ChatGPT fuels boom in robo-advisor market

As ChatGPT approaches its third anniversary, the service has become a tool for thousands of retail investors. Research from eToro shows that about 13% of retail investors use chatbots to pick stocks, and another half are open to trying such tools.

The robo-advisor market, spanning fintech firms, banks, and asset managers, was valued at $61.7 billion in 2024. Research and Markets projects it will grow to $470.9 billion by 2029, an increase of nearly 600%.

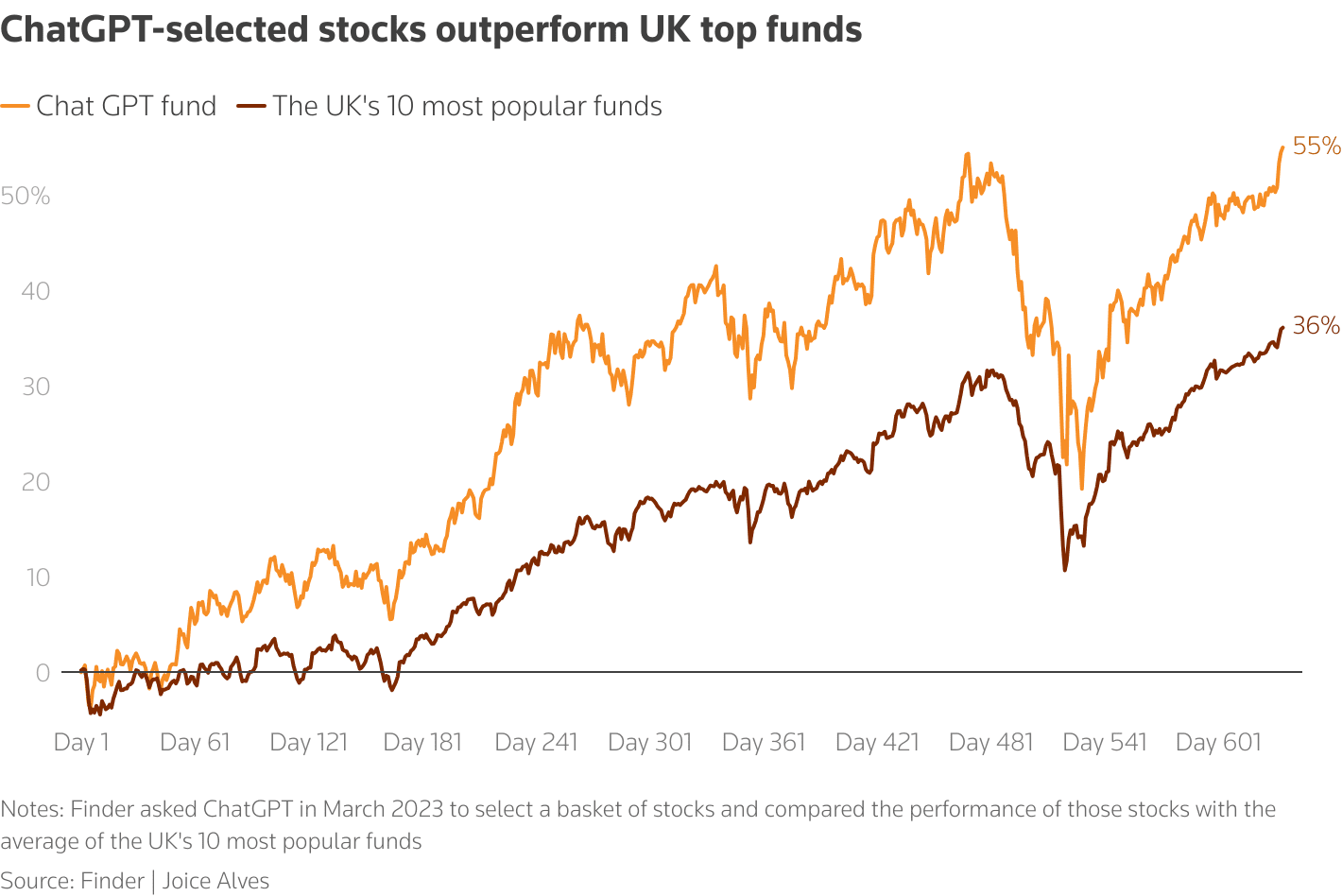

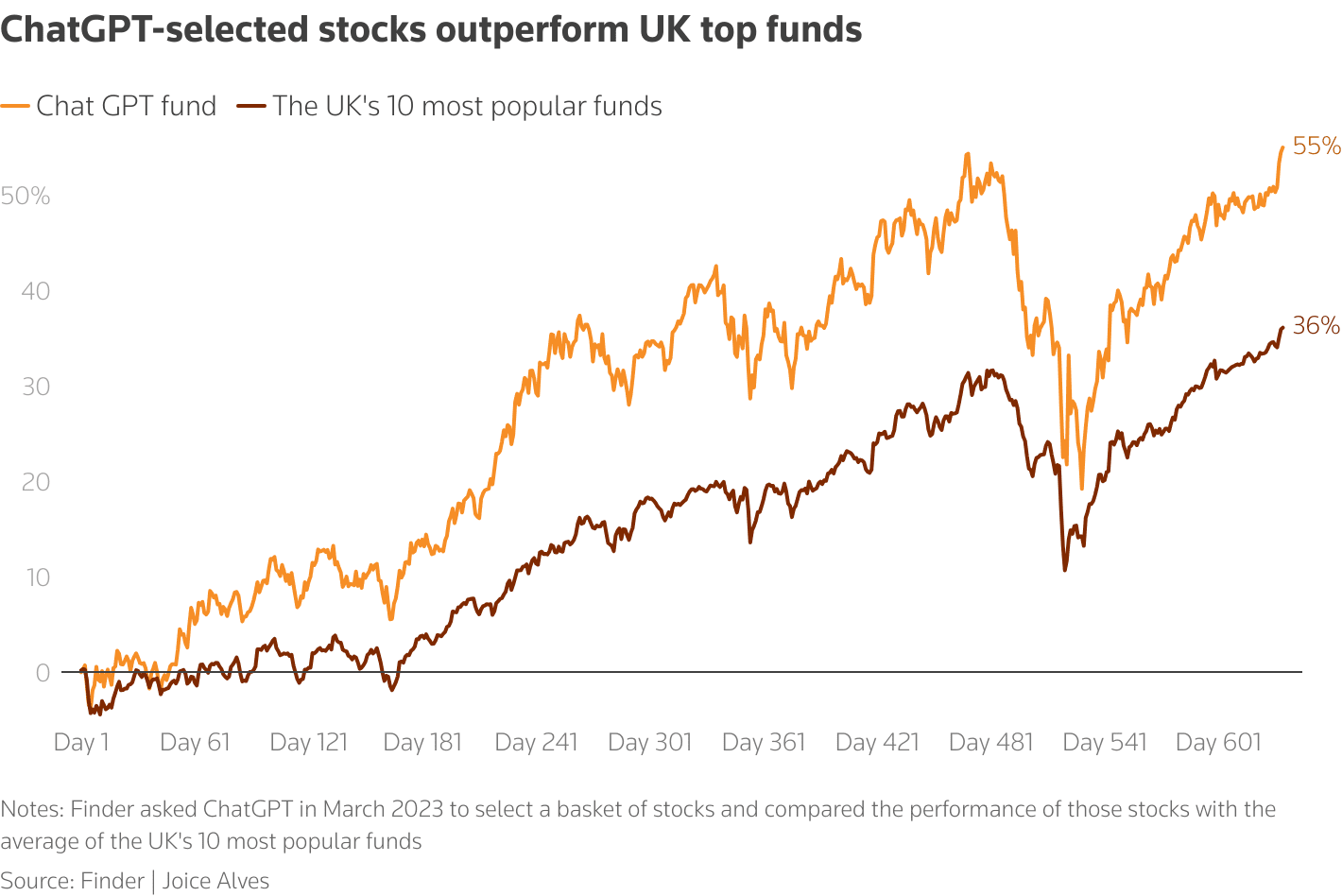

Interest has grown further after a Finder study revealed that a ChatGPT-generated portfolio of 38 stocks, including Nvidia, Amazon, Walmart, and Procter & Gamble, gained nearly 55% since March 2023, outperforming the UK’s 10 largest funds by 19 percentage points.

eToro’s Dan Moczulski said the biggest issue is using general AI models as a “crystal ball.” According to him, they can misreport figures and dates and lean too heavily on past trends. He stressed that investors should rely on specialized platforms trained specifically on financial data. (Background on eToro is available in our eToro reviews.)

Despite the risks, experts acknowledge that AI has democratized investment analysis. Once the domain of major banks, advanced tools are now available to millions of retail investors. ChatGPT and similar models are becoming catalysts for structural change in capital markets, accelerating the shift from traditional advisors to digital services.

Interest has grown further after a Finder study revealed that a ChatGPT-generated portfolio of 38 stocks, including Nvidia, Amazon, Walmart, and Procter & Gamble, gained nearly 55% since March 2023, outperforming the UK’s 10 largest funds by 19 percentage points.

Performance of ChatGPT-selected stocks beats UK’s top 10 funds. Source: reuters.com

Former UBS analyst Jeremy Leung, who manages a multi-asset portfolio without access to Bloomberg, noted that ChatGPT replicates some terminal functions. But he cautioned that the model “does not have access to data behind paywalls” and may miss key factors.

eToro’s Dan Moczulski said the biggest issue is using general AI models as a “crystal ball.” According to him, they can misreport figures and dates and lean too heavily on past trends. He stressed that investors should rely on specialized platforms trained specifically on financial data. (Background on eToro is available in our eToro reviews.)

See also: ChatGPT is skeptical about altcoins

Despite the risks, experts acknowledge that AI has democratized investment analysis. Once the domain of major banks, advanced tools are now available to millions of retail investors. ChatGPT and similar models are becoming catalysts for structural change in capital markets, accelerating the shift from traditional advisors to digital services.

Recommended