Crypto lobby to Senate: protect developers or we walk

More than 100 crypto groups delivered an ultimatum to Senate Banking and Agriculture: pass market-structure legislation that explicitly shields open-source developers and non-custodial tools – or lose industry backing. With the House’s CLARITY Act passed and Senate votes targeted by Sept. 30, definitions now will decide whether builders stay onshore.

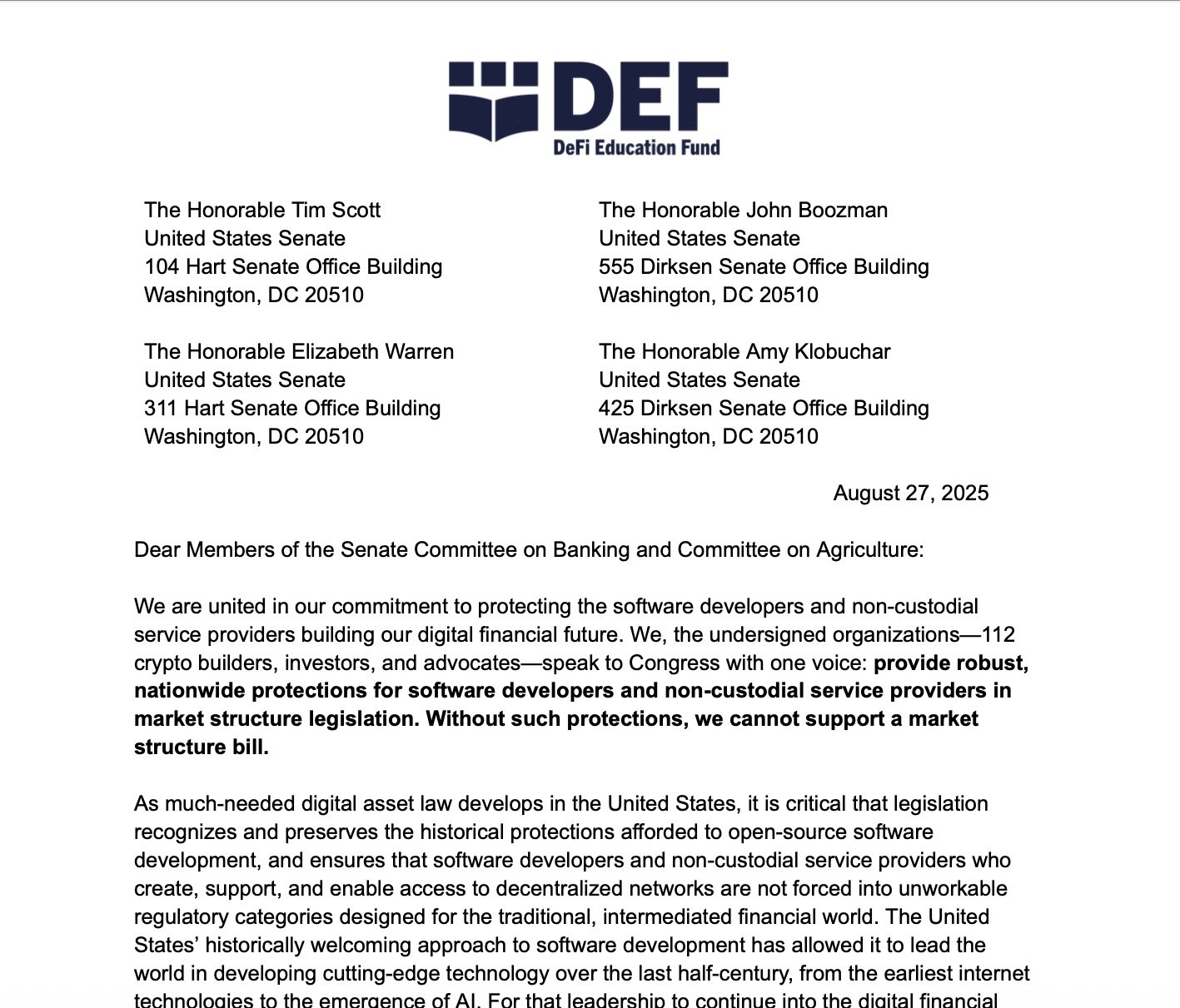

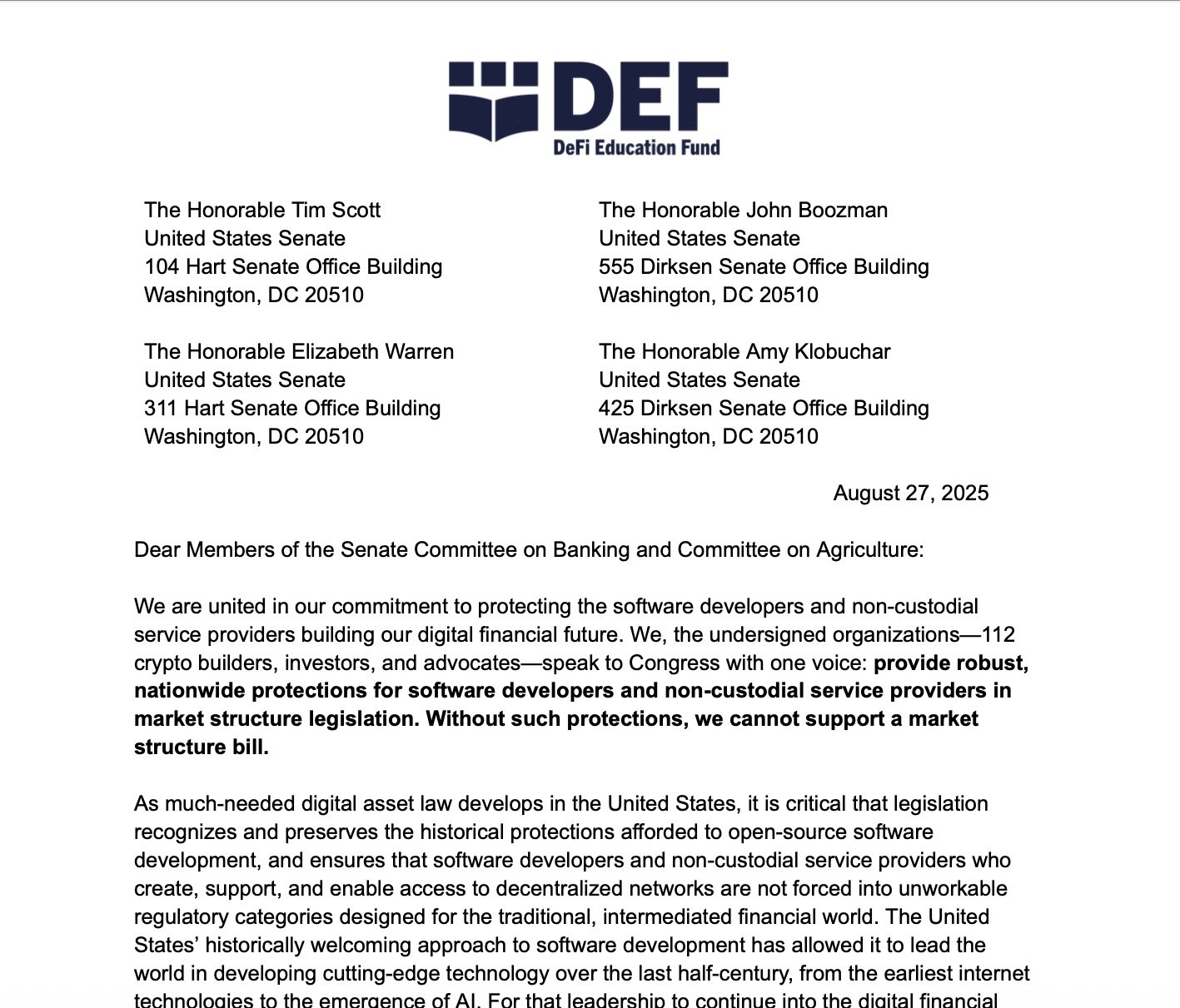

A coalition of U.S. crypto organizations has delivered an unambiguous message to the Senate Banking and Agriculture Committees: any market‑structure bill must include explicit, nationwide protections for software developers and non‑custodial service providers – or it won’t have industry support.

The letter also points to the House vote – 294 in favor – as evidence of bipartisan support for this carve‑out and urges the Senate to “improve on” that baseline in its bill text.

The letter, signed by 100+ groups, lands as Chairman Tim Scott’s committee races to finalize its own framework following the House’s passage of the CLARITY Act in July and amid parallel work by the Senate Agriculture Committee on digital commodities.

Without such protections, we cannot support a market structure bill.

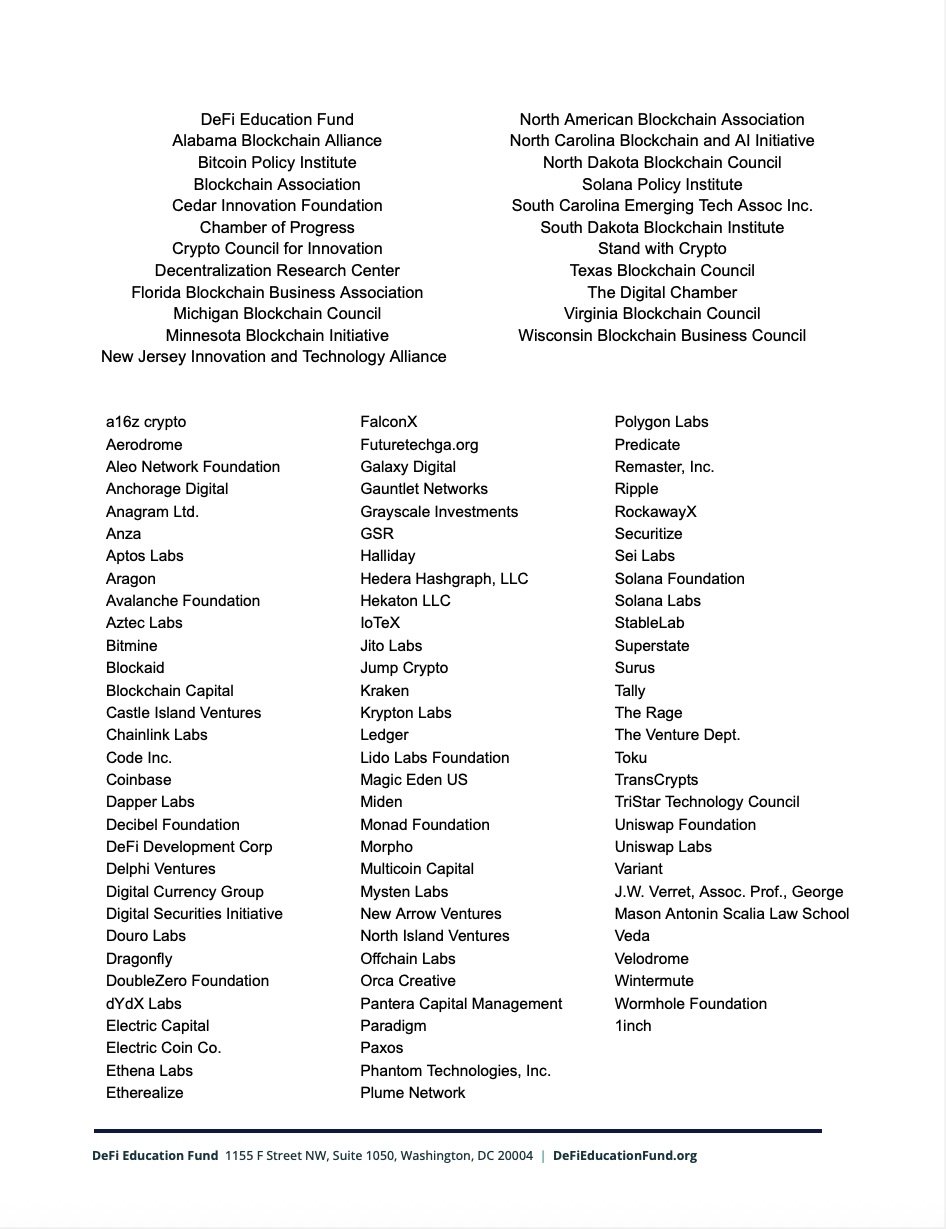

First page of the Aug. 27, 2025 ultimatum from the DeFi Education Fund — co-signed by 100+ crypto groups – urging the Senate to include explicit federal protections for developers and non – custodial providers in market – structure legislation. Source: defieducationfund.org.

Why this matters now

The timeline is tight: Banking Committee draft principles (June), public submissions deadline (August 5), Agriculture Committee's CFTC language (early September), and Banking Committee's target vote on SEC provisions (September 30). Agriculture is expected to unveil its CFTC‑focused language in early September. The next several weeks will determine whether Congress converges on a unified approach – or splits along jurisdictional and technical lines.

Against that backdrop, the coalition’s letter functions as an ultimatum. It’s not a veto on regulation; it’s a line in the sand on who gets regulated. The core argument: open‑source coders and operators of non‑custodial tools are infrastructure providers, not financial intermediaries. Treating them like broker‑dealers or money transmitters, the groups argue, would criminalize basic software work and push development offshore.

The letter calls for a bill that “preserves the historical protections afforded to open‑source software development” and for comprehensive protections for “software developers and non‑custodial service providers who create, support, and enable access to decentralized networks.”

What the coalition wants – in plain English

They’re asking the Senate to mirror the House’s direction on developers and tighten it. The requests cluster around four themes:

- Don’t regulate code as a financial product. Publishing or maintaining open‑source software, running nodes, or offering non‑custodial interfaces should not, by itself, trigger securities‑ or money‑services obligations.

- No back‑door liability. Avoid “aiding and abetting” or strict‑liability theories that would make developers responsible for how strangers use their code.

- Respect non‑custodial design. If a tool never takes control of user funds, its builders shouldn’t be treated like custodians – nor forced into KYC/AML roles they cannot technically fulfill.

- One national standard. Preempt conflicting state rules so compliant teams aren’t trapped in a patchwork that only the largest firms can navigate.

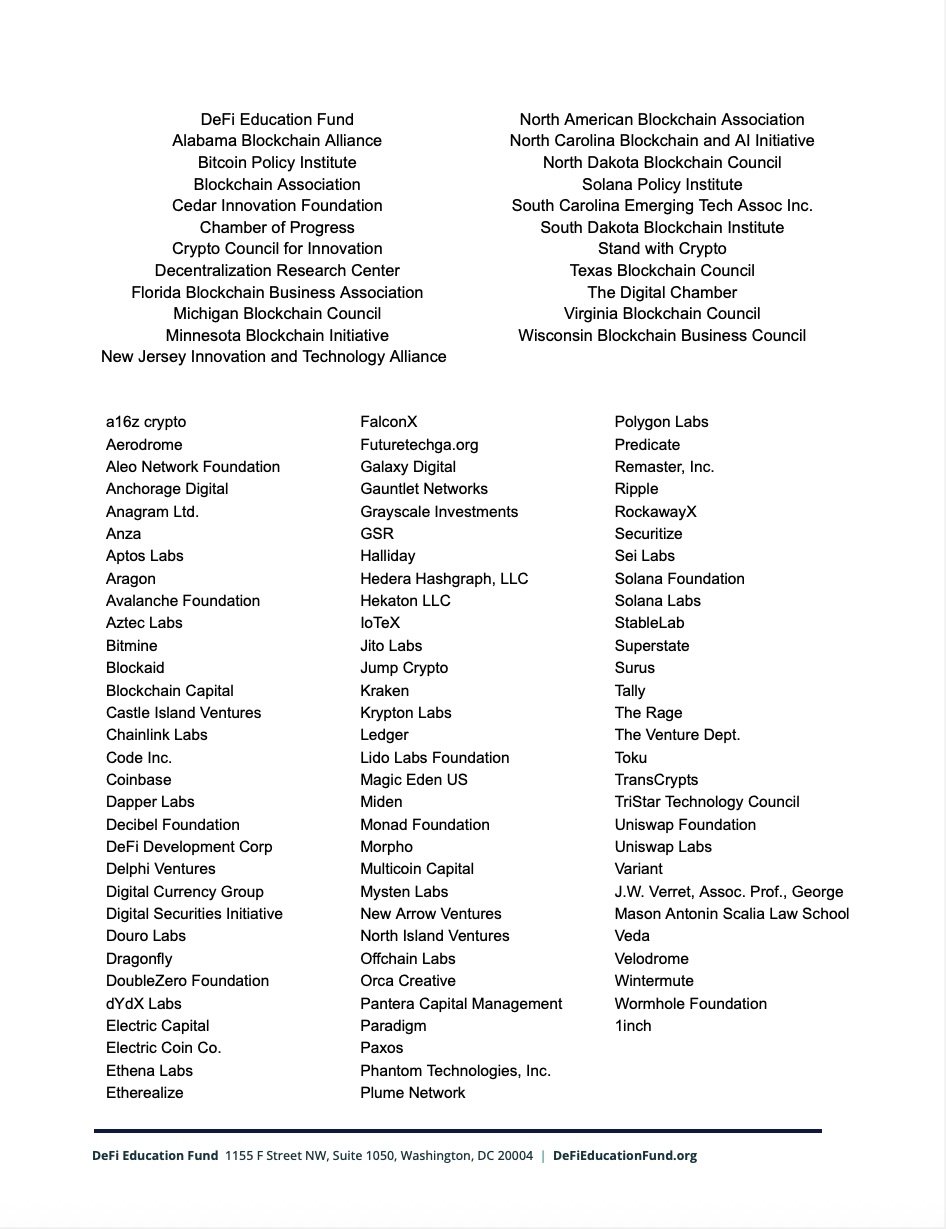

The final page of the coalition’s letter shows the signatories – over 100 of the crypto sector’s largest companies and industry associations – backing developer protections. Source: defieducationfund.org

How this intersects with the Senate’s own principles

Scott, Lummis, Tillis, and Hagerty have already outlined a framework that: draws a statutory line between digital‑asset securities and commodities; preserves self‑custody; and cautions against applying rules built for centralized intermediaries to decentralized protocols. They also back a tailored SEC pathway for token launches and clearer secondary‑market rules. On paper, that’s compatible with the coalition’s focus – if the definitions and exemptions are tight enough.

The friction is in the details. If “intermediary” gets defined so broadly that hosting code or routing messages counts, the promise of protecting non‑custodial builders evaporates. If AML obligations are imposed on software layers that can’t implement them, products will disappear rather than comply. And if Congress punts key questions to enforcement, the gray zone returns.

The stakes for builders, users, and regulators

For builders, the difference between explicit protections and ambiguity is existential: bank accounts, hiring, and fundraising hinge on whether counsel can point to clear statutory language. For users, it’s about access to audited, non‑custodial tools developed in the open – versus a world where only custodial, permissioned platforms survive. For regulators, it’s about channeling risk where it resides: on custodians, exchanges, and issuers who hold assets or make promises – not on the developers writing general‑purpose code.

The coalition’s bet is strategic. If developer protections are baked into statute now, subsequent rulemaking – from the SEC’s market‑structure pilots to the CFTC’s commodities regime – can proceed without collapsing non‑custodial software into the intermediary bucket. If not, the next decade will be fought case‑by‑case in court.

What to watch next

- Draft text from Senate Banking. Look for how it defines “intermediary,” where it draws the line on custody, and whether it preempts conflicting state laws.

- Agriculture’s draft in early September. Pay attention to how “digital commodity” markets treat front‑end developers and node operators.

- Whether the final package locks in non‑custodial carve‑outs. If it does, expect faster on‑shore growth of open‑source tooling. If it doesn’t, expect a chilling effect and renewed flight to friendlier jurisdictions.

Recommended