DeFi hits $237B TVL despite declining user activity

DappRadar’s latest report shows that the total value locked (TVL) in the DeFi sector reached a record $237 billion in Q3 2025, despite declining user activity across decentralized applications (DApps).

The average number of unique active wallets (UAW) fell by 22.4%, from 24 million to 18.7 million per day, reflecting weaker engagement among retail users. The steepest drop occurred in SocialFi and AI DApps, where active wallet counts fell by 60%.

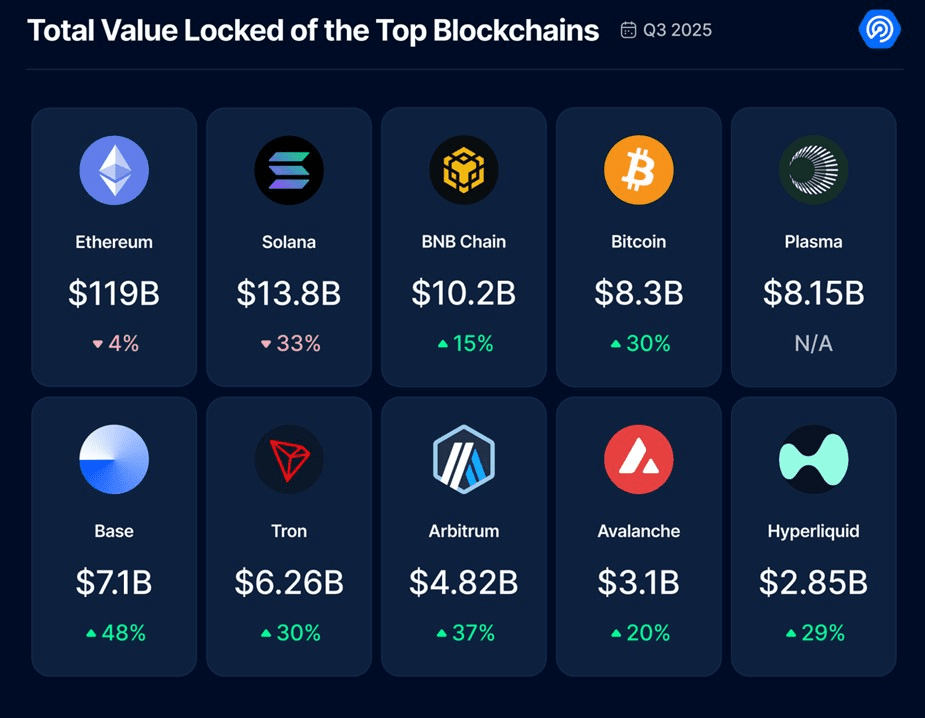

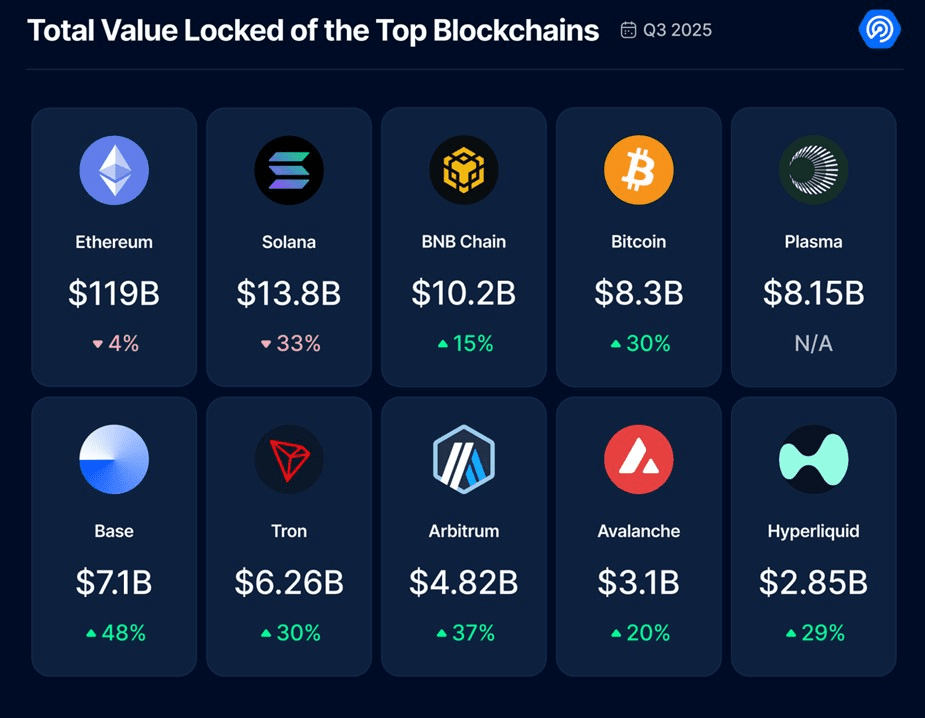

Ethereum remains the leading network with $119 billion in locked assets, followed by BNB Chain and Solana. Notably, BNB Chain recorded the strongest growth (+15%), driven by the success of the decentralized exchange Aster.

Analysts caution that despite the all-time high in TVL, declining wallet activity could signal an overvaluation risk if liquidity growth continues to outpace real protocol usage. Thus, DeFi remains a core destination for capital inflows in the crypto industry but its long-term sustainability will depend on user re-engagement and the integration of RWA assets into mainstream financial products.

At the same time, institutional liquidity continued to grow. Key drivers included a $46 billion increase in stablecoin volume during the quarter, the adoption of the GENIUS Act in the U.S., and the expansion of real-world asset (RWA) tokenization infrastructure. The newly launched Plasma blockchain, designed specifically for stablecoins, added over $8 billion in TVL within its first month.

Ethereum remains the leading network with $119 billion in locked assets, followed by BNB Chain and Solana. Notably, BNB Chain recorded the strongest growth (+15%), driven by the success of the decentralized exchange Aster.

Ranking of blockchains by TVL. Source: dappradar.com

Experts note a widening gap between institutional capital inflows and user engagement. “Retail investors are exiting SocialFi and GameFi, while professional participants are channeling funds into liquid DeFi protocols,” the DappRadar report states.

Analysts caution that despite the all-time high in TVL, declining wallet activity could signal an overvaluation risk if liquidity growth continues to outpace real protocol usage. Thus, DeFi remains a core destination for capital inflows in the crypto industry but its long-term sustainability will depend on user re-engagement and the integration of RWA assets into mainstream financial products.