CZ denies proposing a crypto bank in Kyrgyzstan

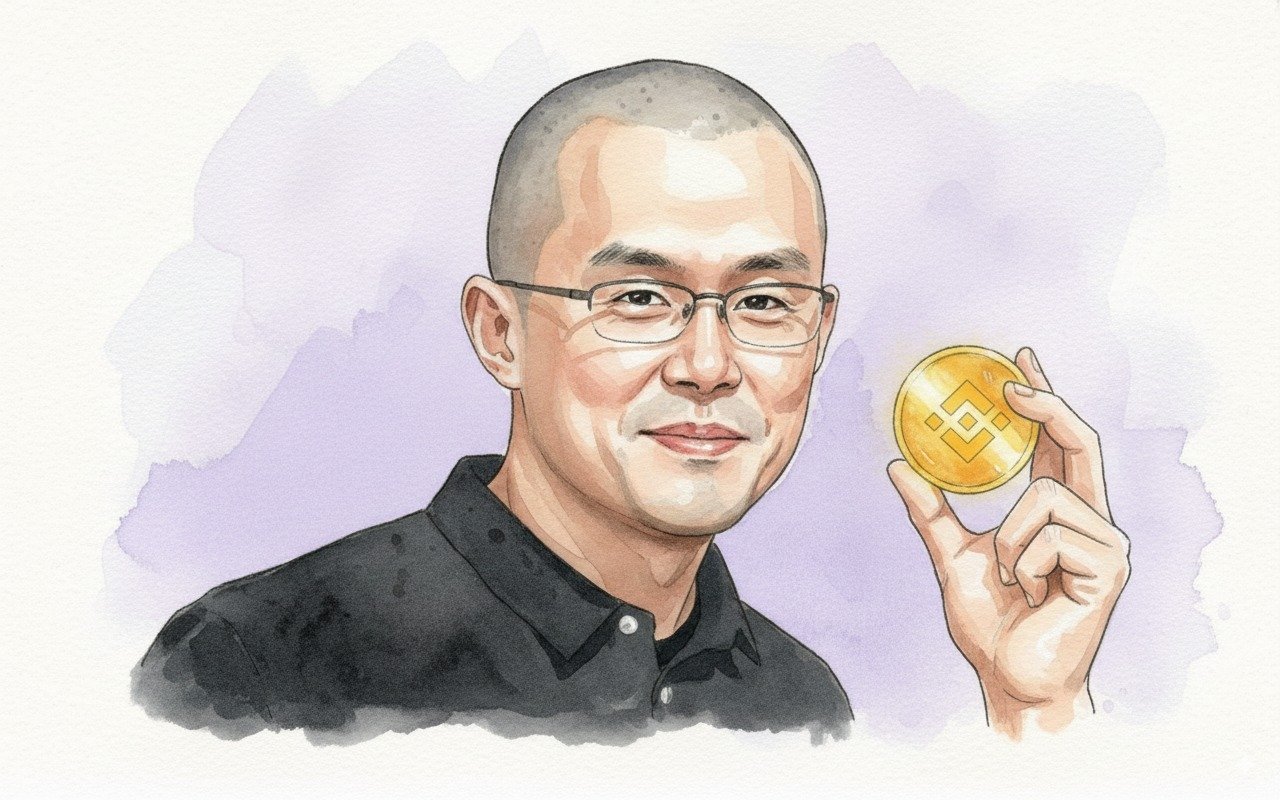

Former Binance chief Changpeng “CZ” Zhao has denied claims that he initiated the creation of a private bank in Kyrgyzstan focused on digital assets.

The discussion was sparked by an interview with President Sadyr Japarov, in which he said that during CZ’s visit in May the parties agreed to open a private bank (Bereket Bank) after the idea of a state‑owned bank failed to gain support.

CZ publicly replied on X that he never proposed setting up a bank and has no interest in running banks. He said he supports “having as many digital, crypto‑friendly banks as possible,” but he did not initiate any bank‑launch proposal. Zhao also confirmed that he indeed advises Kyrgyzstan on blockchain and regulation under a memorandum signed in the spring; however, this advisory role does not involve him launching private financial institutions.

Although CZ later deleted his post (likely to avoid embarrassing the country’s leadership he aims to keep good business relations with), the internet does not forget.

Deleted CZ post on X (formerly Twitter)

It’s also important to view the bank debate against Bishkek’s broader digital agenda. In late October, the authorities announced the KGST stablecoin, pegged 1:1 to the Kyrgyz som (KGS), alongside plans to develop proposals for a state crypto reserve, which, as discussed, could include the BNB token. In parallel, Binance Academy’s education initiatives are being integrated into leading universities in the country, and the Binance app is being localized. All of this aims to expand knowledge and access to infrastructure for local users and businesses.

The broader context also includes an acceleration of crypto activity in the country: according to the council’s secretariat, trading volumes on local platforms increased noticeably in 2025. Policymakers see the combination of a stablecoin and a future digital som as a tool to simplify cross‑border payments and remittances by migrant workers, a key issue for many households across Central Asia and the wider European neighborhood.

In short, the core vector of public policy (building a regulated digital‑finance infrastructure) is driven by local authorities and businesses, not by CZ personally, who serves only as an advisor to local regulators.

Recommended