asset price and its demand drivers

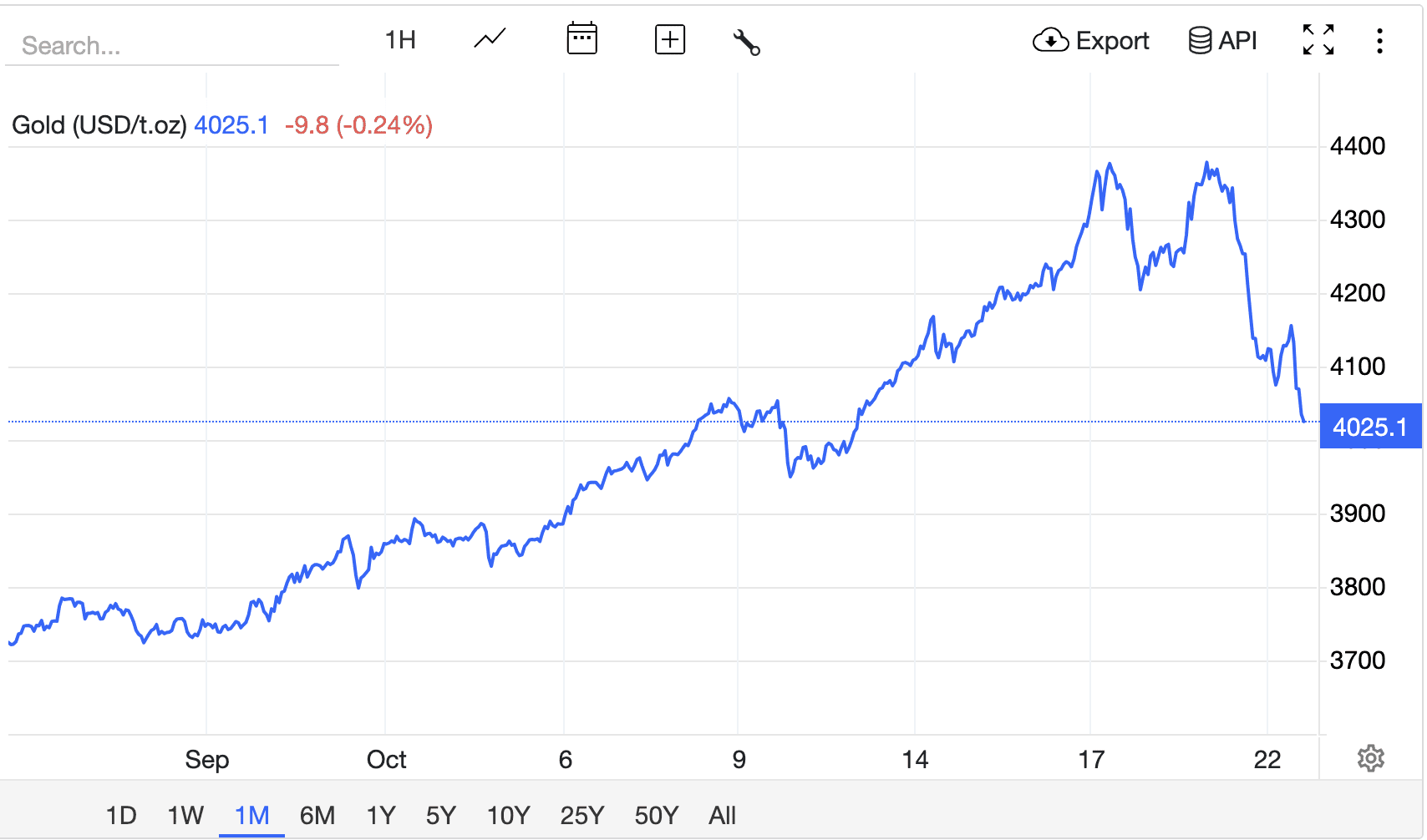

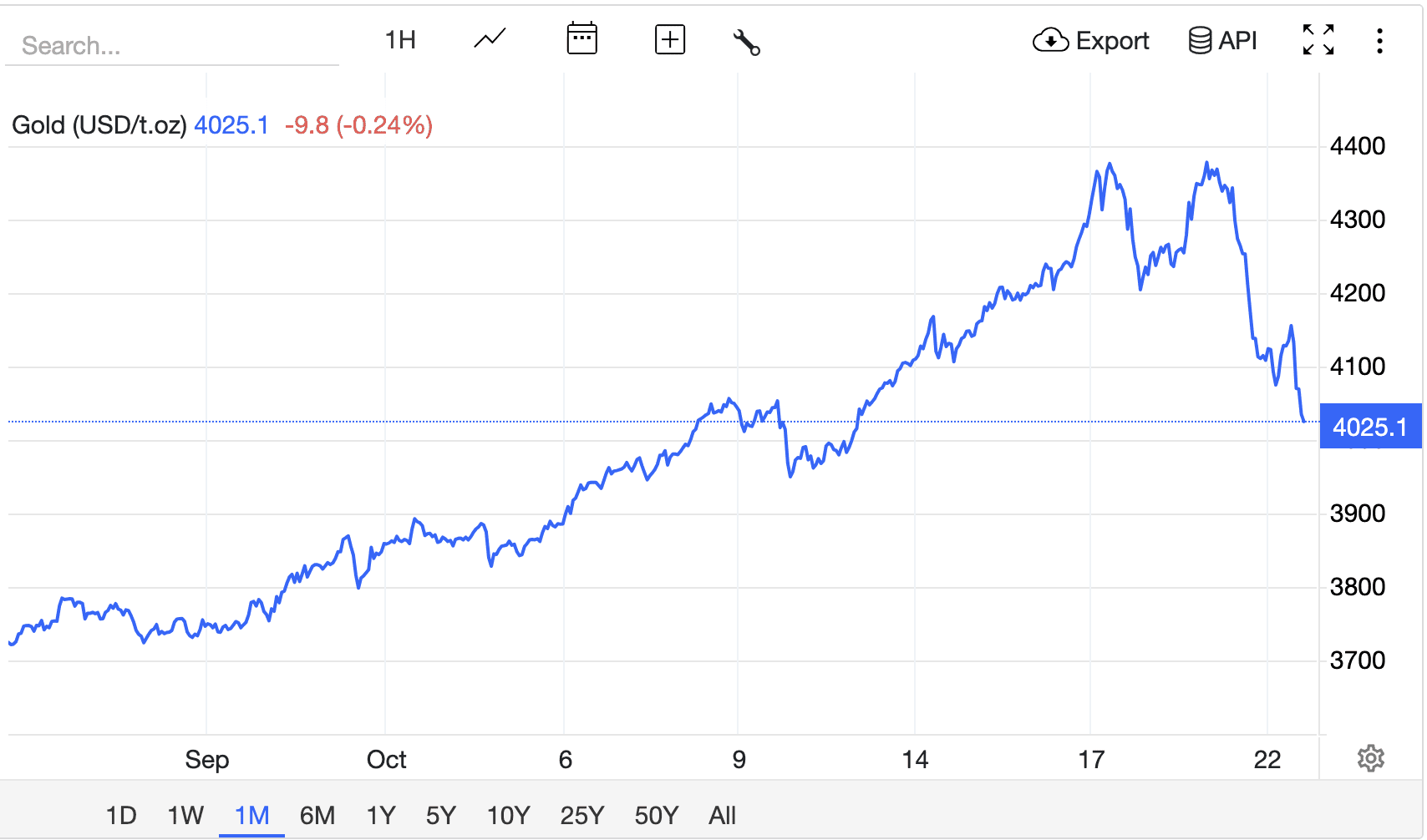

As of 22 October 2025 the gold market looks like a breather after record volatility. On Monday the price set a new all‑time high at $4,381 per ounce, on Tuesday it fell by 6.3%, and on Wednesday it stabilised around $4,025.

This path is explained by three forces coming together: profit‑taking at target levels, a local strengthening of the US dollar, and a reassessment of the expected Fed rate path. Stop‑loss triggers amplified the drop, but liquidity remained robust: spot volumes rose, and expected option volatility reached levels last seen in March 2022. These indicators show market participants are ready to trade a wider price range.

Gold price dynamics over the month. Source: tradingeconomics

The physical segment remains robust. In mid‑October retail dealers saw queues, and the gap between spot and retail prices stayed wide: bars and coins were actively bought at $4,200–4,250 per ounce.

As of 22 October gold is up almost 60% year‑to‑date in 2025, and this backdrop has created a set‑up where corrections test rather than break the trend.

The demand structure is confirmed by official statistics. Gold’s share in central‑bank reserves has reached 20%, exceeding the euro’s share of 16%. Amid tightening dollar liquidity and reserve managers’ desire to diversify currency risk, this balance is likely to persist in the coming months.

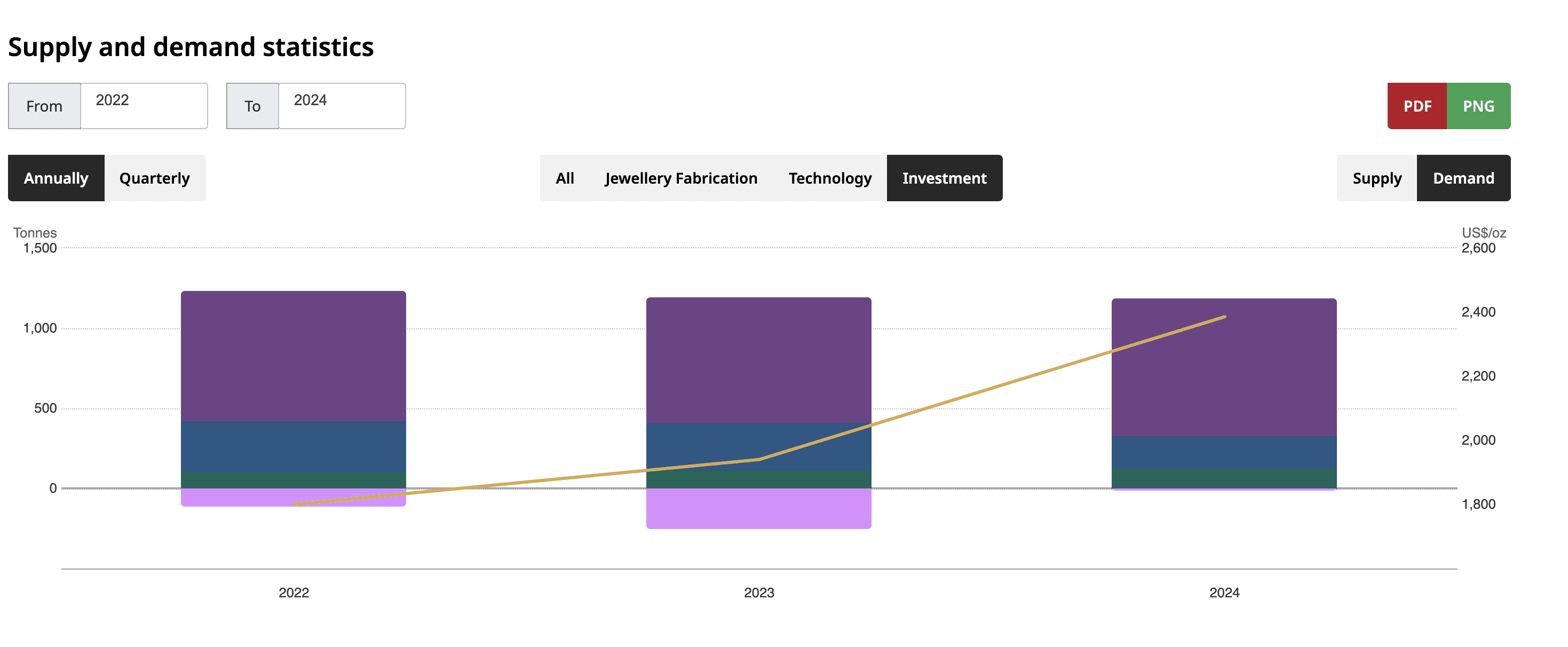

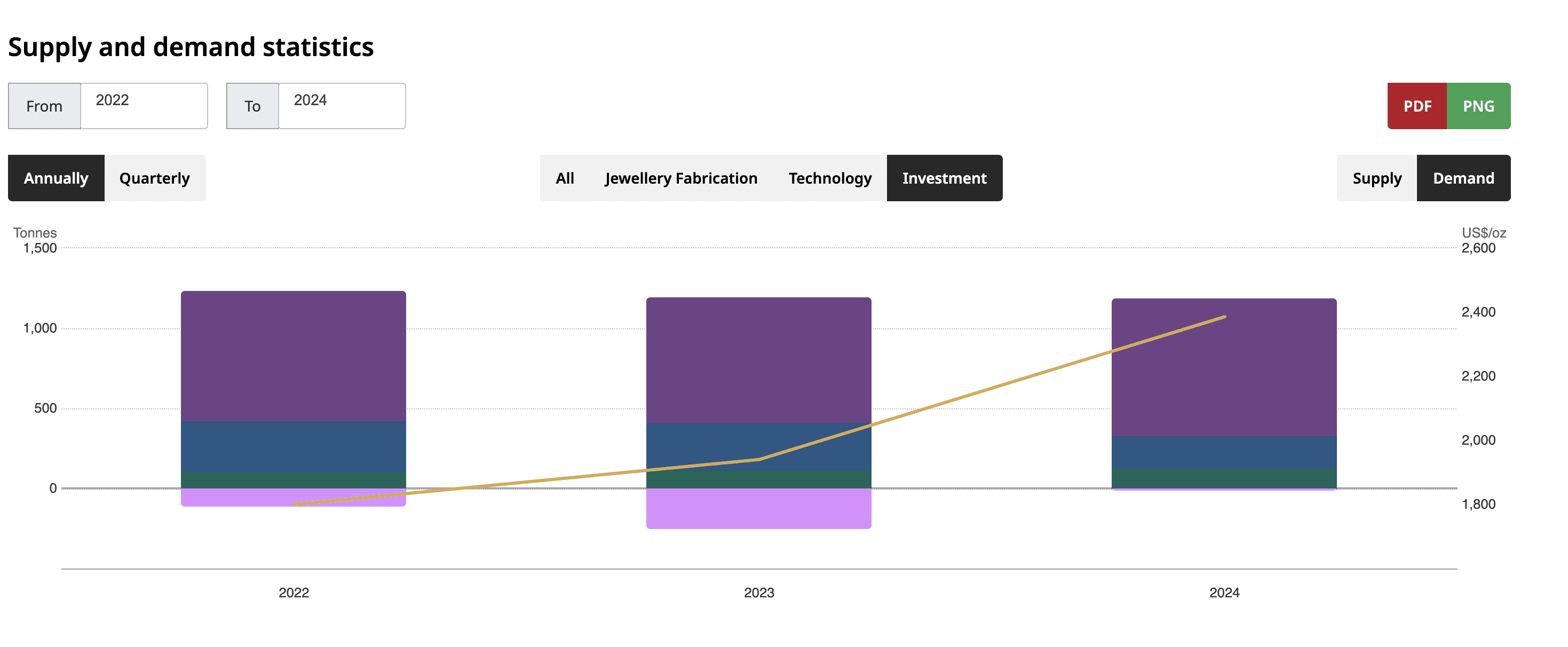

From a flow perspective central banks continue to accumulate: in August 2025 they added another 19 tonnes to reserves, and total purchases over half a year reached 444 tonnes. Supply, by contrast, is growing slowly. Global mine output in 2024 was about 3,300 tonnes versus 3,250 tonnes a year earlier, an increase of just 1.5%. Secondary supply from recycling has picked up at high prices, but even this increase does not significantly change the supply-demand balance: steady central‑bank buying and stable investment demand have absorbed the extra supply without notable price pressure for three years.

Gold demand and supply dynamics. Source: gold.org

Therefore, an equilibrium above $4,000 is economically justified because demand has effectively become institutional. The public sector is withdrawing a meaningful share of newly mined metal from free float.

The practical implication is clear: as long as official net purchases remain at current scale, a stronger dollar and rising real yields can cause corrections but do not alter the overall bullish trend. A reversal would require both a contraction in official demand and more expensive dollar funding. Hence the most likely scenario is heightened volatility with rebounds dominating after shocks.

In these conditions the market already treats gold as a quasi‑reserve asset (i.e., an asset that can be quickly converted into national currency but is not itself legal tender and is not used directly in settlements), which increases the resilience of the price level even without extreme news.

Recommended