Record $10B lines up to exit Ethereum staking

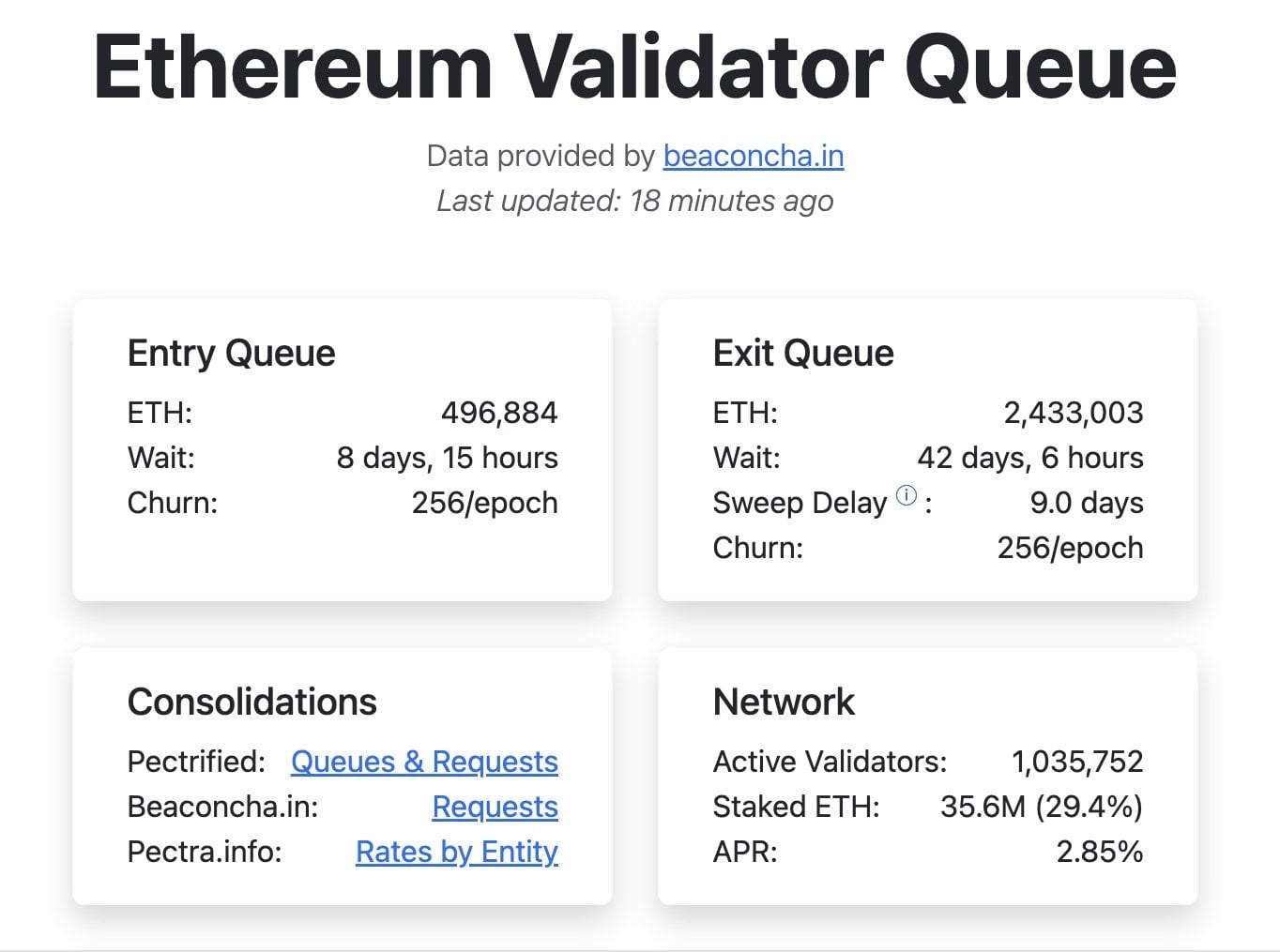

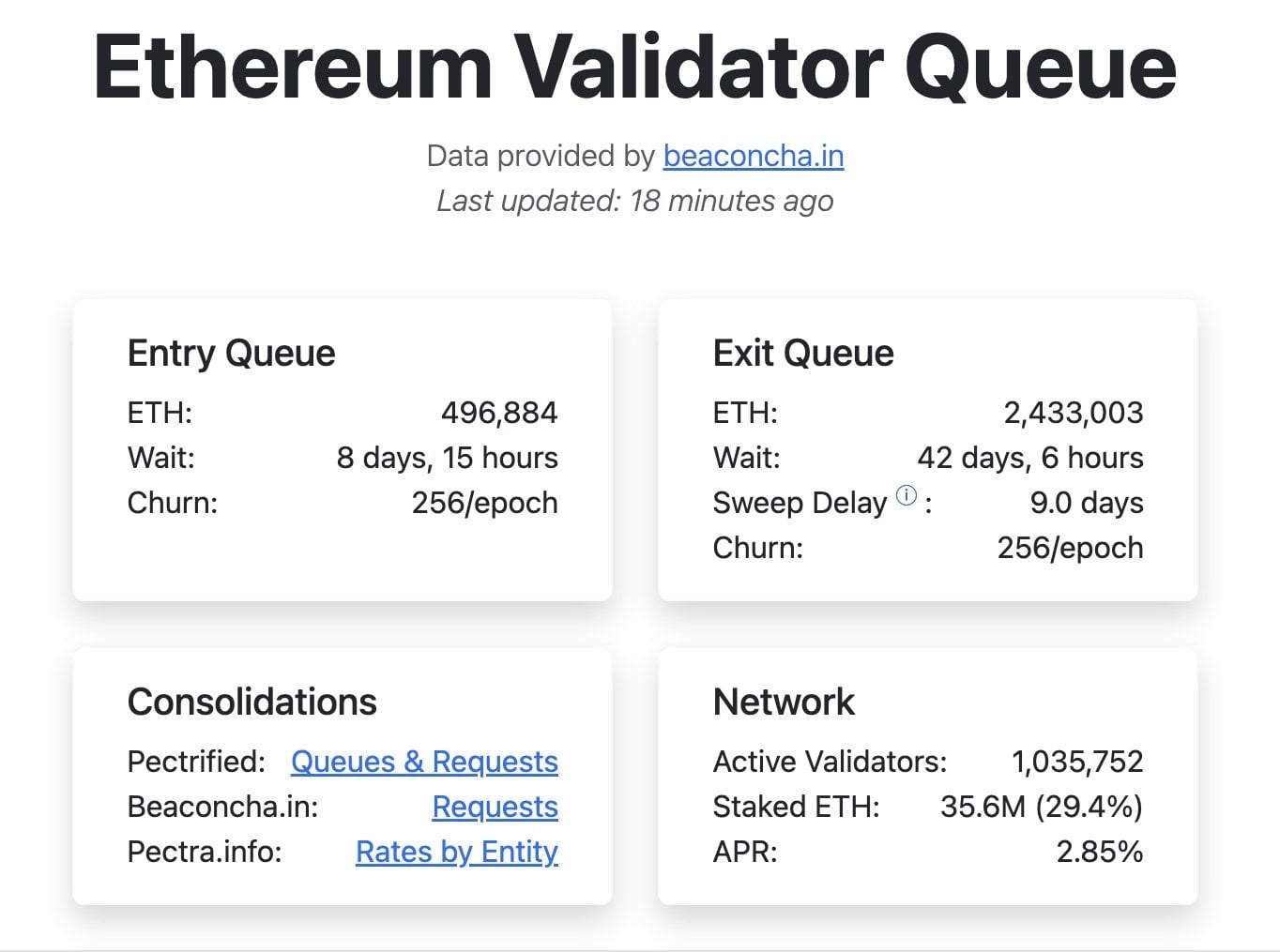

Ethereum just posted its largest validator exit on record. Data from ValidatorQueue.com show more than 2.4 million ETH awaiting withdrawal, pushing the estimated wait to nearly 41 days.

By comparison, the entry queue holds just over 0.5 million ETH with an 8‑day delay. Validators add blocks and attest to transactions on Ethereum’s proof‑of‑stake network; when they request an exit, their stake moves to a line that unlocks over time.

Record exit queue: ~2.43M ETH with ~42-day wait; network remains well-staked. Source: ValidatorQueue.com (beaconcha.in).

The imbalance raises familiar worries about near‑term sell pressure. A chunk of exiting stake could hit the market after withdrawals complete, especially with ETH up strongly year‑over‑year. It’s not a one‑to‑one pipeline to exchanges, though. Operators also exit to consolidate keys, rotate infrastructure or restake elsewhere, so only part of the unlocked ETH necessarily becomes sell supply.

Network health, for now, looks intact. Ethereum still counts ~1.0 million active validators with ~35.6 million ETH staked (about 29% of supply), according to the same dashboard. Those figures imply broad participation and a wide base of capital securing the chain even as some validators line up to leave.

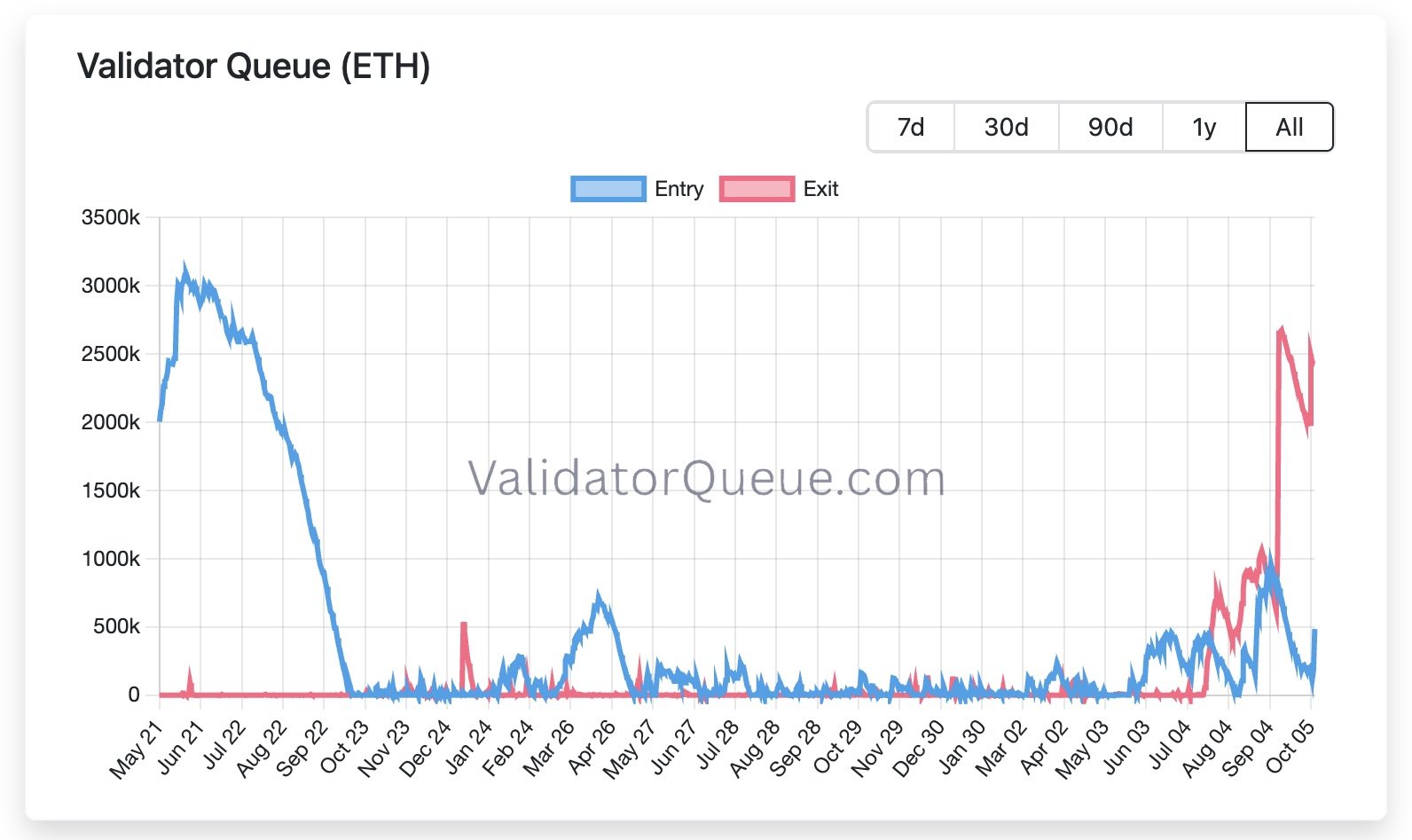

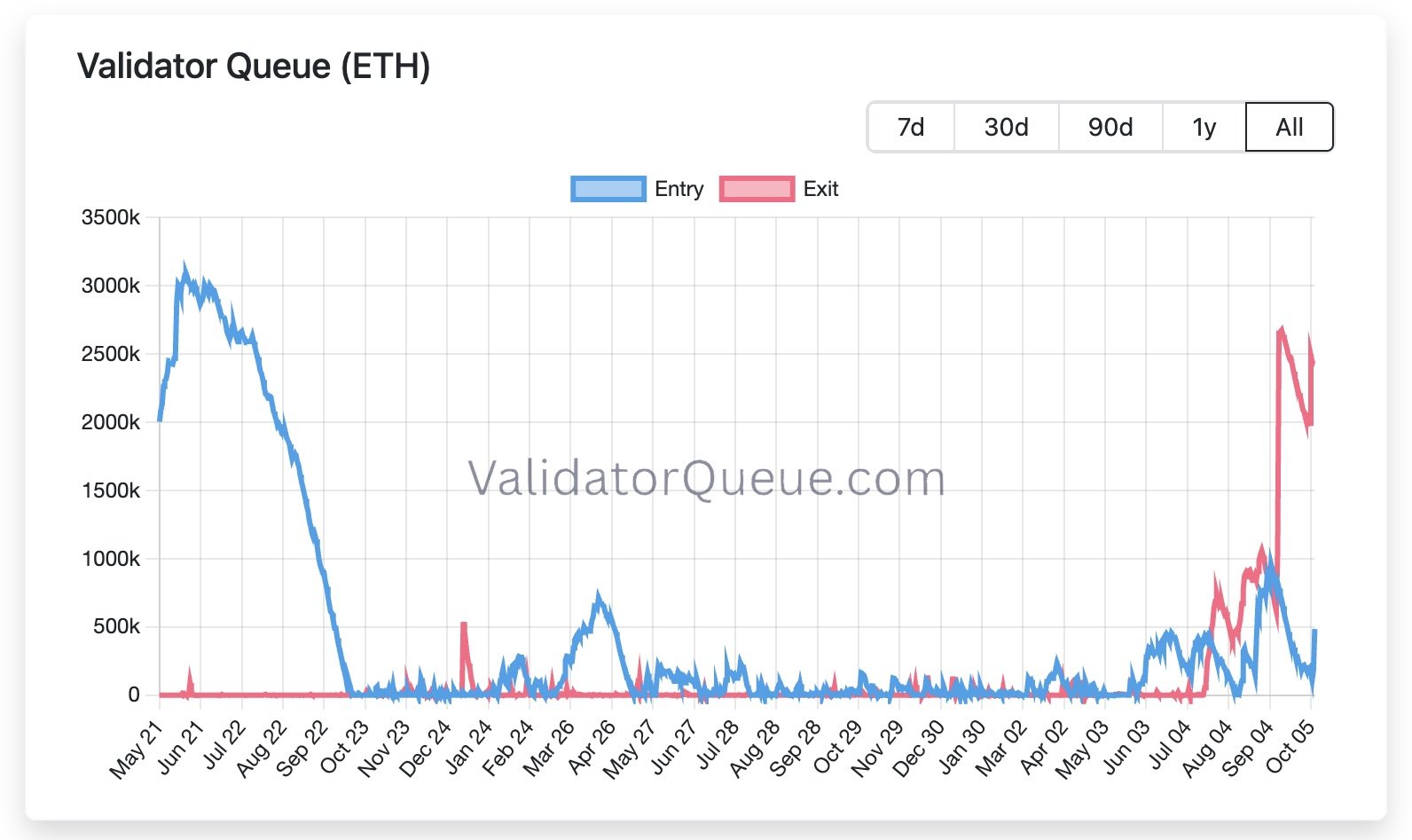

Late-Sept/early-Oct surge: exit requests dwarf entries, setting a new high. Source: ValidatorQueue.com.

Institutional flows are filling in part of the gap. Grayscale introduced staking for its Ether products and submitted $150 million of ETH to the activation queue on Tuesday, followed by another ~272,000 ETH (≈$1.2B) on Wednesday, leaving the firm responsible for a large share of pending activations, according to on-chain analysts. More broadly, ETF allocations and corporate treasuries continue to pull ETH into long‑term holdings, with October ETF net inflows already sizable by industry estimates.

Price reaction hinges on timing and intent. Exits process over weeks, and only ETH that is explicitly transferred to exchanges adds immediate sell supply. If institutional staking and fresh activations keep pace, the net effect on circulating float can remain limited. If the exit queue stays multiple times larger than entries for long, extra supply could weigh on the market while the line clears.

For crypto investors, the practical read is flow‑based: watch the ratio of exits vs entries, signs that large holders are restaking vs selling, and the persistence of ETF and treasury inflows. Those plumbing signals will do more to shape short‑term price pressure than the headline size of the exit queue alone.