European and Asian markets slide amid concerns over U.S. banks

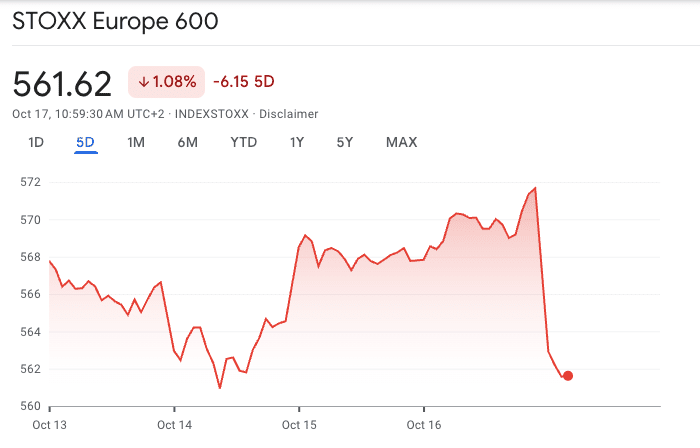

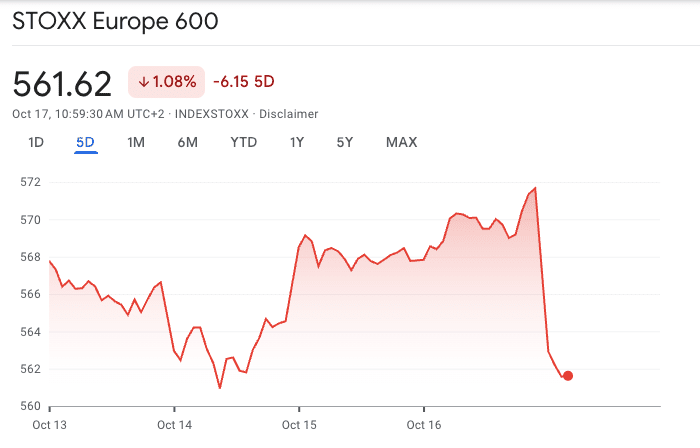

Stocks fell in Europe and Asia on Oct. 17 as U.S. regional bank credit troubles shook confidence and drove investors to safe havens.

European bank shares experienced declines after U.S. regional lenders disclosed loan losses and a fraud lawsuit, triggering broader risk-off sentiment. Major Asian benchmarks, including Japan’s Nikkei and Hong Kong’s Hang Seng, also dropped as worries about banking risks outweighed local economic drivers.

In Europe, financial stocks opened weaker following Thursday’s U.S. regional bank slide. Deutsche Bank, Barclays, and Société Générale were among the notable fallers in early trade, with broader European indices slipping alongside the sector. Traders reacted to reported losses and legal action in the U.S., highlighting rising concerns about credit quality and risk management.

5-day STOXX Europe 600 chart, the widely used barometer of Europe’s large- and mid-cap stock performance. Source: Google Finance

In Asia, selling was broad-based. Japanese megabanks and insurers lost ground, Hong Kong benchmarks fell more than 1%, and regional indices softened as investors rotated into government bonds and precious metals. Gold advanced to fresh record highs, and Treasury yields eased as safe-haven demand grew throughout the session.

The latest bout of risk aversion follows U.S. regional banks’ disclosures of bad-loan charges and legal issues related to suspected fraud. On October 16, 2025, two prominent regional banks, Zions Bancorporation (NASDAQ: ZION) and Western Alliance Bancorporation (NYSE: WAL), revealed issues with loans tied to suspected fraud. These disclosures came amid a broader wave of credit concerns, including recent bankruptcies of borrowers like auto parts supplier First Brands Group and subprime auto lender Tricolor Holdings, which exposed banks to billions in losses.

Recent incidents echo earlier 2025 events, such as JPMorgan Chase's $170 million charge-off tied to Tricolor's collapse and Fifth Third Bancorp's potential $200 million loss from suspected fraud. JPMorgan CEO Jamie Dimon warned on an earnings call that "when you see a cockroach, there are probably more," signaling fears of systemic underreporting.

With banking concerns mounting, economic stress intensified, adding to market uncertainty. Crypto and tech stocks saw declines. Bitcoin fell below $105,000, S&P dropped 0.6% and Nasdaq by 0.4%.

Recommended