67% of institutions expect Bitcoin to rise – survey

Coinbase Institutional and analytics service Glassnode published the quarterly report “Charting Crypto (Q4 2025)” based on a survey conducted from 17 September to 3 October.

The study outlines how professional and retail participants view the market outlook for the coming months and which factors could influence sentiment.

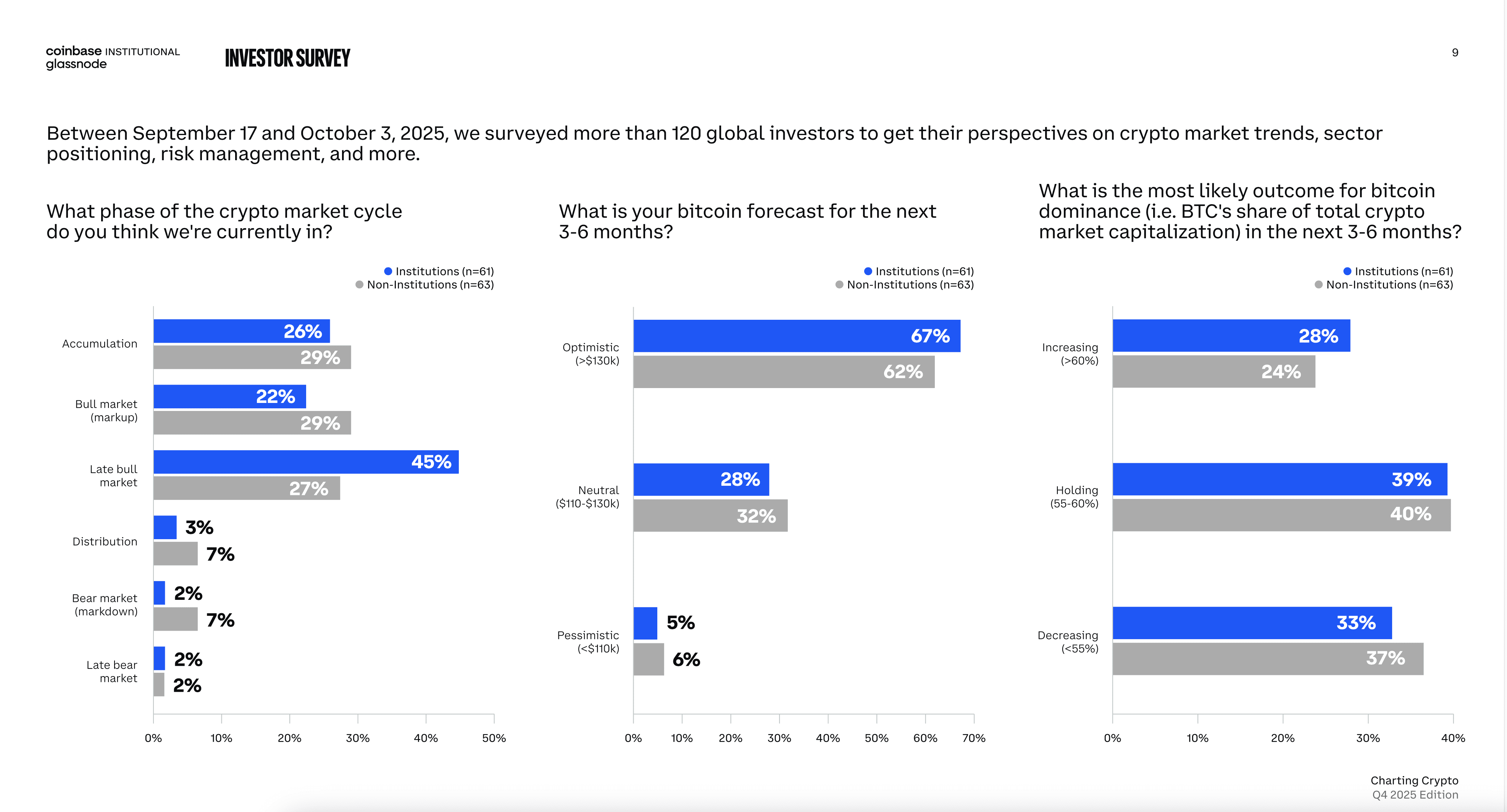

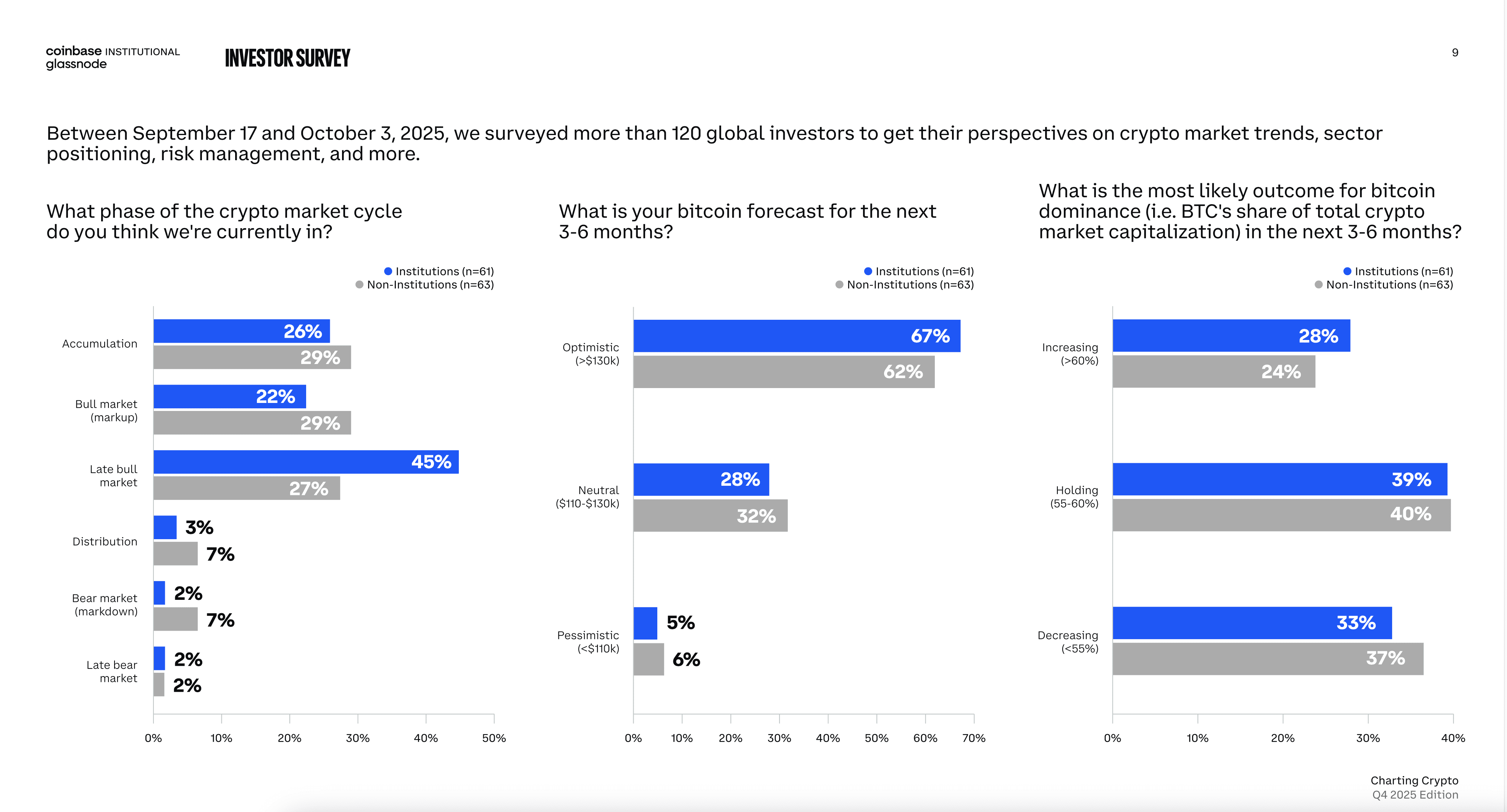

According to the report, a clear majority of respondents expect Bitcoin to strengthen. Among institutional investors, 67% are optimistic, while 62% of retail respondents share that view. In other words, the baseline scenario for the next three to six months is higher prices for BTC, although respondents acknowledge that uncertainty remains.

Most investors expect Bitcoin to rise within six months. Source: Coinbase and Glassnode survey

The reasons given by both groups are similar. Respondents point to ample liquidity and the recent signs of monetary policy easing, which typically support risk assets. Another positive factor is the expansion of spot exchange‑traded funds (ETF) for crypto assets: such products lower the barrier for conventional capital and can channel flows into specific digital tokens.

However, institutional and retail views diverge somewhat on where the market stands in the cycle. 45% of institutional participants describe the current phase as a “late bull market,” compared with 27% of retail respondents. This helps explain why larger players behave more cautiously and why rotation between themes, shifting attention among Bitcoin, Ethereum and other assets, occurs periodically.

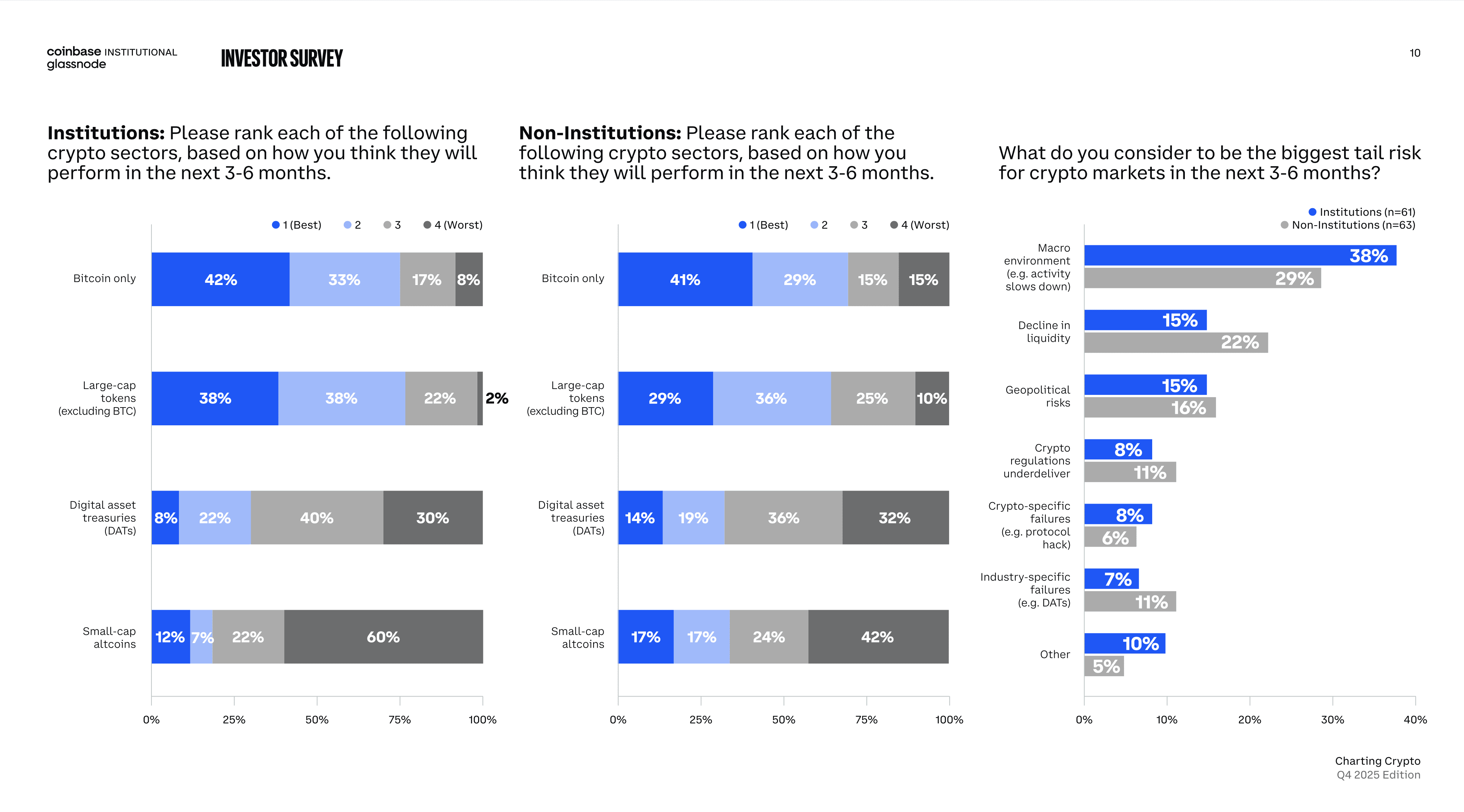

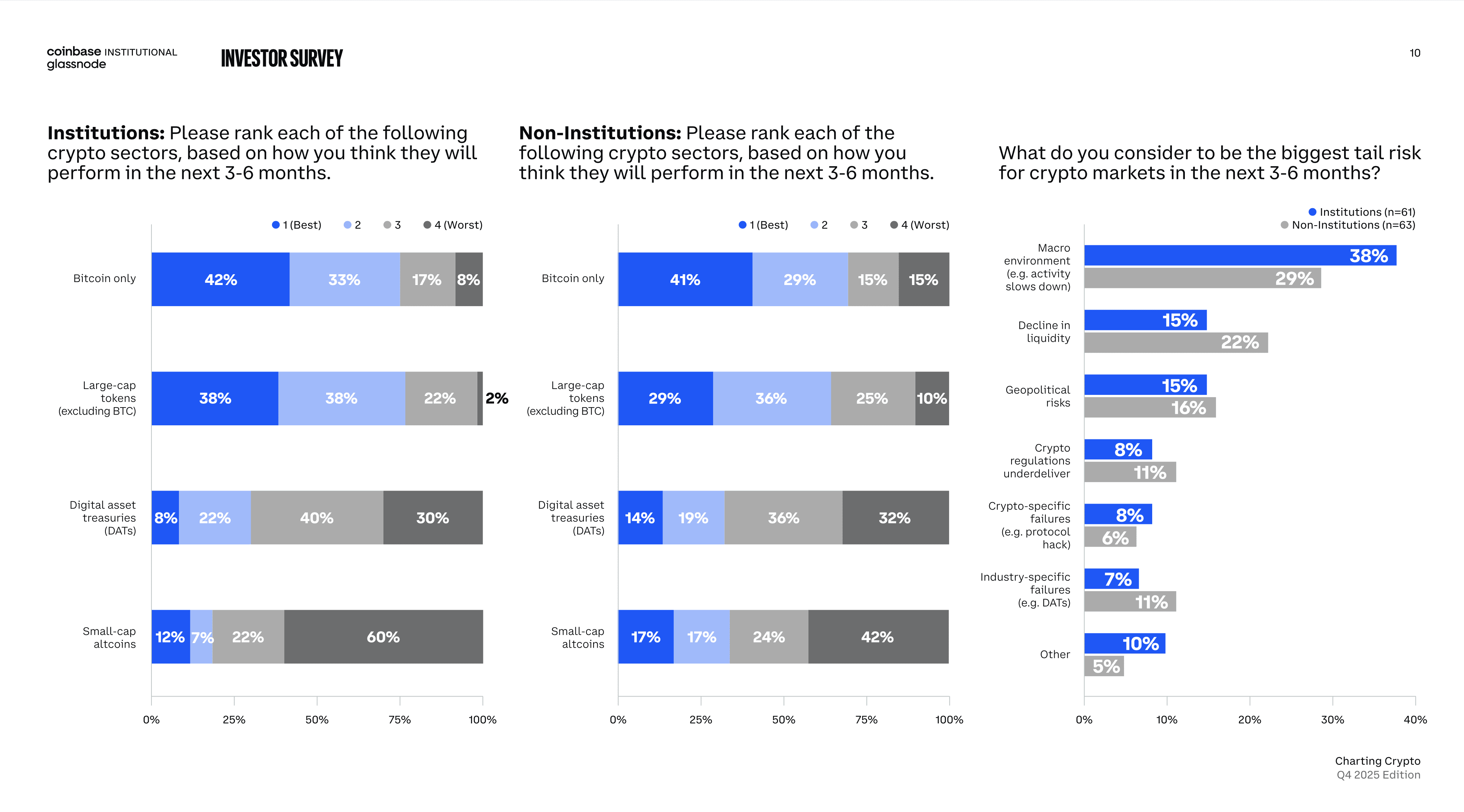

Macro conditions remain the main source of uncertainty. Source: Coinbase and Glassnode survey

The report also records growing interest in Ethereum: this is linked to the development of spot products in the US and to higher activity on Layer‑2 networks, where fees are low and traffic is high. At the same time, companies and funds that hold crypto assets on their balance sheets remain a notable source of demand. Examples of these digital treasuries include Michael Saylor’s approach at MicroStrategy, SharpLink’s ETH accumulation strategy, and other firms that have allocated reserves to digital assets. Nevertheless, confidence in this model is uneven: some investors say they will watch how such strategies perform through different market phases.

Respondents point to deterioration in macroeconomic conditions as the key downside risk: a spike in inflation, higher energy prices or changes in central‑bank policy could slow capital inflows into crypto and prompt reassessment of expectations.

Overall, the report reflects a mildly positive tone: most investors expect Bitcoin to rise, while remaining attentive to geopolitical developments and ready to adjust positions if global conditions change.

Recommended