European banks expand risky loans to boost profits

Leveraged loan issuance in Europe is nearing record highs. BNP Paribas, Deutsche Bank, and Barclays are among the most aggressive lenders in this segment.

European banks are ramping up their exposure to leveraged loans – debt issued to highly indebted companies – seeking higher revenues while taking on greater balance sheet risks.

According to Bloomberg Intelligence, leveraged loan volumes across Europe, the Middle East, and Africa have already hit €249.8 billion ($294B) in 2025. This puts the market on track to exceed last year’s record €337 billion, the highest in 15 years.

According to Bloomberg Intelligence, leveraged loan volumes across Europe, the Middle East, and Africa have already hit €249.8 billion ($294B) in 2025. This puts the market on track to exceed last year’s record €337 billion, the highest in 15 years.

Tighter credit spreads and looser monetary policy in Europe and the UK have fueled demand from corporates eager to lock in cheaper financing. As a result, banks such as BNP Paribas, Barclays, Deutsche Bank, and Credit Agricole have expanded their activity in this sector.

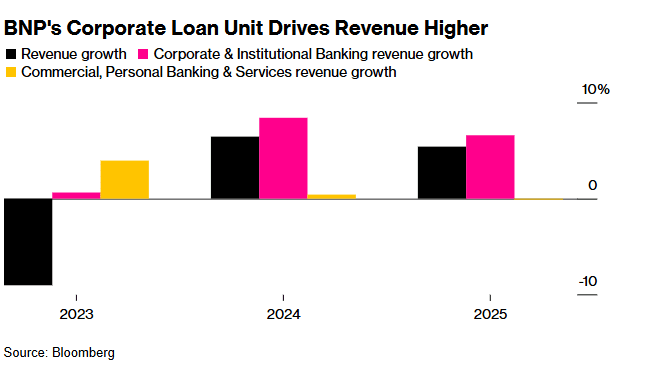

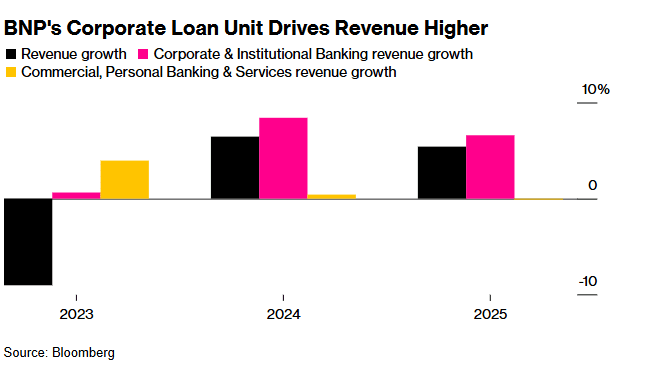

BNP Paribas stands out in particular: its corporate and investment banking unit expects revenue growth of nearly 7% in 2025, while its retail business remains flat. Analysts note that higher earnings from leveraged loans could prompt upward revisions to profit forecasts for the broader European banking sector.

Experts warn that today’s appetite for risk echoes 2007, but note that banks now more frequently use hedging and risk-transfer mechanisms. For instance, BNP Paribas is working on a €2.5 billion securitization deal to shift part of its loan exposure onto pension funds and hedge funds.

Thus, while the leveraged loan boom promises stronger revenues for European banks, it also poses a test of their resilience if market conditions turn.

BNP Paribas stands out in particular: its corporate and investment banking unit expects revenue growth of nearly 7% in 2025, while its retail business remains flat. Analysts note that higher earnings from leveraged loans could prompt upward revisions to profit forecasts for the broader European banking sector.

Corporate lending has become the key driver of BNP’s revenue growth in 2024 and 2025. Source: Bloomberg.com

Still, regulators remain cautious. The ECB is closely monitoring asset quality and has warned that rapid growth could lead to write-downs if credit quality deteriorates. In September, the central bank resolved a long-standing dispute with lenders over reserve requirements for risky loans, tightening rules around valuation models.

Experts warn that today’s appetite for risk echoes 2007, but note that banks now more frequently use hedging and risk-transfer mechanisms. For instance, BNP Paribas is working on a €2.5 billion securitization deal to shift part of its loan exposure onto pension funds and hedge funds.

Thus, while the leveraged loan boom promises stronger revenues for European banks, it also poses a test of their resilience if market conditions turn.

Recommended