China’s rare-earth exports to the US drop ahead of Trump–Xi talks

China’s exports of rare-earth magnets fell 6.1% in September from August to 5,774 tons, ending a three-month rise and stirring fresh concern over supplies ahead of a planned meeting between President Donald Trump and Chinese President Xi Jinping in October.

China exported 5,774 metric tons of rare-earth magnets in September, down 6.1% month on month from 6,146 tons in August, according to data from the General Administration of Customs. Shipments to the United States dropped 28.7% in the month, while year-on-year volumes still rose 17.5%. For January–September, exports totaled 39,817 tons, 7.5% below the same period in 2024.

Beijing expanded its export licensing for rare-earth products in October, after previous restrictions in April and May. The commerce ministry said it will approve licenses for civilian use, but officials also blamed Washington for causing alarm about the limits. The new data comes as negotiators discuss tariffs and access to critical minerals ahead of a tariff truce that ends on November 10.

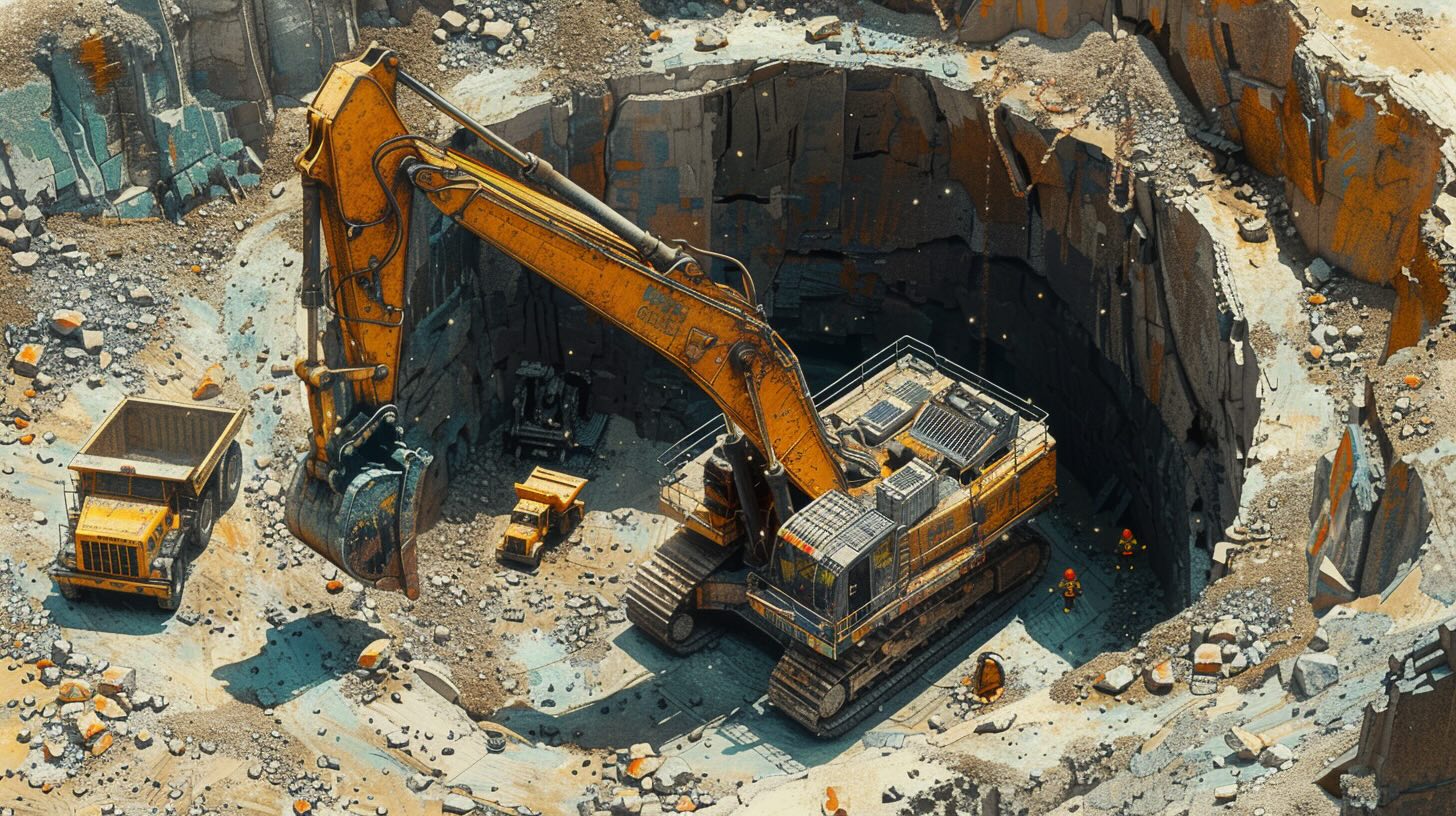

Rare earths are crucial for industries from electronics to renewable energy. Earlier, according to Reuters, Mercedes-Benz production chief Joerg Burzer said the company is working with top suppliers to build ‘buffers,’ like stockpiles, to guard against potential supply disruptions. BMW said part of its supplier network faced disruptions, but its own plants were running normally.

Dialogue between China and the US is supposed to ease as Trump and Chinese President Xi Jinping are expected to meet in the upcoming weeks to discuss trade policy. In mid-October, trade tensions escalated following President Trump’s announcement of 100% tariffs on China in response to its rare earths policy.

Financial markets tumbled after the news, with a record $19 billion liquidated from the crypto market. The expected meeting is viewed as a critical opportunity to de-escalate tensions over rare earths, but the outcome is far from guaranteed. For the crypto market, the meeting has generally been viewed as a short-term positive signal by investors, driving prices up.