Dividend growth beats high yields: 10 stocks that won

Investors who prioritize dividend growth can earn income while beating market benchmarks. Here’s a close look at 10 top-performing stocks and why they succeeded.

High dividend yields can be tempting – 7% looks like free money. But such yields often hide risk, and stock prices can drop if fundamentals weaken. Prices drop, dividends get cut, and your “great deal” vanishes. That’s why disciplined dividend growth matters more than chasing the biggest payout.

MarketWatch analyzed S&P 500 companies for five-year dividend growth and total returns. Among the top performers, tech giants like Apple and Microsoft combined innovation with dividends, while consumer staples such as Procter & Gamble and Coca-Cola showed stable cash flows. Each beat the S&P 500 total return when dividends were reinvested.

What connects them? Reliable cash flow, strong business models, and disciplined management. These aren’t speculative high-yield plays – they are proven businesses that consistently return capital to shareholders.

Take Morgan Stanley. Its current yield is just 2.5%, but investors who bought five years ago enjoy a much higher yield on cost. Growth in asset management ensures consistent payouts even as trading revenues fluctuate.

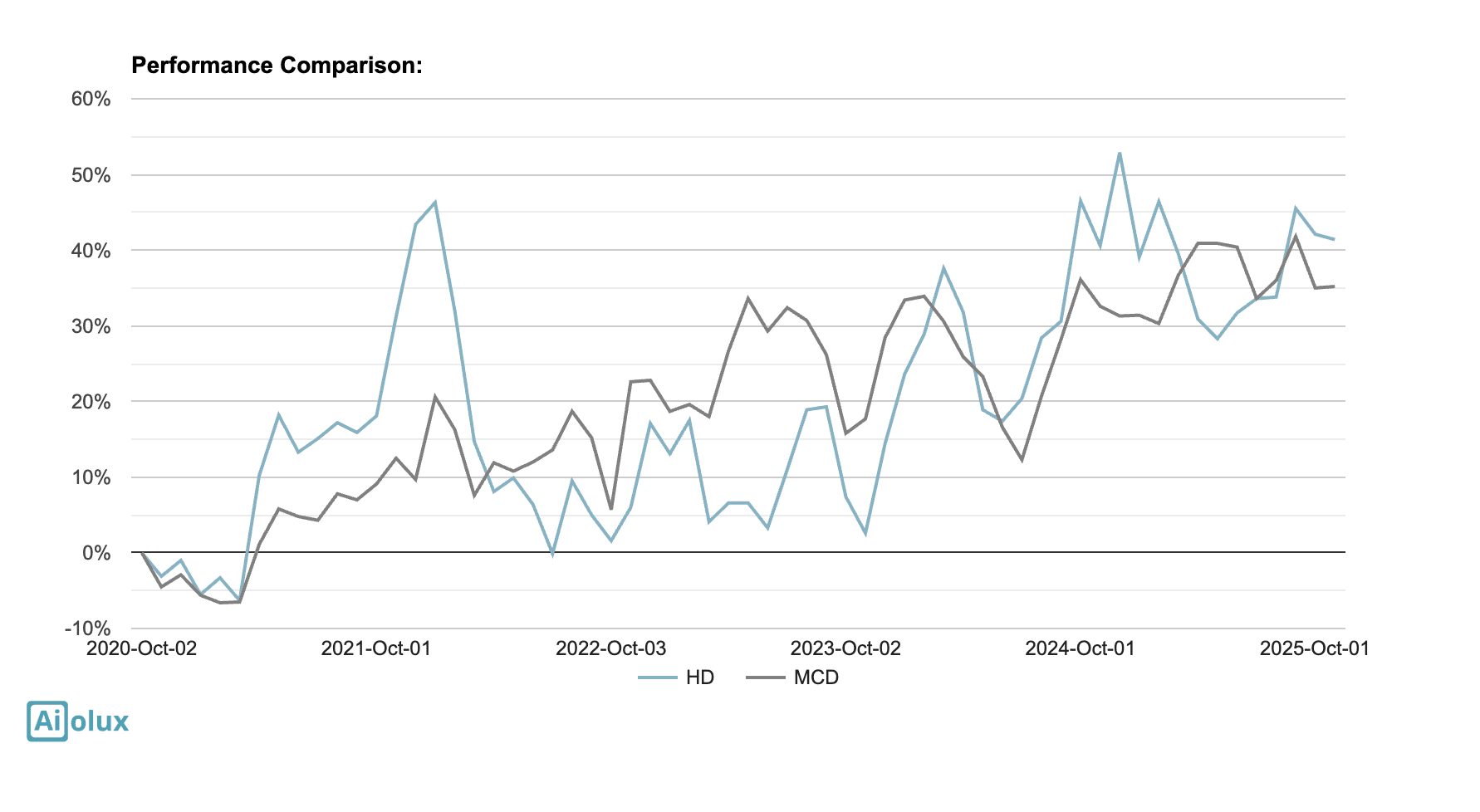

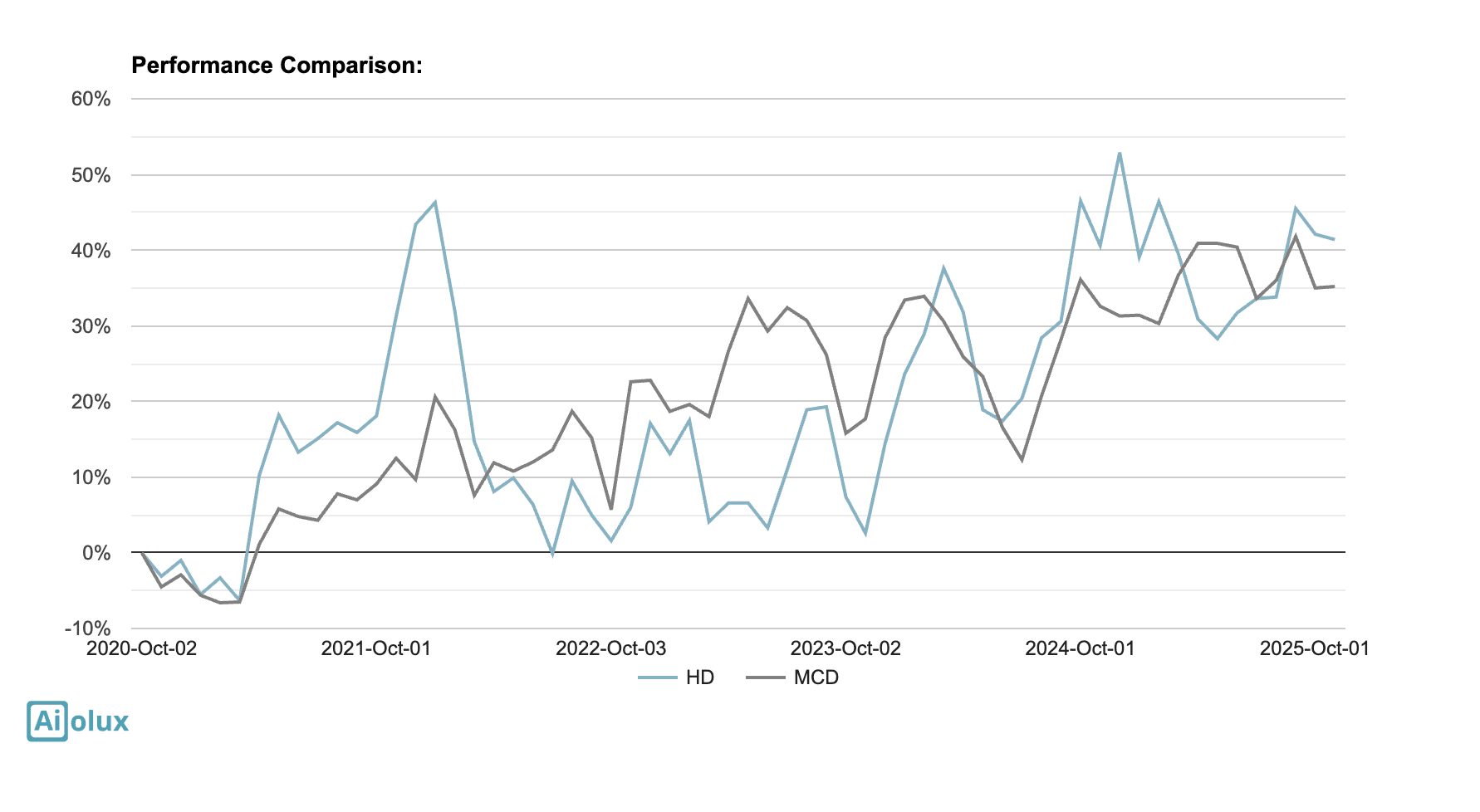

Consumer staples like Procter & Gamble and Coca-Cola show how diversified, stable businesses maintain dividend growth through market swings. McDonald’s and Home Depot benefit from predictable revenue streams and strong pricing power.

MCD (McDonald’s) vs HD (Home Depot) shares price chart. Source: aiolux.com

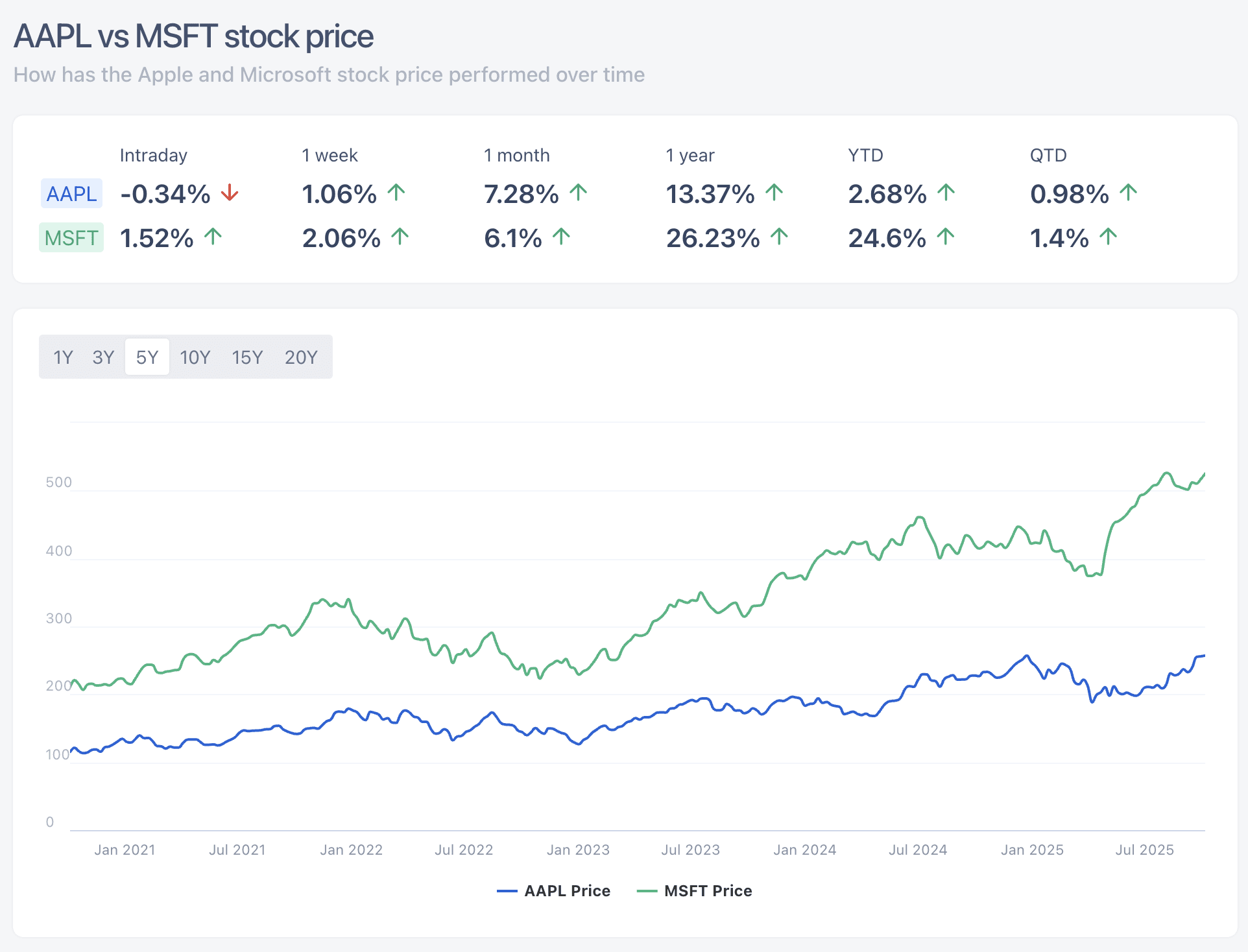

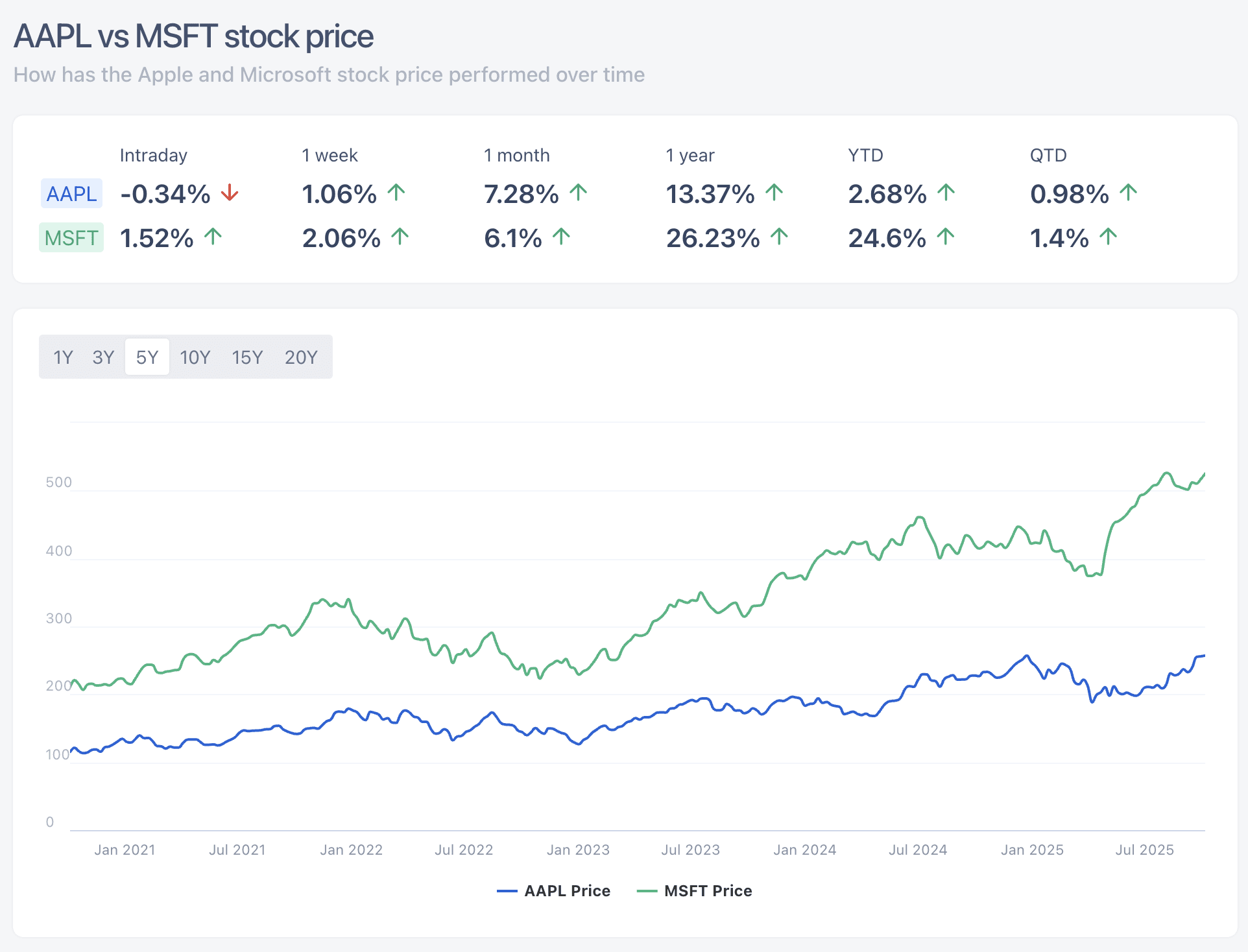

Tech giants like Apple and Microsoft illustrate that even companies not traditionally known for dividends can combine innovation with steady payouts. Their rising cash flows allow them to increase dividends while reinvesting in growth.

AAPL vs MSFT stock price comparison chart Source: FullRatio.com

Financial and payments firms like Visa maintain long-term stability with recurring revenue models, while Johnson & Johnson delivers consistent payouts thanks to its diversified healthcare portfolio.

The lesson is clear: dividend growth signals financial health and management confidence. These stocks provide income while limiting downside risk during downturns. By combining stability with compounding, investors can see meaningful long-term gains.

Instead of chasing the highest yield today, investors should focus on companies that steadily raise dividends and have sustainable business models. The combination of income and price appreciation in these ten stocks demonstrates how patient, disciplined investing pays off.

Recommended