$400 billion destroyed in 4 hours: is crypto still decentralized?

Donald Trump posts on Truth Social about 100% tariffs on Chinese goods – and $400 billion in crypto market cap vanishes within hours. Over $19B in forced liquidations. 1.66 million traders lose money. Can we call a market decentralized when it depends on a single presidential post?

October 10, 2025, 4:45 PM EST. Donald Trump opens Truth Social and posts about the trade war with China.

4:47 PM EST. Bitcoin drops $3,000 in two minutes.

8:00 PM EST. The crypto market loses $400 billion in market cap. Bitcoin hits $105,000 – down 14% from the daily high of $122,000. Ethereum fell to $3,500 (-20%). Solana destroyed by 25%.

That night, $19 billion in positions were forcibly liquidated from more than 1.66 million. According to some reports, it may have been one of the largest liquidation events in cryptocurrency history.

This occurred following a single post from the U.S. President.

"China has taken an extremely hostile position by announcing large-scale export controls on nearly every product they make, effective November 1. In response, the United States will impose a 100% tariff on all Chinese goods, and introduce export controls on critical software – also effective November 1."

Two paragraphs of text – $400 billion in market cap evaporated.

Anatomy of a lightning crash

Trump announces new 100% tariffs on Chinese manufacturers, canceling his meeting with Xi Jinping and threatening "massive increases" in tariffs. The market panics. Mass liquidations.

Bitcoin touches $105,000 (on Binance even $102,000). Ethereum – $3,500. Altcoins also fell significantly, with declines ranging from 20% to 40%.

The total crypto market capitalization fell from $4.25 trillion to $3.78 trillion within 24 hours, representing losses of approximately $470 billion.

Throughout the night, liquidations continued in a cascade. According to some data, $7 billion in positions were liquidated in just one hour, and by the morning of October 11, the total exceeded $19 billion – an absolute historic record.

Flashbacks and tragedies

Experienced traders compare this crash to March 2020, when the global pandemic collapsed markets.

Bitcoin trader Bob Loukas compared the scale of losses to the market reaction during COVID-19, noting the severity of recent liquidations.

"Oh, hadn’t even checked alt’s. Covid level nukes."

Crypto analyst Pentoshi highlighted that the current market downturn ranks among the most severe events in crypto history, with major losses affecting many traders.

"...This flush is in the top 3 all time."

Trader Cole Bartiromo reported losing $1.1 million on a Solana position, emphasizing that even modest leverage levels were insufficient to prevent significant losses.

"Worst financial day of my life."

Someone lost much more than money. One of the most famous Ukrainian crypto traders, Konstantin Ganich (Kostya Kudo), was found dead in his car in the morning. The main version of the investigation is suicide due to catastrophic losses of investor money during yesterday's crash.

This wasn't an ordinary correction. This was mass leverage annihilation.

The decentralization paradox

Just four days earlier, Bitcoin reached a new all-time high of $126,199. Analysts talked about the "euphoria phase." Predictions of $180,000-$200,000 by year-end. ETF inflows were breaking records. Institutions were buying.

And then one presidential post – and the entire "decentralized" ecosystem dropped sharply following the announcement..

How is this even possible?

Bitcoin is a decentralized protocol. No president can stop its operation. No country controls the blockchain. Even if the US bans Bitcoin tomorrow, the network will continue to work.

The problem is that we often confuse "Bitcoin as a project" and "Bitcoin as a market." It turns out these are completely different stories.

Who actually controls the price

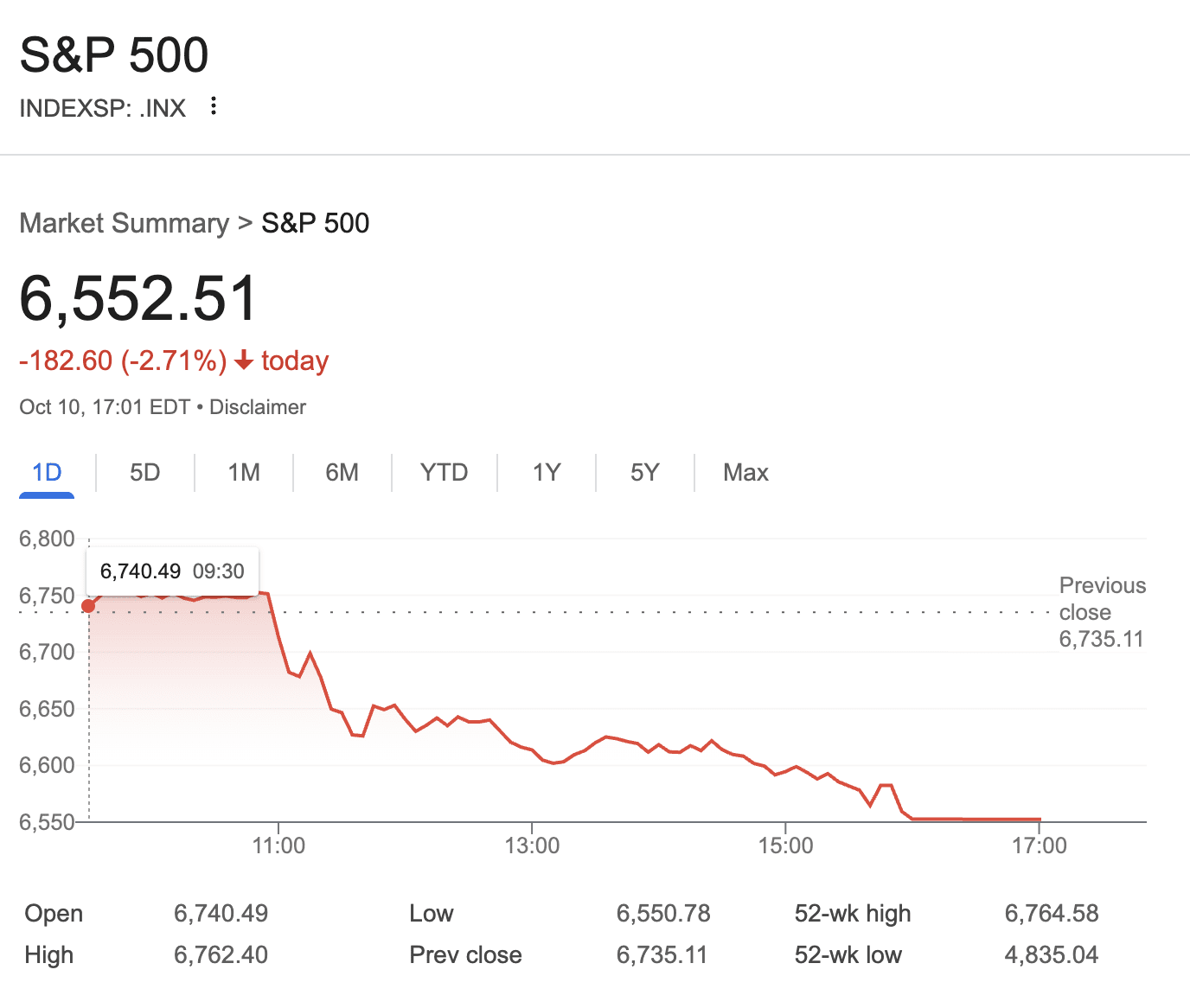

Over 80% of volume trades through centralized exchanges like Binance, Coinbase, and Bybit. Millions of traders trade derivatives with 1:50, 1:100, even 1:125 leverage. Bitcoin ETFs from BlackRock, Fidelity, and Grayscale represent institutional money that reacts to macroeconomics just like traditional finance. When the S&P 500 falls 2.7% (as on October 10), Bitcoin falls with it.Fiat liquidity is controlled by Wall Street, traditional brokers, centralized crypto exchanges, and major market makers.

And when Trump starts a trade war, all this liquidity synchronously flees the market. Whether it's Tesla stock or Bitcoin – the reaction is the same.

$19 billion in liquidations: anatomy of a massacre

When a trader trades with leverage, they borrow from the exchange. For example, having $1,000 and taking 1:50 leverage, a trader can open a $50,000 position. If the market goes their way – they get rich. But if the market falls by even 2%, the exchange automatically closes the position (liquidates) if the initial trader deposit serving as loan collateral disappears. Thus, exchanges never lose their money. But traders do.

Forced closing of a long position is essentially opening a sell order. Thus, when there are many liquidations, they themselves become a reason for pressure on the asset price, continuing its fall. This triggers the next liquidations, which starts to resemble a cascade process.

That's exactly what happened yesterday. For example, former BitMEX (For background, see our BitMEX exchange reviews) founder Arthur Hayes already named automatic liquidations on one of the largest cryptocurrency platforms as the reason for such a deep drop (wonder who that was?).

Who did NOT suffer

Peter Todd, one of the Bitcoin Core developers, slept peacefully that night.

Adam Back, inventor of Hashcash (the technology Bitcoin is based on), didn't receive a margin call.

Hal Finney, if he were alive, also wouldn't have seen any liquidations.

Why?

Because they hold Bitcoin. Not derivatives. Not contracts with 1:125 leverage. Just Bitcoin in their own wallets.

For them, Bitcoin fell from $122,000 to $105,000. Unpleasant? Yes. But they still own the same amount of Bitcoin. No one could forcibly close their positions.

But crypto traders' positions closed automatically. Their money disappeared. Contracts canceled.

Institutional Money = Centralization

For the past two years, the crypto industry has celebrated the influx of institutional money. January 2024 brought the launch of Bitcoin ETFs. BlackRock, Fidelity, Grayscale entered cryptocurrencies. Wall Street recognized Bitcoin.But no one asked: what happens when this money leaves?

Now we know.

When macroeconomics deteriorates, institutional investors sell all risky assets simultaneously: tech company stocks, low-rated bonds, commodity futures, and cryptocurrencies.

Bitcoin falls into the "risk-on assets" category – assets bought during optimism and sold during panic.On October 10, the S&P 500 fell 2.7% (minus 182 points), Dow Jones 1.9% (minus 878 points), Bitcoin 14% (minus $17,000), Ethereum 20%. Everything fell synchronously. Because the same players control the money.

Where Is Decentralization?

Bitcoin as a protocol remains decentralized. No country can stop it. No president controls the blockchain.

But the cryptocurrency market is centralized like never before.

Fiat liquidity is controlled by five major centralized exchanges, Wall Street ETF funds, traditional brokers, and institutional investors. Pricing depends on US macroeconomic decisions, trade wars, Fed policy, and presidential statements on social media.

And when Trump turns on the tariff printer, all this centralized liquidity synchronously flees. Protocol decentralization doesn't matter if 95% of the money is controlled by centralized players.

Who really controls crypto

Crypto remains under the complete control of the crypto market. When traders come to a broker for leverage - they don't buy crypto. They buy a contract for difference and essentially enter a casino.

No one changed Bitcoin's decentralized nature that night. But everyone saw where all the fiat liquidity is - it's under the control of centralized players, and they can continue doing whatever they want.

Peter Todd, Adam Back, and other cypherpunks didn't get liquidated. But they also got Bitcoin at $105,000.

The difference is that tomorrow they'll still own Bitcoin. And 1.66 million liquidated traders won't.

Epilogue for those who read to the end

True Bitcoin decentralization isn't about its price not depending on governments. It's about the fact that if you own private keys – no one can take your coins, even if Trump announces 10,000% tariffs.

But for that, you need to buy Bitcoin. Not Bitcoin contracts with 1:125 leverage.

Not your keys, not your coins.

Satoshi warned us.

Recommended