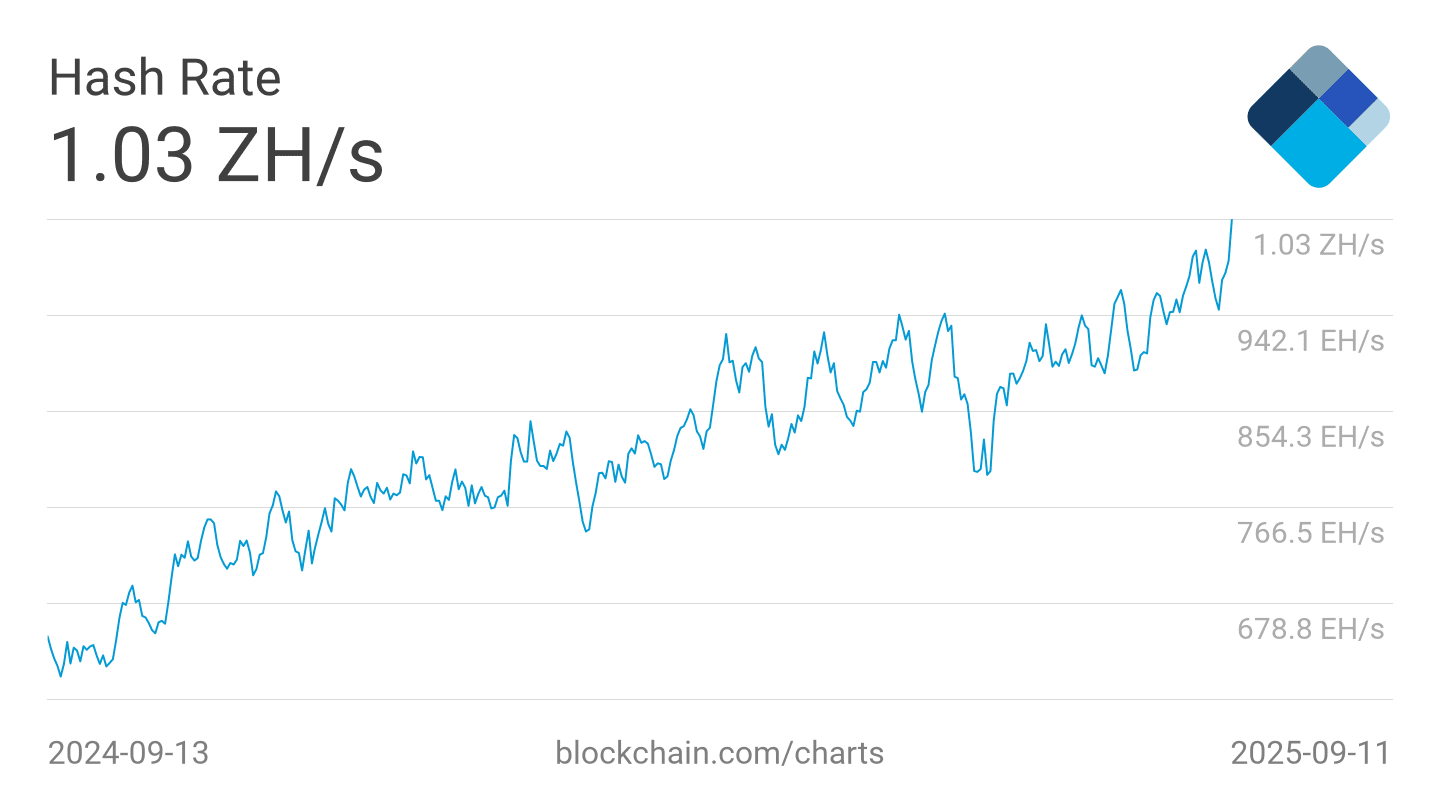

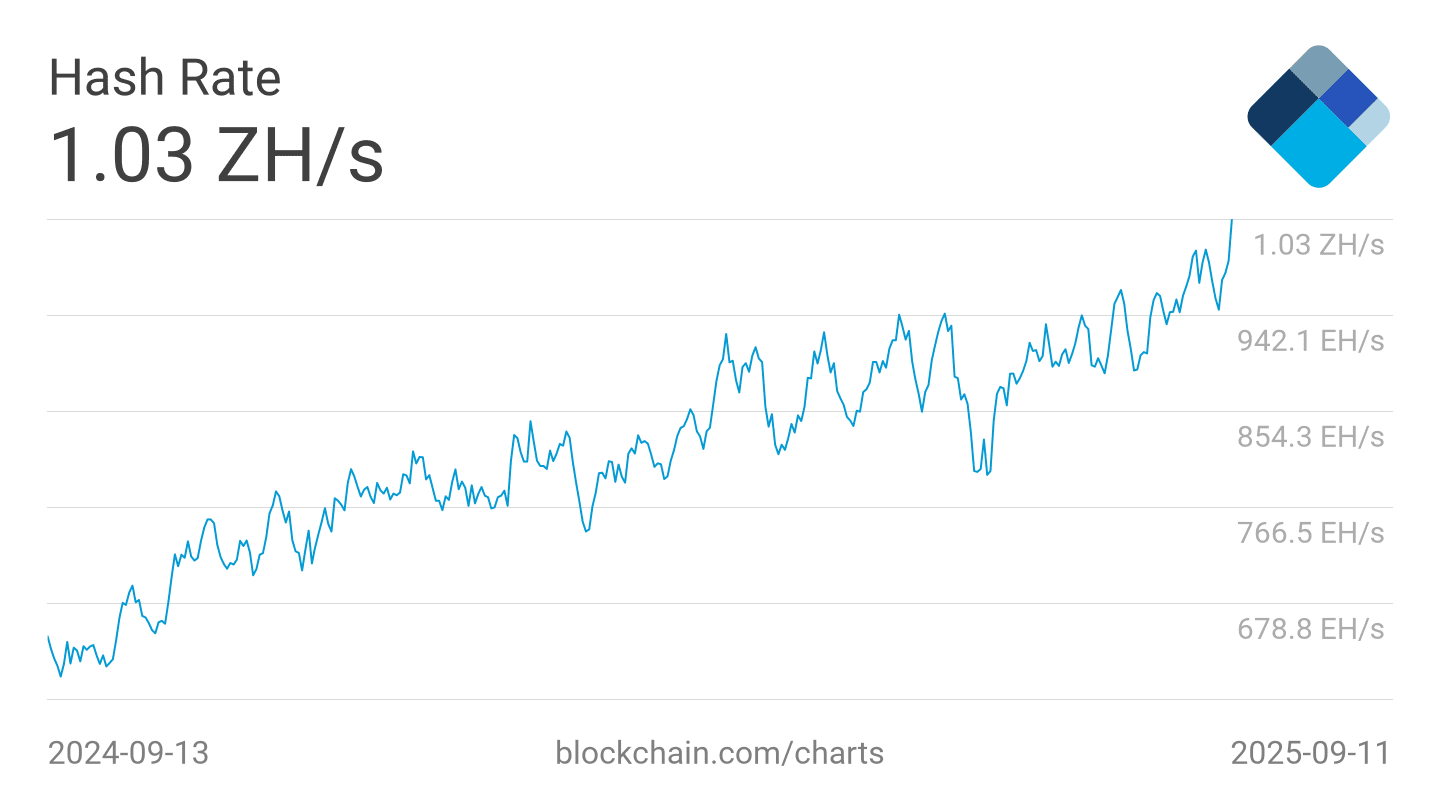

Bitcoin hashrate and network difficulty hit all-time highs

On Sept. 12, Bitcoin’s hashrate reached an all-time high of 1.12 billion terahashes per second (TH/s), according to Bitinfocharts. At the same time, mining difficulty rose to a new record of 136.04 trillion.

The surge in computing power was accompanied by a rise in miner reserves to 1.808M BTC, the highest in 50 days. CryptoQuant data shows miners are holding rather than selling, accumulating coins in anticipation of a price increase.

The next difficulty adjustment is scheduled for Sept. 18, with a projected increase of another 6.4% to 144.7T, making Bitcoin mining even more resource-intensive.

Analysts note that spikes in hashrate have historically preceded Bitcoin price rallies, especially after halvings, when coin supply tightens. With the Federal Reserve’s rate decision looming on Sept. 17, investors are betting on policy easing and increased demand for risk assets, including cryptocurrencies.

BTC is trading at $114,900, up nearly 2.3% over the week. On derivatives markets, Myriad Markets users estimate an 80% chance Bitcoin will hold above $105,000 in September, and a 56% chance it will surpass $125,000 by year’s end.

Thus, record network metrics combined with a favorable macro backdrop are fueling forecasts of a potential “decisive breakout” for Bitcoin, with altcoins traditionally following the lead of the top cryptocurrency.

BTC hashrate chart. Source: blockchain.com

According to Varun Satyam, co-founder of DeFi platform Davos Protocol, during such periods “less efficient miners shut down operations, while large players hold or expand positions, preparing for a breakout.”

The next difficulty adjustment is scheduled for Sept. 18, with a projected increase of another 6.4% to 144.7T, making Bitcoin mining even more resource-intensive.

Analysts note that spikes in hashrate have historically preceded Bitcoin price rallies, especially after halvings, when coin supply tightens. With the Federal Reserve’s rate decision looming on Sept. 17, investors are betting on policy easing and increased demand for risk assets, including cryptocurrencies.

BTC is trading at $114,900, up nearly 2.3% over the week. On derivatives markets, Myriad Markets users estimate an 80% chance Bitcoin will hold above $105,000 in September, and a 56% chance it will surpass $125,000 by year’s end.

Thus, record network metrics combined with a favorable macro backdrop are fueling forecasts of a potential “decisive breakout” for Bitcoin, with altcoins traditionally following the lead of the top cryptocurrency.

Recommended