FSB warns of risks from gaps in global crypto regulation

The Financial Stability Board (FSB) released a report warning of growing risks to the global economy due to gaps and inconsistencies in cryptocurrency regulation.

The organization warned that crypto firms and stablecoin issuers are exploiting uneven regulations by basing operations in jurisdictions with the weakest oversight. According to the regulator, this trend could threaten global financial stability.

“Different rules could lead to . . . dynamics which could exacerbate shocks,” said FSB Secretary-General John Schindler, noting that early signs of such risks are already emerging.

The report was released during the IMF and World Bank annual meetings in Washington, where differing approaches to crypto regulation were a central topic. The FSB noted that with Donald Trump’s administration adopting a more crypto-friendly stance, the United States is moving toward supportive policies, while Europe remains cautious and China continues to uphold a strict ban on most crypto activity.

Among 40 jurisdictions surveyed, only Bermuda and the Bahamas have fully implemented rules for crypto lending and margin trading. The lack of such frameworks elsewhere, the FSB warned, could trigger chain defaults and cascading failures during periods of market stress.

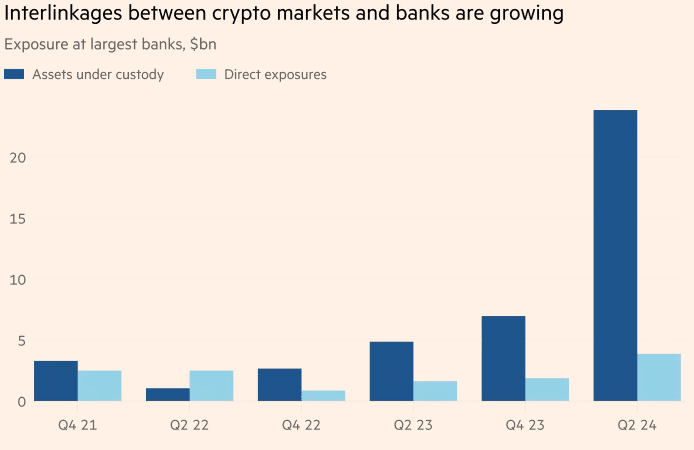

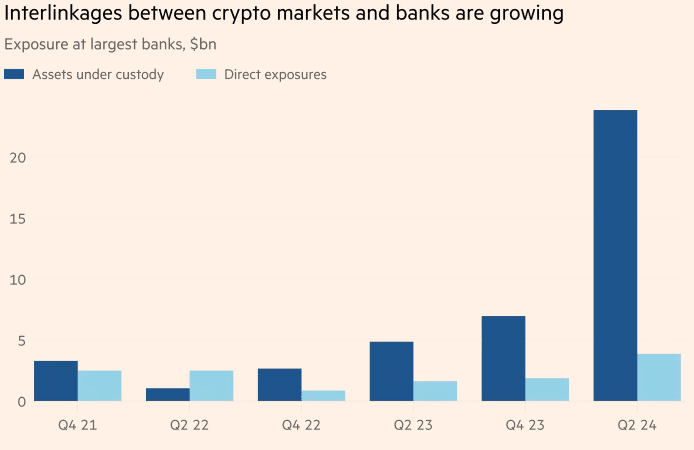

The report also highlighted the growing links between traditional banks and crypto markets. As of Q2 2024, major banks collectively managed under $25 billion in clients’ crypto assets, but the FSB cautioned that as this exposure increases, systemic risks could grow sharply.

Ties between banks and crypto markets are strengthening, driven by rapid growth in custody assets by mid-2024. Source: ft.com

Schindler said that while progress has been made since the regulator issued a series of recommendations in 2023, many countries still lack the resources and technical capacity to properly oversee and analyze crypto data.

He also warned of mounting regulatory arbitrage, as major firms move operations to more permissive jurisdictions, complicating efforts to maintain global financial stability.

Recommended