Euro, yen and NZD slip against U.S. dollar

The New Zealand dollar, the euro and the Japanese yen have been losing ground to the U.S. dollar for a third straight day. NZD/USD moved toward $0.574, EUR/USD slipped below $1.17, and USD/JPY traded around ¥152.6 per $1.

This pattern reflects a mix of geopolitical uncertainty and expectations of changes in fiscal policy in several countries, which lifts demand for the dollar as a more predictable currency.

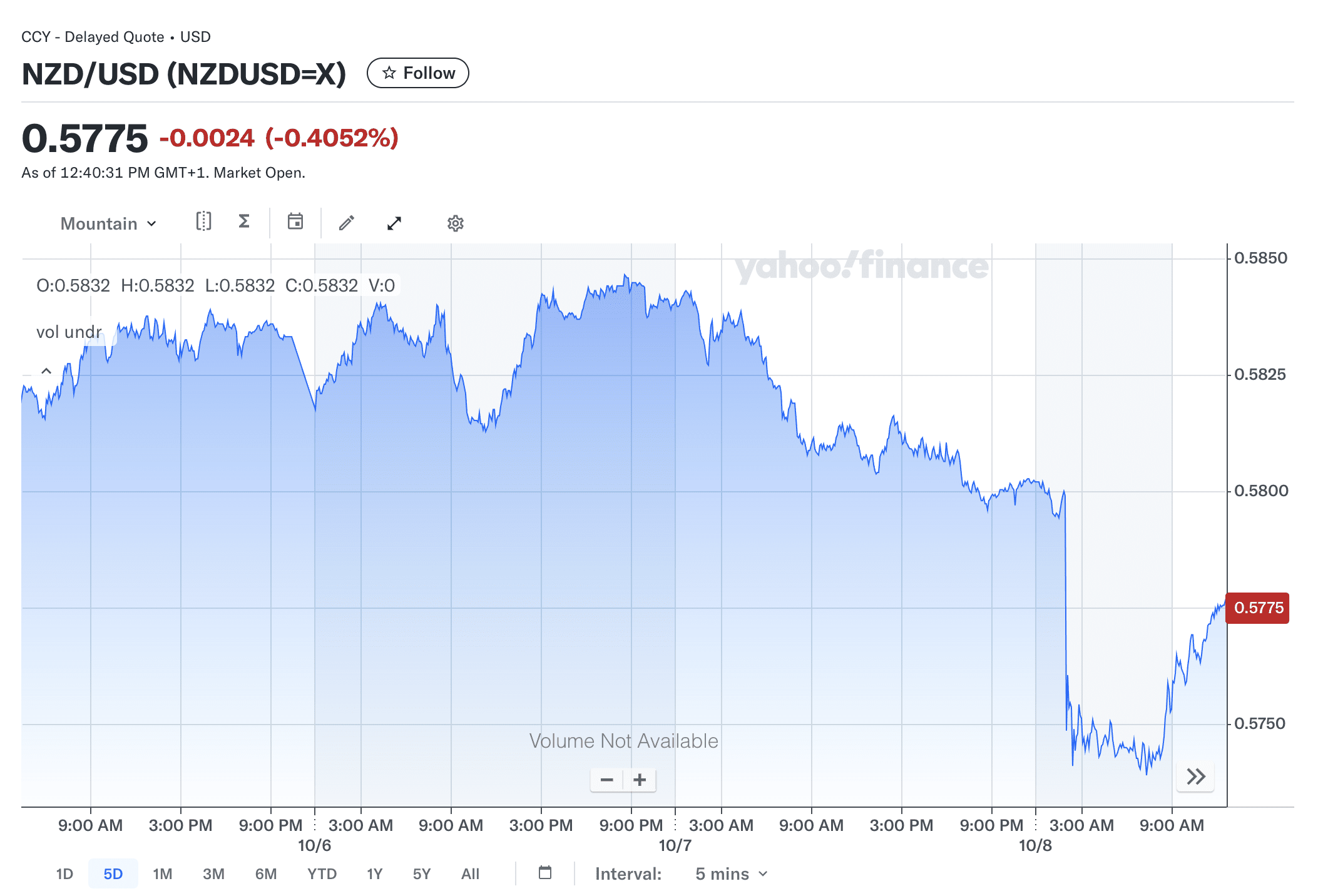

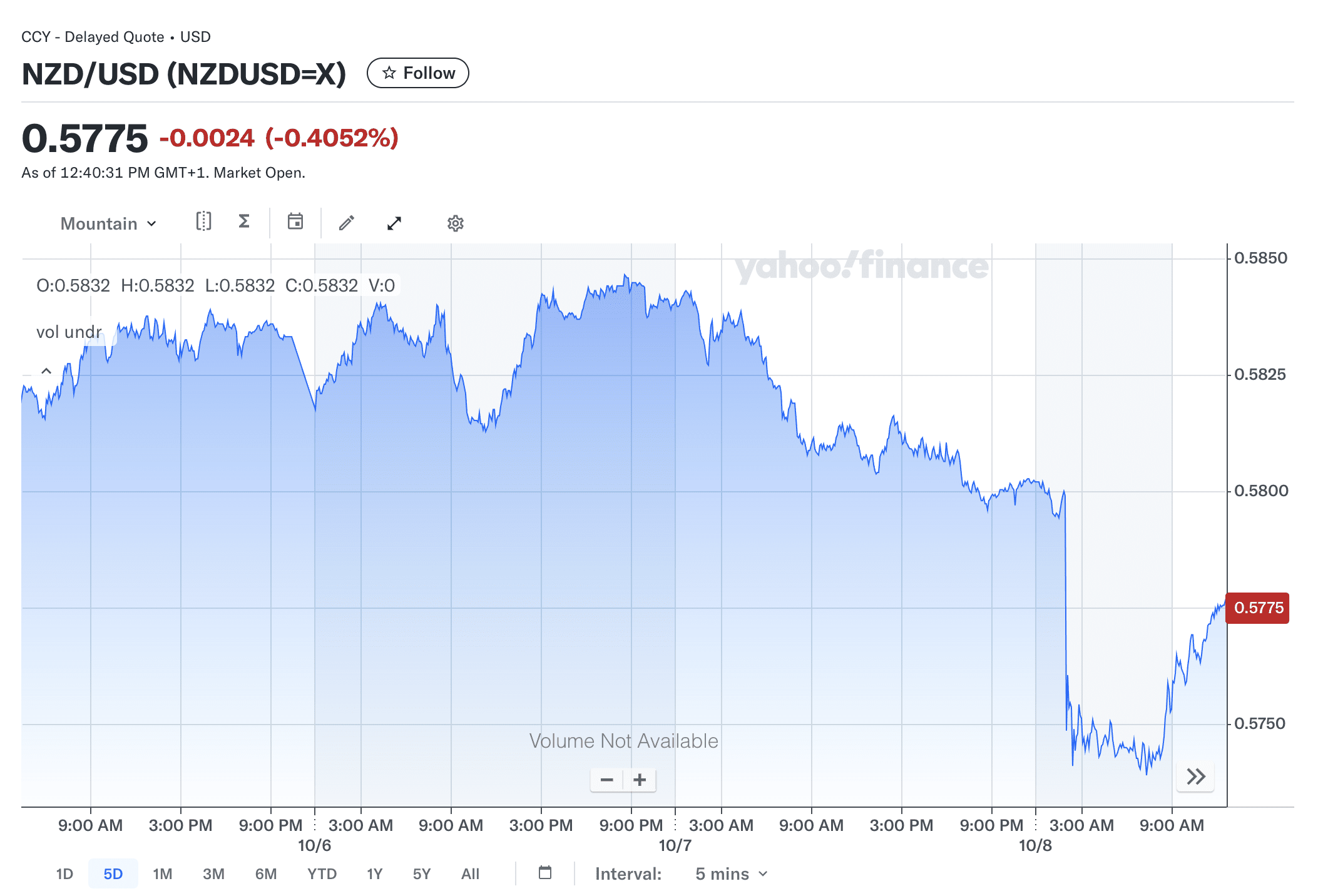

The New Zealand dollar has been driven primarily by the Reserve Bank of New Zealand’s 50 bp rate cut. The central bank also signalled it is ready to ease further if labour‑market and consumer‑price indicators fail to improve. For the currency, that means lower yield and reduced appeal while U.S. rates remain relatively steady.

NZD/USD price dynamics. Source: finance.yahoo

The euro has softened as markets debate France’s fiscal path and the timetable for stabilizing public finances. A complex pre‑election backdrop, the resignation of Prime Minister Le Cornu and discussion over the deficit have weighed on confidence, limiting demand for the single currency.

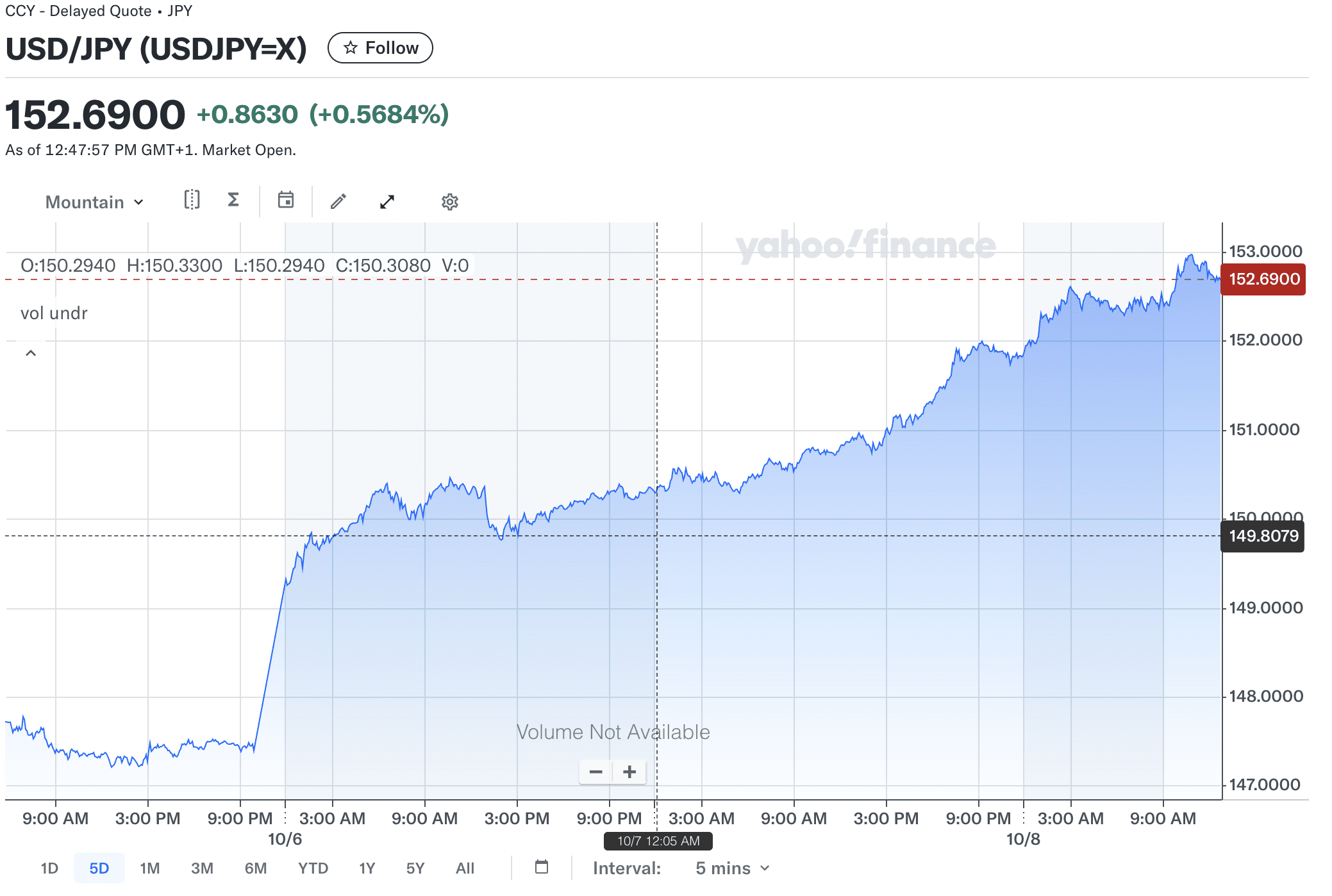

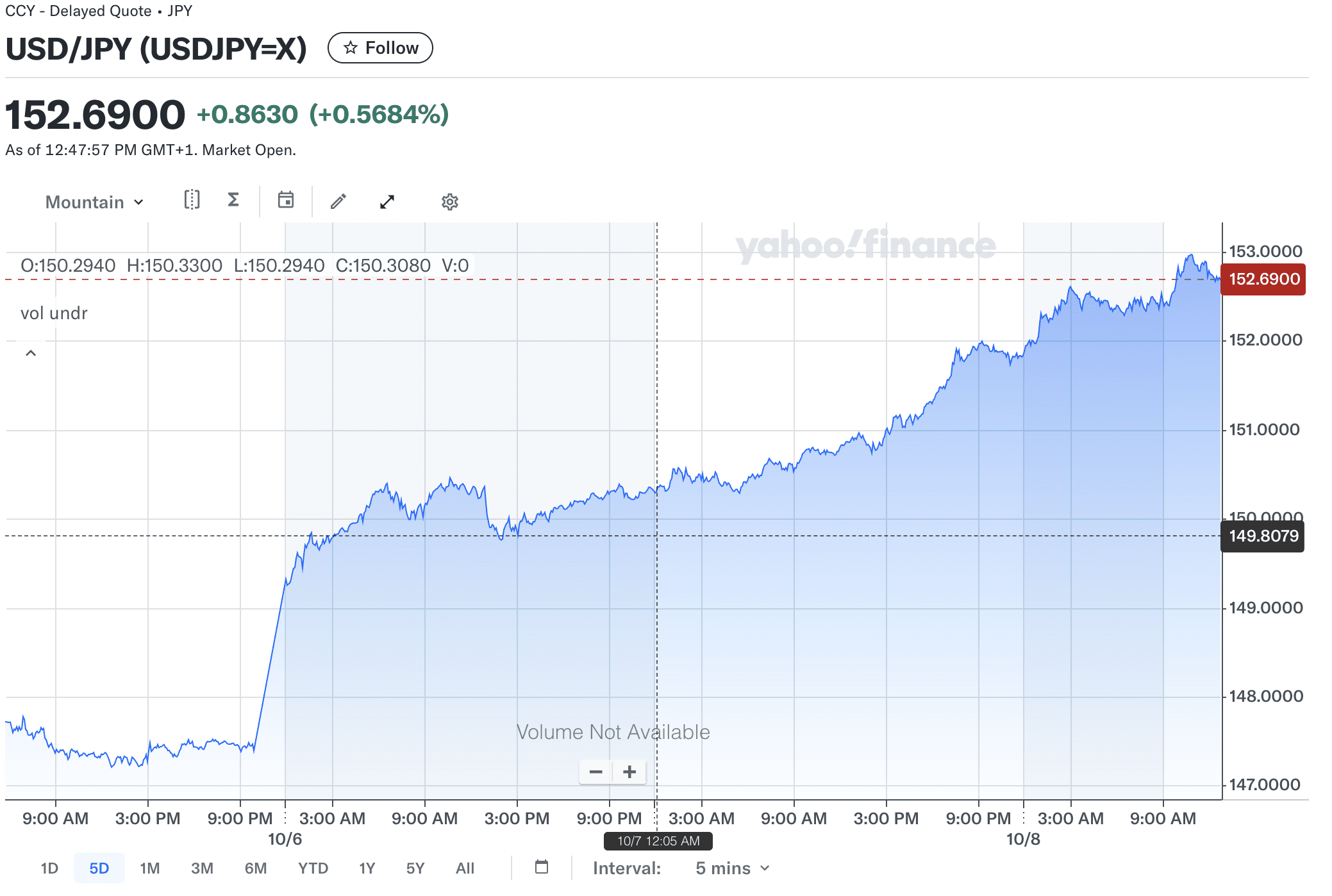

The yen remains under pressure amid expectations of continued policy support in Japan following the intra‑party vote. A softer stance on both the budget and monetary conditions typically weakens the currency, and USD/JPY has moved back to levels seen in February.

USD/JPY price dynamics. Source: finance.yahoo

U.S. domestic politics are also adding caution. The ongoing government shutdown encourages investors to diversify risk. In this setting, interest in safe‑haven assets has increased: the spot price of gold has exceeded $4,000 per ounce.

The dollar index is holding near two‑month highs around 98.9. Expectations for the Federal Reserve remain measured: futures markets imply a gradual total of around 110 bp of rate cuts by end‑2026 and a 25 bp reduction already in November. At the same time, statements from Fed officials point to a careful pace of decisions, which supports the dollar and curbs hopes for a swift pivot toward easier policy.

As a result, the New Zealand dollar, the euro and the Japanese yen are on the front line of the current repricing: the first due to the RBNZ’s policy shift, the second because of European political developments, and the third amid expectations of low rates and additional budget measures in Japan.

As long as these factors persist, demand for the dollar is likely to stay firm, and a rapid change in market sentiment looks unlikely.

Recommended