Modest euro‑area retail uptick supports EUR/GBP

Eurostat’s fresh August retail report shows a weak but positive demand pulse across the euro area. EUR/GBP trades near 0.8700. We unpack the headline numbers, who’s driving the move, and what markets might watch next.

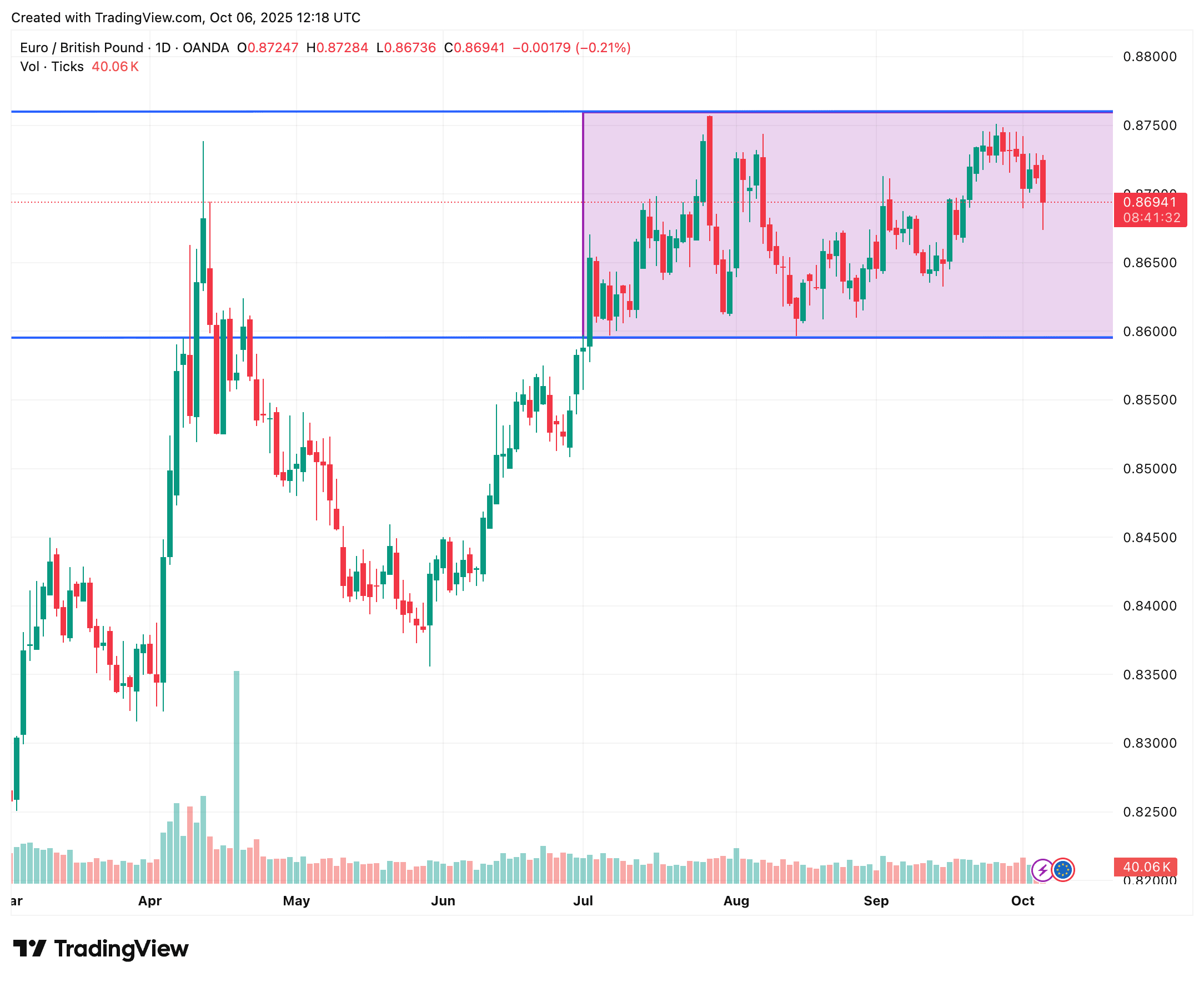

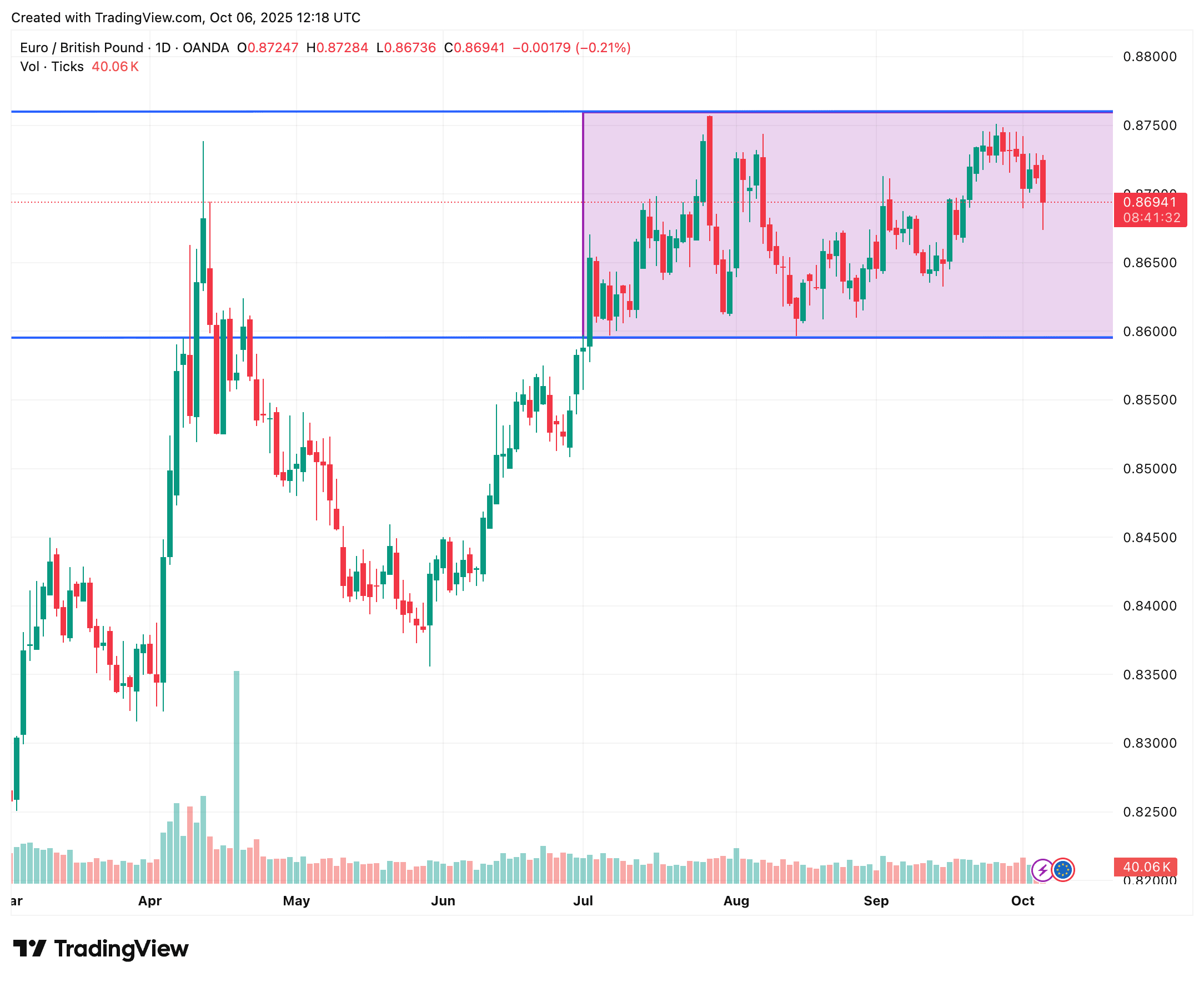

EUR/GBP edged up toward 0.8700 after the latest Eurostat report (the EU’s statistics office) on retail trade.

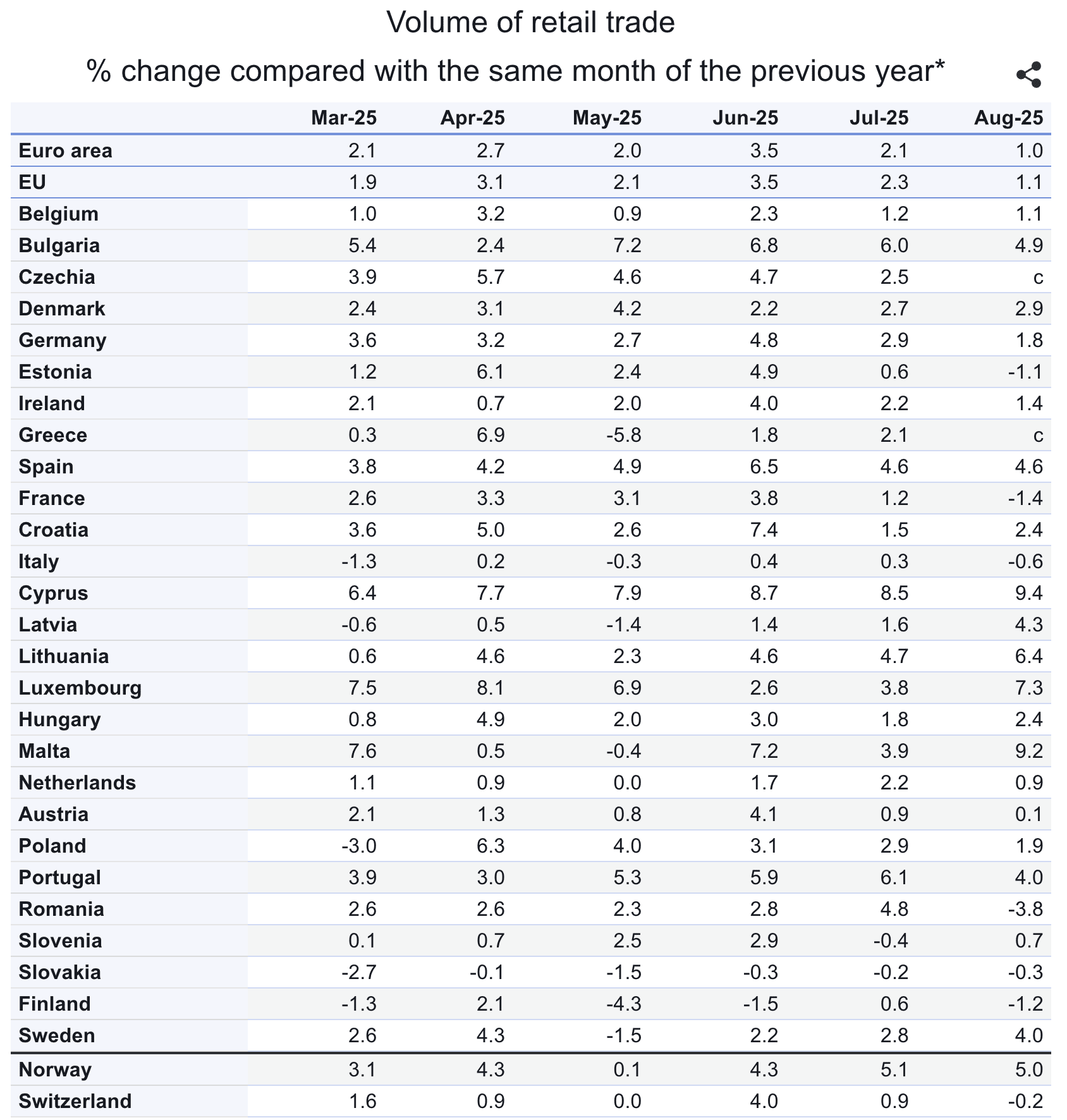

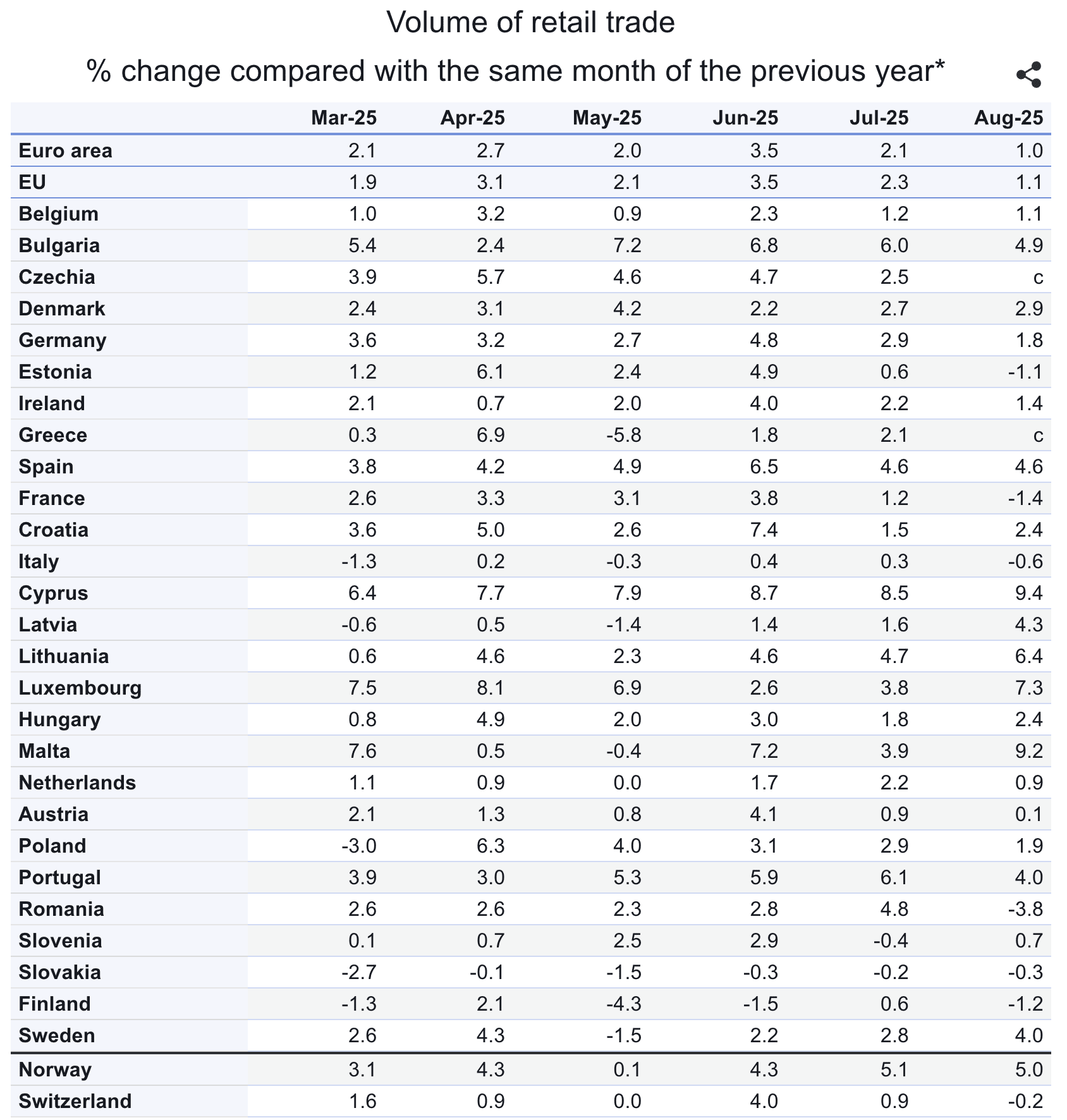

Romania (−3.8%) and France (−1.4%) lagged after moderate summer gains. Declines also appeared in Finland (-1.2%) and Estonia (-1.1%).

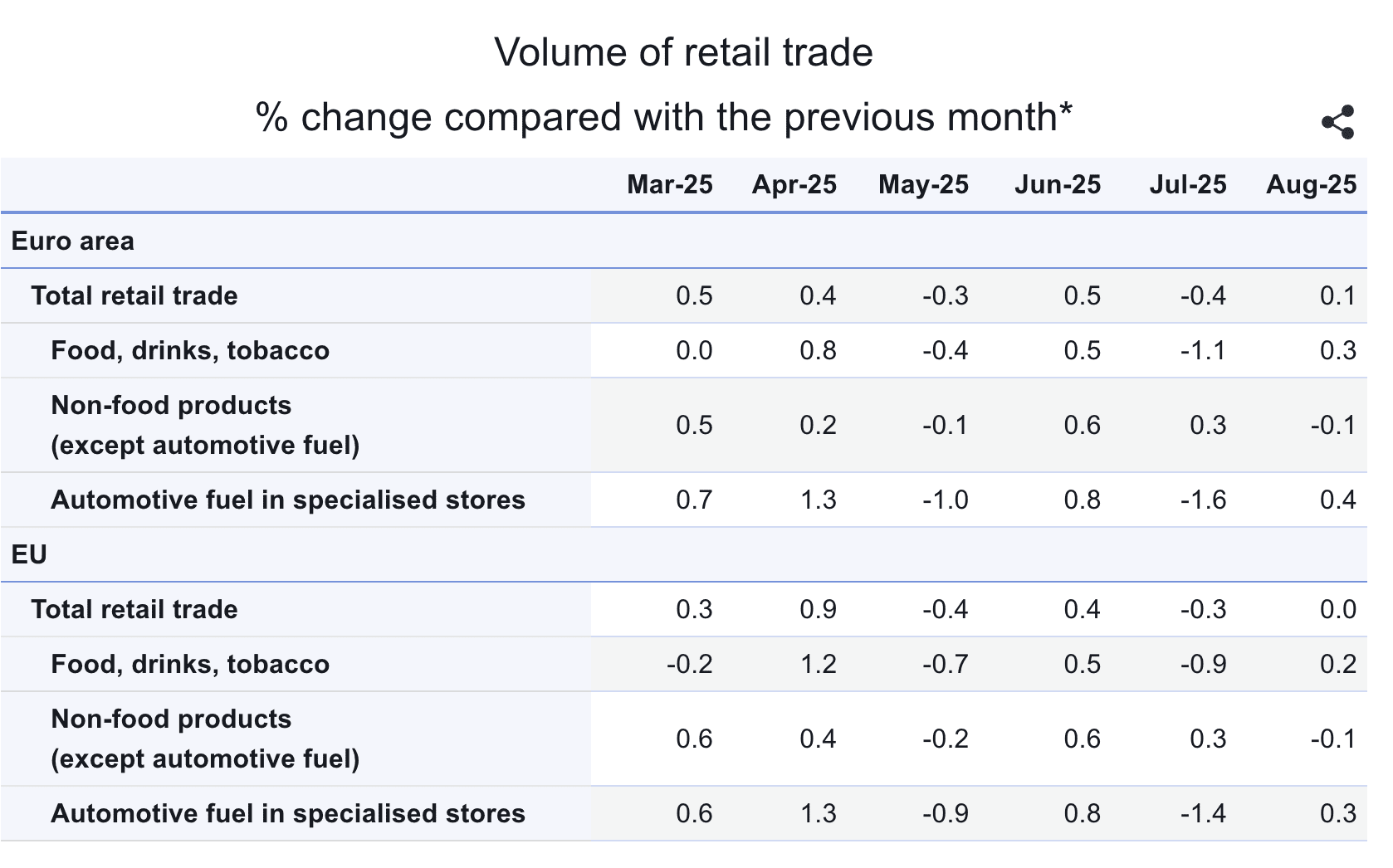

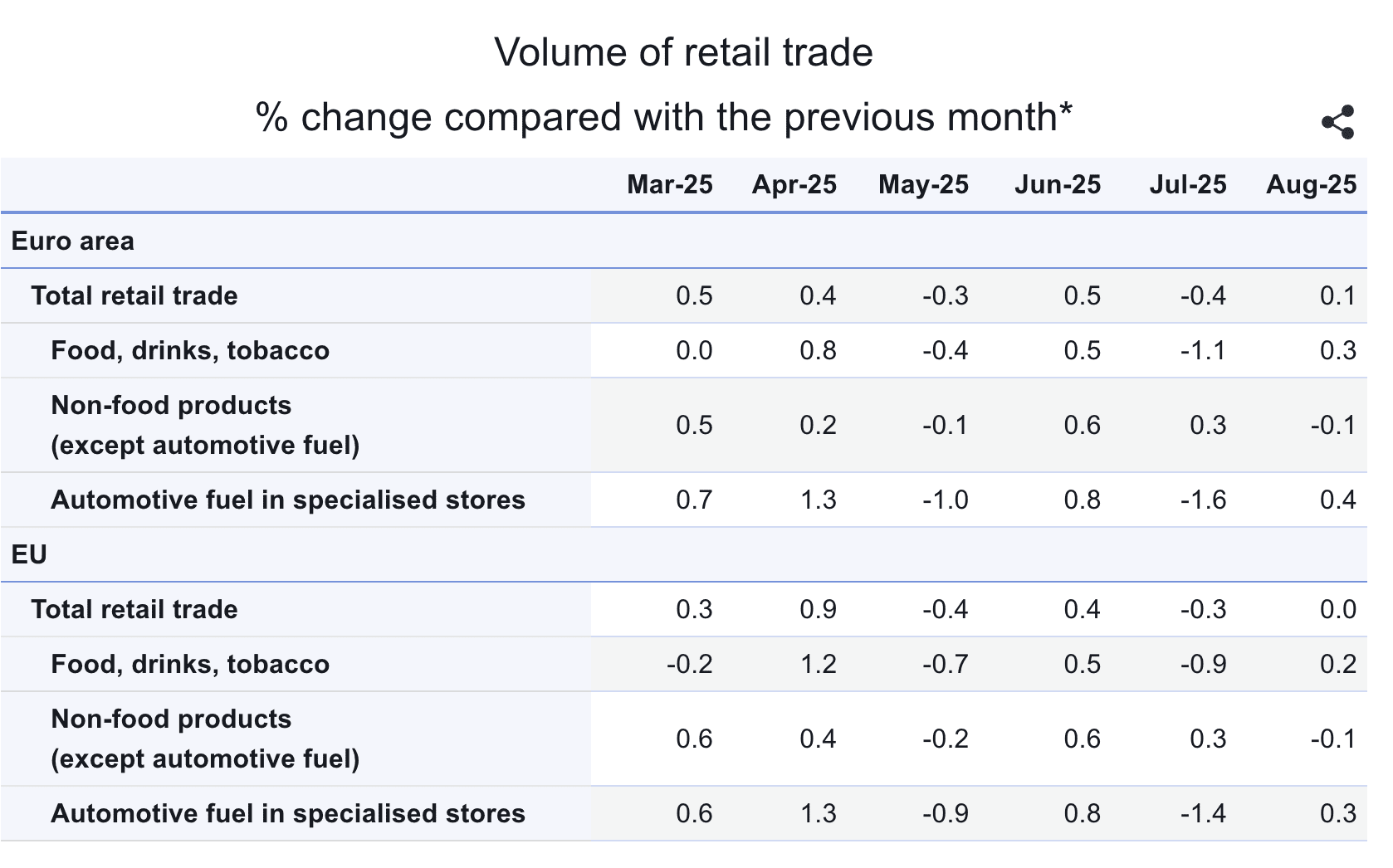

In August, store purchases across euro-area countries rose 0.1% m/m and 1.0% y/y. For the European Union as a whole the change was flat on the month (0.0% m/m) and +1.1% y/y. The result was largely in line with forecasts, so no significant volatility was observed in the currency market. The pair remains within the 0.8600-0.8760 range, where it has stabilized following a volatile July.

The breakdown looks modestly constructive. In the euro area, gains came from “food, beverages and tobacco” (+0.3% m/m) and “automotive fuel” (+0.4% m/m), while “non‑food” slipped slightly (-0.1% m/m). The EU‑wide mix is similar: +0.2% m/m for food, -0.1% m/m for non‑food, and +0.3% m/m for fuel.

Retail demand mix in Europe. Source: ec.europa.eu

By country, the standouts include:

- Cyprus (+9.4%)

- Malta (+9.2%)

- Luxembourg (+7.3%)

- Lithuania (+6.4%)

- Bulgaria (+4.9%)

- Sweden and Portugal (both about +4%)

Change in retail trade by country. Source: ec.europa.eu

Compared with July, when euro‑area retail fell 0.5% overall, the August print signals a small month‑to‑month rebound but a clear cooling in the annual pace to ~1%. This suggests that consumer momentum remains uneven, with the recovery still fragile, especially with high borrowing costs and mixed energy price dynamics.

For EUR/GBP, this set of signals is broadly neutral with a slight euro bias. A positive m/m in the euro area reduces the risk of a deeper consumption dip, but slower y/y growth tempers risk appetite. The pair is likely to remain in a 0.8680-0.8750 band near term, with direction shaped by upcoming ECB commentary, final services PMI (Purchasing Managers’ Index – a business‑activity gauge for the services sector), and U.K. labor‑market releases.

Stronger‑than‑expected U.K. data could pull the pair back toward 0.8600, while a softer U.K. backdrop would open the path to 0.8800. The next Eurostat retail release is scheduled for November 6, 2025, giving markets a month to reassess the region’s demand trajectory.

Recommended