Fed prepares 25 bps rate cut: what markets expect today

Today the Fed may cut interest rates for the first time in 2025. Markets price in 96% probability of a 25 bps cut, but the key question remains: will cryptocurrencies react to the news exactly as crypto enthusiasts expect?

The Federal Open Market Committee (FOMC) convenes for a two-day meeting that will conclude with the announcement of interest rate decisions (at 8:00 PM Kyiv time).

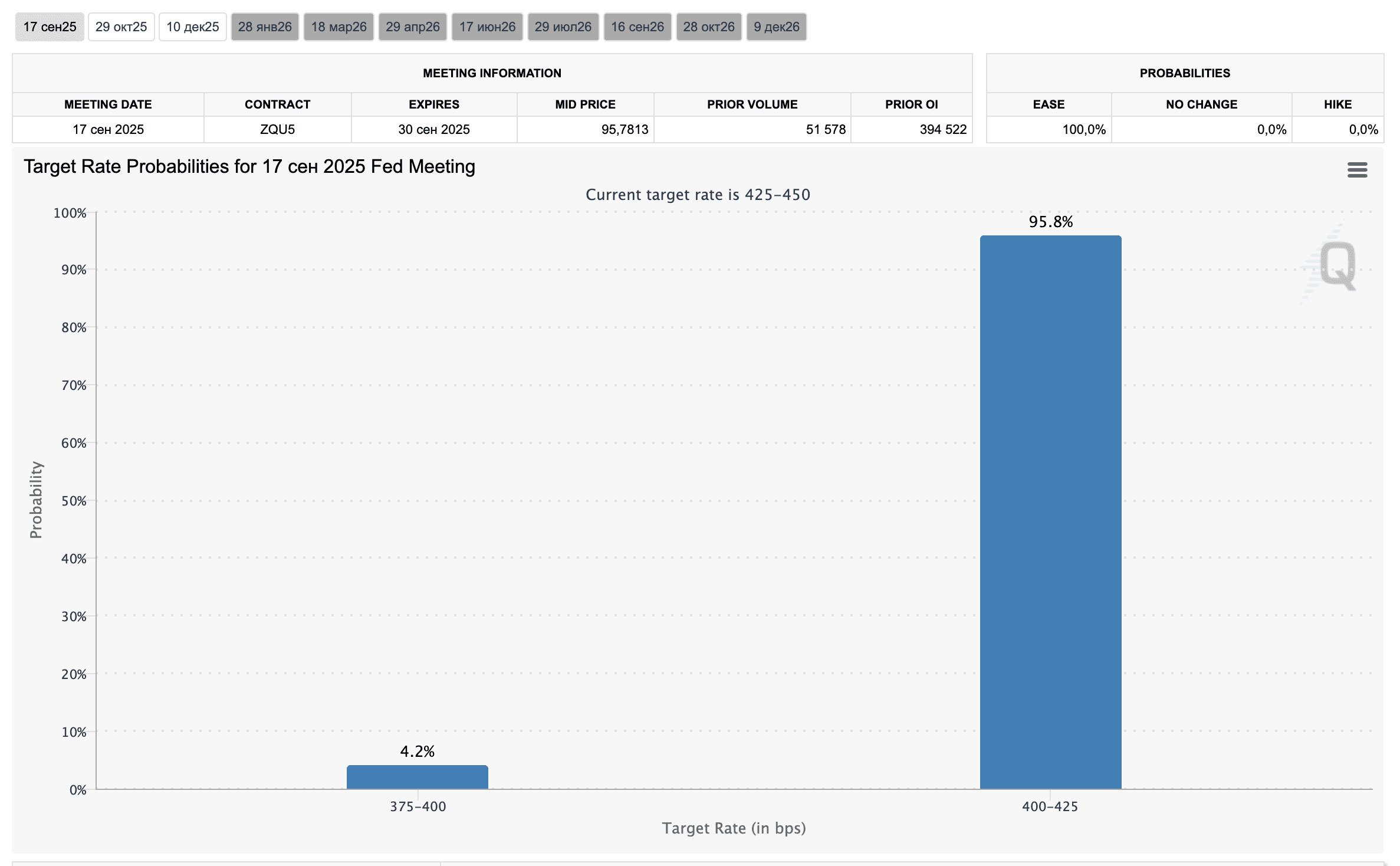

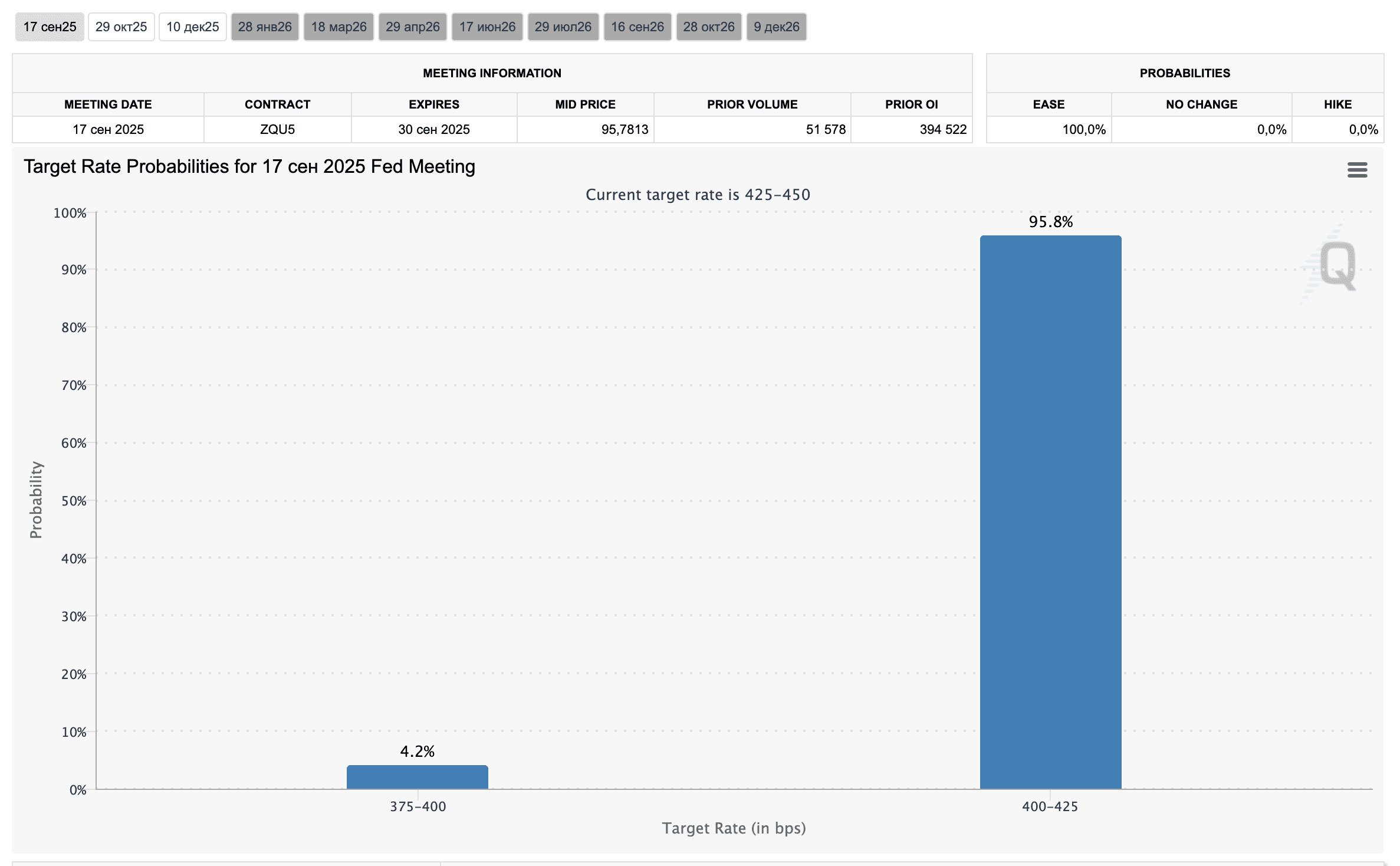

The CME FedWatch tool shows a 96% probability of a 25 basis point cut and a 4% probability of a more significant 50 basis point reduction. These indicators haven't changed for several months, so there's a huge probability that the future news about the actual rate cut is already priced in.

Market participants likely won’t be surprised if the Fed announces a rate cut today. However, the well-known phenomenon called "sell the news" could quite disappoint novice or hesitant investors.

The FOMC holds eight regular meetings per year, but today stands apart – this is the first potential rate cut since December 2024, when the Fed began changing its aggressive anti-inflation policy.

Consensus: 25 basis points

Virtually all analysts agree on forecasting a quarter percentage point reduction – from the current range of 4.25-4.5% to 4.0-4.25%.

However, uncertainty remains. "We expect that at the September meeting, the discussion will focus not so much on whether the Fed should cut rates, but on what this cut should be – 25 or 50 points," experts note.

Renowned entrepreneur and investor Anthony Pompliano is categorically confident that the Fed's decision will lead to a rally in Bitcoin, gold, and stocks.

Three development scenarios

Scenario 1: "Soft Landing" (25 bps) A moderate 0.25% reduction will demonstrate the Fed's cautious approach. Stock markets will receive moderate momentum, the dollar may weaken slightly, and cryptocurrencies could show restrained growth.

Scenario 2: "Aggressive Pivot" (50 bps) A half-percent reduction could signal serious Fed concerns about the economy. This will cause strong volatility: stocks may initially soar but then fall due to recession fears.

Scenario 3: "Status Quo" (no changes) An unlikely scenario that could trigger market collapse due to dramatically revised expectations.

Why markets may not react to a rate cut

With a 96% probability of a rate cut already priced in, the real question is how markets will react.

The market trades not on the fact of the cut itself, but on future expectations. All attention will be focused on the Fed's assessments and recommendations for the rest of 2025,explains Bloomberg Intelligence lead analyst Mike McGlone.

Goldman Sachs expert Jan Hatzius adds:

If Powell hints at a more aggressive cutting cycle than expected, we'll see a rally. If signals are restrained – a correction is possible even with the cut itself.

Crypto in focus

For cryptocurrencies, the situation is particularly intriguing. Recent analysis has shown a weak correlation between rate cuts and Bitcoin growth. "Cryptocurrencies now trade more on narratives about regulatory clarity and institutional adoption than on macroeconomic data," believes Galaxy Digital founder Mike Novogratz.

Even so, some of the $7 trillion sitting in money market funds might flow into riskier assets, including cryptocurrencies, if deposit yields drop.

What's next?

Today's possible Fed decision is just the beginning. Bank of America analysts forecast another 2-3 cuts by the end of 2025 under the base scenario. JPMorgan is more conservative, expecting a pause after September.

"Markets will carefully study the dot plot and Powell's press conference. That's where the real intrigue lies," summarizes a Citi strategist.

The FOMC decision will be announced today at 8:00 PM Kyiv time, Jerome Powell's press conference will begin at 8:30 PM.

Recommended