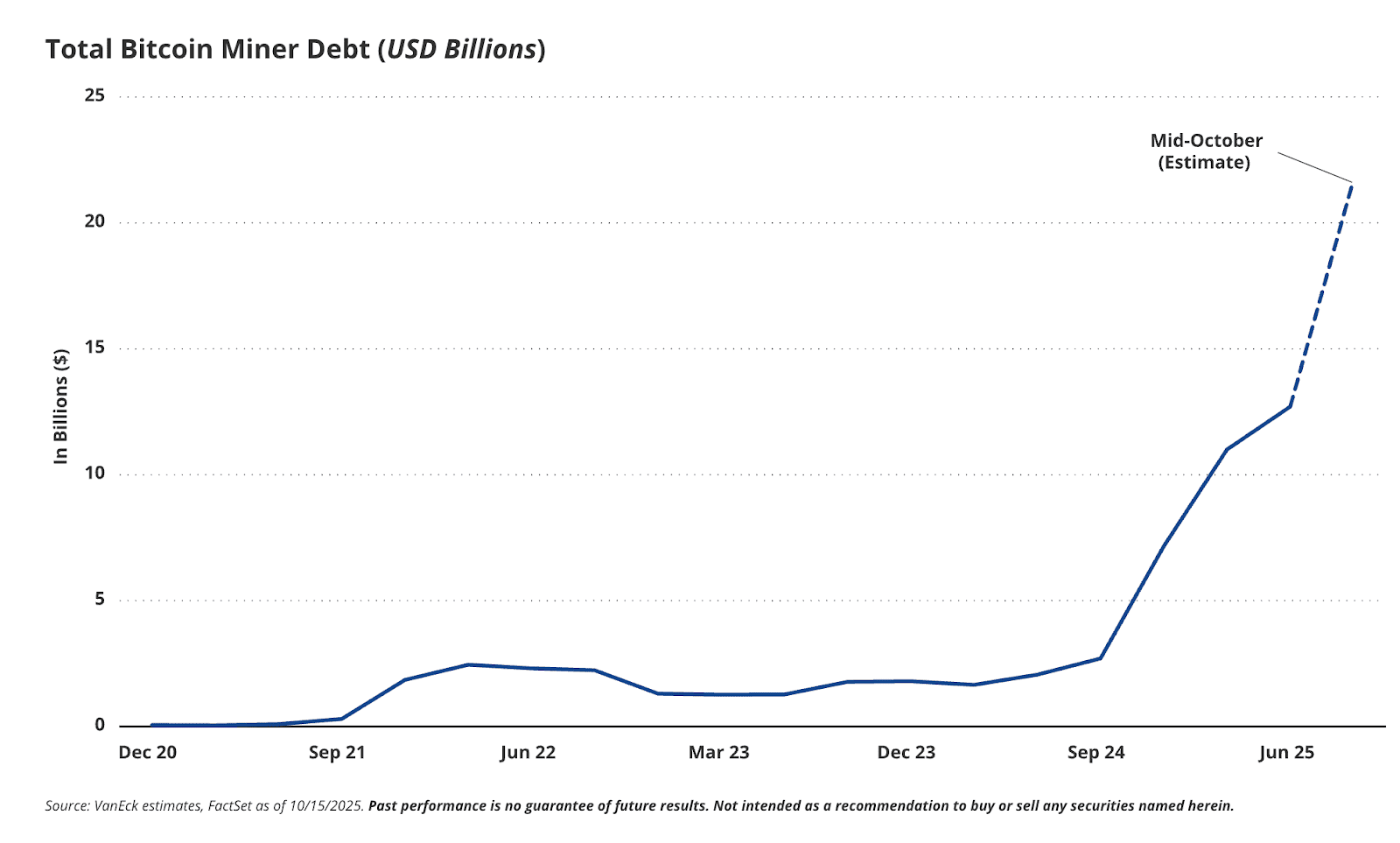

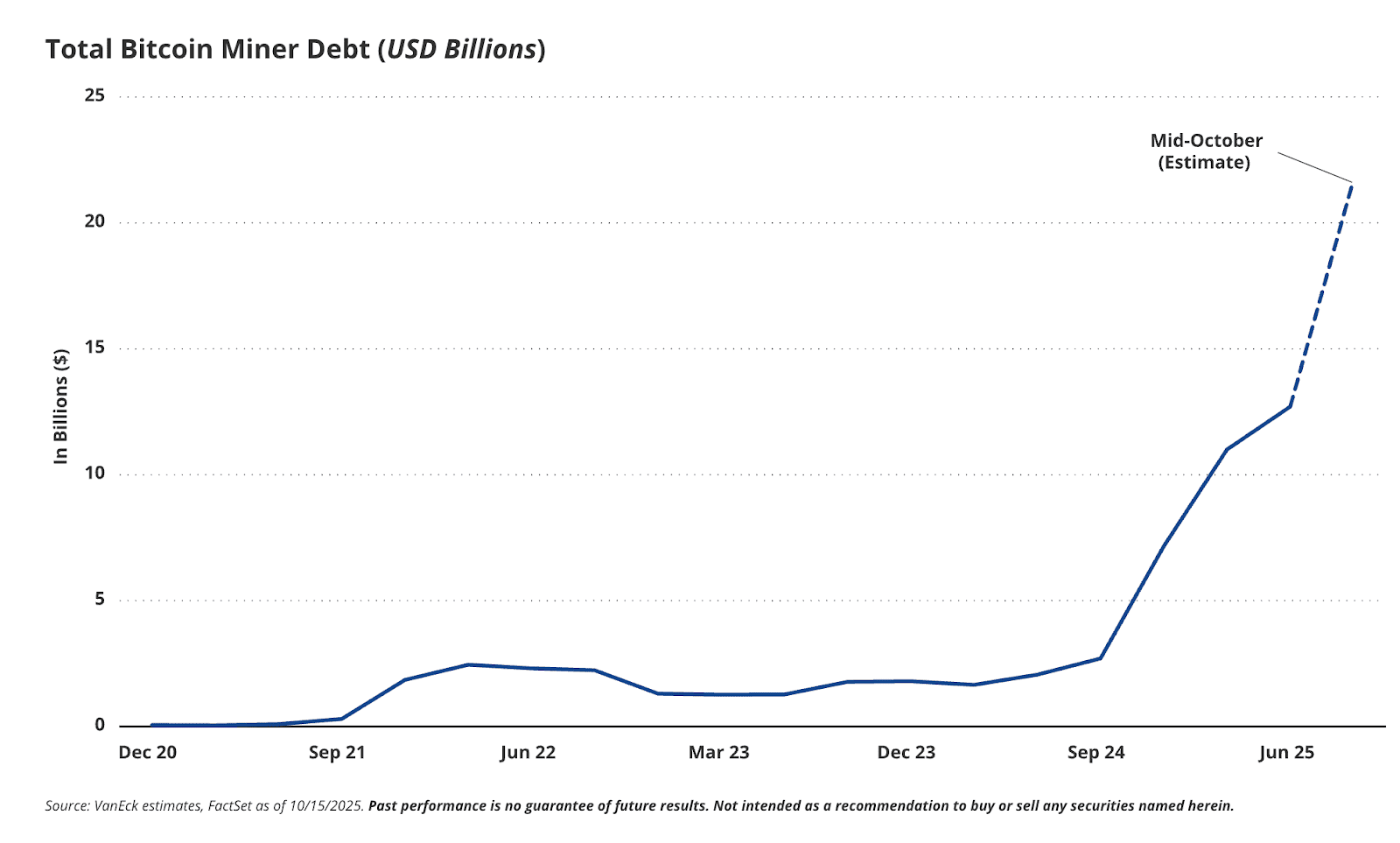

Bitcoin miners’ debt rises sixfold in a year to $12.7 billion

Over the past year, the total debt of Bitcoin mining companies has jumped from $2.1 billion to $12.7 billion.

The surge in borrowing is tied to large-scale investments in artificial intelligence (AI) and high-performance computing (HPC) infrastructure – sectors miners are rapidly expanding into to offset declining revenues after April’s halving (an event that halves the miner reward every four years.)

According to a report by VanEck, publicly traded mining firms have issued about $6.3 billion in debt and convertible bonds over recent quarters, including a record $4.6 billion at the end of 2024. Notable examples include Bitfarms, which raised $588 million through convertible notes; TeraWulf, which issued $3.2 billion in bonds; and IREN, which borrowed $1 billion to expand its data centers.

Total Bitcoin miner debt. Source: vaneck.com

VanEck describes the miners’ current situation as a “melting ice” effect: without constant reinvestment in new hardware, miners lose hash rate – and with it, block rewards. Previously, companies relied mainly on issuing new shares, but falling stock prices and shareholder dilution have pushed them toward debt financing instead.

Following the halving, which cut the block reward to 3.125 BTC, mining profitability dropped by 40–50%. This has driven the sector to diversify into AI computing and data center operations, where revenues are steadier and supported by long-term contracts. The shift allows miners to secure cheaper loans and reduce exposure to Bitcoin’s volatility.

VanEck notes that expanding into AI infrastructure does not threaten Bitcoin’s network security; instead, it improves energy efficiency and supports scaling mining farms by redistributing excess power capacity.

Analysts warn the mounting debt could pose a systemic risk. If interest rates rise and Bitcoin prices fall, miners may face a wave of bankruptcies should AI or hosting revenues fail to cover debt obligations.

Recommended