Deutsche Bank: Bitcoin could join Central‑Bank Reserves by 2030

Deutsche Bank says Bitcoin could appear in official central‑bank reserves by 2030, alongside gold. This insight comes from a new Deutsche Bank Research report.

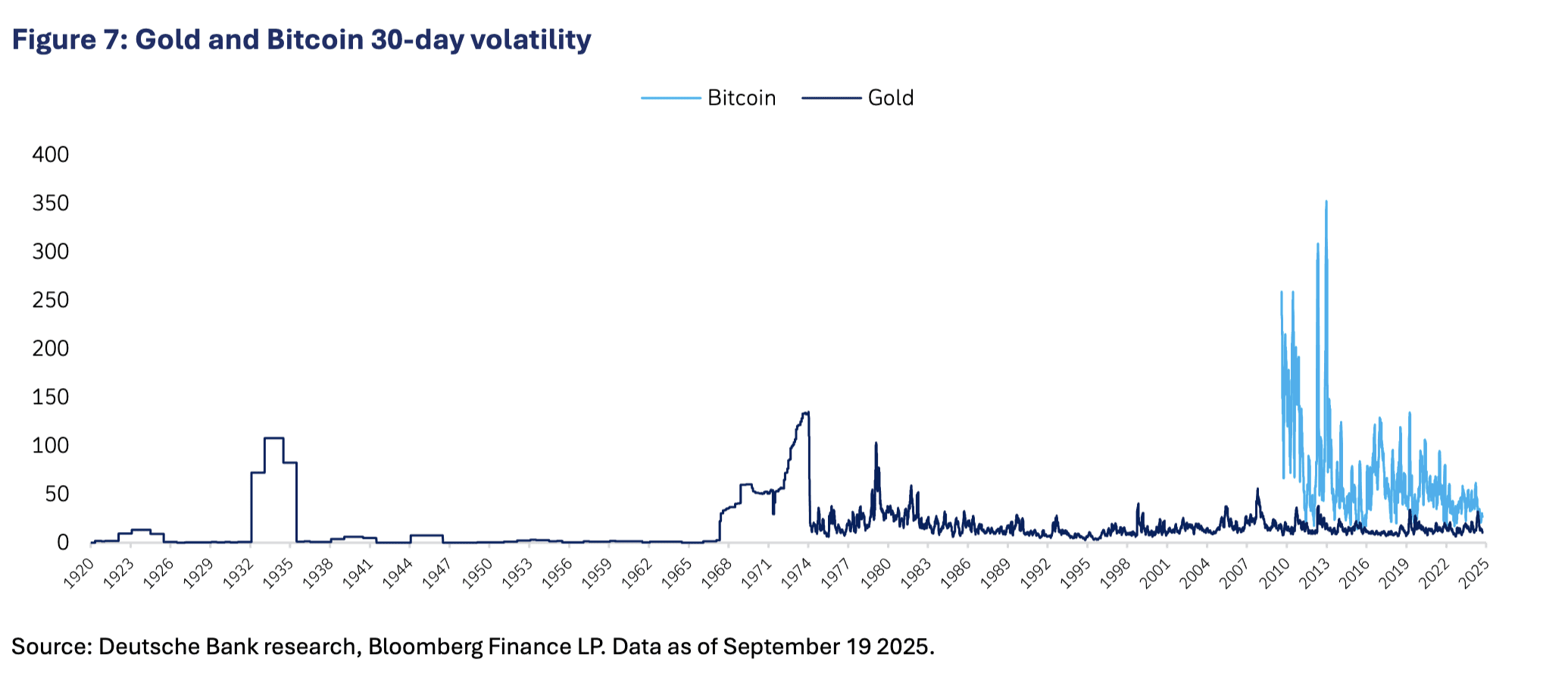

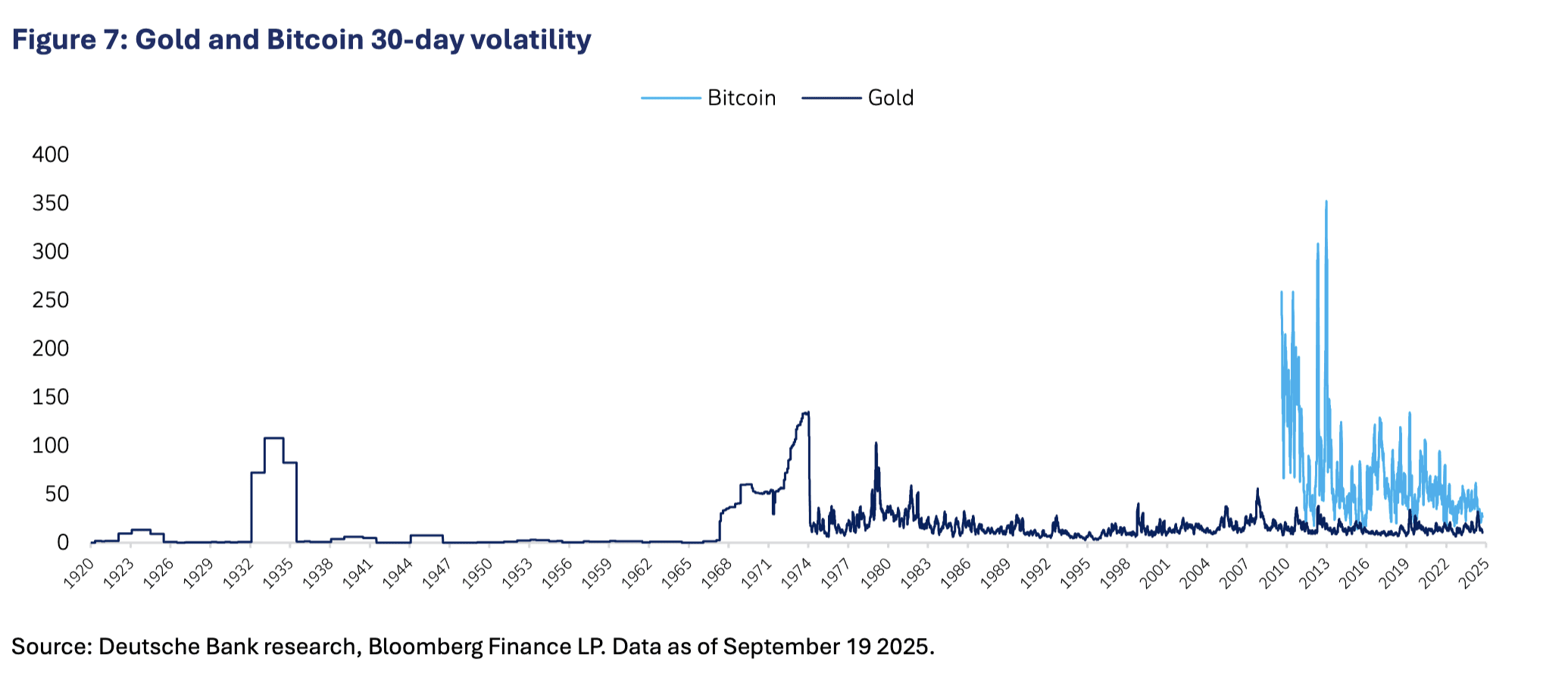

In a new research note by Marion Laboure and Camilla Siazon, the bank says the crypto asset, “backed by nothing” in the traditional sense has been acquiring traits of a reserve instrument: lower volatility over time, deeper liquidity, and persistently low correlation with mainstream assets. The point is not to replace gold, the authors stress, but to coexist with it. For central banks, that could mean small BTC allocations as a diversification and geopolitical‑risk hedge.

Deutsche Bank does not expect the largest Western central banks to move first. In 2025, leaders at the European Central Bank and the Swiss National Bank publicly rejected the idea of holding crypto in reserves. Pilot steps are more likely in countries that value demonstrating technological openness and flexible reserve management.

Comparison of the monthly volatility of Bitcoin and gold. Source: Deutsche Bank Research

The report outlines five conditions for Bitcoin’s “promotion” to reserve status:

- A further decline in volatility;

- Sufficient market depth and liquidity;

- No challenge to the dollar’s dominance;

- Gradual regulatory acceptance;

- Durable institutional demand.

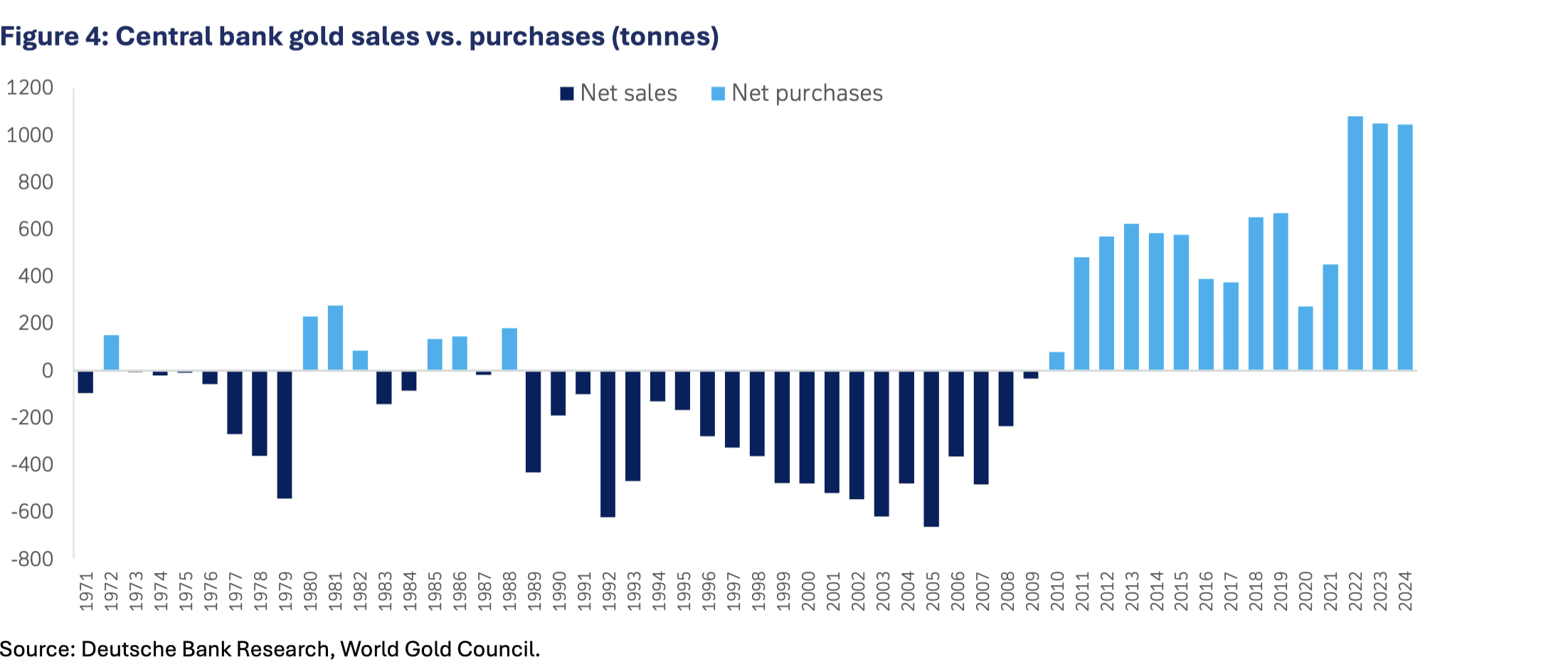

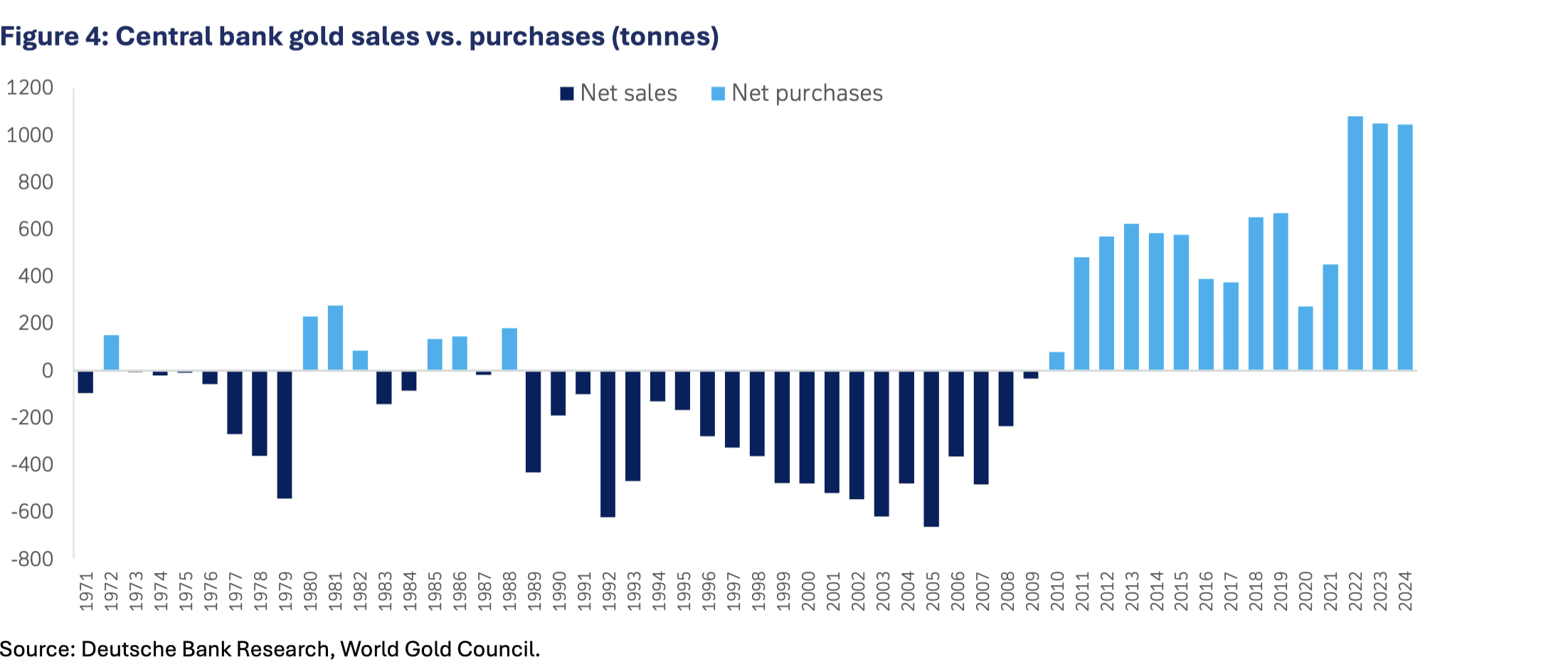

Since 2023, central banks have been buying record amounts of gold, while the dollar’s share of global reserves has slipped (to about 43% in 2024 from roughly 60% in 2000).

A chart of the balance between central bank gold purchases and sales shows a stable trend towards accumulation. Source: Deutsche Bank Research

In parallel, Bitcoin has been going through cycles of institutionalization. These include spot ETF listings to the rise of corporate “Bitcoin treasuries.” Against that backdrop, Deutsche Bank sees room for BTC to play the role of “digital gold”: supply‑capped and issuer‑independent.

If these conditions hold, Bitcoin could appear in some central‑bank balance sheets by decade‑end as an additional reserve asset, without displacing gold or the U.S. dollar.

Recommended