Crypto millionaires buy golden visas abroad

The 2025 Crypto Wealth Report by Henley & Partners reveals surging demand from crypto millionaires for "golden visas" as digital asset acceptance grows globally.

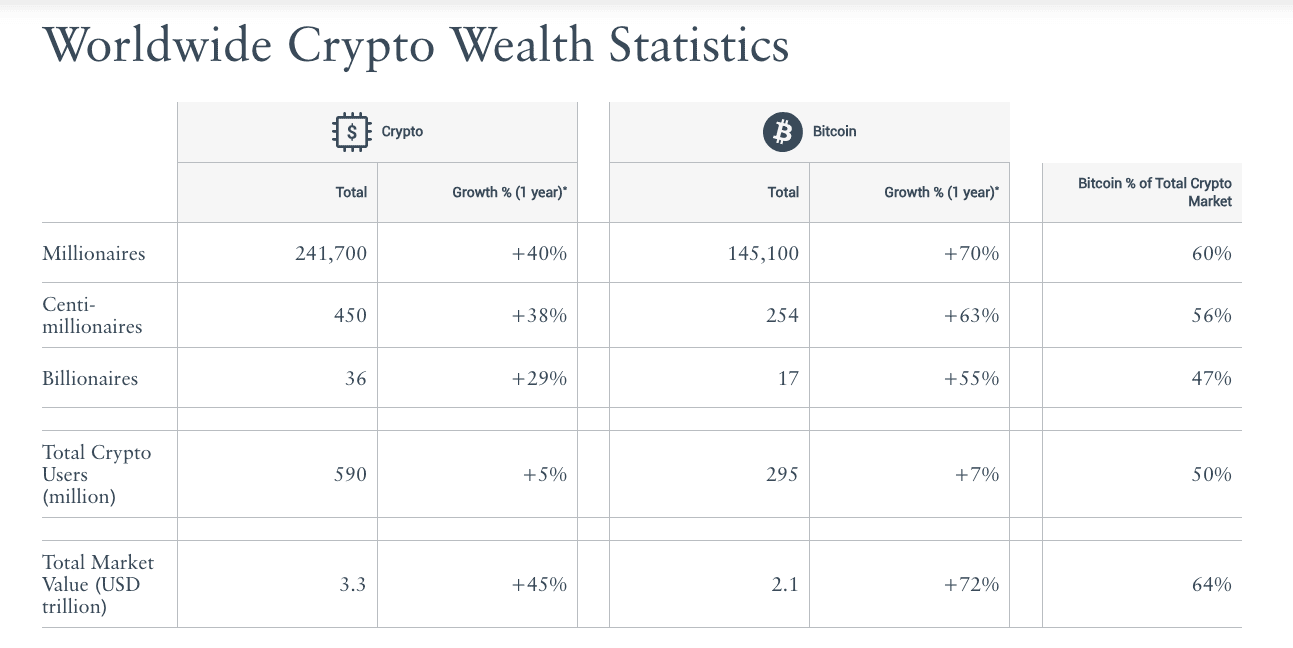

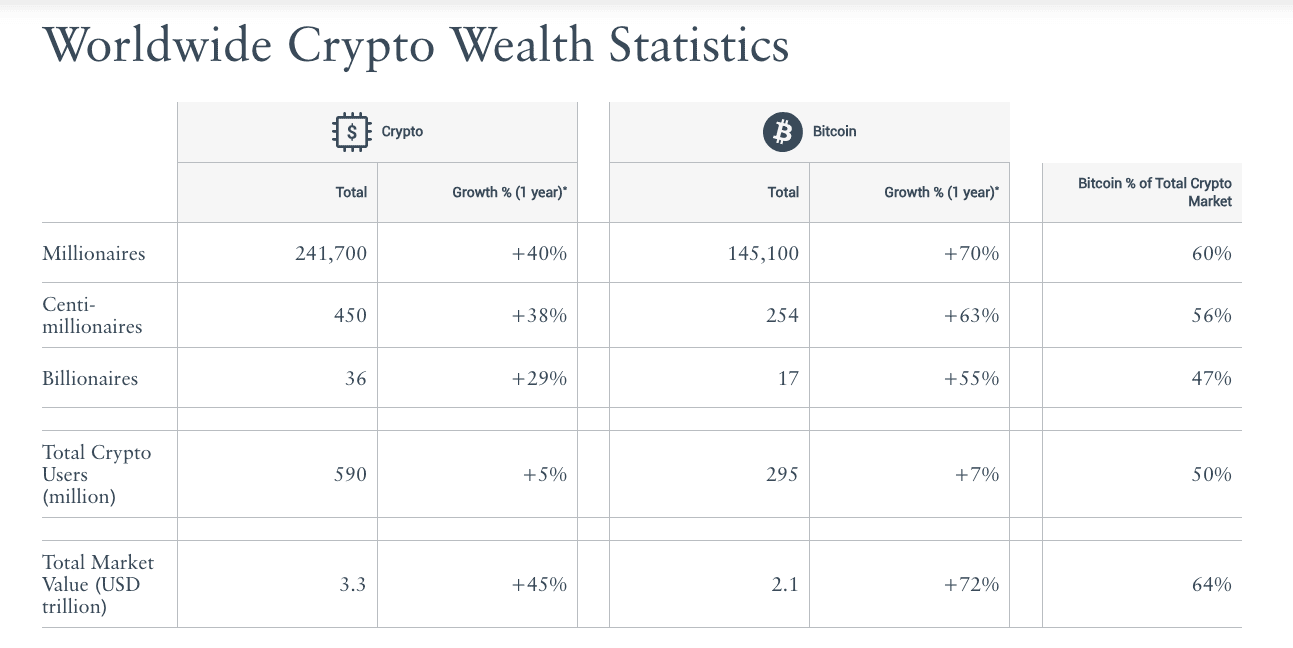

According to new research by citizenship advisory company Henley & Partners, there are 241,700 crypto millionaires worldwide, up 40% in a year, including 145,100 Bitcoin millionaires, a 70% jump. The report notes that wealthy crypto investors are looking for migration programs and securing globally diversified residence as a protection against regulatory volatility.

Several nations worldwide now accept cryptocurrency for citizenship applications, including the United Arab Emirates, Singapore, St. Kitts and Nevis, and El Salvador.

Wealthy individuals who own large amounts of cryptocurrency are among the most globally mobile investors, showing how digital assets are linked to cross-border wealth, according to Andrew Amoils, Head of Research at New World Wealth. He noted that crypto and gold are becoming the preferred ways for the rich to store wealth.

According to Henley & Partners’ benchmarking criteria, Singapore ranks as the top jurisdiction for crypto millionaires. Hong Kong comes second, supported by strong economic conditions and a favorable tax system. The United States stands out for its high public adoption of crypto and strong innovation. Switzerland and the UAE round out the Top 5, with the UAE earning a perfect score for tax benefits, as it charges no taxes on crypto trading, staking, or mining.

Several nations worldwide now accept cryptocurrency for citizenship applications, including the United Arab Emirates, Singapore, St. Kitts and Nevis, and El Salvador.

Wealthy individuals who own large amounts of cryptocurrency are among the most globally mobile investors, showing how digital assets are linked to cross-border wealth, according to Andrew Amoils, Head of Research at New World Wealth. He noted that crypto and gold are becoming the preferred ways for the rich to store wealth.

In previous decades, precious stones like diamonds were widely used to move money discreetly across borders thanks to their portability. Today, crypto and gold have largely taken their place as the modern stores of portable wealth,he said.

Bitcoin millionaires rise to 145,100 as global crypto wealth grows 45%. Source: Henley & Partners

This growth in borderless wealth is reshaping how wealthy people manage their finances globally. The report shows crypto millionaires are seeking countries that not only recognize digital assets but excel in digital asset infrastructure adoption, economic stability factors, favorable regulatory environments, and high levels of public crypto adoption.

According to Henley & Partners’ benchmarking criteria, Singapore ranks as the top jurisdiction for crypto millionaires. Hong Kong comes second, supported by strong economic conditions and a favorable tax system. The United States stands out for its high public adoption of crypto and strong innovation. Switzerland and the UAE round out the Top 5, with the UAE earning a perfect score for tax benefits, as it charges no taxes on crypto trading, staking, or mining.

Recommended